When Referring To Risk Which Statement Is Reasonable

A new consensus is emerging among risk management professionals: understanding the nuances of risk perception is paramount. The debate over which statement best encapsulates reasonable risk assessment has intensified, prompting a renewed focus on evidence-based decision-making.

This article explores the evolving understanding of risk and highlights the statement deemed most reasonable by leading experts. The aim is to provide clear guidance for individuals and organizations navigating an increasingly complex world.

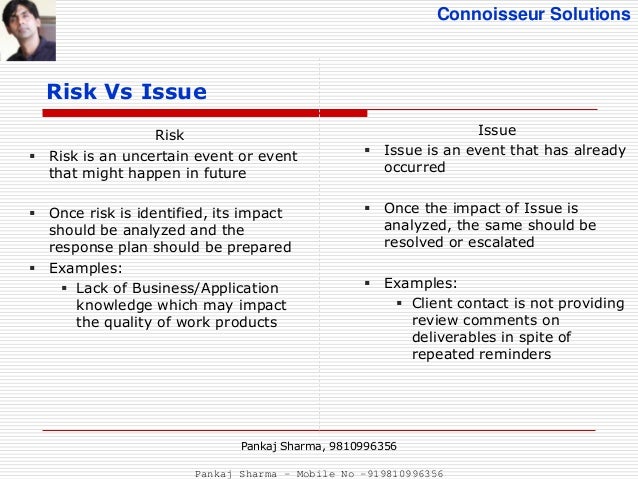

The Core Issue: Defining "Reasonable" Risk

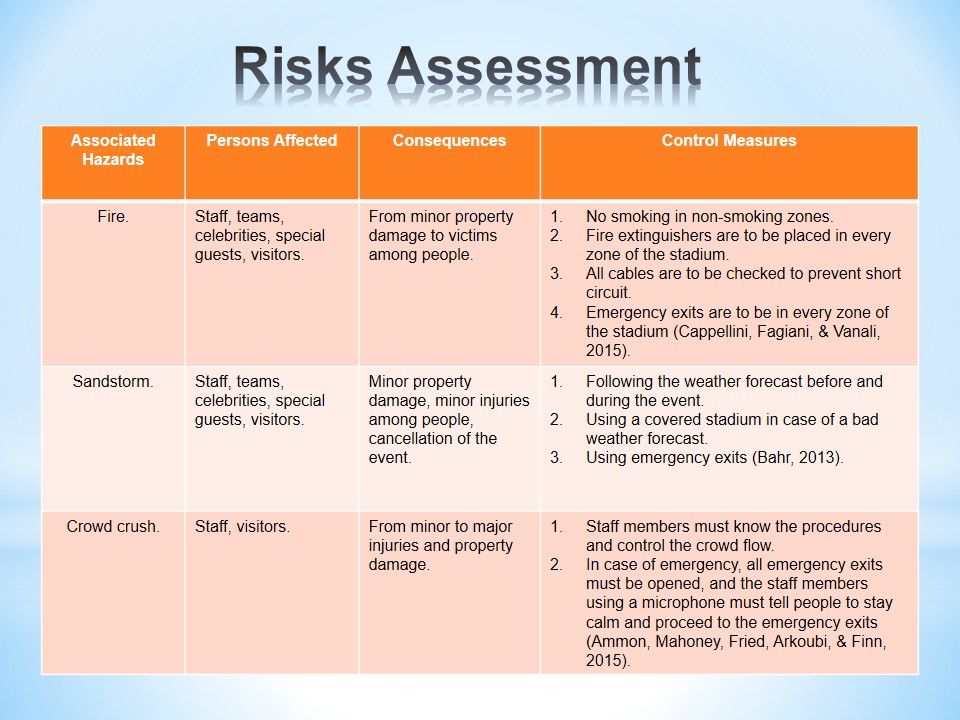

The core of the debate centers around how individuals and organizations should perceive and respond to potential risks. Different perspectives offer varying degrees of emphasis on quantitative analysis, qualitative judgment, and contextual awareness.

