What To Ask For When Purchasing A Business

Imagine stepping into a bustling bakery, the aroma of fresh bread filling the air. Flour dusts the aprons of smiling employees, and the rhythmic clang of the oven timer creates a comforting symphony. You’re not just a customer today; you’re considering becoming the owner, the guardian of this sweet-smelling legacy. But before you grab your apron and start perfecting that sourdough starter, you need to ask the right questions.

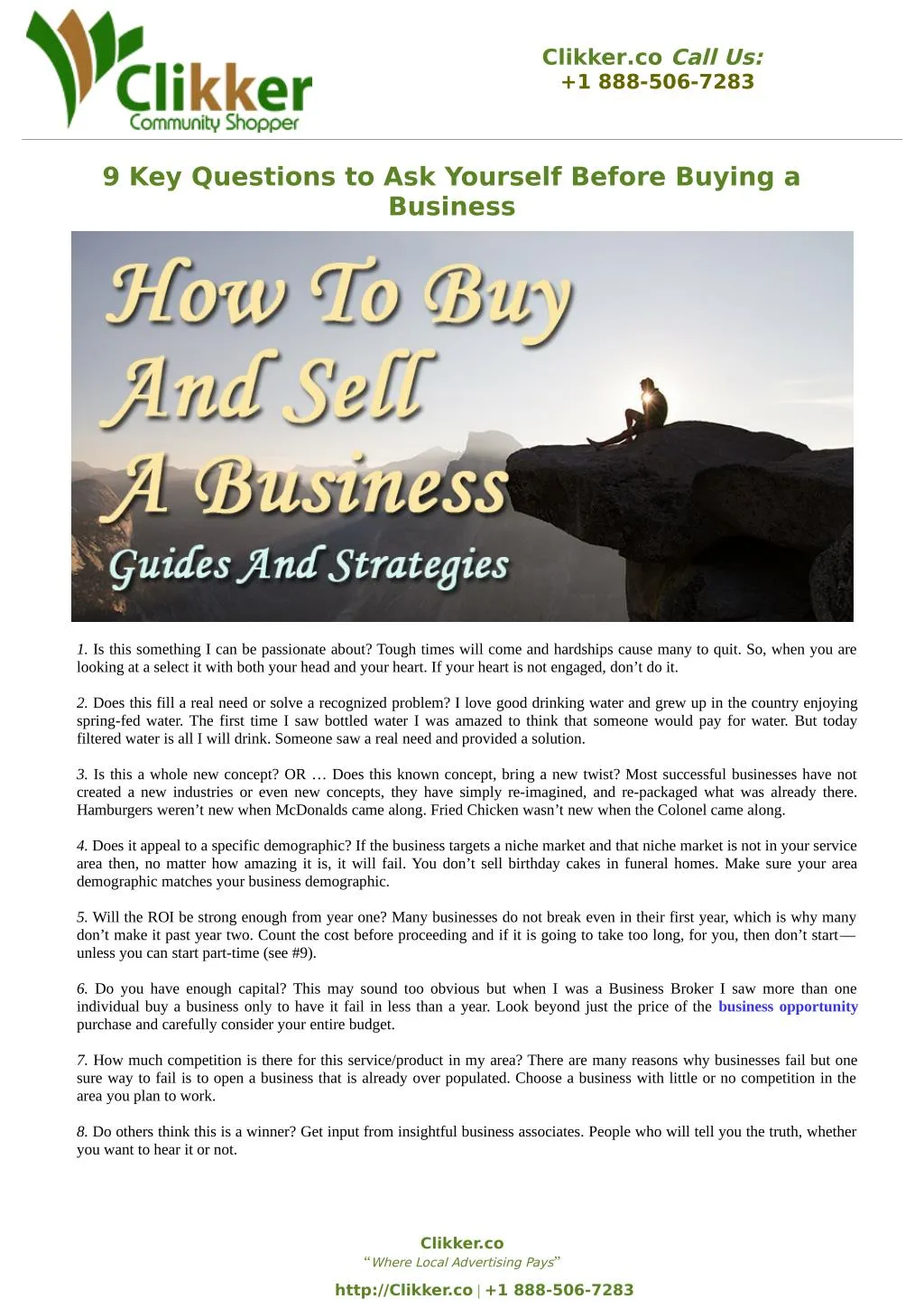

Purchasing a business is a significant undertaking, a leap of faith intertwined with careful planning. Knowing what to ask upfront can prevent costly surprises and ensure you’re making a well-informed decision. This article will guide you through the essential inquiries you need to make, transforming you from an interested observer into a confident buyer.

