What Was The Largest Deduction For This Pay Period

The weight of inflation continues to press down on American wallets, but a less discussed, yet equally significant factor is quietly chipping away at take-home pay: deductions. While healthcare costs and retirement contributions are often scrutinized, a recent analysis reveals a surprising contender for the title of the largest deduction for many U.S. workers this pay period.

This article delves into the dominant force behind this deduction, exploring its implications for individuals, businesses, and the broader economy. We'll examine the data, consult expert opinions, and analyze potential future impacts of this financial pressure point.

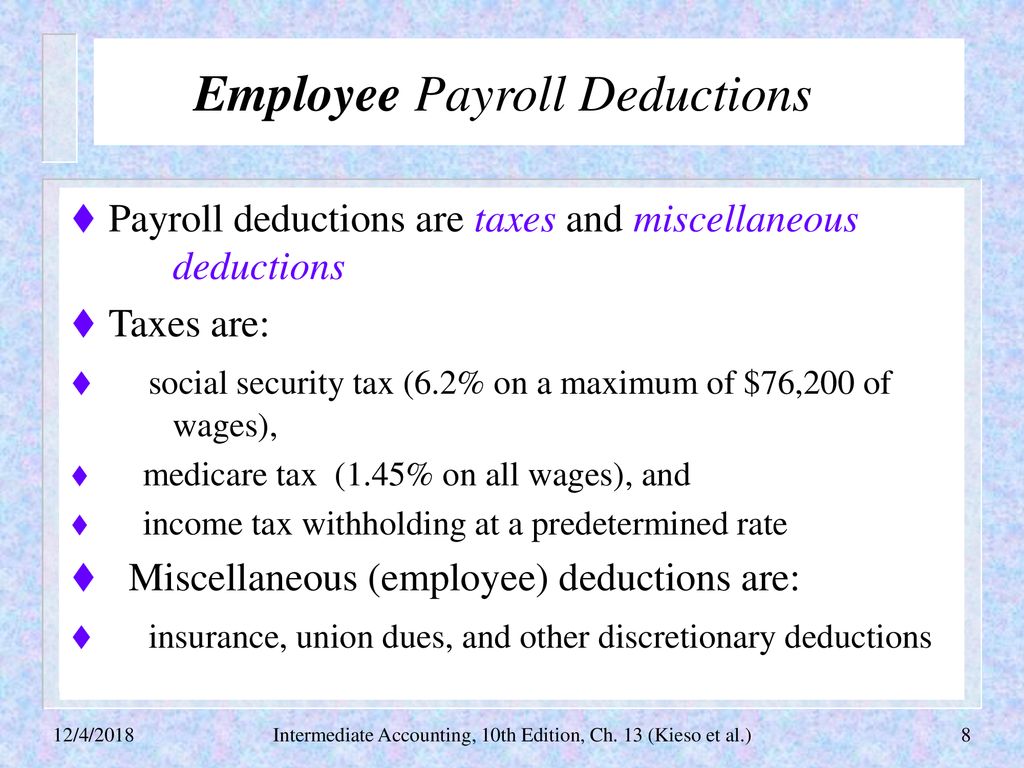

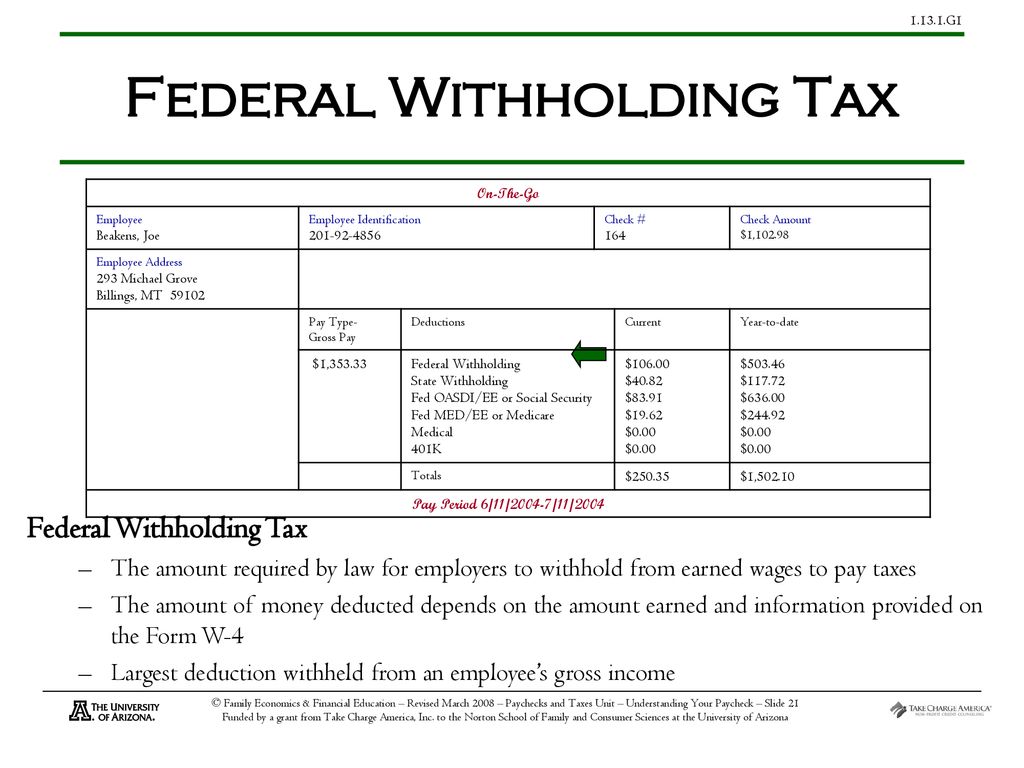

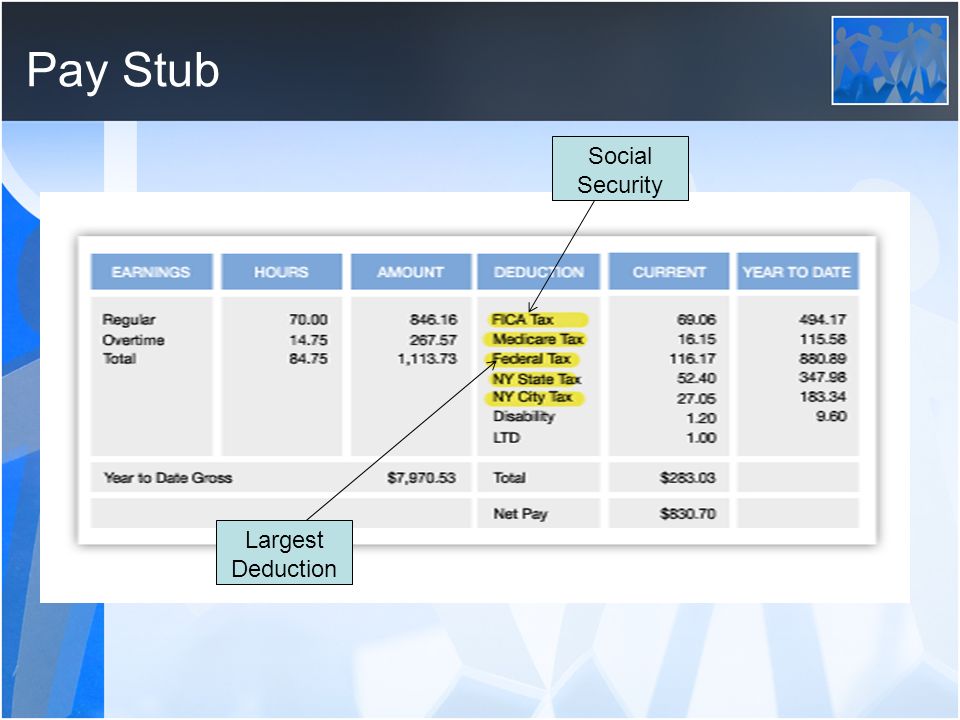

The Leading Deduction: Social Security Taxes

According to data compiled from payroll processors and analyzed by the Economic Policy Institute (EPI), Social Security taxes emerged as the largest single deduction for a significant portion of American workers during the most recent pay period. This deduction, mandated under the Federal Insurance Contributions Act (FICA), funds the Social Security retirement, disability, and survivor benefits programs.

