When Do 1099s Have To Be Mailed

Time is running out for businesses to comply with 1099 reporting requirements. The deadline to mail out 1099 forms to recipients is fast approaching, demanding immediate action.

This article provides a concise guide to understanding the 1099 mailing deadlines, ensuring businesses avoid penalties and maintain compliance with IRS regulations.

Key Deadline: January 31st

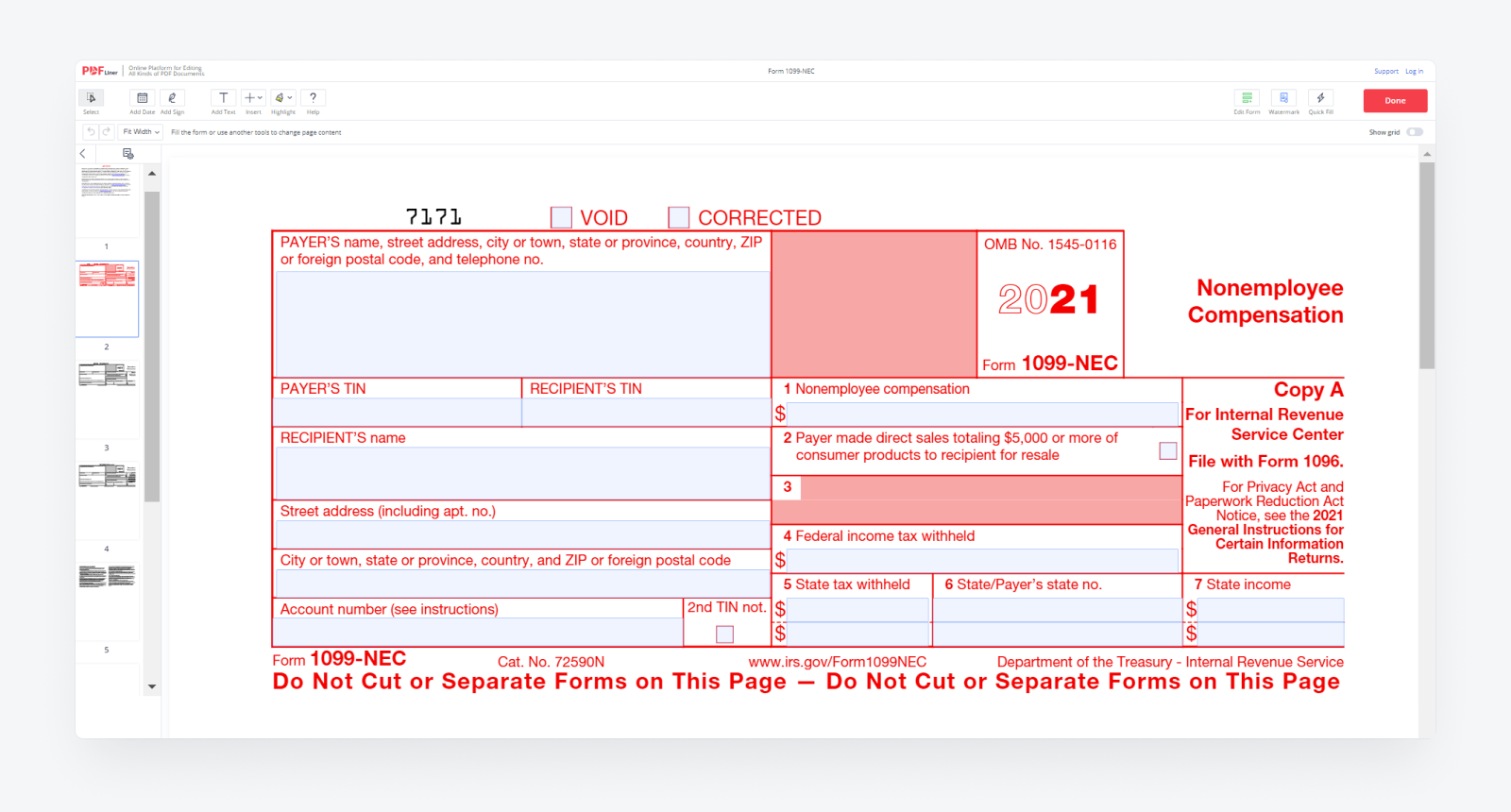

The most critical deadline to remember is January 31st. This is the date by which businesses must mail out Form 1099-NEC to independent contractors they paid $600 or more during the previous tax year.

This deadline applies specifically to nonemployee compensation, which is reported on Form 1099-NEC. Failure to meet this deadline can result in significant penalties from the IRS.

