Where Can I Cash A Check From Citibank

In an era of increasing digital transactions, the need to cash a physical check might seem antiquated, yet it remains a vital necessity for many. Particularly for individuals receiving checks from major financial institutions like Citibank, understanding where and how to securely access their funds is paramount. Navigating this process can be surprisingly complex, especially given the evolving landscape of banking and financial services.

This article serves as a comprehensive guide for individuals seeking to cash a check issued by Citibank. We will explore the various options available, from traditional branch banking to alternative methods, and offer insights into potential fees, identification requirements, and other considerations. By providing a clear and concise overview, this article aims to empower readers with the knowledge necessary to efficiently and safely access their money.

Cashing Checks at Citibank Branches

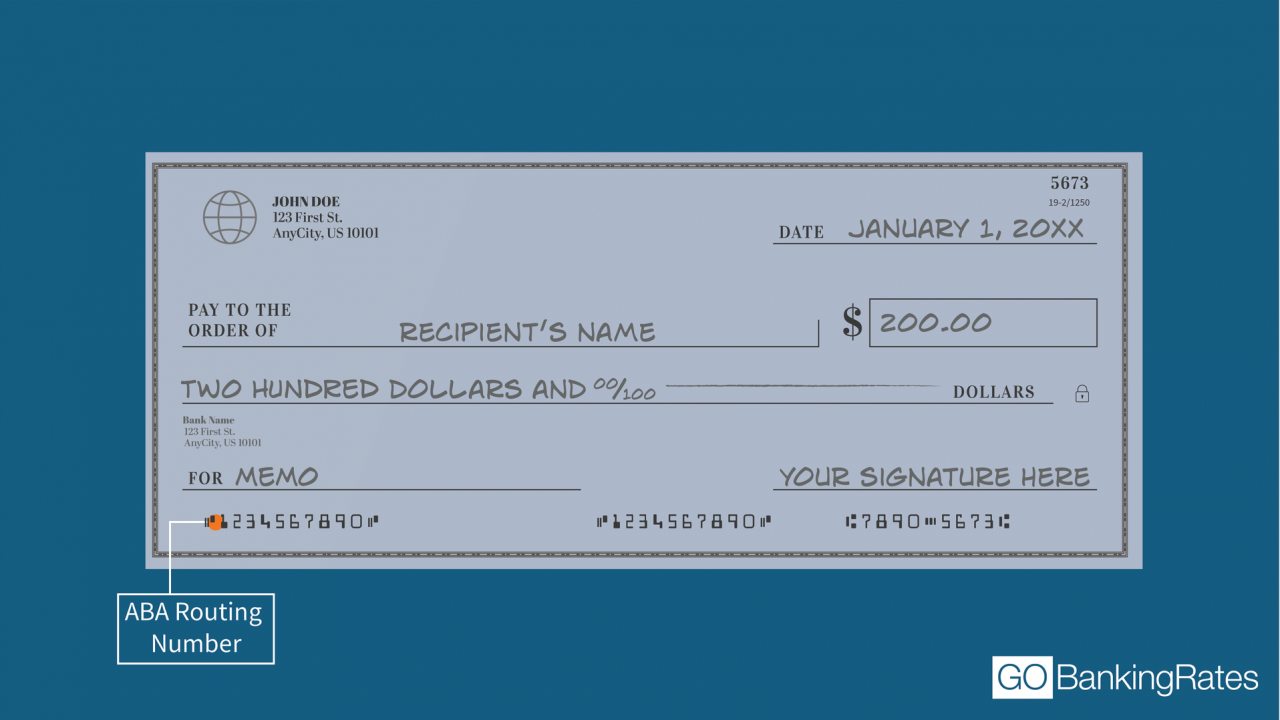

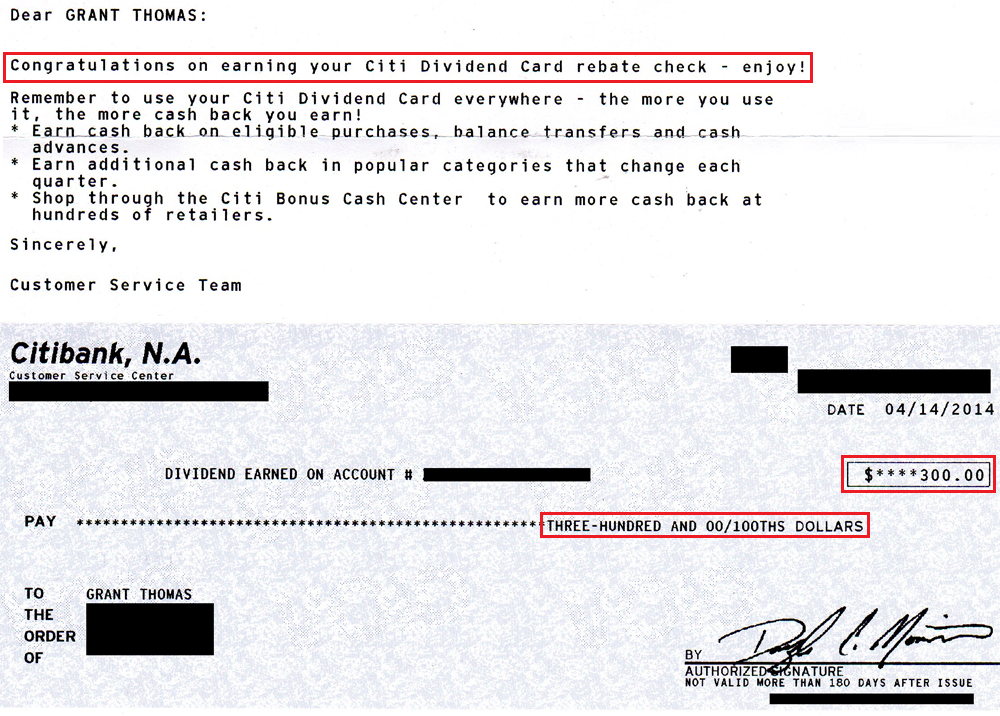

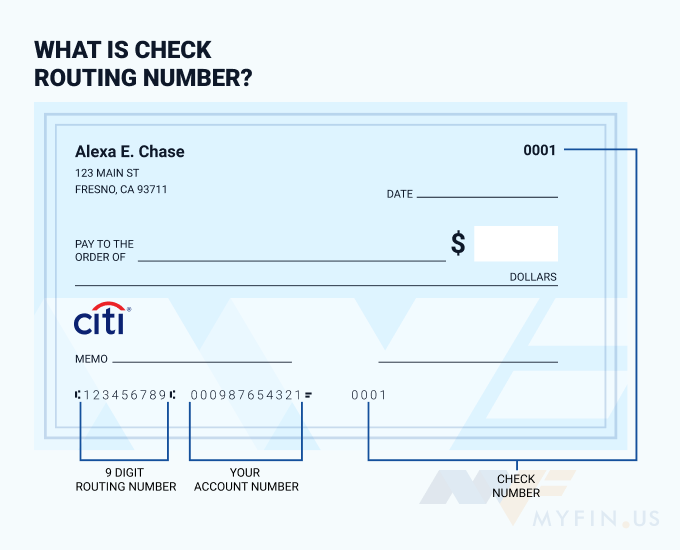

The most straightforward method for cashing a Citibank check is, unsurprisingly, at a Citibank branch. For Citibank customers, this process is typically seamless. You will need to present the check along with valid photo identification, such as a driver's license or passport.

If you are not a Citibank customer, you can still cash the check at a branch, but the process may involve additional scrutiny. Citibank may charge a fee for non-customers to cash checks, and the amount can vary depending on the check amount and branch location. It’s best to call ahead to confirm their policy and associated fees.

Utilizing Third-Party Check Cashing Services

Several third-party check-cashing services offer an alternative to traditional banks. These services, such as Walmart, Kroger, and dedicated check-cashing outlets, can be convenient options, especially for individuals without bank accounts or those seeking extended hours.

Walmart, for example, allows customers to cash checks up to a certain limit for a small fee. Similarly, many grocery store chains offer check-cashing services, but the availability and fees can vary significantly depending on location and store policy. Be sure to check their specific limits and fees before heading to the store.

