What's Apple Card Monthly Installments

Imagine snagging that sleek new iPhone, the one you've been eyeing for months. The cashier rings you up, and instead of that familiar pang of financial dread, you feel a surprising sense of calm. You're not about to drop a huge sum upfront. Instead, you're opting for a series of manageable, interest-free payments. This isn't some futuristic dream; it's the reality of Apple Card Monthly Installments, a program designed to make Apple products more accessible and affordable.

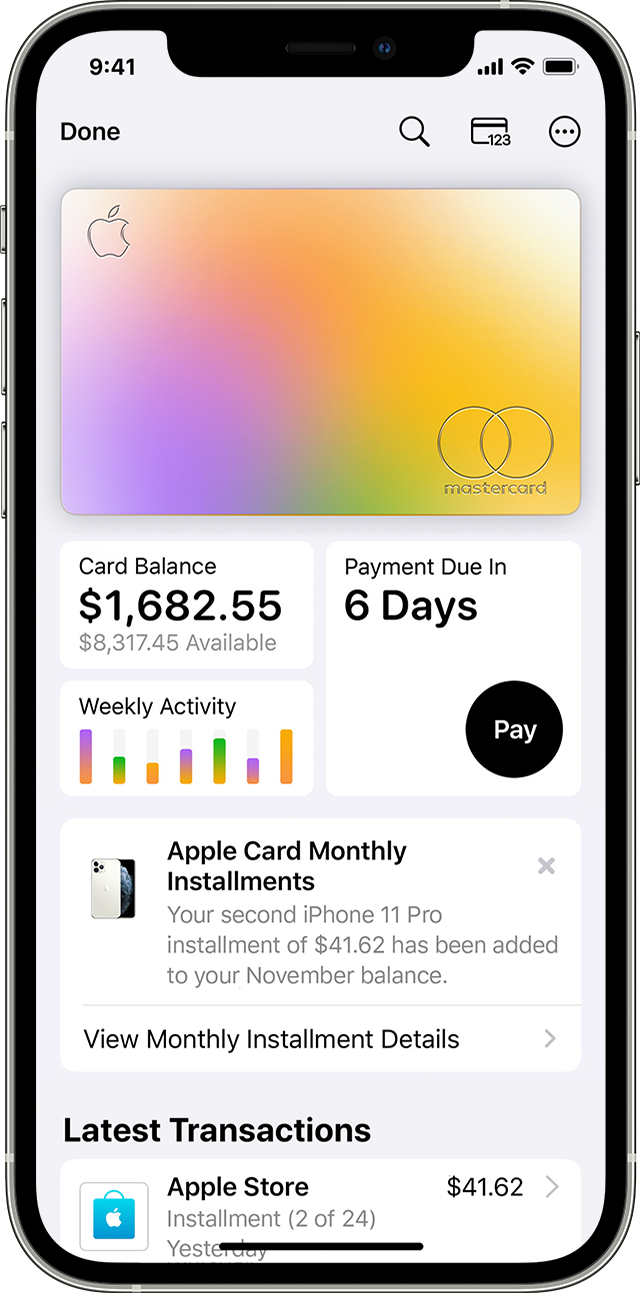

At its core, Apple Card Monthly Installments is a feature that allows Apple Card users to purchase select Apple products and pay for them over a set period, typically 6, 12, or even 24 months, with 0% APR. This feature is seamlessly integrated into the Apple Card experience, offering a transparent and straightforward way to manage purchases without incurring additional interest charges. It's a smart move by Apple, making their ecosystem more appealing to a wider audience.

The Backstory and Evolution

The Apple Card, launched in 2019 in partnership with Goldman Sachs, was already making waves in the credit card industry with its focus on simplicity, privacy, and daily cash back rewards. The introduction of Monthly Installments was a natural progression, addressing a key barrier for many potential customers: the upfront cost of Apple's premium products.

Before Monthly Installments, customers either had to pay in full, use a different credit card (potentially incurring interest charges), or explore third-party financing options. Apple sought to streamline this process, providing a more integrated and cost-effective solution within its own ecosystem.