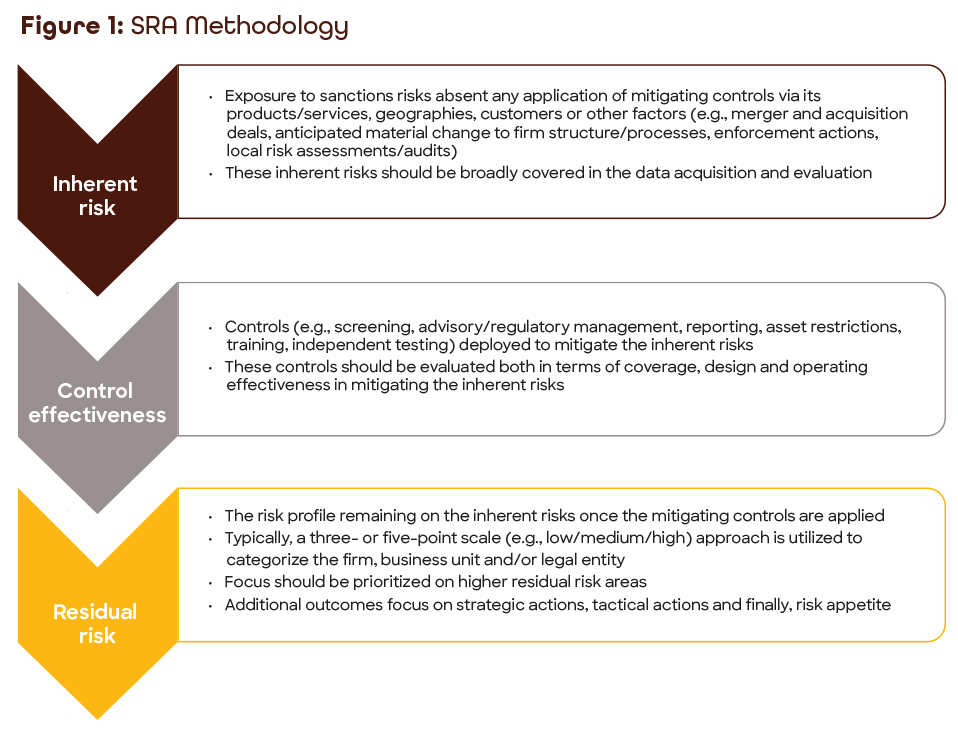

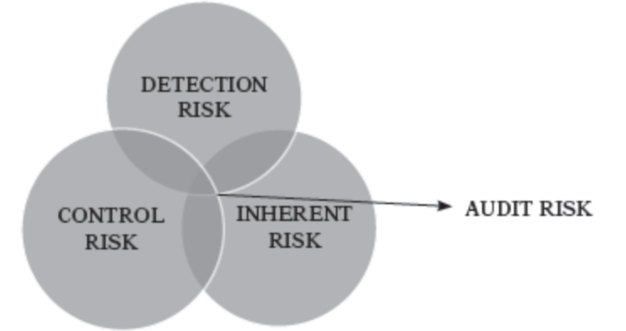

One prevalent perspective prioritizes quantitative analysis, stating that risk should be assessed primarily through statistical probabilities and potential financial impacts. Another view emphasizes the importance of qualitative judgment, arguing that subjective factors, such as reputation and stakeholder values, must be considered.

