Where Is Greenline Loans Headquarters Located Is It Tribal

Imagine searching for financial assistance, the kind that feels like a helping hand rather than a complicated maze. In that search, the name Greenline Loans might surface. It’s a name that promises quick solutions, but behind the digital interface lies a complex web of questions, especially regarding its headquarters and its potential affiliation with tribal lands.

This article aims to unravel the mystery surrounding Greenline Loans, specifically addressing where its headquarters are located and whether it operates under tribal affiliation. Understanding these aspects is crucial for consumers to make informed decisions and navigate the often-murky waters of online lending.

The Search for Greenline Loans' Headquarters

Pinpointing the exact location of Greenline Loans' headquarters proves to be a challenging task. Unlike traditional financial institutions with readily available addresses and contact information, Greenline Loans operates primarily online. This digital presence makes it difficult to ascertain a physical headquarters location through conventional means.

Often, online lenders, particularly those operating under a tribal lending model, maintain a deliberately vague public profile regarding their physical location. This is a common practice designed to protect tribal sovereignty and avoid certain state regulations.

Numerous online searches reveal conflicting information. Some sources vaguely suggest a location within the United States, while others hint at an affiliation with tribal lands. However, concrete evidence pinpointing a specific physical address remains elusive.

Understanding Tribal Lending

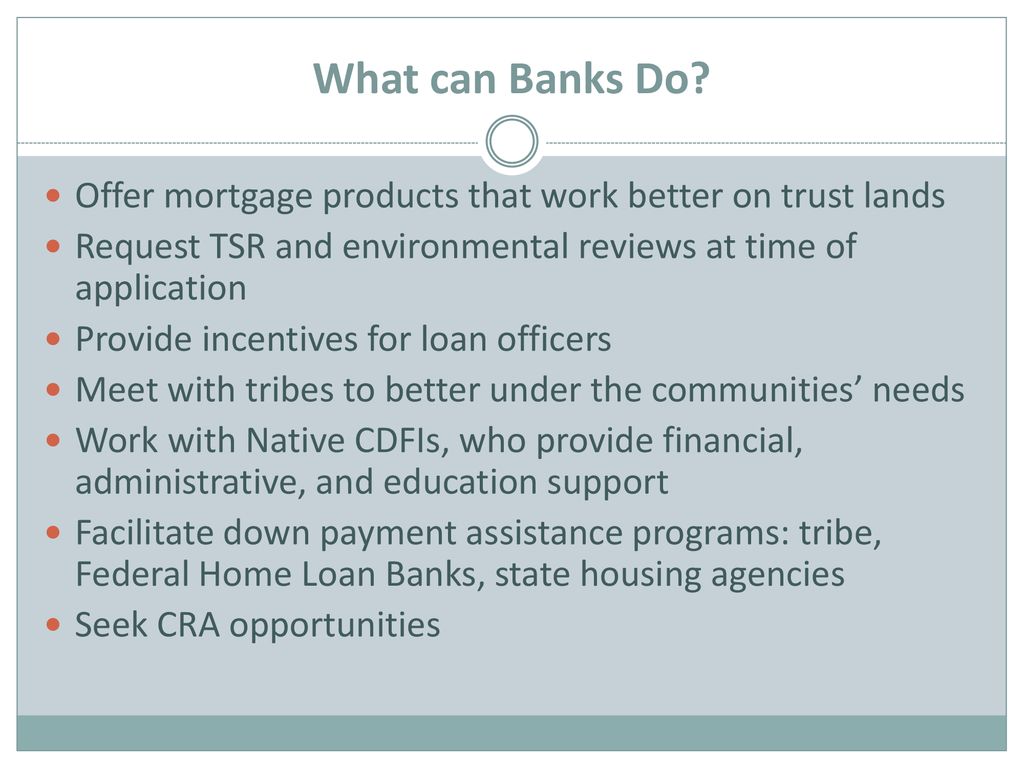

To fully understand the ambiguity surrounding Greenline Loans' headquarters, it's essential to grasp the concept of tribal lending. Tribal lending entities are businesses owned and operated by Native American tribes. These lenders often operate under the laws of their respective tribes, which are considered sovereign nations.