Mobile Check Deposit: A Digital Solution

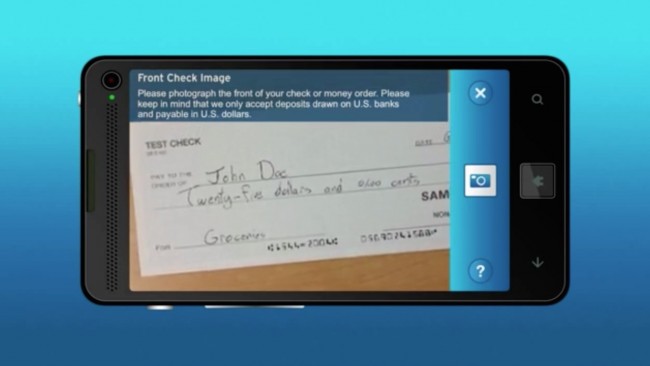

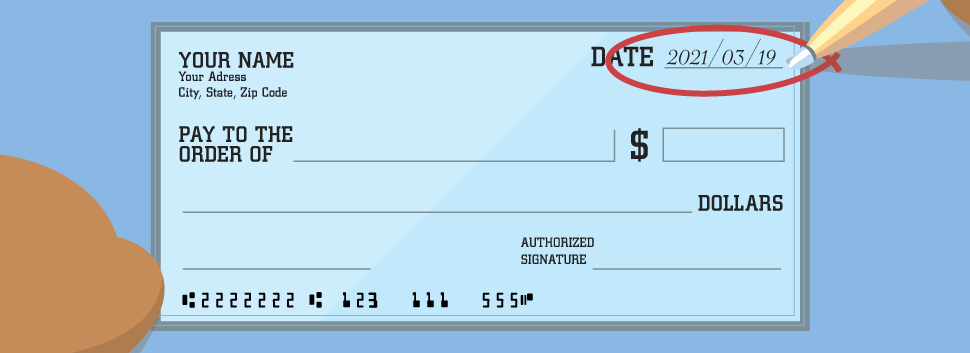

For those with access to a smartphone and a bank account, mobile check deposit offers a convenient digital solution. Most banks, including Citibank, offer mobile banking apps that allow customers to deposit checks remotely by taking a picture of both sides of the check.

While this method eliminates the need to visit a physical branch, it's important to note that the funds may not be immediately available. Banks typically place a hold on deposited funds to verify the check's authenticity, and the length of the hold can vary depending on the bank's policy and the check amount. Citibank's policies regarding mobile deposit limits and hold times should be reviewed within their mobile app or website.

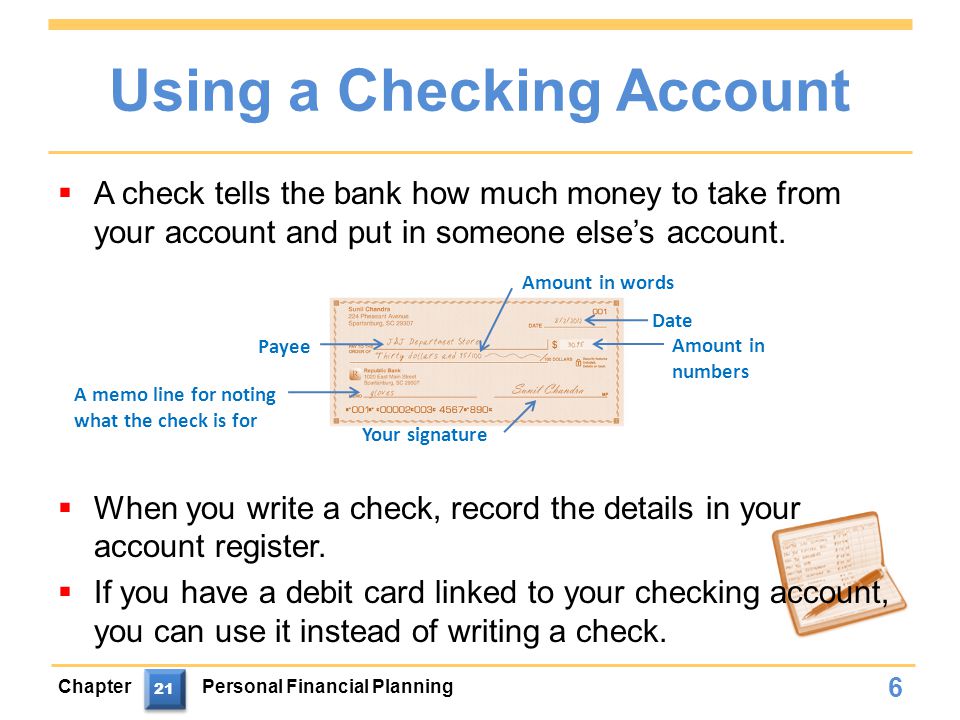

Understanding Fees and Identification Requirements

Fees associated with cashing a check can vary significantly depending on the method used. Citibank may charge non-customers a fee, while third-party check-cashing services often have their own fee structures. It is always advisable to inquire about fees before proceeding to avoid surprises.

Regardless of where you choose to cash your Citibank check, valid photo identification is essential. Common forms of acceptable ID include a driver's license, passport, or state-issued identification card. Some institutions may also require additional documentation, such as a social security card or utility bill, to verify your identity.