How it Works: A Step-by-Step Guide

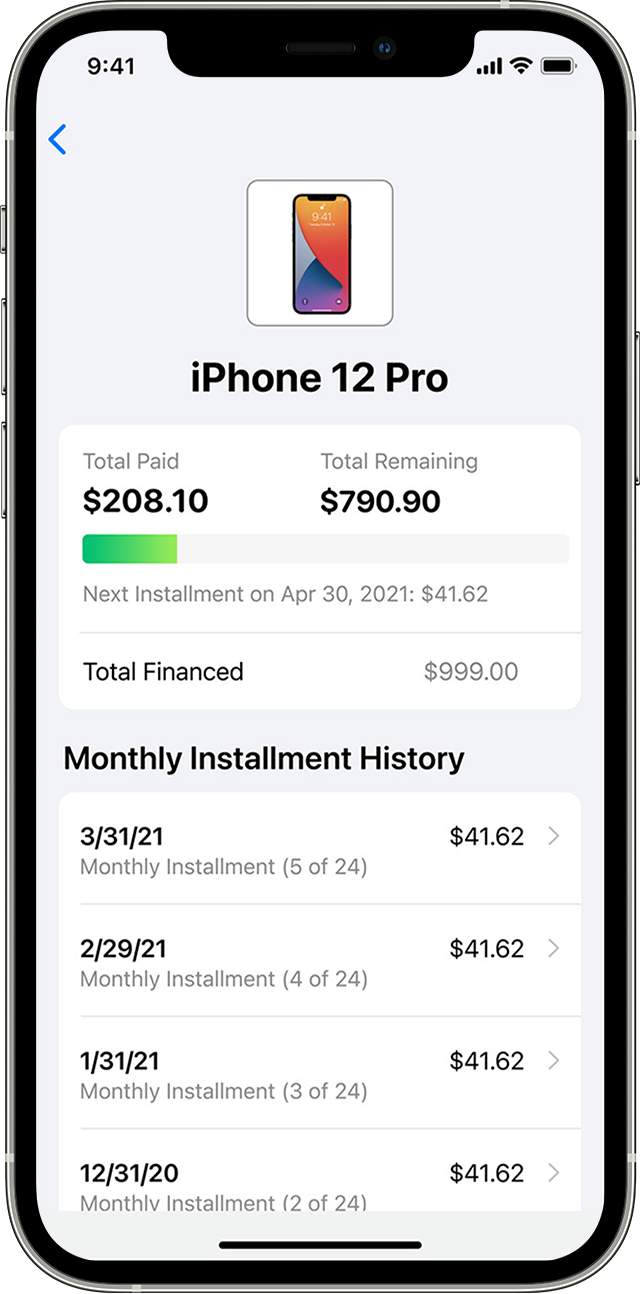

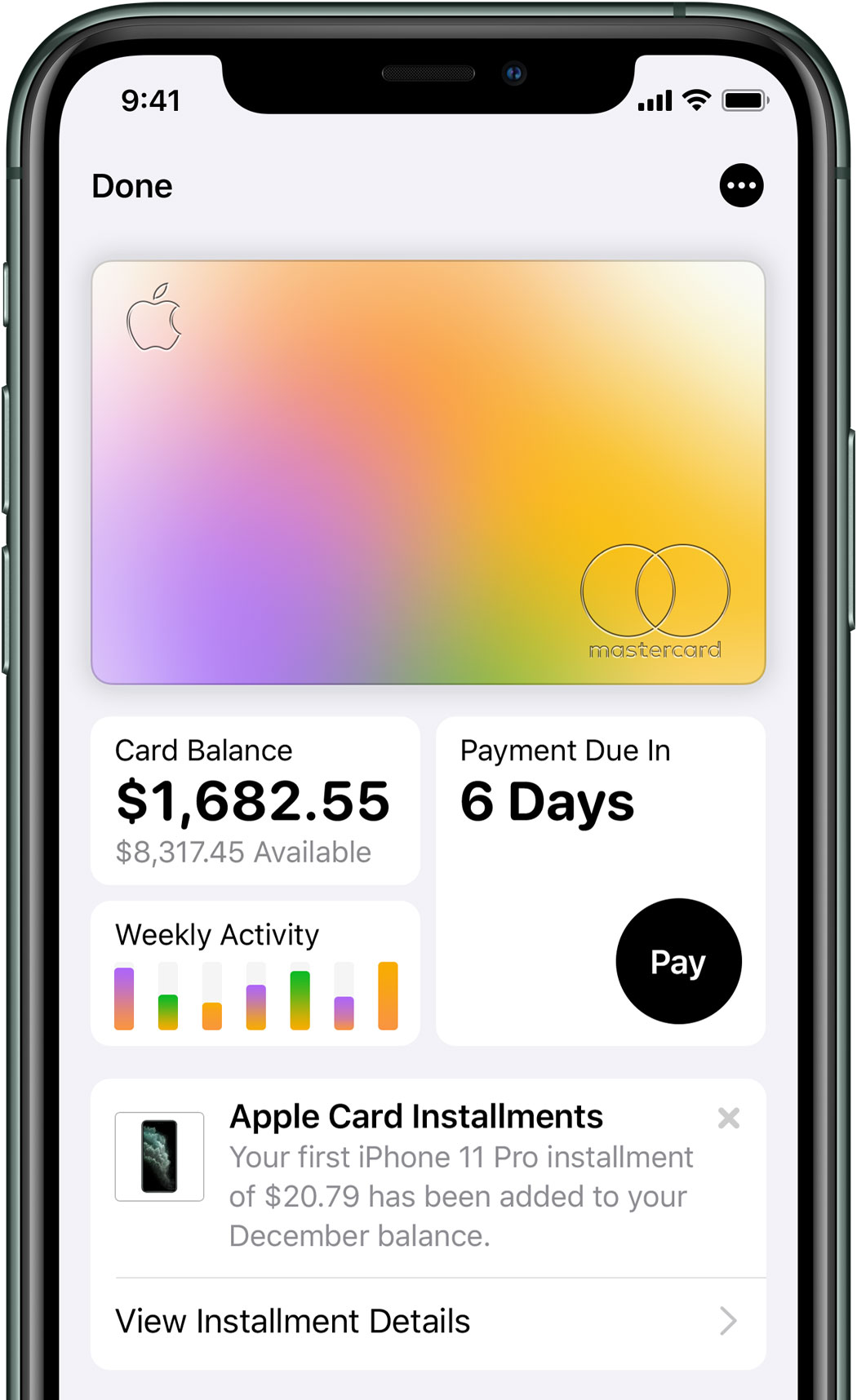

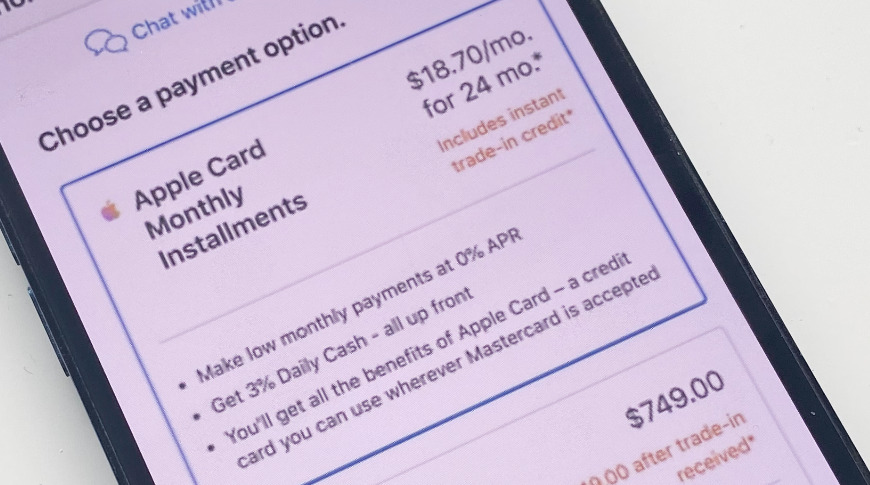

The process is remarkably simple. When purchasing an eligible product, like an iPhone, iPad, Mac, or Apple Watch, users can select the "Pay Monthly" option during checkout, either online or at an Apple Store. The purchase is then divided into equal monthly installments, which are added to their Apple Card balance.