This sovereignty allows them to potentially offer loans nationwide, sometimes at interest rates that exceed state regulations. Tribal lenders assert their sovereign immunity protects them from state laws, making them a controversial topic in the lending industry. The argument hinges on the idea that tribes have the right to self-governance and economic development, including the provision of financial services.

The debate surrounding tribal lending revolves around balancing consumer protection with tribal sovereignty. While tribal lenders argue they provide much-needed financial access to underserved populations, critics contend that their high interest rates and fees can trap borrowers in cycles of debt.

Is Greenline Loans a Tribal Lender?

Determining whether Greenline Loans operates as a tribal lender requires careful investigation. Direct confirmation from the company itself is often difficult to obtain, and official statements can be scarce.

However, several indicators can suggest a possible tribal affiliation. One key indicator is the presence of disclaimers on the website regarding tribal law and sovereign immunity. These disclaimers often state that the loan agreement is governed by tribal law, not the law of the borrower's state.

Another potential indicator is the involvement of a tribal economic development arm. Many tribes have established economic development corporations to manage and oversee their business ventures, including lending operations. If Greenline Loans is linked to such an entity, it strengthens the possibility of tribal affiliation.

Consumer reviews and complaints can also provide clues. Borrowers who have dealt with Greenline Loans may mention interactions with tribal representatives or references to tribal law in their loan agreements.

It's important to note that even with these indicators, definitively confirming Greenline Loans' tribal status can be challenging without official confirmation. The company's website may use language designed to obscure its true nature, and publicly available information may be limited.

The Importance of Due Diligence

Regardless of whether Greenline Loans is a tribal lender, the lack of transparency surrounding its headquarters highlights the importance of due diligence for borrowers. Before taking out any loan, consumers should carefully research the lender and understand the terms and conditions.

This includes verifying the lender's credentials, reading online reviews, and understanding the applicable interest rates and fees. Borrowers should also be aware of their rights and responsibilities under the loan agreement and seek legal advice if necessary.

Furthermore, consumers should be wary of lenders that promise guaranteed approval or require upfront fees. These are often red flags that indicate a potentially predatory lending practice.

Navigating the Online Lending Landscape

The online lending landscape is constantly evolving, and new lenders emerge regularly. This makes it essential for consumers to stay informed and exercise caution when seeking financial assistance online.

Regulatory oversight of online lenders can vary significantly, depending on factors such as their location and affiliation. Some lenders are subject to strict state and federal regulations, while others operate in a regulatory gray area.

Consumers can protect themselves by choosing lenders that are transparent about their operations and comply with applicable laws. They should also be aware of the potential risks associated with online lending, such as high interest rates and hidden fees.

Reputable lending platforms will provide clear and concise information about their terms and conditions, as well as their contact information and physical address. They will also be responsive to customer inquiries and complaints.

Ultimately, the responsibility for making informed borrowing decisions rests with the consumer. By conducting thorough research and exercising caution, borrowers can navigate the online lending landscape and find the financial assistance they need without falling prey to predatory practices.

Conclusion: A Call for Transparency

The quest to uncover the location of Greenline Loans' headquarters and its potential tribal affiliation underscores the need for greater transparency in the online lending industry. While the specific details of this case remain somewhat unclear, the broader implications are significant.

Whether Greenline Loans operates from a physical office building or within the boundaries of a tribal nation, the lack of readily available information creates uncertainty for borrowers. This uncertainty can lead to confusion and potentially harmful financial decisions.

Moving forward, increased regulatory scrutiny and greater transparency are essential to protect consumers from predatory lending practices. By demanding clear and concise information from lenders, borrowers can make informed decisions and avoid falling into cycles of debt. The online lending landscape should be one of empowerment, not exploitation, where individuals can access financial assistance with confidence and clarity.