For employees, the Social Security tax rate is 6.2% of gross wages, up to an annual wage base limit. In 2024, this limit is $168,600.

Why Now? A Perfect Storm of Factors

Several converging factors have contributed to Social Security taxes becoming the most prominent deduction. Primarily, the increase in wages, intended to offset inflation, has resulted in higher taxable income for many individuals.

As workers' incomes rise, even if nominally, they contribute more to Social Security until they reach the wage base limit. Inflation has also driven cost-of-living adjustments (COLAs) for Social Security recipients, placing increased demand on the system and potentially fueling concerns about its long-term solvency.

Furthermore, the growing number of baby boomers retiring places increasing strain on the Social Security system. The larger the beneficiary pool, the more pressure there is to collect sufficient tax revenue to fund promised benefits.

Impact on Workers and Businesses

The prominence of Social Security taxes as a deduction has tangible effects on both workers and businesses. For employees, a larger Social Security tax bite translates to less disposable income in each paycheck.

This can strain household budgets, particularly for lower and middle-income families already grappling with rising prices. Businesses, too, face implications, as they are required to match employee Social Security contributions.

This employer-side burden can impact profitability and potentially influence hiring decisions, especially for small businesses operating on thin margins.

Expert Perspectives

Economists offer varying perspectives on the significance of this trend. Elise Gould, a senior economist at the Economic Policy Institute, emphasizes the importance of Social Security as a safety net, but also acknowledges the immediate financial strain on workers.

"While Social Security is a vital program, its payroll tax can be a significant burden, especially for low-wage workers who may not feel they are seeing immediate benefits commensurate with the deduction," Gould stated in a recent interview.

Others argue that the current Social Security tax structure is sustainable and necessary to maintain the program's integrity. Andrew Biggs, a resident scholar at the American Enterprise Institute, points out that Social Security taxes are dedicated funds specifically for retirement and disability benefits.

"The debate is not about whether Social Security is necessary, but about how best to fund it for future generations. Claiming it's unfairly burdensome ignores that it is a crucial part of the retirement system," Biggs explained.

The Future of Social Security Deductions

The future trajectory of Social Security deductions is subject to ongoing debate and policy discussions. Proposals range from raising the wage base limit to increasing the Social Security tax rate, or even adjusting benefit formulas.

Any of these changes could significantly impact the size of the deduction and its impact on workers' paychecks. The Social Security Administration projects that the current system will be unable to pay full benefits to retirees starting in the mid-2030s.

This impending shortfall intensifies the urgency of addressing the funding challenges and considering potential reforms. Legislative action or inaction will have significant consequences for current and future generations.

Navigating the Deduction Landscape

For individuals, understanding the components of their paycheck and the purpose of each deduction is crucial. Familiarizing yourself with the Social Security system and its projected future can help you plan for retirement and advocate for policies that align with your financial interests.

Resources from the Social Security Administration and independent financial advisors can provide valuable insights. Businesses, too, should stay informed about potential changes to Social Security regulations and plan accordingly to minimize any negative impacts on their operations and workforce.

In conclusion, while the prominence of Social Security taxes as the largest deduction may come as a surprise to some, it underscores the complex interplay of economic forces, demographic shifts, and policy choices that shape our financial realities. Addressing the challenges and opportunities surrounding Social Security is essential to ensuring a stable and secure future for all Americans.