What To Ask For When Buying A Business

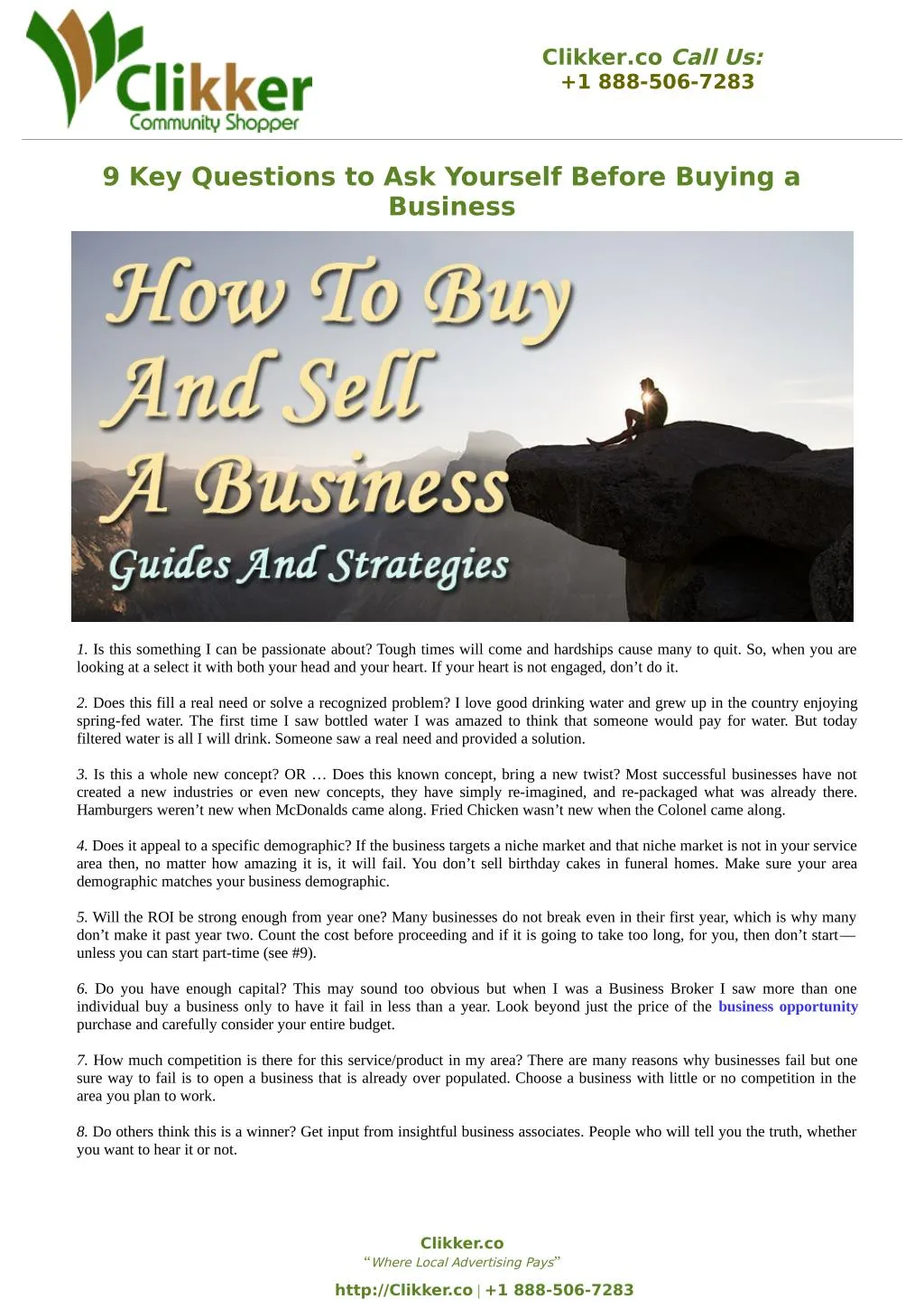

Thinking of buying a business? Don't go in blind. Due diligence is key to avoiding costly mistakes.

Acquiring a business involves much more than just signing on the dotted line. This guide provides the essential questions to ask and information to obtain before finalizing any deal, ensuring a smooth and profitable transition.

