What To Bring To Tax Appointment H&r Block

The tax season is upon us, and for many, that means gathering documents and scheduling appointments. Walking into your tax appointment prepared can save you time, money, and a whole lot of stress. Overlooking vital paperwork is a common pitfall, potentially leading to delays in your refund or even inaccurate filings.

Navigating the complexities of tax preparation requires meticulous attention to detail. This article serves as a comprehensive guide to what you need to bring to your H&R Block tax appointment. Gathering all necessary documents beforehand ensures a smooth and efficient experience, maximizing your potential tax benefits and minimizing potential headaches.

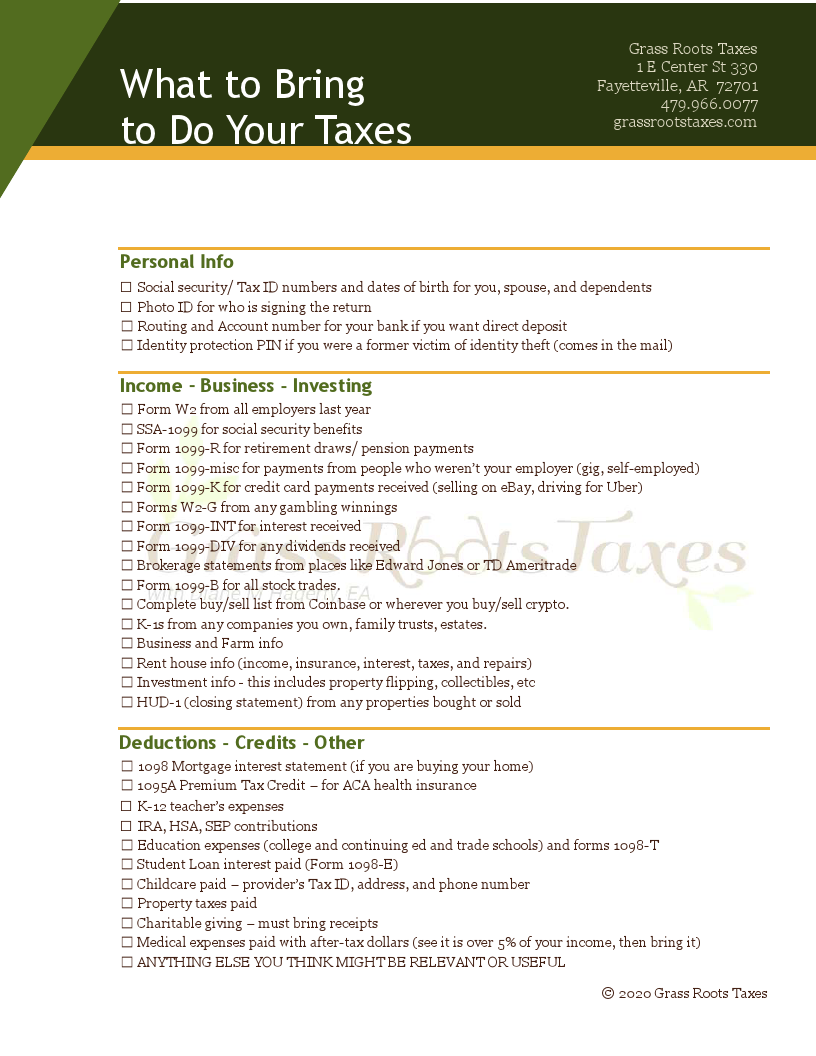

Essential Identification and Personal Information

Firstly, bring a valid photo ID, such as a driver's license or passport. This is necessary for identity verification purposes. You'll also need your Social Security card or a document containing your Social Security number, as well as those for your spouse and dependents, if applicable.

Make sure to have birth dates for yourself, your spouse, and dependents. Having this fundamental information readily available streamlines the initial stages of the appointment. It also prevents any potential errors in your tax return.

Income Statements: The Foundation of Your Return

Your Form W-2 from each employer you worked for during the tax year is paramount. This document details your earnings and the amount of taxes withheld. If you're self-employed or a freelancer, bring your Form 1099-NEC, which reports payments received for services rendered.

For income from investments, collect Form 1099-DIV for dividends, Form 1099-INT for interest income, and Form 1099-B for proceeds from broker transactions. If you received unemployment benefits, you'll need Form 1099-G.

Don't forget documentation for other income sources, such as alimony received, royalties, or income from rental properties. Having these records complete ensures accurate reporting of your total income, a critical step in tax preparation.

Deduction-Related Documents: Maximizing Your Savings

If you're claiming itemized deductions, gather all relevant documentation. This includes records of medical expenses, such as receipts from doctor's visits, hospital bills, and prescription costs. Remember, only medical expenses exceeding 7.5% of your adjusted gross income (AGI) are deductible.

Keep track of your mortgage interest statements (Form 1098) and property tax bills for potential deductions. Records of charitable contributions, both cash and non-cash, are also important. If you made non-cash donations, itemize the items and their estimated fair market value.

For those with student loans, bring Form 1098-E, which reports the interest paid during the year. Self-employed individuals should collect documentation for business expenses, such as receipts for office supplies, travel costs, and professional development. Accurate records are vital for maximizing potential deductions and reducing your tax liability.

Credits: Unlocking Additional Benefits

Certain tax credits require specific documentation. For childcare expenses, bring the name, address, and tax identification number of the daycare provider or caregiver. If you're claiming the Earned Income Tax Credit (EITC), be prepared to provide information about your qualifying children and meet the eligibility requirements.

If you're claiming education credits, such as the American Opportunity Tax Credit or the Lifetime Learning Credit, bring Form 1098-T from your educational institution. This form reports qualified tuition and related expenses paid during the tax year.

Other Important Documents

Have a copy of last year's tax return readily available. This helps your tax preparer understand your prior tax situation and identify any changes. If you received any letters from the IRS, bring those along as well.

If you made estimated tax payments during the year, bring documentation of those payments. This includes the amounts paid and the dates of payment. For those contributing to retirement accounts, such as IRAs, bring records of your contributions.

For those receiving or paying alimony or spousal support, bring the divorce decree or separation agreement that outlines the terms of the arrangement. Be mindful that changes in tax law may impact the taxability of alimony payments.

Forward-Looking Considerations

Staying organized throughout the year can significantly ease the tax preparation process. Consider using a tax preparation checklist or software to track your income and expenses. As tax laws are subject to change, staying informed about new regulations and potential impacts on your tax situation is essential.

Consulting with a tax professional can provide personalized guidance and ensure you're taking advantage of all available deductions and credits. This is especially beneficial if you have complex tax situations, such as self-employment income or significant investment holdings.

By meticulously gathering the necessary documents and working closely with a tax professional like H&R Block, you can navigate the tax season with confidence and accuracy. This approach can also minimize stress and optimize your tax outcome.