When Is Cony Ex Dividend Date

Imagine a sunny afternoon, the gentle hum of the stock market ticker in the background, and the anticipation building as investors eagerly await the next ex-dividend date. For those holding Cony shares, or considering adding them to their portfolio, that date is a crucial piece of information, marking the threshold for eligibility to receive the next dividend payout. It's a moment where careful planning and timely action can translate into tangible returns.

The key question on the minds of current and potential Cony shareholders is: when exactly is the ex-dividend date? Understanding this date is paramount, because it determines who is entitled to the upcoming dividend payment. This article will delve into the specifics surrounding Cony's dividend schedule, providing clarity and insights to help you make informed investment decisions.

Understanding the Ex-Dividend Date

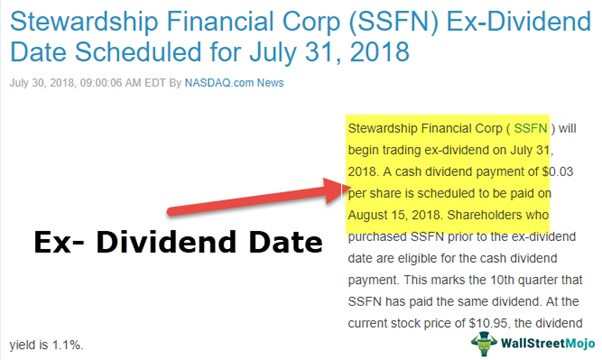

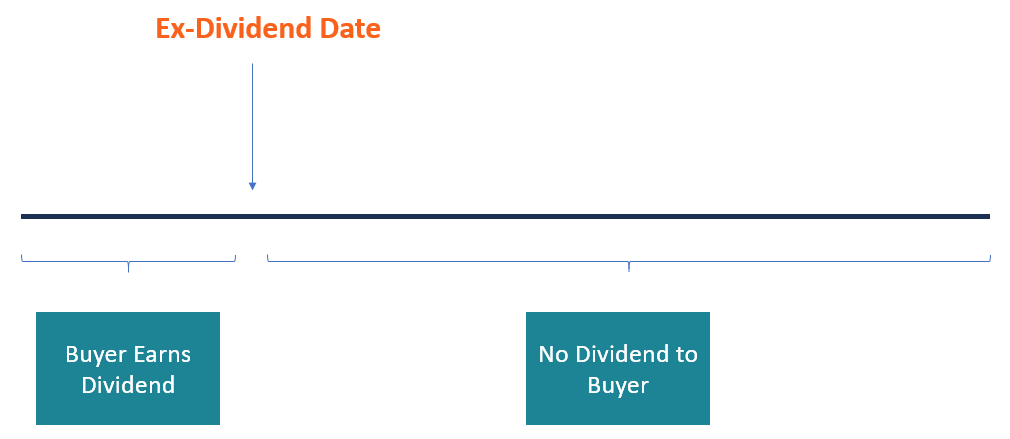

The ex-dividend date is a date set by the exchange (like the NYSE or Nasdaq) where a stock trades. To be eligible for a dividend, you must purchase the stock before the ex-dividend date. If you buy the stock on or after the ex-dividend date, you will not receive the next dividend payment.

This might seem counterintuitive, but it ensures a smooth dividend distribution process. It allows companies to efficiently manage their shareholder records and accurately distribute the payouts.