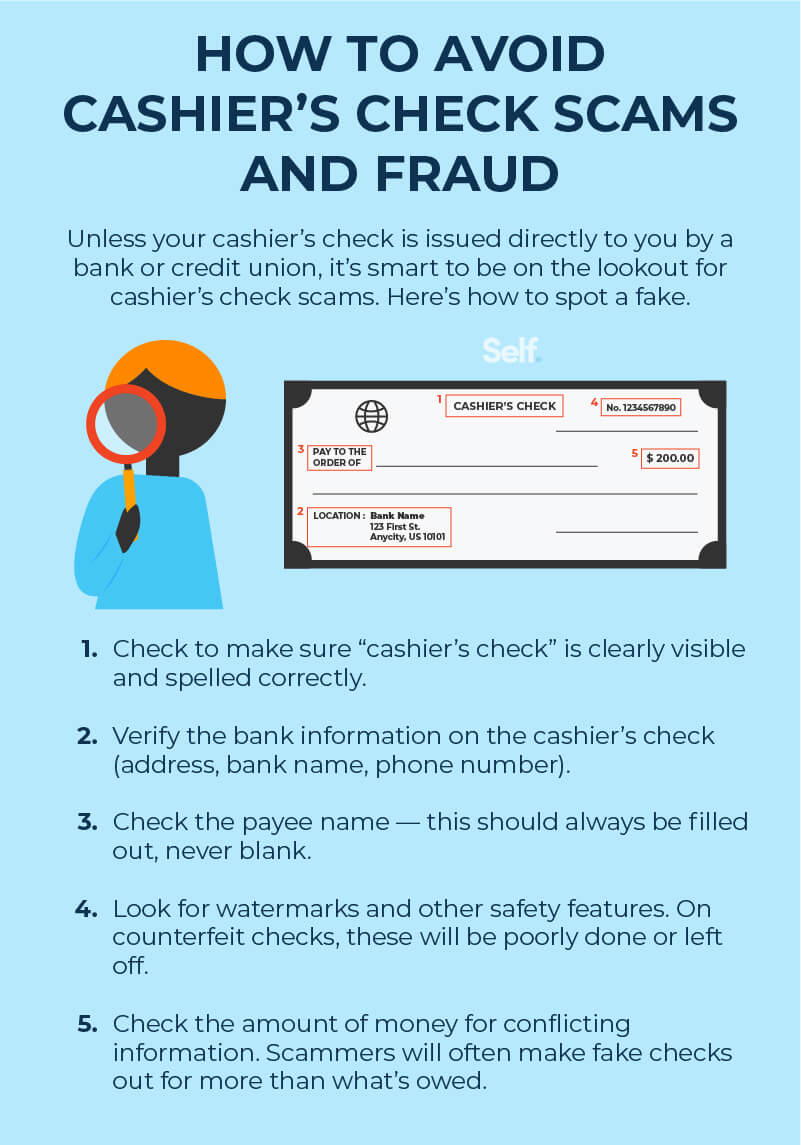

Preventing Check Fraud and Ensuring Security

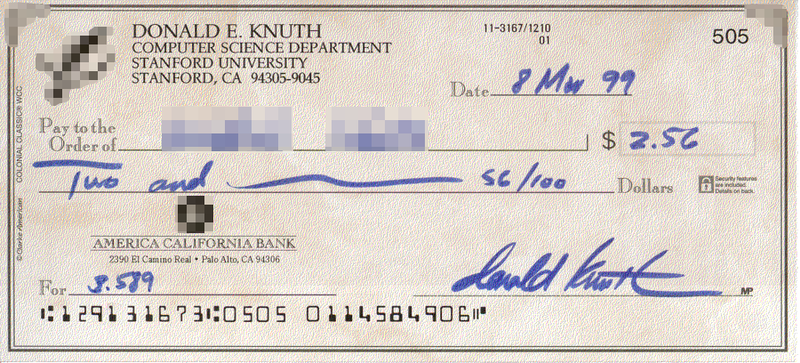

When cashing a check, it's crucial to take precautions to prevent fraud. Never endorse a check until you are ready to cash it. Avoid sharing your personal information or check details with untrusted sources.

If you suspect fraudulent activity, contact Citibank immediately and report the incident to the authorities. Also, be wary of check-cashing services that seem too good to be true, as they may be involved in illegal activities. Always opt for reputable and established institutions.

Looking Ahead: The Future of Check Cashing

As digital payment methods continue to gain popularity, the need for physical checks may gradually diminish. However, checks are likely to remain a relevant form of payment for the foreseeable future, particularly for certain transactions and demographic groups.

Banks and financial institutions are constantly evolving their services to meet the changing needs of their customers. Expect to see continued innovation in check-cashing methods, with a greater emphasis on digital solutions and enhanced security measures. Understanding the current options available and staying informed about future developments will empower individuals to navigate the check-cashing process with confidence and efficiency.