What To Do When Closing A Business

Closing a business is a difficult decision, but knowing how to navigate the process can ease the transition for owners, employees, and customers alike. The process involves a complex series of legal, financial, and logistical steps that must be carefully considered to avoid potential liabilities and ensure a smooth closure.

Whether due to financial hardship, retirement, or a change in personal circumstances, business owners need a roadmap to navigate the winding down of their operations. This article outlines essential steps to help business owners close their businesses responsibly and efficiently.

Initial Considerations and Planning

The first crucial step is developing a comprehensive closure plan. This involves evaluating the current financial state of the business, including outstanding debts, assets, and liabilities.

Consulting with legal and financial professionals is highly recommended at this stage. According to the Small Business Administration (SBA), seeking professional advice can help business owners understand their legal obligations and develop a sound financial strategy for closing.

Addressing Legal and Regulatory Requirements

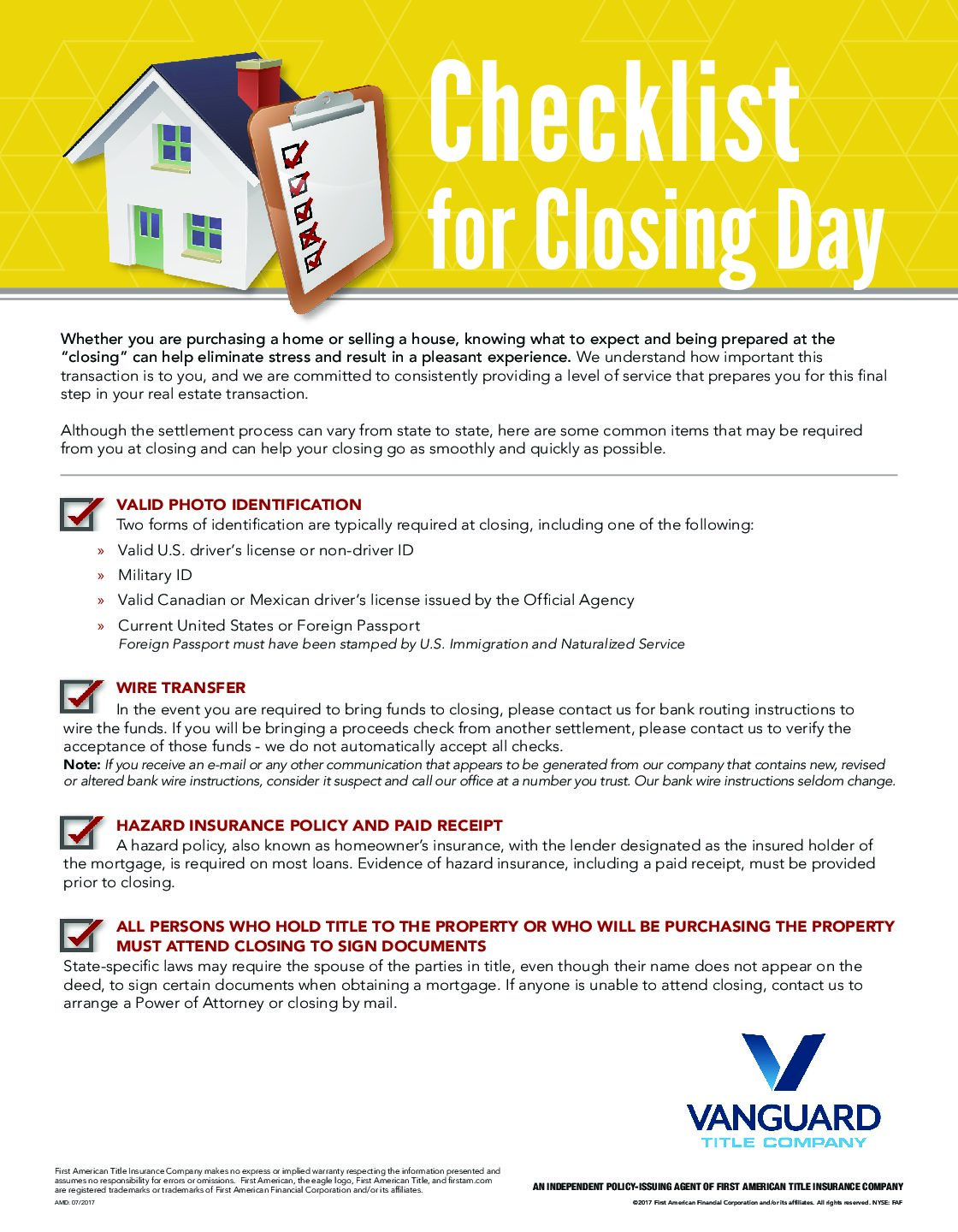

Closing a business involves a number of legal and regulatory requirements that vary depending on the business structure and location. You'll need to formally dissolve your business with the relevant state agencies.