The Prevailing Statement: A Balanced Approach

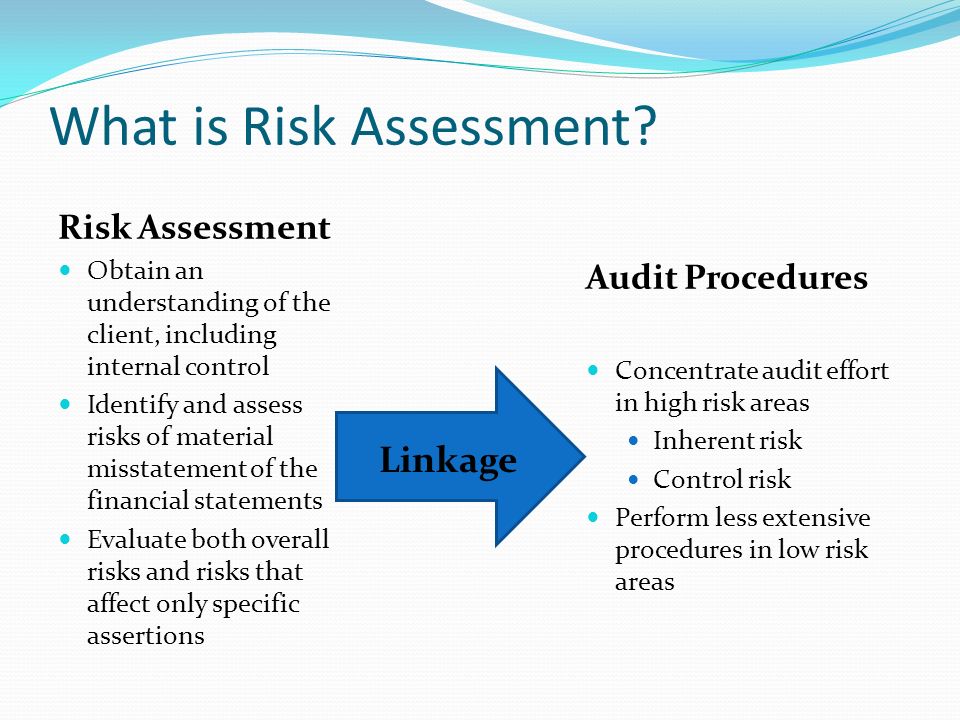

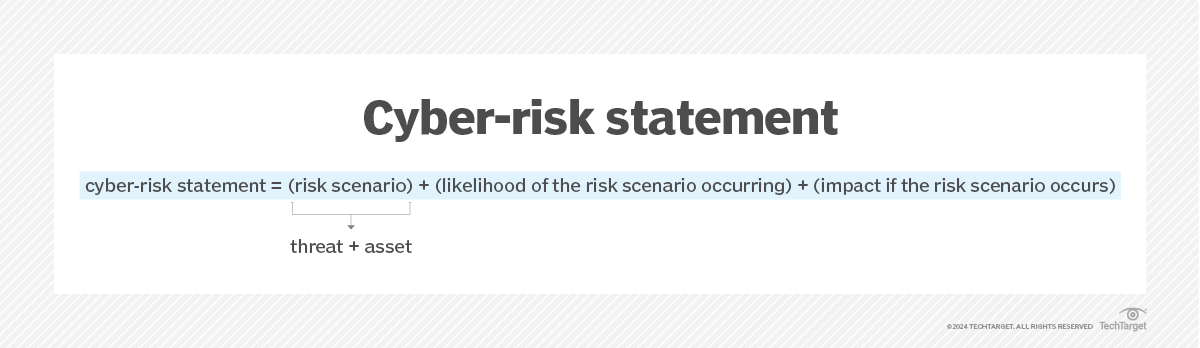

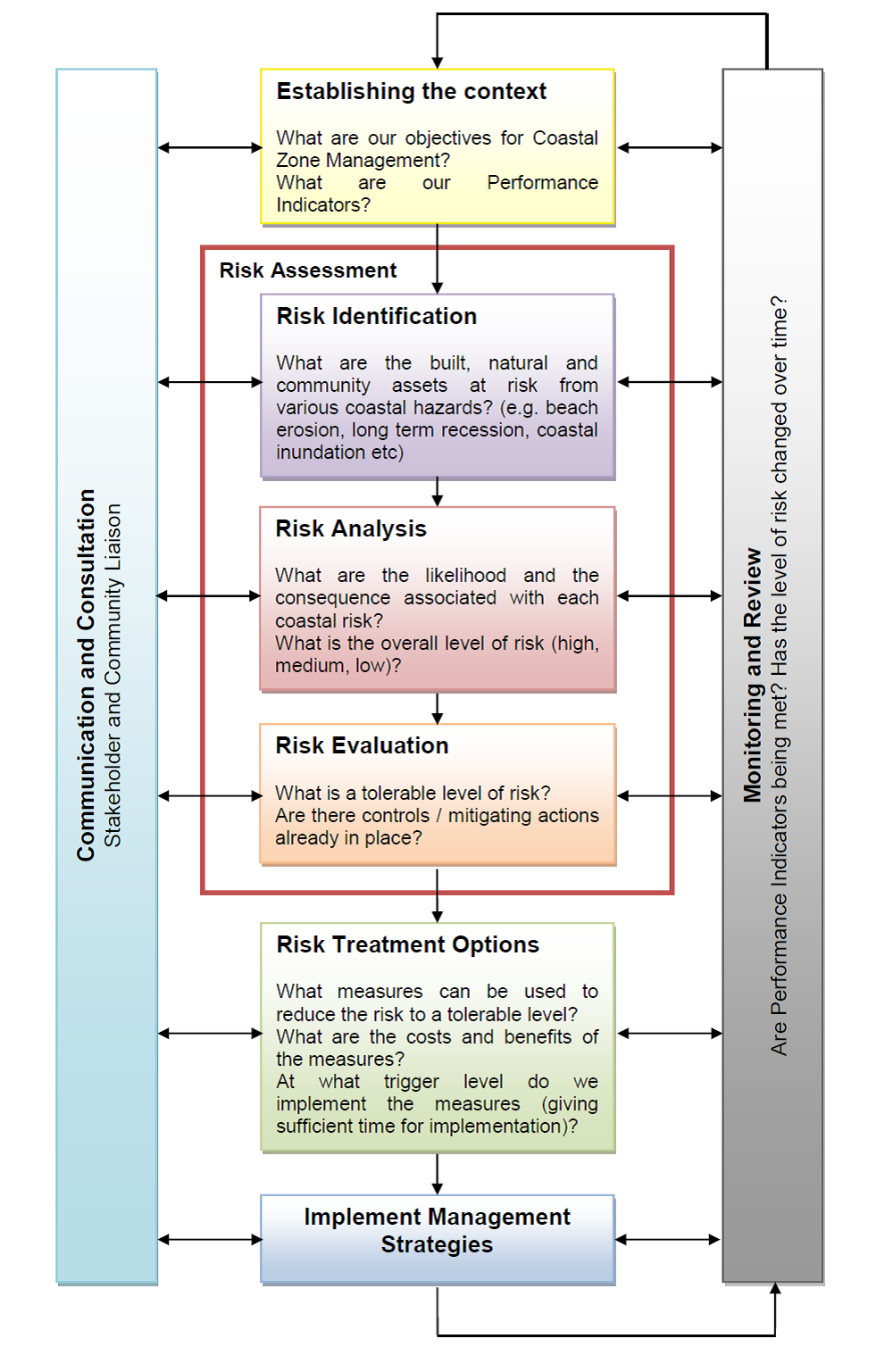

After extensive review of current research and expert opinions, the statement considered most reasonable advocates for a balanced approach. This approach integrates both quantitative and qualitative elements in risk assessment.

The statement emphasizes that "risk should be assessed through a combination of statistical analysis, expert judgment, and consideration of stakeholder values, ensuring a holistic and context-sensitive understanding of potential threats and opportunities." This perspective acknowledges that while data is important, human judgment and ethical considerations cannot be ignored.

“Relying solely on numbers can blind you to unforeseen consequences, while ignoring data altogether can lead to reckless decision-making,” says Dr. Anya Sharma, a leading risk management consultant. “The key is to find a balance that allows for informed, ethical, and practical risk management.”

Evidence and Support

This balanced approach is supported by several key studies. A recent report by the Risk Management Society (RIMS) found that organizations that integrate both quantitative and qualitative risk assessments demonstrate greater resilience and adaptability.

The study, which analyzed data from over 500 companies, revealed that companies using a balanced approach were better equipped to anticipate and respond to unexpected events. They also exhibited stronger stakeholder relationships and a more positive organizational culture.

Furthermore, several regulatory bodies are increasingly emphasizing the importance of integrating qualitative factors into risk assessments. For example, the Basel Committee on Banking Supervision now requires banks to consider qualitative factors such as governance and culture when assessing operational risk.

