Which Factor Supports Maintaining A Dual Income

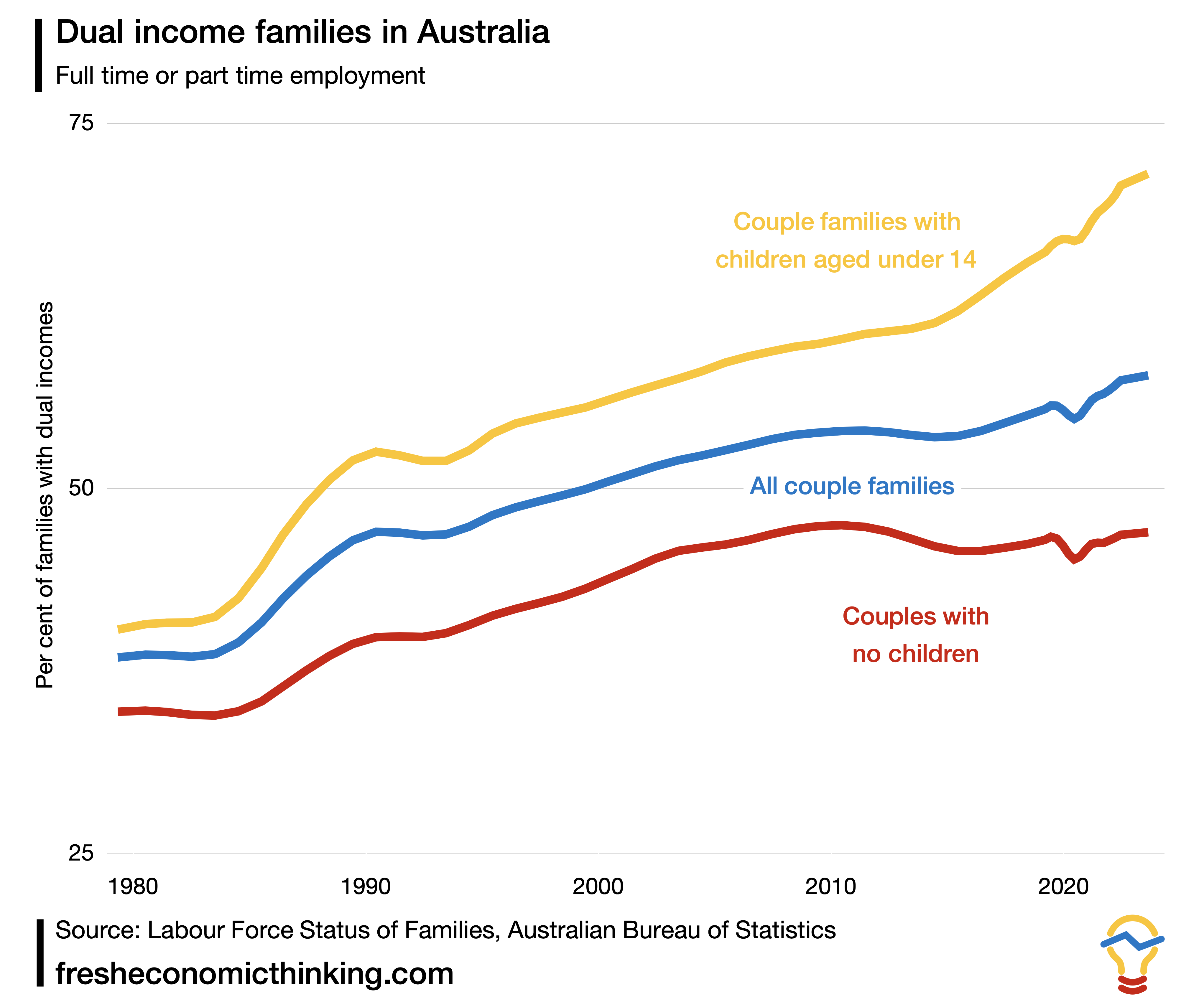

The relentless surge in the cost of living is reshaping the economic landscape for families across the nation. Once considered a lifestyle choice, the dual-income household is increasingly becoming a necessity, a bulwark against financial instability in an era of escalating expenses and uncertain economic forecasts.

This trend raises a critical question: What specific factors are now so compelling that they necessitate, or at least strongly support, maintaining a dual-income household? Understanding these factors is crucial for policymakers, economists, and families alike, as they navigate the complexities of the modern economy.