This usually involves filing articles of dissolution with the secretary of state's office. Ensure all required permits and licenses are canceled with the appropriate local and state authorities.

Failure to properly dissolve the business can result in ongoing tax liabilities and legal responsibilities.

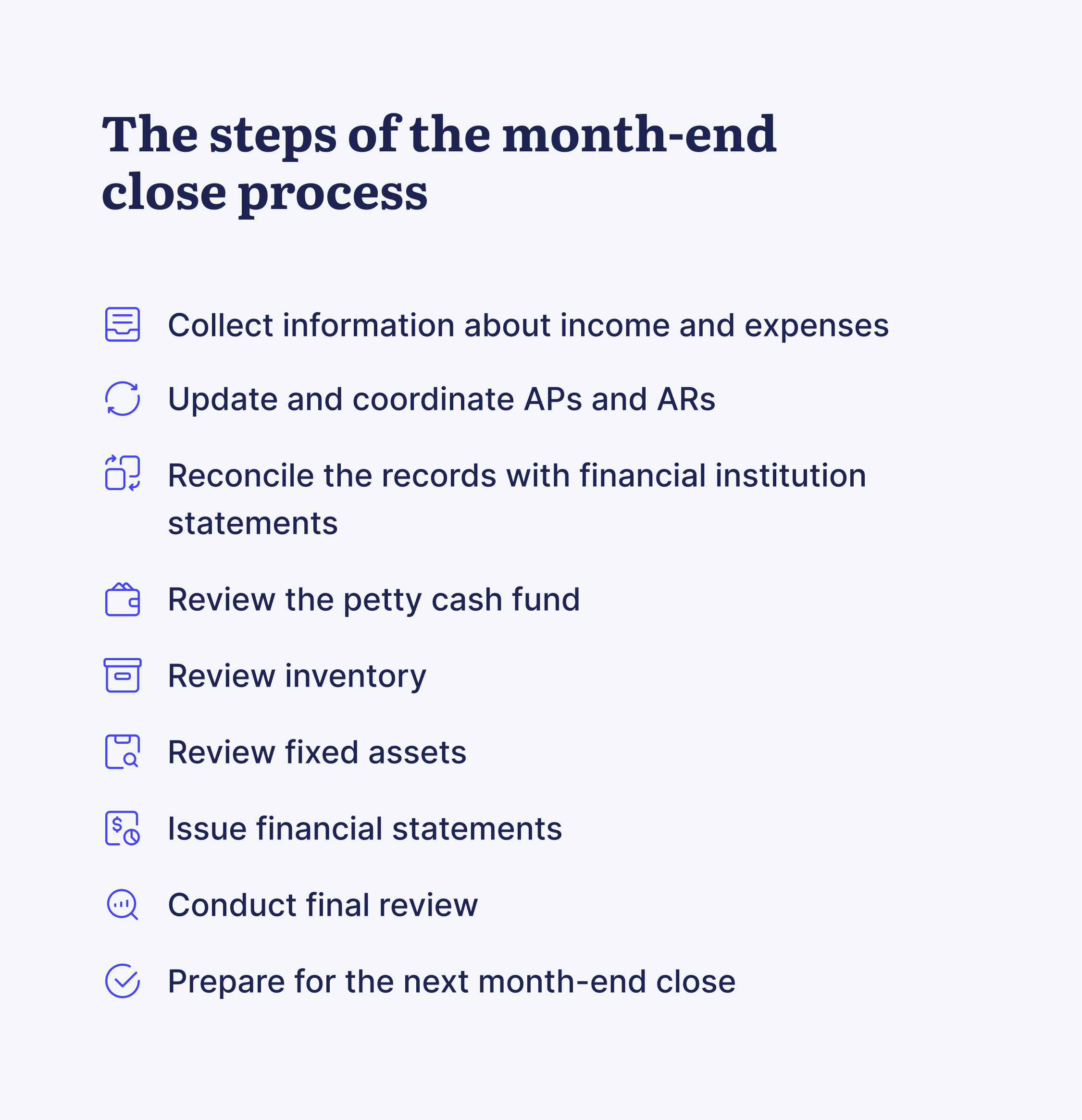

Managing Finances and Outstanding Debts

Dealing with outstanding debts is a critical aspect of closing a business. Begin by creating an inventory of all debts, including loans, vendor invoices, and taxes owed.