Challenges and Considerations

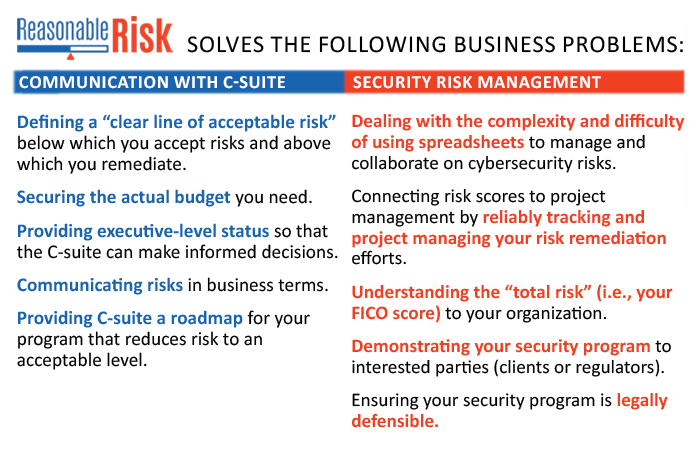

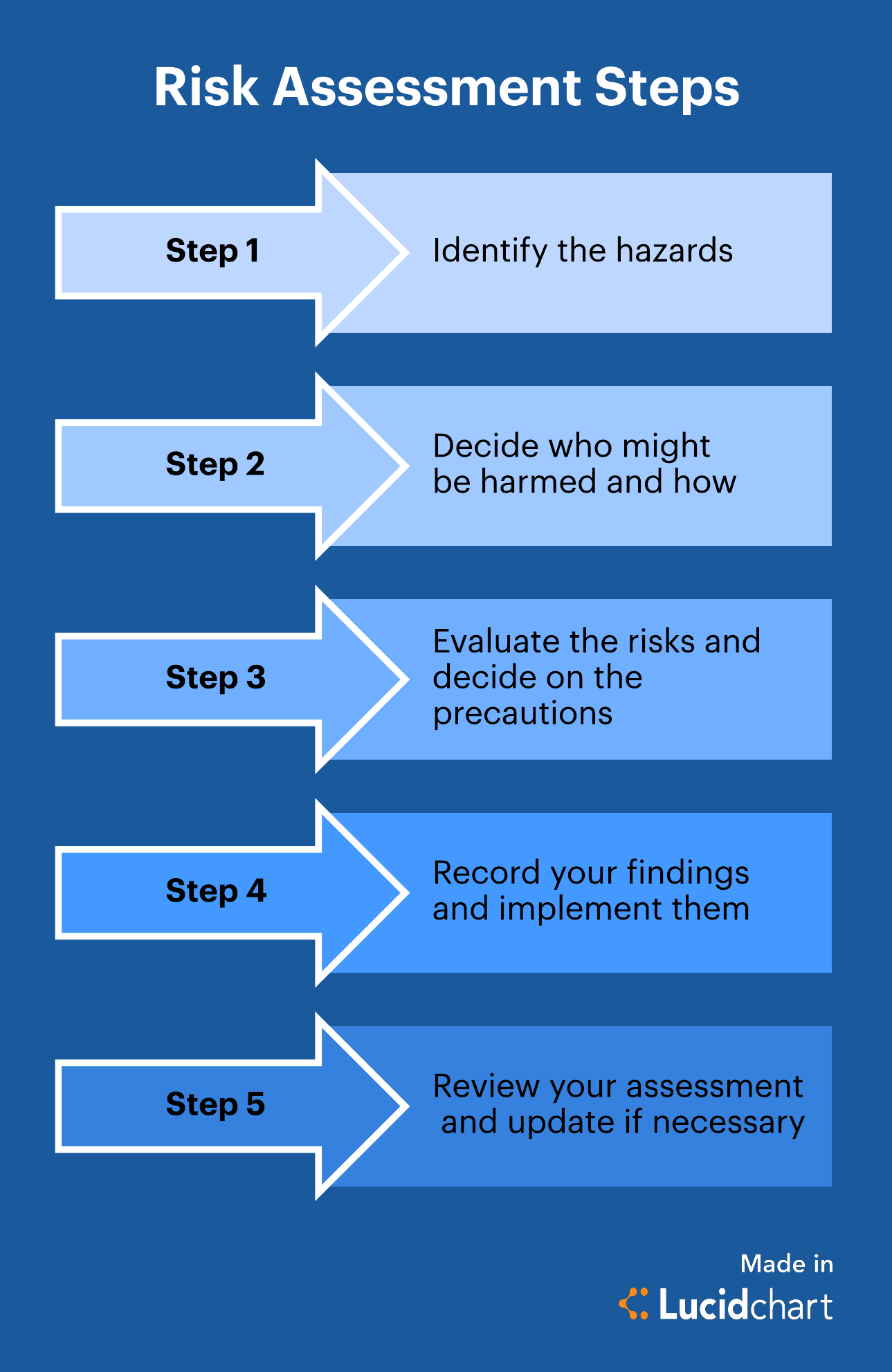

Implementing a balanced approach to risk assessment is not without its challenges. One of the main hurdles is the difficulty in quantifying qualitative factors.

Organizations must develop robust frameworks for capturing and analyzing subjective information. This requires training employees to identify and articulate relevant qualitative insights.

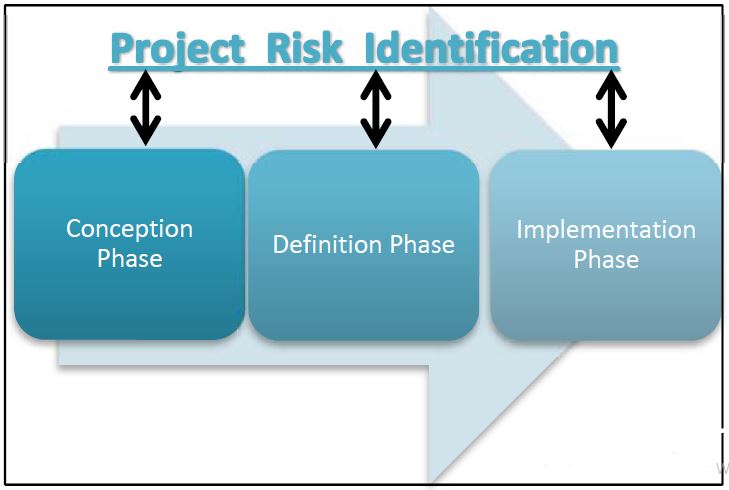

Another challenge is ensuring that risk assessments are tailored to the specific context. A one-size-fits-all approach can be ineffective, as different organizations and industries face unique risks and have different stakeholder priorities.