The Nut Graf: A Multifaceted Imperative

This article examines the confluence of economic pressures that are driving the rise of the dual-income household. We will delve into the key factors, including stagnating wages, rising housing costs, the burden of childcare expenses, and the ever-present need for financial security in an unpredictable world. Expert opinions and data from reputable sources will illuminate the complex dynamics at play, providing a comprehensive understanding of this evolving economic reality.

Stagnant Wages and the Shrinking Middle Class

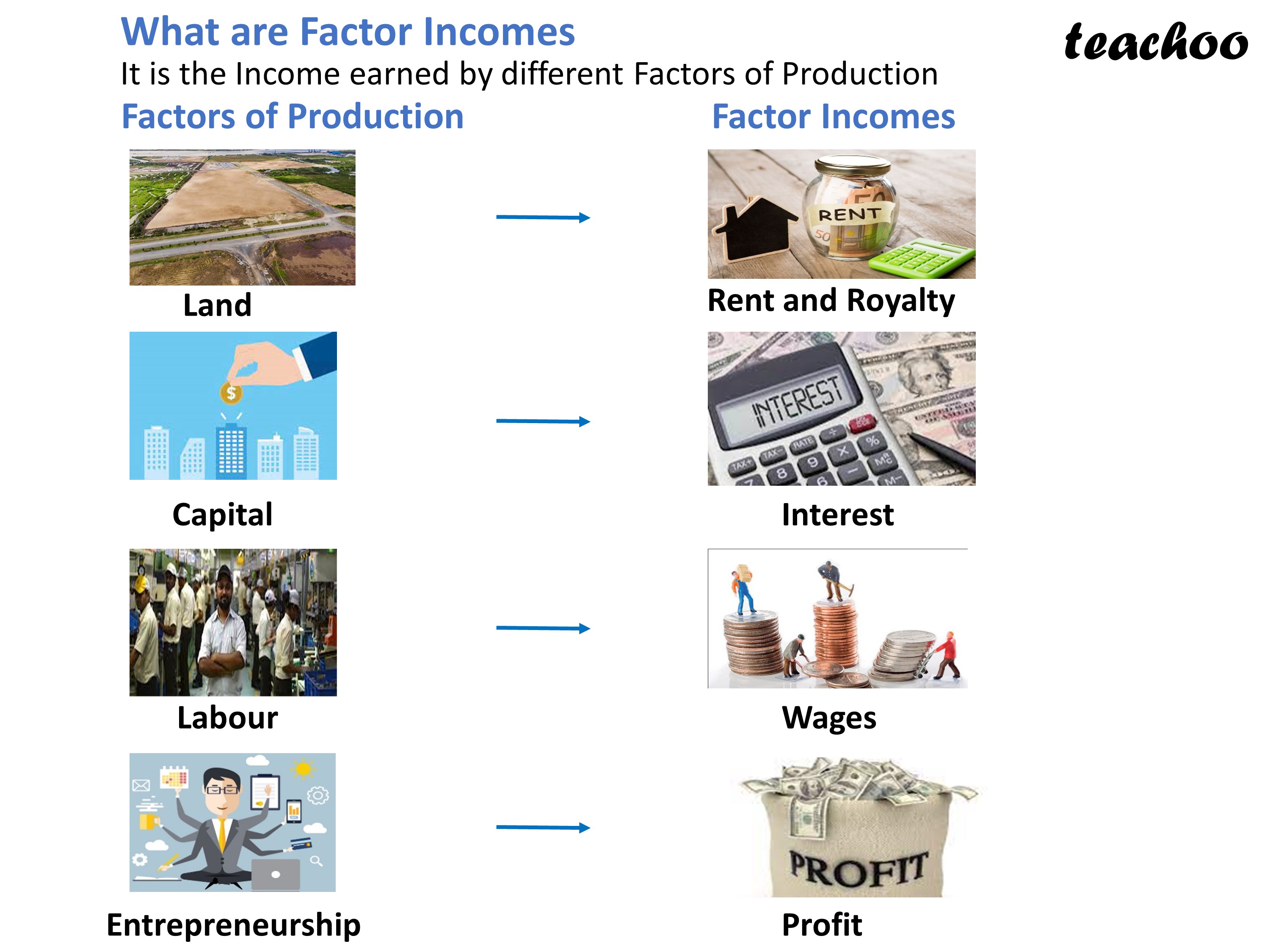

One of the most significant factors driving the need for dual incomes is the stagnation of real wages. Despite productivity gains, the purchasing power of the average worker has remained relatively flat for decades, making it difficult for a single income to adequately support a family.

Data from the Pew Research Center consistently shows that the middle class is shrinking, with more households falling into lower-income brackets. This erosion of the middle class is directly linked to the inability of single-earner households to maintain a comfortable standard of living.