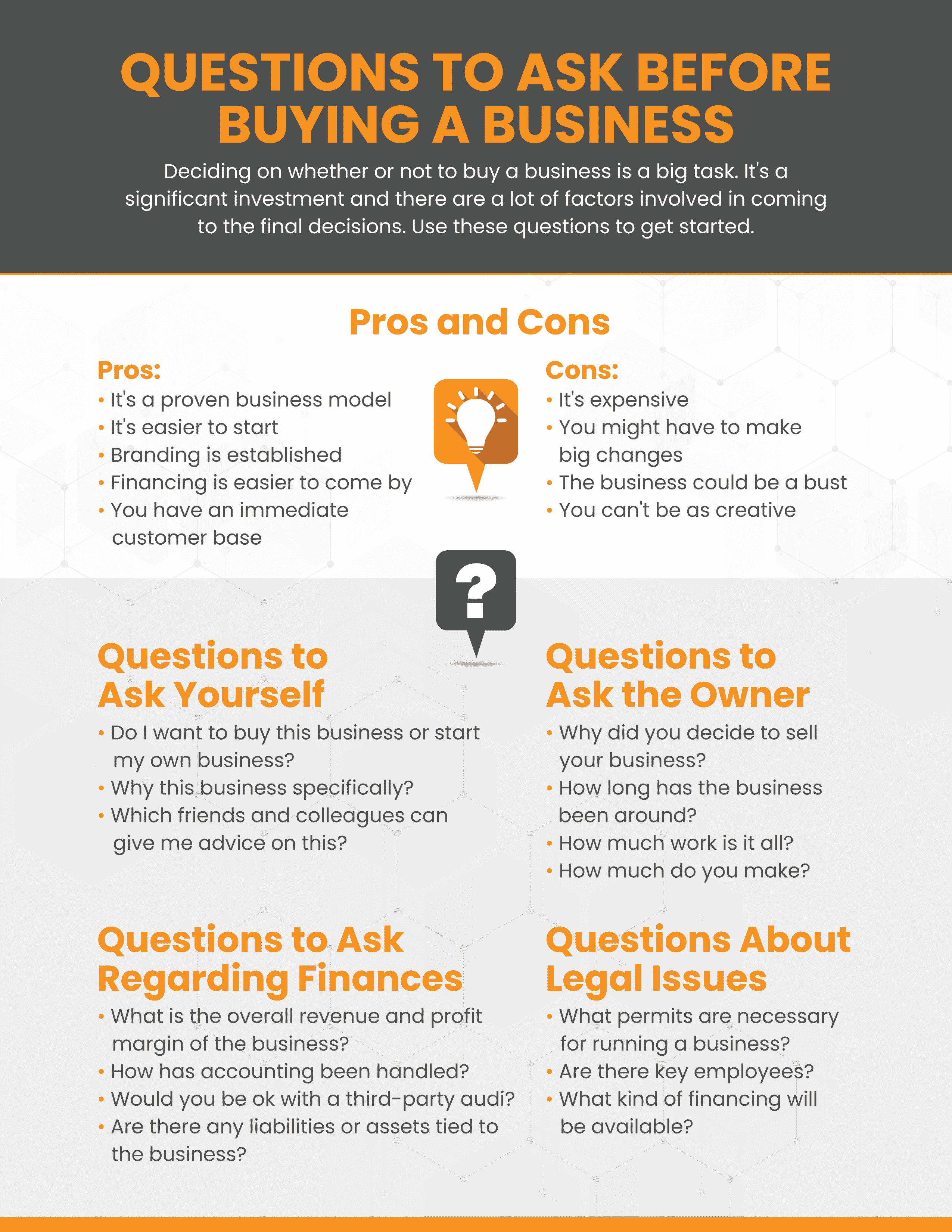

Financial Health: Dig Deep

Profit and Loss Statements

Request at least the past three years of Profit and Loss (P&L) statements. Analyze trends in revenue, expenses, and net profit.

Verify the accuracy of these statements with audited financial records if possible.

Balance Sheets

Examine the company's assets, liabilities, and equity. Look for hidden debts or potential financial risks.

Pay close attention to the current ratio (current assets divided by current liabilities) to assess short-term liquidity.

Cash Flow Statements

Understand how the business generates and uses cash. A healthy cash flow is crucial for ongoing operations.

Review statements for the past three years.

Tax Returns

Request copies of the business's tax returns for the past three to five years. Look for any discrepancies or red flags.

Consult with a tax professional to review these documents.

