Which Is Cheaper Geico Or Progressive

The question of which auto insurance giant, Geico or Progressive, offers the more affordable rates has plagued drivers for years. Millions pore over quotes annually, hoping to shave precious dollars off their insurance premiums. The answer, however, is far from straightforward, varying significantly based on individual circumstances and driving profiles.

The true cost comparison between Geico and Progressive is complex. It's not a simple matter of one consistently being cheaper than the other. Instead, the "cheaper" option hinges on factors like driving record, age, vehicle type, location, and the specific coverage options selected. This article delves into the nuances of auto insurance pricing to illuminate which company might offer a better deal for different driver demographics.

Factors Influencing Insurance Rates

Several key elements dictate the price of car insurance, regardless of the provider. Understanding these factors is crucial when comparing quotes from Geico and Progressive.

Driving Record

A clean driving record invariably leads to lower premiums. Accidents and traffic violations, especially DUI convictions, significantly increase the cost of insurance. Drivers with multiple incidents on their record will typically find both Geico and Progressive charging higher rates.

Age and Experience

Younger drivers, statistically considered riskier, typically face higher insurance costs. As drivers gain experience and maintain a clean record, their premiums tend to decrease. Senior drivers may also see increased rates in some cases, depending on age and health conditions.

Vehicle Type

The make and model of your vehicle play a significant role in determining insurance rates. Expensive vehicles, sports cars, and vehicles prone to theft generally carry higher premiums.

Location

Location is a crucial factor. Urban areas with higher population density and crime rates tend to have higher insurance costs compared to rural areas.

Coverage Options

The level of coverage chosen directly affects the premium. Liability-only coverage is cheaper than comprehensive and collision coverage. Adding features like uninsured/underinsured motorist protection will also influence the overall cost.

Geico vs. Progressive: A Rate Comparison

Obtaining precise, personalized quotes from both Geico and Progressive is the best way to determine which is cheaper for your specific situation. However, general trends and publicly available data offer some insights.

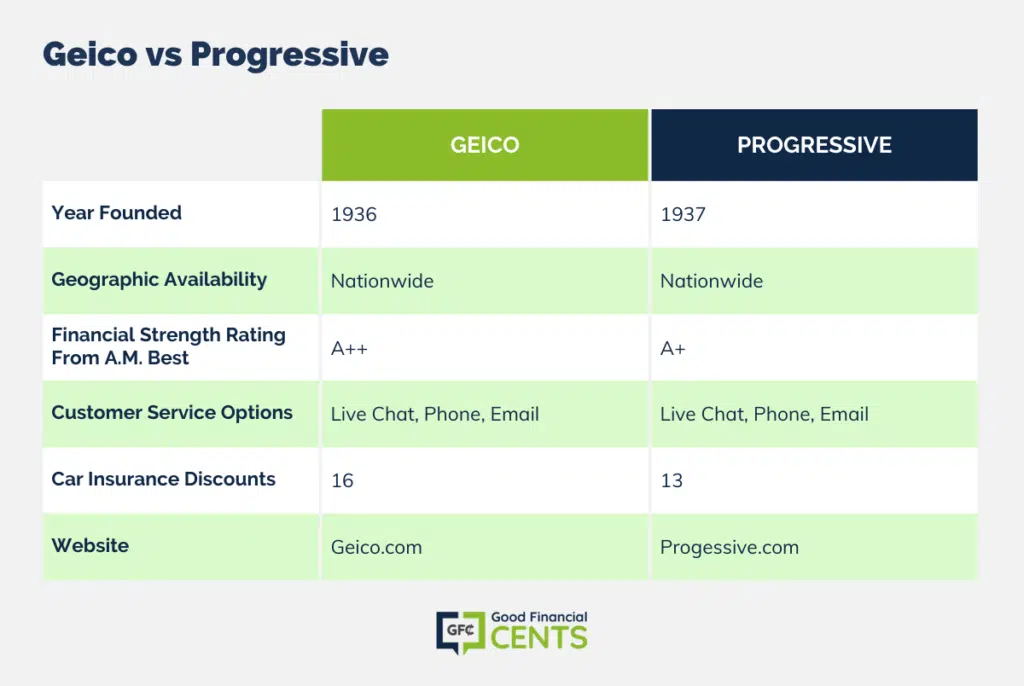

According to multiple studies and aggregated rate data from sources like NerdWallet and The Zebra, Geico often presents slightly lower average rates for drivers with good driving records. Progressive, on the other hand, sometimes offers more competitive rates for drivers with less-than-perfect records.

It's important to remember that these are just averages, and individual experiences can vary. Some drivers with excellent records might still find Progressive offering a better deal, while others with blemishes on their record may find Geico more affordable.

“Ultimately, the best way to know which company offers the lowest rate is to get quotes from both,” advises the Insurance Information Institute.

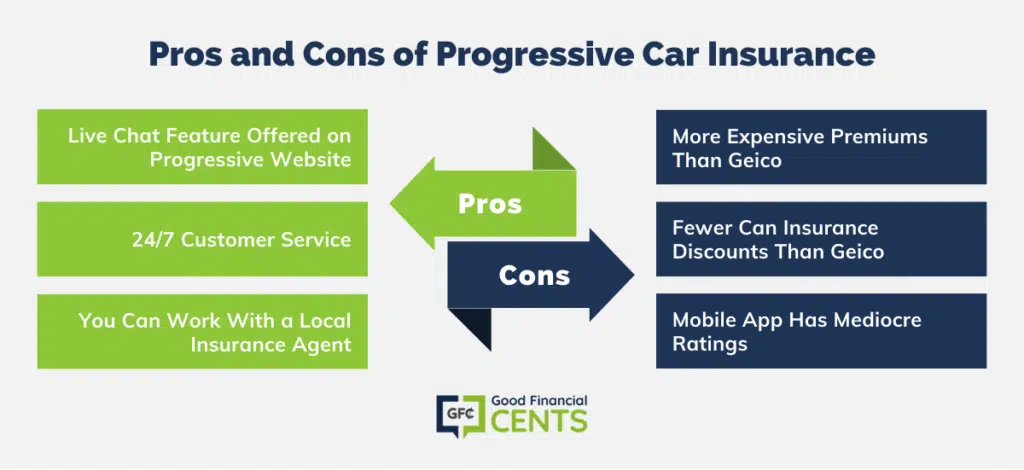

Discounts and Other Considerations

Both Geico and Progressive offer various discounts that can significantly impact the final premium. These discounts can include:

- Multi-policy discounts (bundling auto and home insurance)

- Safe driver discounts

- Good student discounts

- Military discounts (especially relevant for Geico)

- Discounts for having anti-theft devices

Beyond price, consider factors like customer service, claims handling, and financial stability when choosing an insurer. Reading customer reviews and checking the company's financial ratings from agencies like A.M. Best can provide valuable information.

The Future of Auto Insurance Pricing

The auto insurance landscape is constantly evolving. Telematics, which uses data collected from devices in your car to track driving habits, is becoming increasingly popular. Progressive's Snapshot program and similar programs from Geico offer potential discounts based on safe driving behavior.

The rise of autonomous vehicles may also disrupt the industry in the long term. As cars become more self-driving, the responsibility for accidents may shift from drivers to manufacturers, potentially altering insurance models.

In conclusion, there's no definitive "cheaper" option between Geico and Progressive. The best approach is to obtain personalized quotes from both companies, compare coverage options, and factor in discounts and customer service ratings. By carefully evaluating all these aspects, drivers can make an informed decision and secure the best possible insurance rate for their individual needs.