The Housing Affordability Crisis

The skyrocketing cost of housing, whether renting or buying, is another major contributor. In many urban areas, housing costs consume a significant portion of household income, leaving little room for other essential expenses.

According to the National Association of Realtors, housing affordability is at its lowest point in decades. This pressure makes it increasingly difficult for single-income families to secure adequate housing without facing financial strain.

The Escalating Cost of Childcare

For families with children, the cost of childcare represents a significant financial burden. The availability of affordable, quality childcare is often a deciding factor in whether both parents can participate in the workforce.

A report by Child Care Aware of America highlights the fact that in many states, childcare expenses exceed the cost of college tuition. This exorbitant cost effectively necessitates a dual income for many families to afford childcare and maintain their careers.

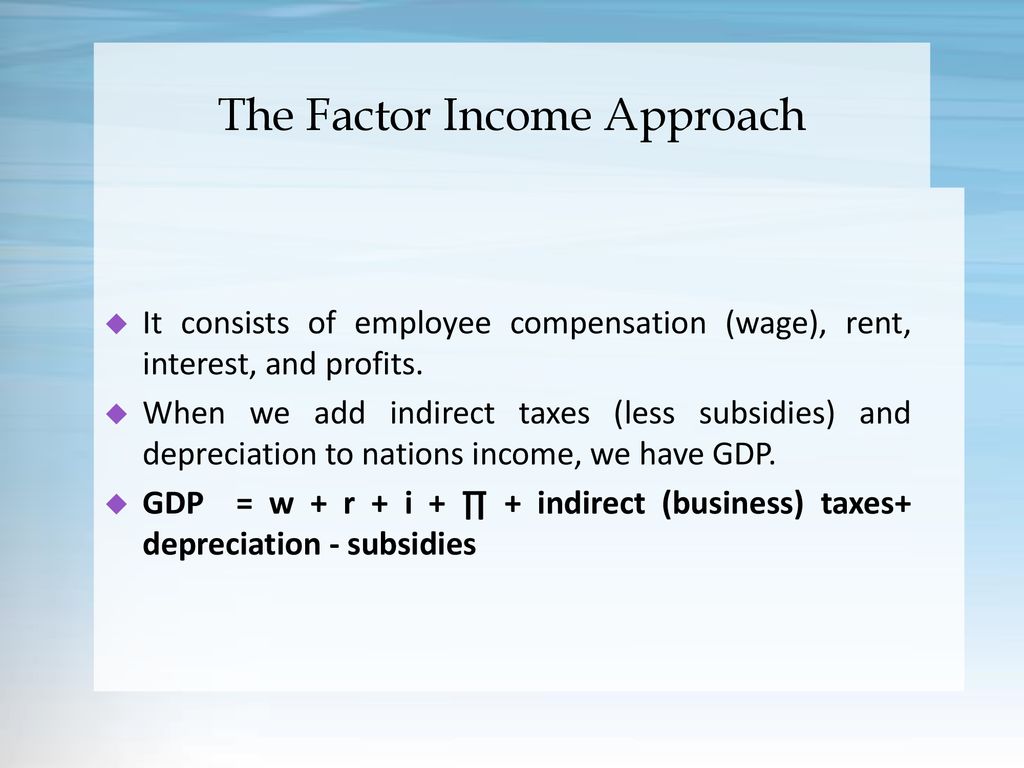

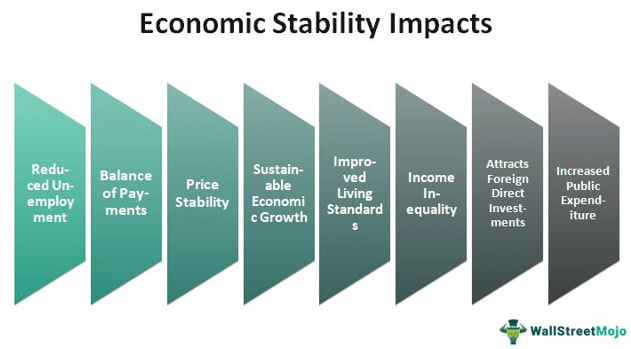

Financial Security and Risk Mitigation

Beyond immediate expenses, the need for financial security is a powerful motivator for maintaining a dual income. A second income provides a buffer against unexpected financial emergencies, such as job loss or medical expenses.

The Social Security Administration also notes that dual-income households often have a higher potential for retirement savings and a more secure financial future. This long-term perspective underscores the importance of a dual income in an era of economic uncertainty.