The Dividend Timeline

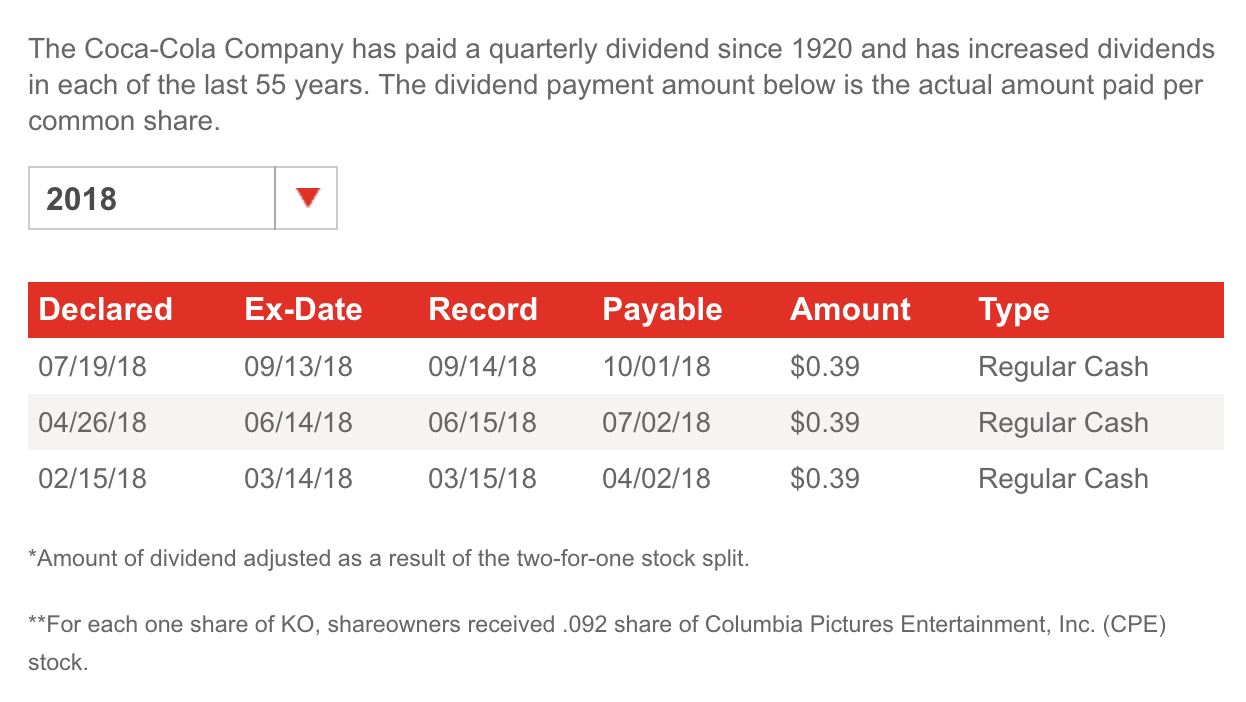

To fully grasp the significance of the ex-dividend date, it's helpful to understand the broader dividend timeline. This timeline typically consists of four key dates: the declaration date, the record date, the payment date, and, of course, the ex-dividend date.

The declaration date is when the company's board of directors announces the dividend, its amount, and the record date. The record date is the date on which a shareholder must be officially registered as a shareholder to receive the dividend.

The payment date is when the dividend is actually disbursed to eligible shareholders. The ex-dividend date is usually set one business day before the record date to allow for settlement of trades.

Finding Cony's Ex-Dividend Date

Unfortunately, as of my last update, "Cony" does not appear to be a publicly traded company, stock, or ETF for which I have definitive dividend information. If Cony is a ticker symbol that does exist, it's crucial to verify the specific details with reliable sources.

To find accurate dividend information, you should consult the company's official website under the investor relations section. Financial news outlets like Bloomberg, Reuters, and Yahoo Finance are also excellent resources for dividend information.

If Cony is an ETF, sites like ETF.com or the ETF provider's website should have the necessary details. Always double-check the information against multiple sources to confirm its accuracy, as dates can change without prior notice.

What to Look For on Financial Websites

When searching for Cony's ex-dividend date, look for sections labeled "Dividends," "Investor Relations," or "Financial Information." These sections will often provide a dividend history and an upcoming dividend schedule.

Pay close attention to the currency the dividends are paid in, and whether there are any special considerations, like a special one-time dividend. Furthermore, look for any announcements or press releases that mention changes to the dividend policy or payment schedule.

You can also set up alerts on your brokerage account or financial news apps to notify you of dividend announcements related to Cony. This proactive approach ensures that you never miss an important dividend-related update.

The Significance of the Ex-Dividend Date for Investors

The ex-dividend date is particularly important for short-term traders and income-seeking investors. Traders often attempt to capture the dividend by buying the stock before the ex-dividend date and selling it shortly afterward, an activity known as dividend capture.

However, it's important to note that the stock price typically drops by roughly the amount of the dividend on the ex-dividend date. This is because the value of the company has effectively decreased by the amount of cash distributed as dividends.

For long-term investors, the ex-dividend date is less critical in isolation. However, dividend income is a significant component of total return, so understanding the timing is beneficial for managing cash flow and reinvesting dividends.

Dividend Reinvestment Plans (DRIPs)

Many companies offer Dividend Reinvestment Plans or DRIPs, which allow shareholders to automatically reinvest their dividends back into the company's stock. DRIPs can be a powerful tool for long-term wealth building, as they enable compounding returns over time.

If Cony offers a DRIP, the ex-dividend date still applies, but the mechanics of receiving the dividend are different. Instead of receiving cash, the dividend amount is used to purchase additional shares of Cony stock, often at a discounted price.

DRIPs can be a hands-off way to grow your investment in Cony, allowing you to accumulate more shares without incurring brokerage fees. Be sure to check the terms and conditions of Cony's DRIP, if one exists, to understand the specific details and requirements.

Beyond the Date: Understanding Dividend Yield

While the ex-dividend date is important for determining eligibility, the dividend yield is crucial for assessing the attractiveness of a dividend-paying stock. The dividend yield is the annual dividend payment divided by the stock's current price, expressed as a percentage.

A higher dividend yield suggests that the stock is generating more income relative to its price. However, a very high dividend yield can also be a red flag, potentially indicating that the company is struggling or that the dividend is unsustainable.

Before investing in Cony (assuming it exists as a publicly traded entity), carefully evaluate its dividend yield in comparison to its peers and the overall market. A healthy and sustainable dividend yield is a sign of a financially sound company that is committed to returning value to its shareholders.

Staying Informed and Making Wise Investments

The world of investing is dynamic, and dividend schedules can change. It's important to stay informed and regularly review your investment decisions. Setting reminders to check for dividend announcements and updates can help you stay on top of things.

Remember, the ex-dividend date is just one piece of the puzzle. A comprehensive investment strategy should consider various factors, including the company's financial health, growth prospects, and overall market conditions.

By combining careful research with a long-term perspective, you can make informed investment decisions that align with your financial goals and risk tolerance.

In Conclusion

While the specific ex-dividend date for "Cony" requires further investigation based on its exact nature (company, fund, etc.), the principles discussed here are universally applicable to all dividend-paying securities. Understanding the dividend timeline, particularly the significance of the ex-dividend date, empowers investors to make timely decisions and optimize their income streams.

Ultimately, successful investing involves continuous learning and adaptation. Stay curious, consult reliable sources, and seek professional advice when needed. The journey of financial growth is a marathon, not a sprint, and every informed decision brings you closer to your goals.

As you navigate the complexities of the stock market, remember that knowledge is your greatest asset. Embrace the process, stay disciplined, and may your investment journey be prosperous and rewarding.

:max_bytes(150000):strip_icc()/Ex-date_final-78915c0d15d34121ae53b40675961f60.png)