Where Does Restricted Cash Go On The Balance Sheet

Understanding the complexities of a balance sheet is crucial for investors, analysts, and anyone seeking a clear picture of a company's financial health. One specific area that often causes confusion is the treatment of restricted cash. Knowing exactly where this type of cash appears on the balance sheet, and understanding why it's classified in a certain way, is essential for accurate financial analysis.

This article will dissect the placement of restricted cash on the balance sheet, outlining the governing principles and offering real-world context.

What is Restricted Cash?

Restricted cash is cash that is legally or contractually earmarked for a specific purpose and, therefore, is not available for the company's immediate use.

Restrictions can arise from various sources, including legal requirements, contractual obligations, or internal company policies.

For instance, a company might be required to maintain a certain cash balance as collateral for a loan, or it might set aside funds for a specific project like a building expansion.

Where Does It Go On The Balance Sheet?

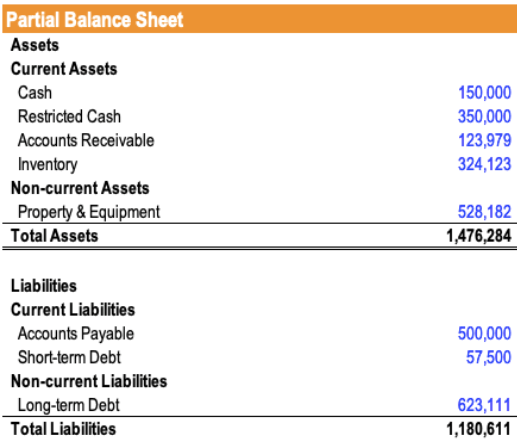

The placement of restricted cash on the balance sheet hinges on the period of restriction, and this is dictated by Generally Accepted Accounting Principles (GAAP).

Under GAAP, the classification of restricted cash depends on whether the restriction is short-term (less than one year) or long-term (more than one year).

