What Will Happen If I Stop Paying My Credit Cards

The weight of credit card debt can feel crushing, a constant shadow looming over financial stability. But what happens when that weight becomes unbearable, and the decision to stop paying seems like the only option? The consequences are far-reaching, impacting not just your credit score but also your financial future and overall well-being.

This article delves into the tangible repercussions of ceasing credit card payments. It provides a comprehensive understanding of the domino effect, from immediate fees and interest charges to potential legal action and long-term credit damage.

The Immediate Aftermath: Fees, Interest, and Increased Debt

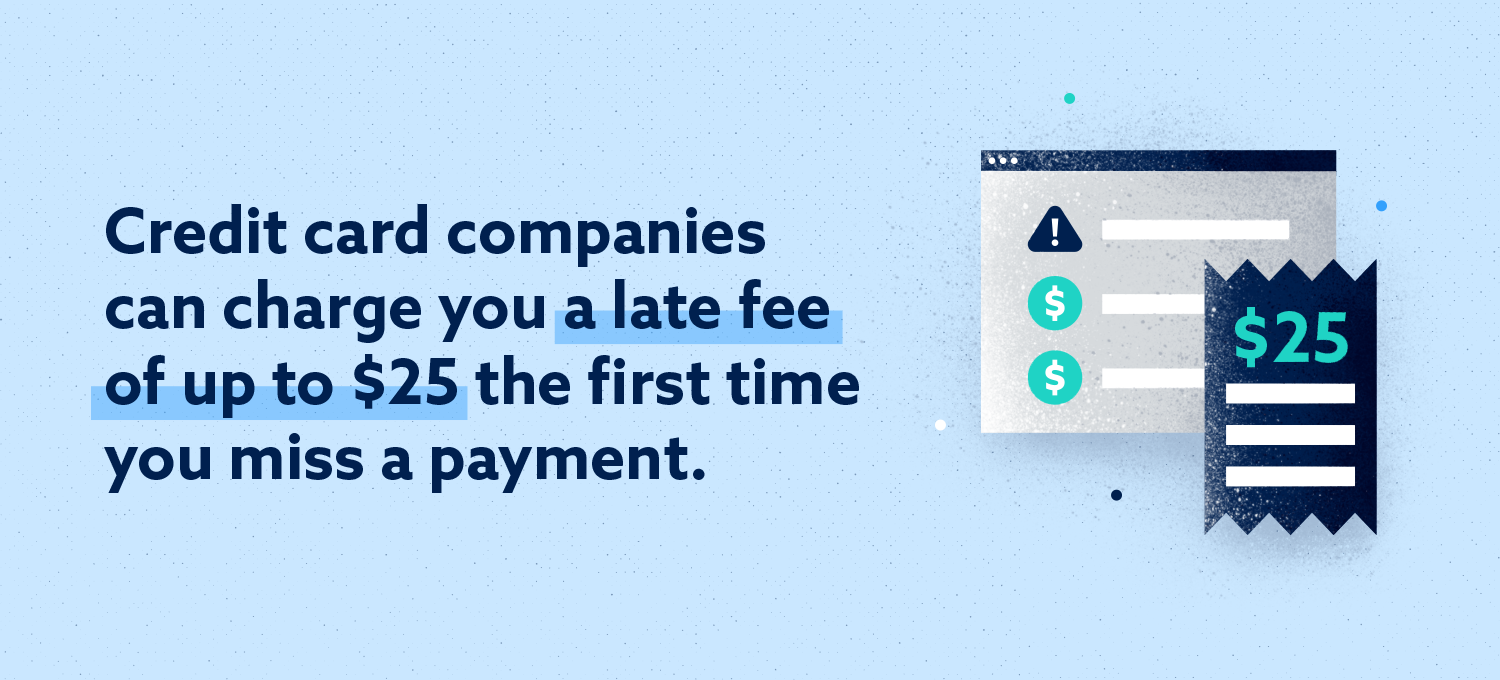

The initial consequence of a missed credit card payment is almost immediate: late fees. These fees, often ranging from $25 to $39 depending on the card issuer and your payment history, are added to your outstanding balance. This increases the amount you owe and puts you further behind.

Furthermore, your interest rate may jump to a higher, often punitive, rate, known as the penalty APR. According to the Consumer Financial Protection Bureau (CFPB), this can significantly increase the cost of carrying a balance, making it even more difficult to repay what you owe.