Moving Forward: Implementation and Refinement

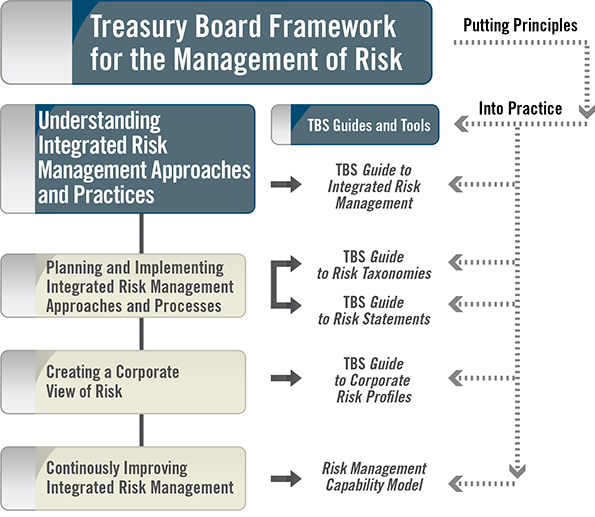

The adoption of this balanced approach requires a shift in mindset. Organizations must move away from purely quantitative models and embrace a more holistic view of risk.

This involves investing in training, developing new assessment tools, and fostering a culture of open communication. It also requires ongoing monitoring and refinement of risk management processes.

Continuous learning is essential, as the risk landscape is constantly evolving. Organizations must stay abreast of emerging threats and best practices to ensure that their risk management strategies remain effective.