Current Asset Classification

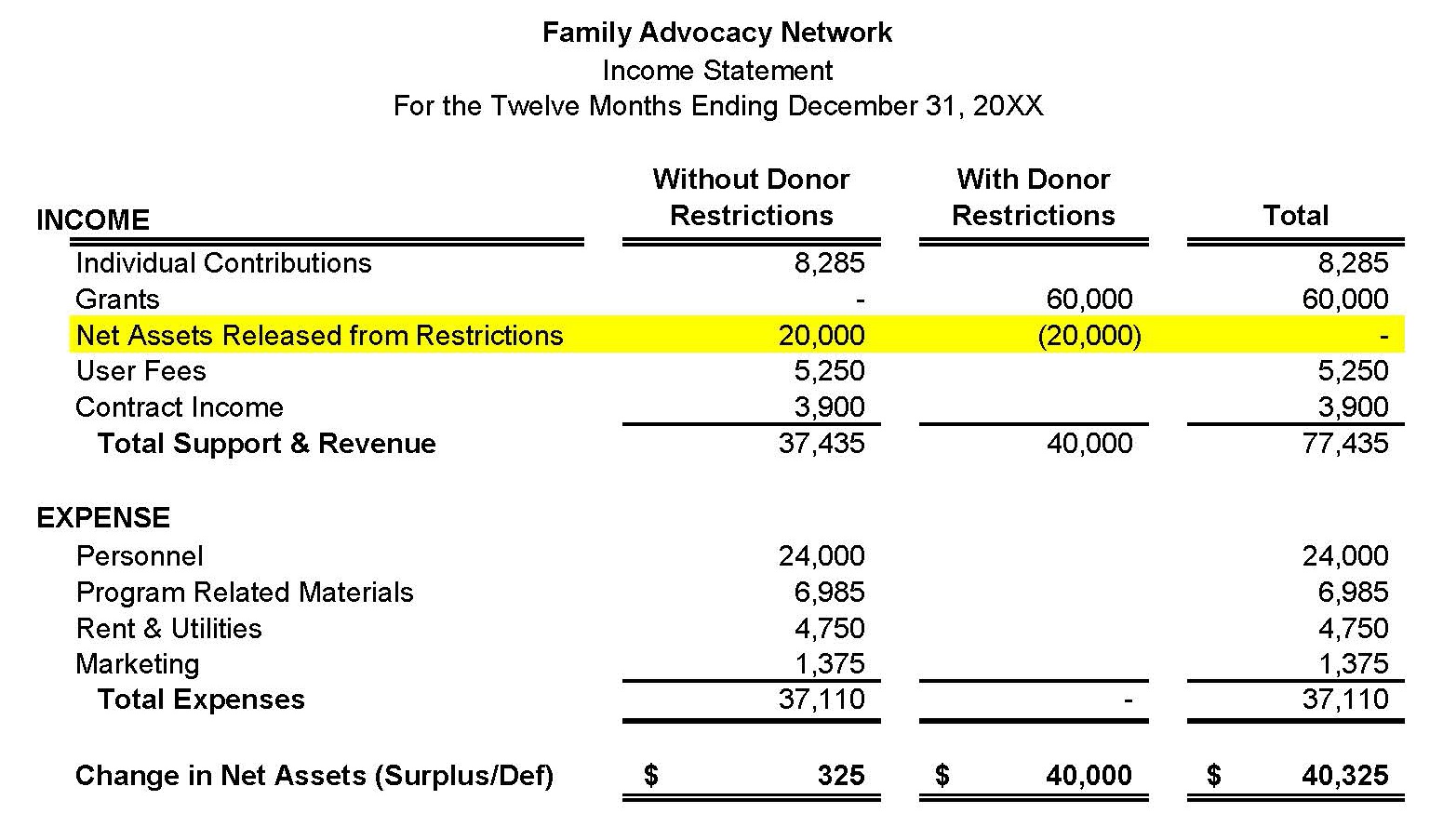

If the restriction on the cash is expected to be lifted within one year or the company's operating cycle (whichever is longer), the restricted cash is classified as a current asset.

It will appear on the balance sheet separate from unrestricted cash and cash equivalents.

The line item is often labeled as "Restricted Cash – Current," "Restricted Cash for Short-Term Purposes," or a similar descriptive title.

Non-Current Asset Classification

When the restriction extends beyond one year or the company's operating cycle, the restricted cash is classified as a non-current asset.

It typically appears in the "Other Assets" section of the balance sheet, which comes after current assets and property, plant, and equipment (PP&E).

Similar to its current counterpart, the non-current restricted cash will be clearly labeled as "Restricted Cash – Non-Current," "Restricted Cash for Long-Term Purposes," or a comparable designation.

Disclosure Requirements

Simply placing the restricted cash on the balance sheet isn't enough.

GAAP also requires companies to disclose information about the nature and amount of restricted cash in the footnotes to the financial statements.

This disclosure provides transparency, explaining *why* the cash is restricted, the terms of the restriction, and the specific uses to which it's limited.

Significance and Impact

The proper classification of restricted cash is vital for accurate financial analysis.

Failure to correctly categorize and disclose restricted cash can mislead investors and other stakeholders about a company's true liquidity and financial flexibility.

For example, if a significant portion of a company's cash is restricted for a long-term project, its short-term ability to meet its obligations could be significantly impaired.

Real-World Examples

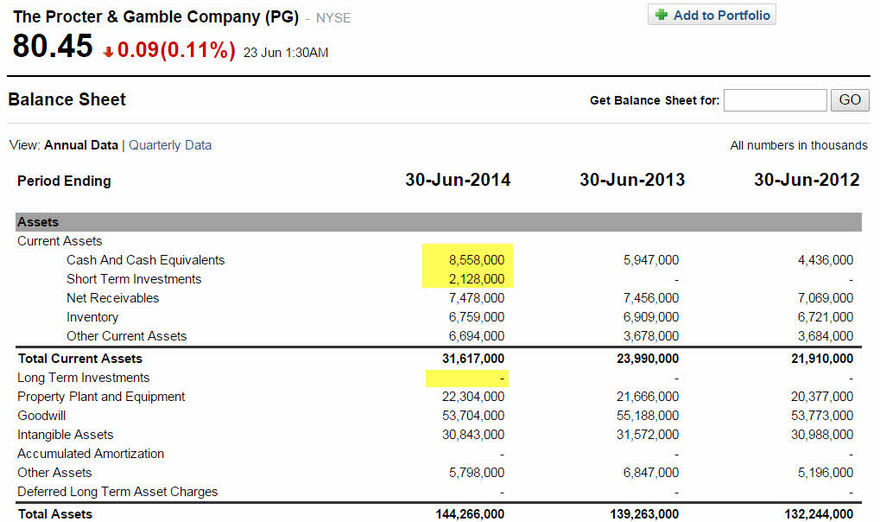

Consider a construction company, ABC Builders, which has secured a $10 million loan to finance a new project.

The loan agreement stipulates that ABC Builders must maintain a $500,000 cash balance in a segregated account as collateral.

If the loan term is five years, the $500,000 would be classified as a non-current asset under "Other Assets" on ABC Builders' balance sheet.

Conversely, imagine XYZ Retail is required by a lease agreement to maintain $100,000 in escrow for potential damages. If the lease is for one year, the $100,000 would be a current asset.

Conclusion

Understanding the nuances of restricted cash is paramount for anyone interpreting a company's financial statements.

Its proper classification on the balance sheet – as either a current or non-current asset – coupled with clear and comprehensive disclosures, provides critical insights into a company's liquidity, financial obligations, and overall financial health.

By paying close attention to this aspect of the balance sheet, investors and analysts can make more informed decisions and gain a more accurate understanding of a company's financial position.

:max_bytes(150000):strip_icc()/Restricted-cash_final-aa54f0ce0256464d966180c8245909d2.png)