Unveiling the Financial Landscape

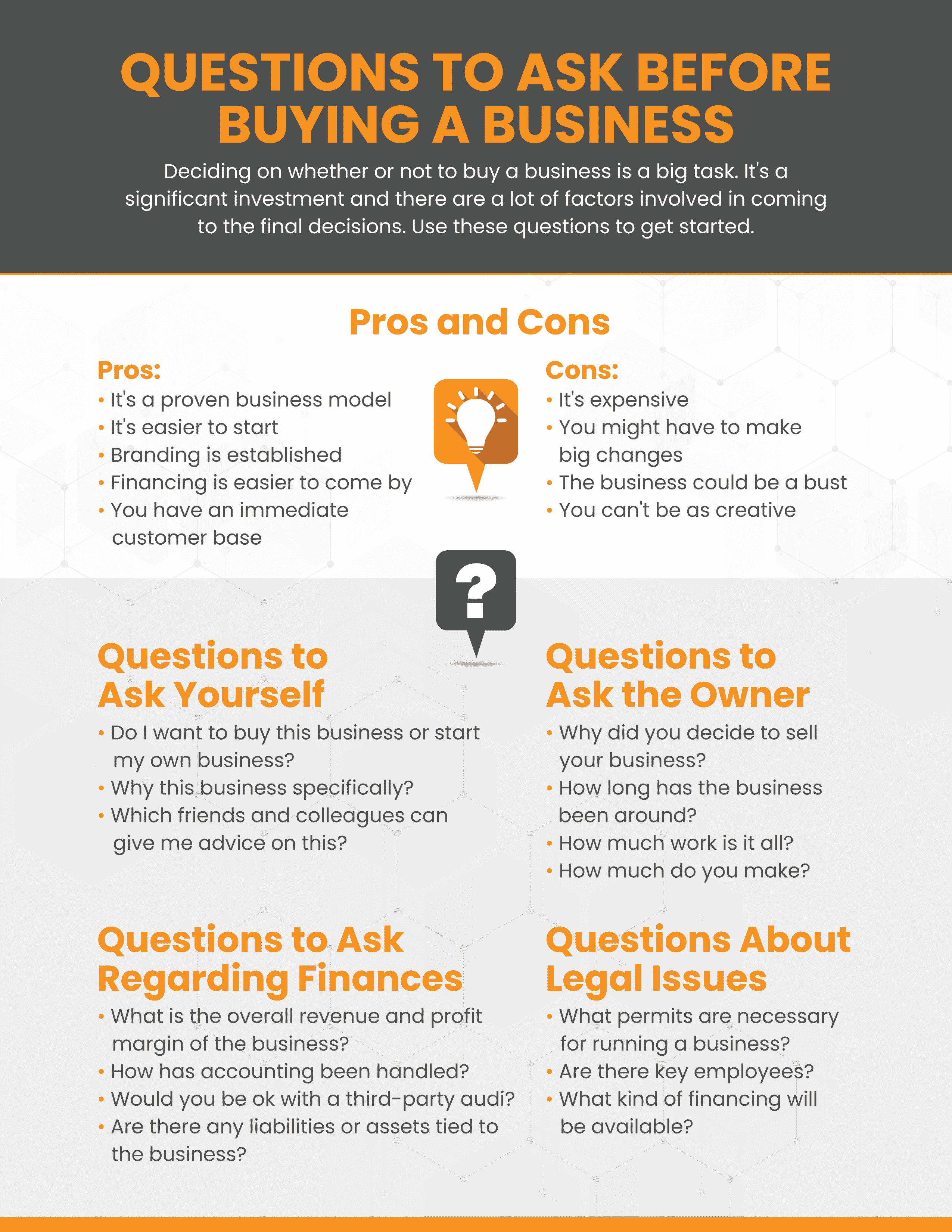

First and foremost, delve deep into the financials. Request at least three years of financial statements, including profit and loss statements, balance sheets, and cash flow statements. Don't just glance at the numbers; scrutinize them.

Verify the information. Consider hiring a qualified accountant to conduct due diligence and ensure the accuracy of the financial records. A professional can identify potential red flags and hidden liabilities.

Specifically, ask about revenue trends. Are sales consistently growing, declining, or fluctuating? Understand the seasonality of the business, if any, and how it impacts cash flow.

Inquire about gross profit margins and net profit margins. These metrics reveal the profitability of the business and how effectively it manages its expenses. Investigate any significant changes in these margins over time.

Understanding Operations and Assets

Beyond the numbers, you need to understand the day-to-day operations of the business. Ask for a comprehensive list of all assets included in the sale, from equipment and inventory to intellectual property and customer lists.

Evaluate the condition of the assets. Are the machines well-maintained, or are they nearing the end of their lifespan? A thorough assessment can help you estimate future capital expenditures.

Determine the value of the inventory. Is it saleable, or is it obsolete or damaged? Understand the inventory turnover rate to gauge how efficiently the business manages its stock.

Ask about key supplier relationships. Are there exclusive contracts in place, and what are the terms? Assess the risk of losing these relationships after the acquisition.

Legal and Regulatory Compliance

Legal and regulatory compliance is another crucial area of inquiry. Request copies of all relevant permits, licenses, and regulatory filings. Ensure the business is in good standing with all applicable authorities.

Investigate any pending or threatened litigation. Review any existing contracts, leases, and agreements to understand your obligations after the acquisition. A lawyer should review these to catch anything you may have overlooked.

Ask about employee contracts and benefits. Understand the terms of employment, including salaries, benefits, and any outstanding liabilities. Ensure compliance with labor laws and regulations.

Customer Relationships and Goodwill

A business is often only as good as its customer base. Request information about customer demographics, retention rates, and satisfaction levels. A loyal customer base is a valuable asset.

Understand the role of the current owner in maintaining customer relationships. Will the owner be staying on for a transition period to introduce you to key clients? A smooth transition is essential for retaining customers.

Ask about the business's reputation and goodwill. What is the business's brand image, and how is it perceived in the market? Goodwill can be a significant intangible asset.

The "Why" Behind the Sale

Finally, and perhaps most importantly, ask the seller why they are selling the business. Their answer can provide valuable insights into the business's prospects and potential challenges.

Is the owner retiring, or are there other reasons for selling? Are there underlying problems with the business that the seller is not disclosing? Dig deeper and don't be afraid to ask tough questions.

Verify the seller's statements with your own research and due diligence. Seek independent sources of information to corroborate their claims. Trust but verify.

Purchasing a business is an exciting journey, filled with both opportunities and challenges. By asking the right questions and conducting thorough due diligence, you can navigate this process with confidence and build a successful future.

![What To Ask For When Purchasing A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)