Consider negotiating payment plans with creditors to minimize financial strain. The Internal Revenue Service (IRS) offers various options for businesses struggling to pay their taxes, including installment agreements and offers in compromise.

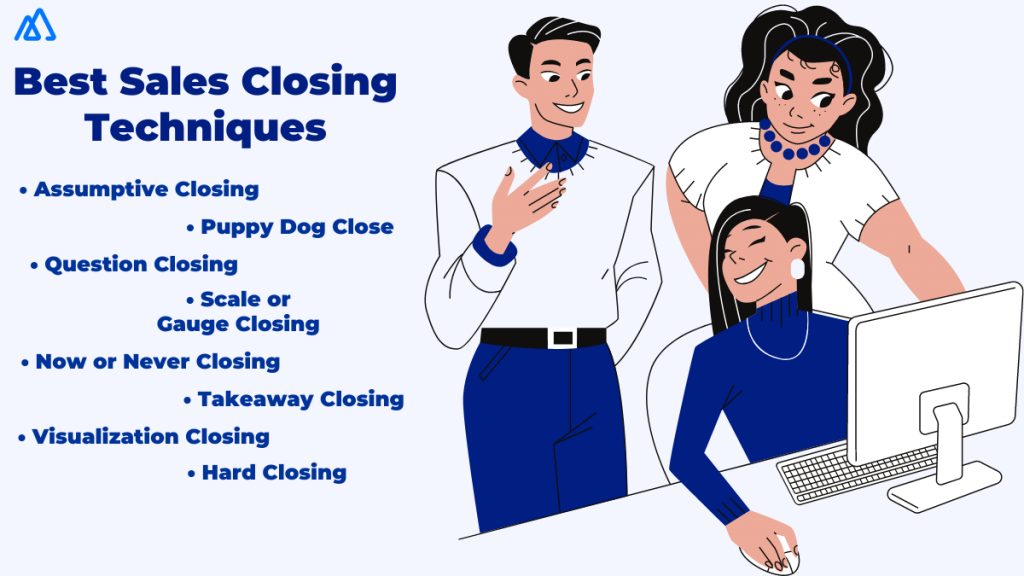

Communicating with Stakeholders

Open and honest communication with stakeholders is essential throughout the closure process. This includes informing employees, customers, and suppliers about the impending closure.

Employees should be notified in advance, if possible, and provided with information about their rights, including severance pay (if applicable) and unemployment benefits. Customers should be informed about the closure and any potential refunds or warranties that may be affected.

Suppliers need to be notified to avoid any further orders or deliveries.

Operational Procedures and Asset Liquidation

Once the initial planning is complete, focus shifts to the operational aspects of closing the business. This includes liquidating assets, settling contracts, and finalizing employee matters.

Liquidation can involve selling assets through auctions, private sales, or liquidators. Carefully assess the value of each asset and determine the most effective method of sale to maximize returns.

Finalizing Employee Matters

Properly handling employee matters is crucial for a smooth closure. This includes paying all outstanding wages, benefits, and accrued vacation time.

Provide employees with the necessary paperwork, such as W-2 forms and information about their eligibility for unemployment benefits. Consider offering outplacement services to help employees find new employment.

Terminating Leases and Contracts

Review all leases and contracts to determine the terms for termination. Negotiate with landlords and vendors to minimize any penalties or fees associated with early termination.

Obtain written confirmation of termination agreements to avoid any future disputes. If necessary, seek legal advice to ensure that all terminations are handled properly.

Post-Closure Responsibilities

Even after the business is officially closed, certain responsibilities remain. These include filing final tax returns, retaining business records, and addressing any potential legal claims.

Tax obligations don't end when the doors close. According to the IRS, business owners must file final federal and state tax returns, including income tax, employment tax, and sales tax returns.

Business records should be retained for a certain period, typically several years, to comply with legal and tax requirements.

Closing a business is undoubtedly challenging, but careful planning and execution can minimize stress and ensure a responsible transition. By following these steps and seeking professional guidance, business owners can navigate the closure process with confidence and integrity.

![What To Do When Closing A Business How to Close a Business Checking Account in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2023/02/How-to-close-a-business-checking-account-screenshot.jpg)