The Impact of Inflation

Recent surges in inflation have further exacerbated the need for dual incomes. The rising cost of goods and services has eroded purchasing power, making it even more difficult for single-income households to make ends meet.

Data from the Bureau of Labor Statistics shows that the Consumer Price Index (CPI) has increased significantly in recent years, reflecting the impact of inflation on household budgets. This inflationary pressure amplifies the need for a second income to maintain living standards.

The Changing Nature of Work

The gig economy and the rise of freelance work have also contributed to the prevalence of dual-income households. Many individuals supplement their primary income with part-time or freelance work to increase their financial stability.

This trend is particularly evident among younger generations, who are more likely to embrace flexible work arrangements and multiple income streams. The changing nature of work is reshaping the landscape of household finances.

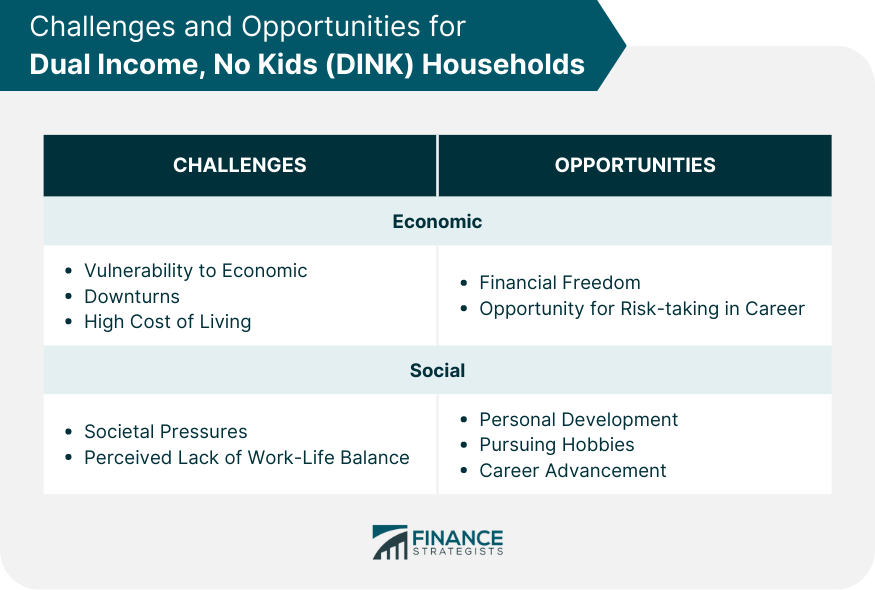

The Perspective of Choice vs. Necessity

While the economic pressures are undeniable, it's important to acknowledge that for some families, maintaining a dual income is a matter of choice rather than pure necessity. This choice may be driven by career aspirations, personal fulfillment, or a desire to achieve a higher standard of living.

However, for a growing number of families, the dual-income model is becoming increasingly essential for survival. The line between choice and necessity is blurring as economic realities shift.

Expert Opinions and Data Insights

Economists emphasize that the need for dual incomes is a complex issue with no easy solutions. Policies aimed at addressing wage stagnation, housing affordability, and childcare costs are crucial for alleviating the pressure on families.

Dr. Anya Sharma, a labor economist at the Economic Policy Institute, argues that "investments in education, affordable housing, and childcare are essential for creating a more equitable economic environment where single-income families can thrive." Her research highlights the systemic issues that contribute to the rise of dual-income households.

Looking Ahead: The Future of Household Finances

The trend towards dual-income households is likely to continue, driven by the factors discussed above. Policymakers, businesses, and families must adapt to this evolving economic reality.

Addressing the underlying economic challenges is essential for creating a more sustainable and equitable future for all families. This requires a multifaceted approach that tackles wage stagnation, housing affordability, and the rising cost of childcare.

Ultimately, the ability for families to thrive, whether with a single income or dual incomes, is a reflection of the overall health and stability of the economy. Investing in policies that support families and promote economic opportunity is crucial for building a brighter future.

![Which Factor Supports Maintaining A Dual Income [Eco] What is Net Factor Income from Abroad? - Class 12 Teachoo](https://d1avenlh0i1xmr.cloudfront.net/large/3c9ea36b-e0e0-4f61-9f3d-4260812acdbe/slide17.jpg)

![Which Factor Supports Maintaining A Dual Income [Economics] What is Domestic Income ? - Class 12 Teachoo](https://d1avenlh0i1xmr.cloudfront.net/a194f9c1-d261-4be5-bb9c-670a0fd510ab/slide25.jpg)