Operational Insights: Know the Inner Workings

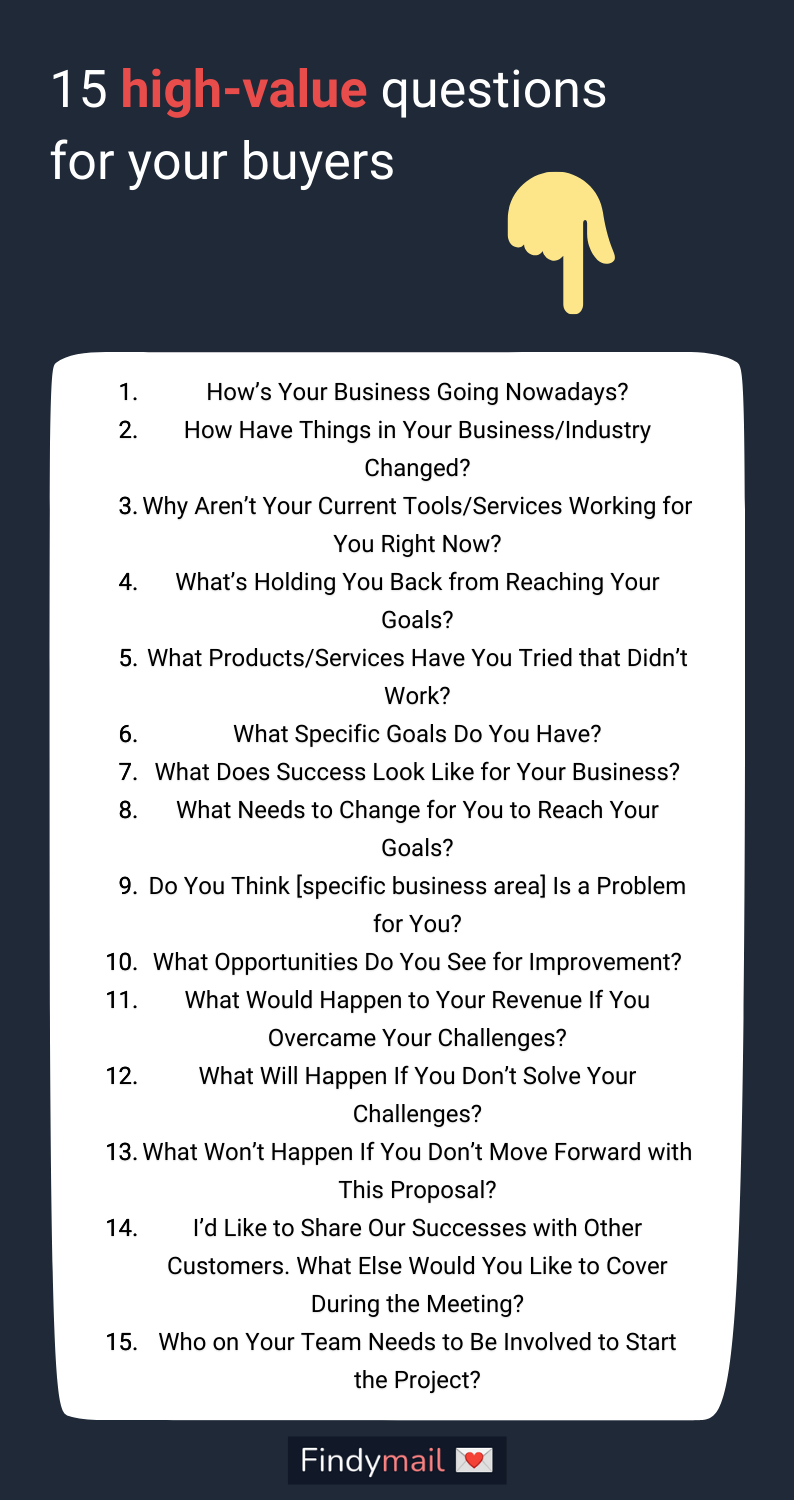

Customer Base

Who are the key customers? What is the customer retention rate?

A concentrated customer base can pose a risk if a major client leaves.

Supplier Agreements

Review existing supplier contracts. Understand the terms, pricing, and renewal options.

Determine if there are any exclusive agreements or potential supply chain vulnerabilities.

Employee Information

Obtain details about employee salaries, benefits, and contracts. Understand the employee turnover rate.

Are there any union agreements or pending labor disputes?

Legal and Regulatory Compliance

Are there any pending lawsuits or legal challenges against the business?

Ensure the business is in compliance with all relevant regulations and licenses.

Assets and Liabilities: What You're Really Buying

Inventory

Conduct a physical inventory count and valuation. Assess the condition and marketability of the inventory.

Is the inventory obsolete or slow-moving?

Equipment and Property

Evaluate the condition of all equipment and property. Obtain appraisals if necessary.

Determine if there are any outstanding liens or mortgages on the assets.

Intellectual Property

Does the business own any patents, trademarks, or copyrights? Verify ownership and validity.

Protect your investment by ensuring proper transfer of intellectual property rights.

Beyond the Numbers: Intangible Value

Reputation and Goodwill

Research the business's reputation online and offline. Understand its brand image and customer perception.

Negative reviews or a poor reputation can impact future sales.

Industry Trends

Analyze the current and future trends in the industry. Is the business positioned for long-term success?

Consider factors such as market growth, competition, and technological advancements.

Reason for Sale

Understand why the current owner is selling the business. Be wary of vague or evasive answers.

The seller's motivation can provide valuable insights into the business's true condition.

Due Diligence: Your Best Defense

Thorough due diligence is non-negotiable. Engage professionals such as accountants, lawyers, and industry experts to assist you.

Don't be afraid to walk away if you uncover significant problems or red flags. Protect your investment.

Before making any commitment, ensure all questions are answered and all information is verified. Consult with experienced advisors to guide you through the process. Securing your future starts with informed decisions. Don't wait, start your due diligence today.

![What To Ask For When Buying A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)