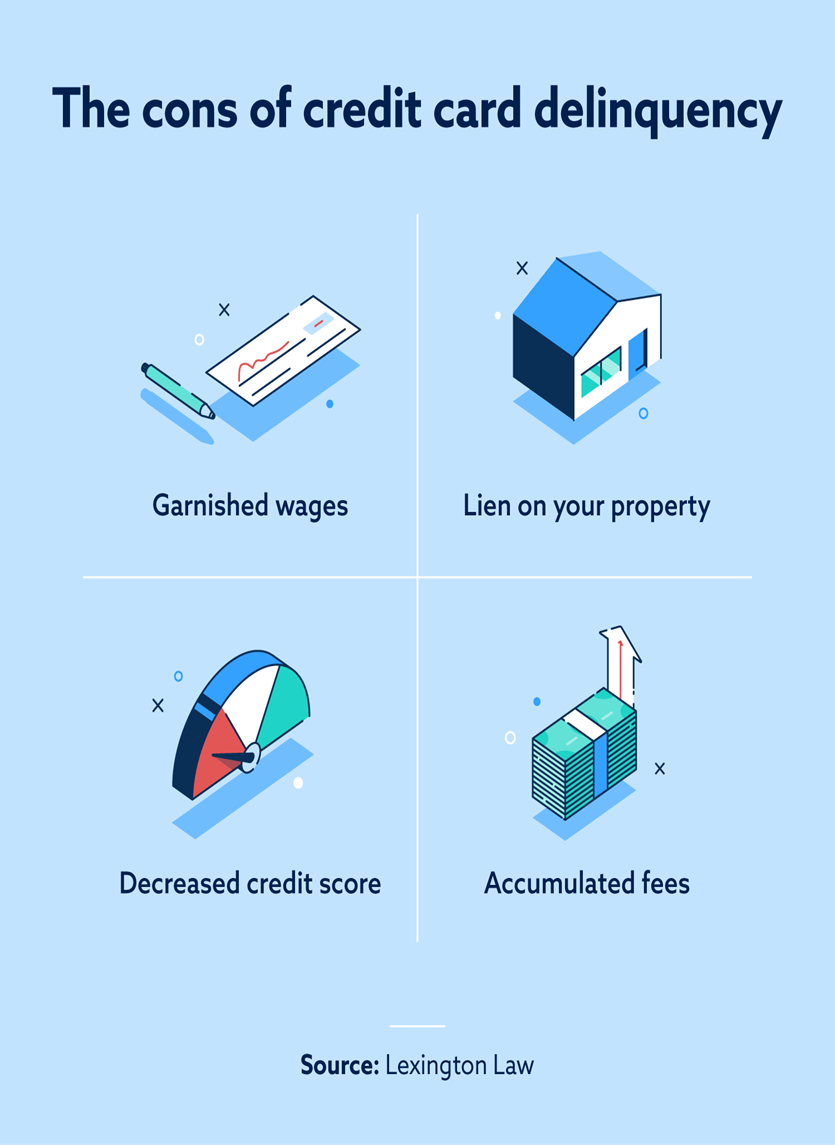

Missing one payment can trigger a chain reaction, with each subsequent missed payment compounding the problem. The debt grows due to accumulating interest and fees, creating a seemingly insurmountable financial hurdle.

The Credit Score Hit: A Long-Term Consequence

One of the most significant long-term effects of stopping credit card payments is the damage to your credit score. Payment history is the most important factor in determining your credit score, accounting for approximately 35% of your FICO score, as reported by Experian.

A single missed payment can negatively impact your score, and multiple missed payments will severely damage it. This can make it difficult to obtain loans, rent an apartment, or even secure certain jobs in the future.

The severity of the impact depends on your current credit score. Someone with excellent credit will likely experience a more significant drop than someone with already poor credit. According to FICO, a person with a good credit score could see a drop of 50 to 100 points or more after a missed payment.

Debt Collection and Legal Action

After several missed payments, the credit card company will likely begin debt collection efforts. This typically starts with phone calls and letters demanding payment. These communications can become increasingly frequent and aggressive as time passes.

If these efforts are unsuccessful, the credit card company may sell your debt to a debt collection agency. These agencies are often more aggressive in their collection tactics. They will continue to contact you, demanding payment and potentially offering settlement options.

Eventually, the credit card company or debt collector may file a lawsuit against you to recover the debt. If they win the lawsuit, they can obtain a judgment against you, which allows them to garnish your wages or levy your bank accounts to satisfy the debt. Wage garnishment means a portion of your paycheck will be automatically deducted to pay off the debt.

Impact on Other Aspects of Your Financial Life

The negative consequences of stopping credit card payments extend beyond your credit score and debt collection. Your ability to secure future credit is severely hampered. Applying for a mortgage, car loan, or even another credit card becomes significantly more challenging, and if approved, the interest rates will likely be much higher.

Renting an apartment can also be affected. Landlords often check credit reports as part of the application process, and a poor credit history can lead to denial. Some employers also review credit reports, particularly for positions involving financial responsibility.