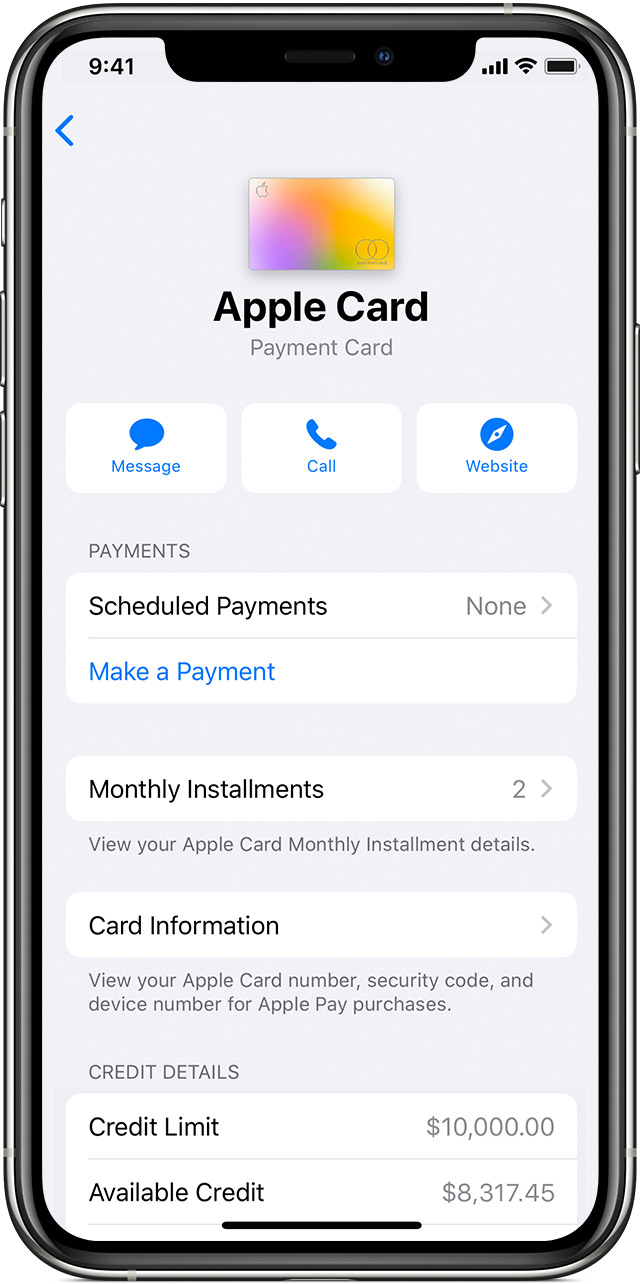

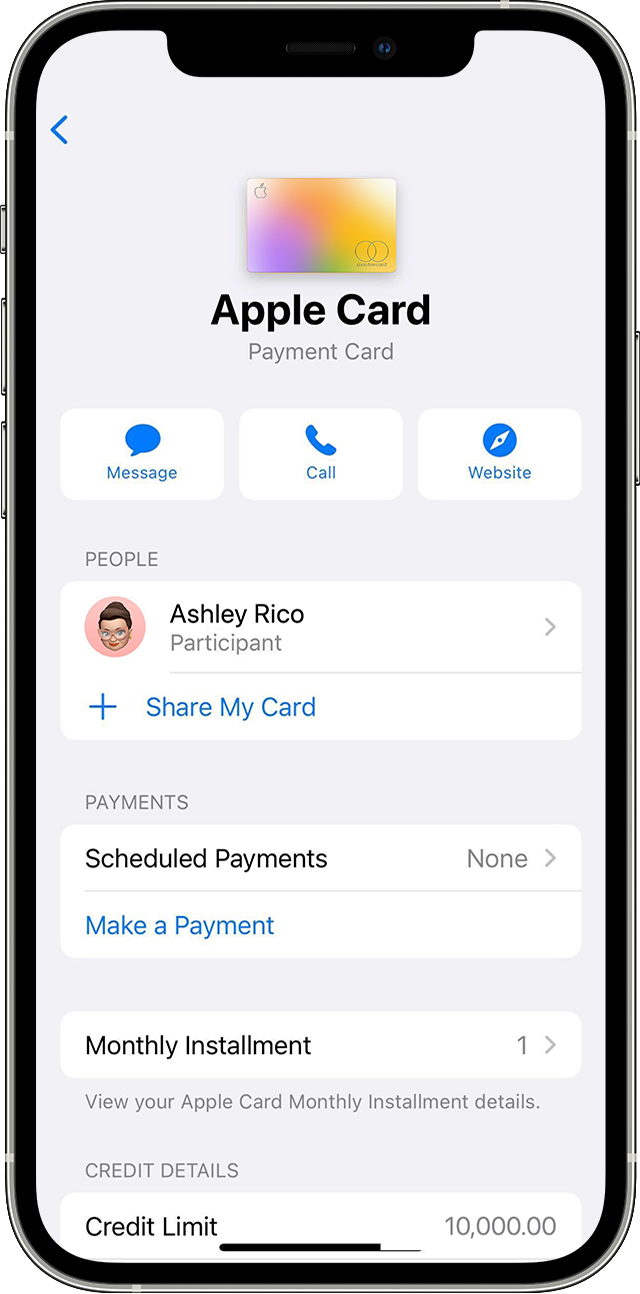

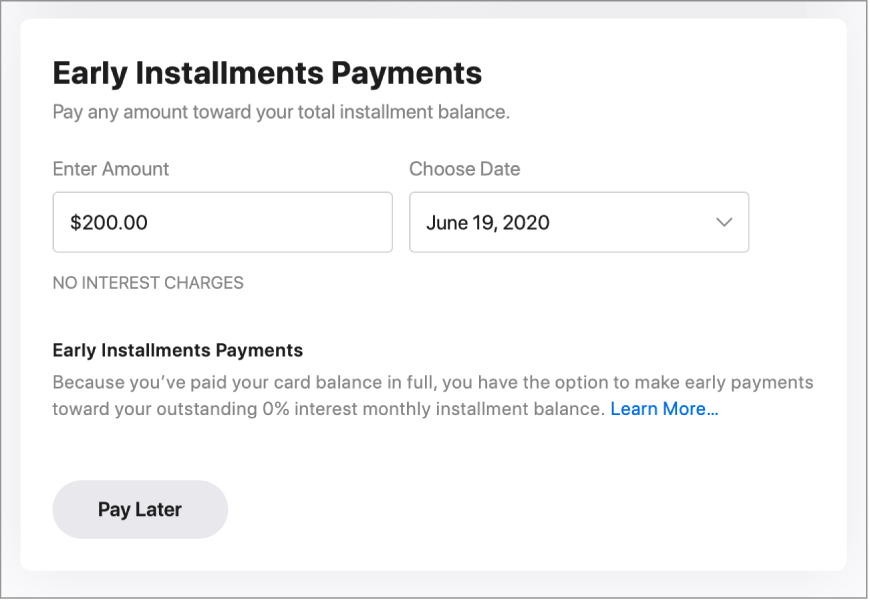

Each month, the installment payment is included in the minimum payment due on their Apple Card statement. One of the nicest features is the real-time tracking of installment balances within the Wallet app, providing a clear view of how much is left to pay and when each payment is due.

The Benefits: More Than Just Affordability

The most obvious benefit is the 0% APR. This can represent significant savings compared to carrying a balance on a traditional credit card, where interest charges can quickly accumulate. It transforms a potentially expensive purchase into a series of predictable, manageable payments.

Beyond cost savings, Monthly Installments offer greater flexibility. Consumers can access premium Apple products without significantly impacting their immediate cash flow, opening up the Apple ecosystem to a wider range of customers. Furthermore, customers still earn Daily Cash on their purchases, even when using Monthly Installments, sweetening the deal even further.

Potential Considerations

While Apple Card Monthly Installments offer undeniable benefits, it's important to consider a few key points. You do need to be approved for an Apple Card to take advantage of the program. Your credit limit will determine the maximum purchase amount you can finance.

It's also crucial to maintain responsible spending habits. Missing payments can negatively impact your credit score and could potentially lead to the termination of the installment plan. Always ensure you can comfortably afford the monthly payments before committing to the program.

The Bigger Picture

Apple Card Monthly Installments represents a strategic move by Apple to enhance customer loyalty and drive sales. By removing financial barriers and offering a seamless purchasing experience, Apple strengthens its ecosystem and attracts new customers. It's a win-win situation: consumers gain access to coveted Apple products, and Apple expands its reach and revenue streams.

Ultimately, the success of this program hinges on responsible use. When used wisely, Apple Card Monthly Installments can be a valuable tool for managing finances and accessing the technology you desire. It's about finding a balance between aspiration and affordability, allowing you to embrace the Apple experience without breaking the bank.