Other 1099 Forms & Deadlines

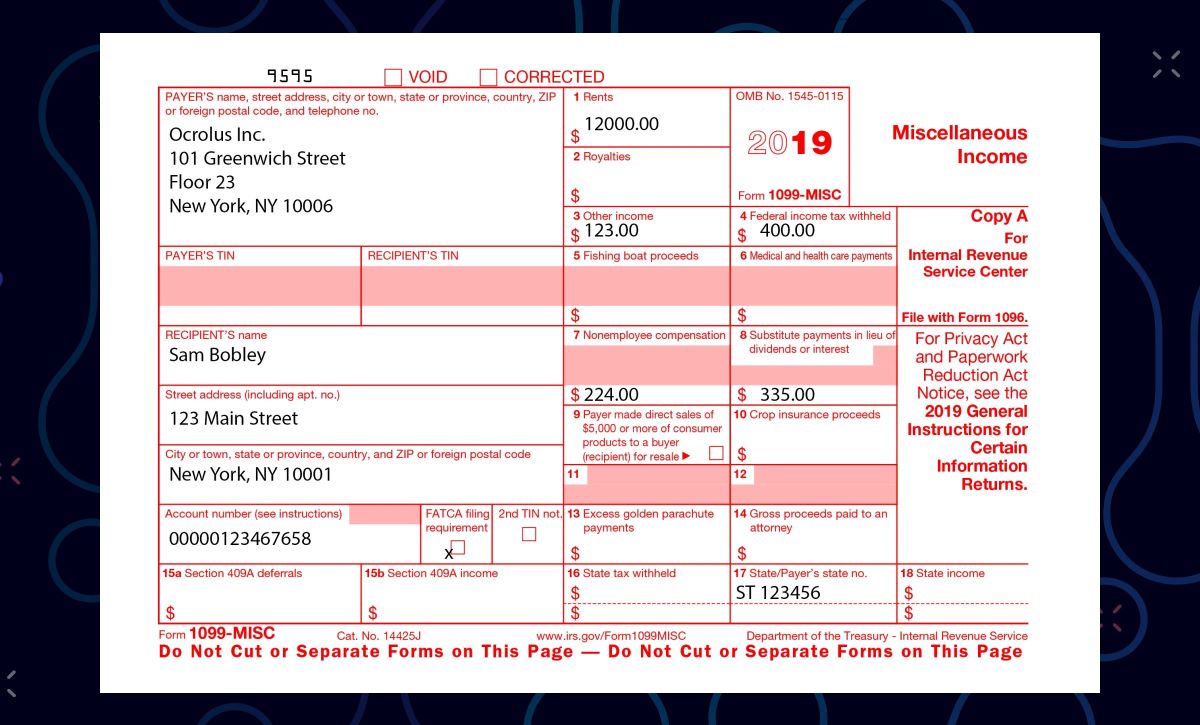

While January 31st is paramount for 1099-NEC, other 1099 forms have different deadlines. Understanding these nuances is crucial for comprehensive compliance.

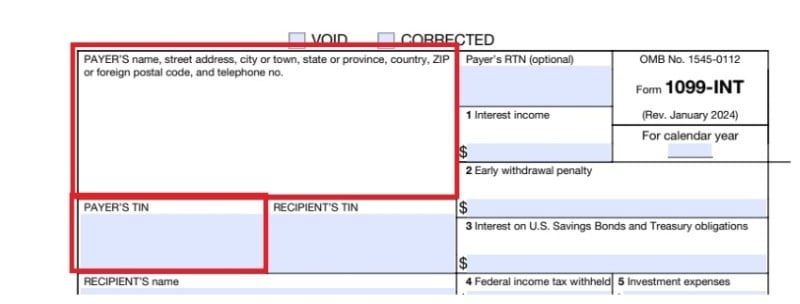

For instance, if you are reporting interest, dividends, or royalties on Form 1099-DIV or Form 1099-INT, the mailing deadline to recipients is also generally January 31st.

However, there are exceptions, particularly regarding Form 1099-B (Proceeds from Broker and Barter Exchange Transactions) and Form 1099-S (Proceeds from Real Estate Transactions). Consult IRS guidelines for specifics on these forms.

Who Needs to Send a 1099?

Businesses are required to issue 1099 forms to individuals and entities they paid for services, rent, royalties, or other forms of income, typically exceeding $600. This applies to independent contractors, freelancers, and other non-employees.

Generally, you do not need to issue a 1099 to corporations, but there are exceptions, particularly for payments to attorneys for legal services.

Carefully review IRS guidelines (Publication 1220) to determine if you are required to file a 1099 for a particular payee.

How to Ensure Timely Mailing

Several steps can be taken to guarantee timely mailing of 1099 forms. These include gathering recipient information early and using efficient mailing methods.

First, collect W-9 forms from all applicable payees before the year ends. This form provides the necessary information, such as name, address, and taxpayer identification number (TIN), needed to complete the 1099.

Second, use certified mail to ensure proof of mailing and delivery. This protects against potential disputes or claims of non-receipt.

Penalties for Late Filing

The IRS imposes penalties for failing to file or furnish 1099 forms on time. These penalties can be substantial, depending on the size of the business and the length of the delay.

As of 2023, the penalty for failing to furnish a correct payee statement (e.g., 1099) is tiered, starting at $50 per statement if corrected within 30 days, increasing to $110 per statement if corrected after August 1st, with maximum penalties varying based on business size.

Intentional disregard of filing requirements can lead to even steeper penalties. Avoid these by adhering to the deadlines and filing accurately.

Electronic Filing Considerations

Businesses filing 250 or more information returns (including 1099s) must file electronically with the IRS. While the deadlines for furnishing to recipients remain the same, electronic filing has its own set of requirements.

The IRS’s Transmitter Control Code (TCC) and other specific formatting requirements must be adhered to for electronic submissions.

Start the electronic filing process early, as obtaining a TCC can take time. Consider using a third-party e-filing service to simplify the process.

Where to Get Help

The IRS provides resources and guidance to assist businesses with 1099 filing requirements. There are many sources of guidance available.

Consult the IRS website and publications, such as Publication 1220 and the general instructions for Form 1099-NEC. Seek professional advice from a qualified tax advisor or accountant.

Several accounting software programs also offer tools and support for generating and filing 1099 forms.

Act Now to Ensure Compliance

Given the approaching deadlines and potential penalties, businesses must take immediate action. Ensuring that 1099 forms are accurately prepared and mailed by the January 31st deadline is essential for compliance and avoiding costly fines.

Gather the necessary information, review your payee list, and choose a method of delivery that guarantees timely arrival. Don't delay!

Stay informed of any updates to IRS regulations and seek professional guidance when needed to maintain ongoing compliance.