Your credit card debt can even affect your mental health. The stress and anxiety associated with debt can lead to depression, sleep problems, and other health issues. Seeking help from a therapist or financial advisor can be beneficial in managing the emotional toll of debt.

Alternatives to Defaulting: Seeking Help and Exploring Options

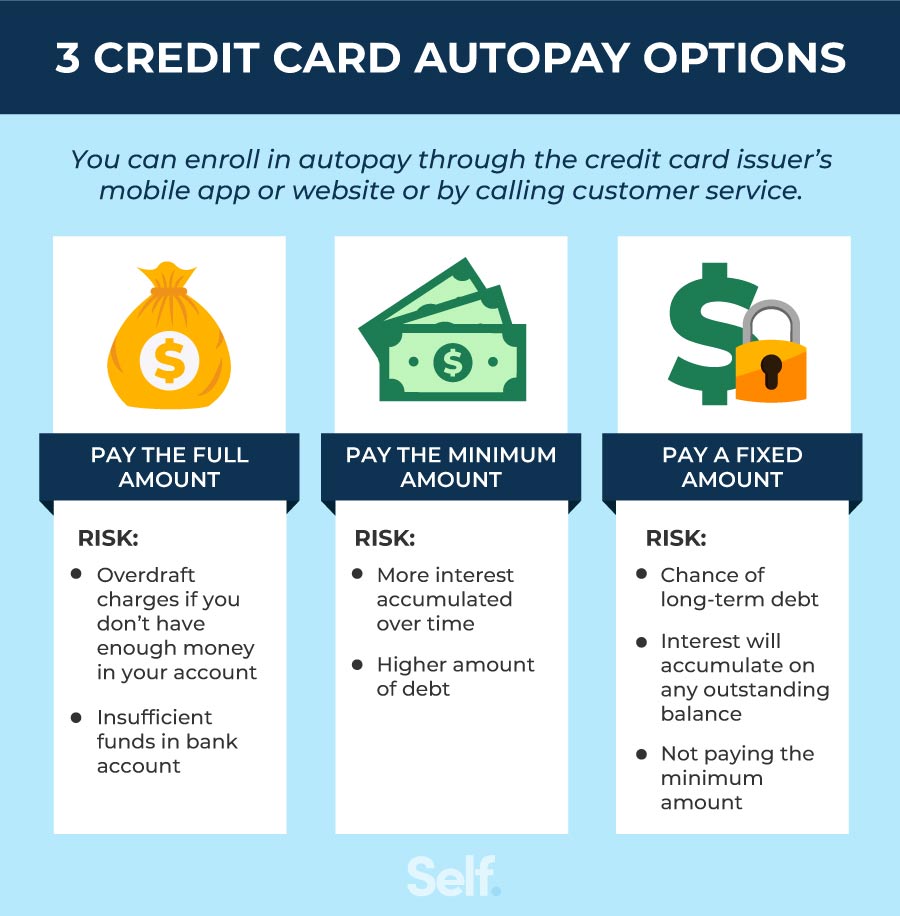

Before stopping credit card payments, explore alternative solutions to manage your debt. Contact your credit card company and inquire about hardship programs, which may offer temporary reduced interest rates or payment plans.

Consider credit counseling. Non-profit credit counseling agencies can help you develop a budget, negotiate with creditors, and explore debt management plans. These plans involve making a single monthly payment to the agency, which then distributes the funds to your creditors.

Debt consolidation loans can be an option for some. This involves taking out a new loan to pay off your existing credit card debt, ideally at a lower interest rate. However, be cautious of fees and ensure you can comfortably afford the new monthly payments.

"Ignoring your debt will not make it disappear; it will only compound the problem," warns the National Foundation for Credit Counseling (NFCC).

The Long Road to Recovery

Recovering from the consequences of stopping credit card payments takes time and discipline. Rebuilding your credit score requires consistent on-time payments for all your financial obligations.

Consider secured credit cards. These cards require a cash deposit as collateral, making them easier to obtain with poor credit. They can help you rebuild your credit history if used responsibly.

It's crucial to establish a budget and stick to it. Avoid accumulating new debt and prioritize paying down existing debts. Regularly monitor your credit report for errors and signs of identity theft.

Moving Forward: Financial Responsibility and Prevention

The best approach is to prevent credit card debt from becoming overwhelming in the first place. This involves responsible spending habits, budgeting, and understanding the terms and conditions of your credit cards.

Avoid maxing out your credit cards and strive to keep your credit utilization ratio (the amount of credit you're using compared to your total credit limit) below 30%. Pay your bills on time and in full whenever possible.

Stopping credit card payments can have serious and long-lasting consequences. By understanding the risks and exploring available alternatives, individuals can make informed decisions and protect their financial future. Seeking professional help and adopting responsible financial habits are crucial steps toward managing debt and achieving financial stability.