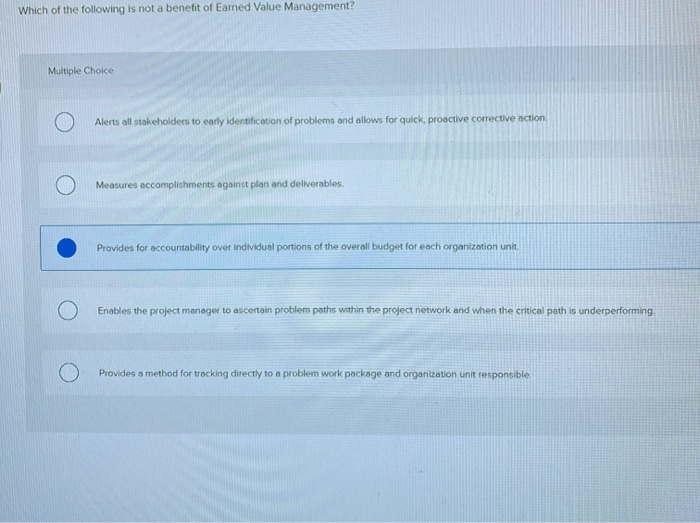

Which Is Not A Benefit Of Ei

The aroma of freshly brewed coffee swirled through the air at the community center, mingling with the murmur of voices. Sarah, a single mother who recently lost her job, sat nervously at a table, a pamphlet on Employment Insurance (EI) clutched in her hand. She was trying to navigate the complex world of government benefits, hoping to find a lifeline during this difficult period, but confusion clouded her brow. It felt like deciphering a secret code, and she wondered, "Which of these promised benefits is actually *not* what I'm getting?"

The question of what EI *doesn't* offer is crucial. Understanding the limitations of Employment Insurance is just as important as understanding its benefits. Many Canadians mistakenly believe EI is a catch-all safety net, when in reality, it has specific eligibility requirements and limitations. This article aims to clarify those misunderstandings, outlining what EI isn't designed to provide and highlighting the areas where individuals may need to seek alternative support.

Understanding the Basics of EI

Employment Insurance, often called EI, is a federal program designed to provide temporary financial assistance to eligible workers who have lost their jobs through no fault of their own. It's funded through contributions made by both employees and employers. The program aims to ease the financial burden during job searches or temporary periods of unemployment.

The program has evolved over the years. Originally introduced in 1940 as Unemployment Insurance, it was designed to help workers transition between jobs. Changes have been made to reflect the shifting needs of the Canadian workforce.

What EI Is Not: Dispelling the Myths

Myth 1: EI Guarantees Your Previous Salary

One of the most common misconceptions is that EI will fully replace your previous income. In reality, EI typically provides 55% of your average insurable earnings, up to a maximum yearly insurable earnings amount, which is capped annually. This means that higher-income earners will receive a smaller percentage of their previous salary.

This replacement rate might not be enough to cover all living expenses. Individuals often need to adjust their budgets significantly or seek additional sources of income.

Myth 2: EI Covers All Types of Job Loss

EI eligibility is not universal. Individuals who quit their jobs without just cause, or who are dismissed for misconduct, are generally ineligible for benefits. This is a crucial distinction.

The reason for job separation is a key factor. Layoffs due to economic downturns or company restructuring are usually covered, while voluntary departures often are not, unless there are extenuating circumstances.

Myth 3: EI Lasts Indefinitely

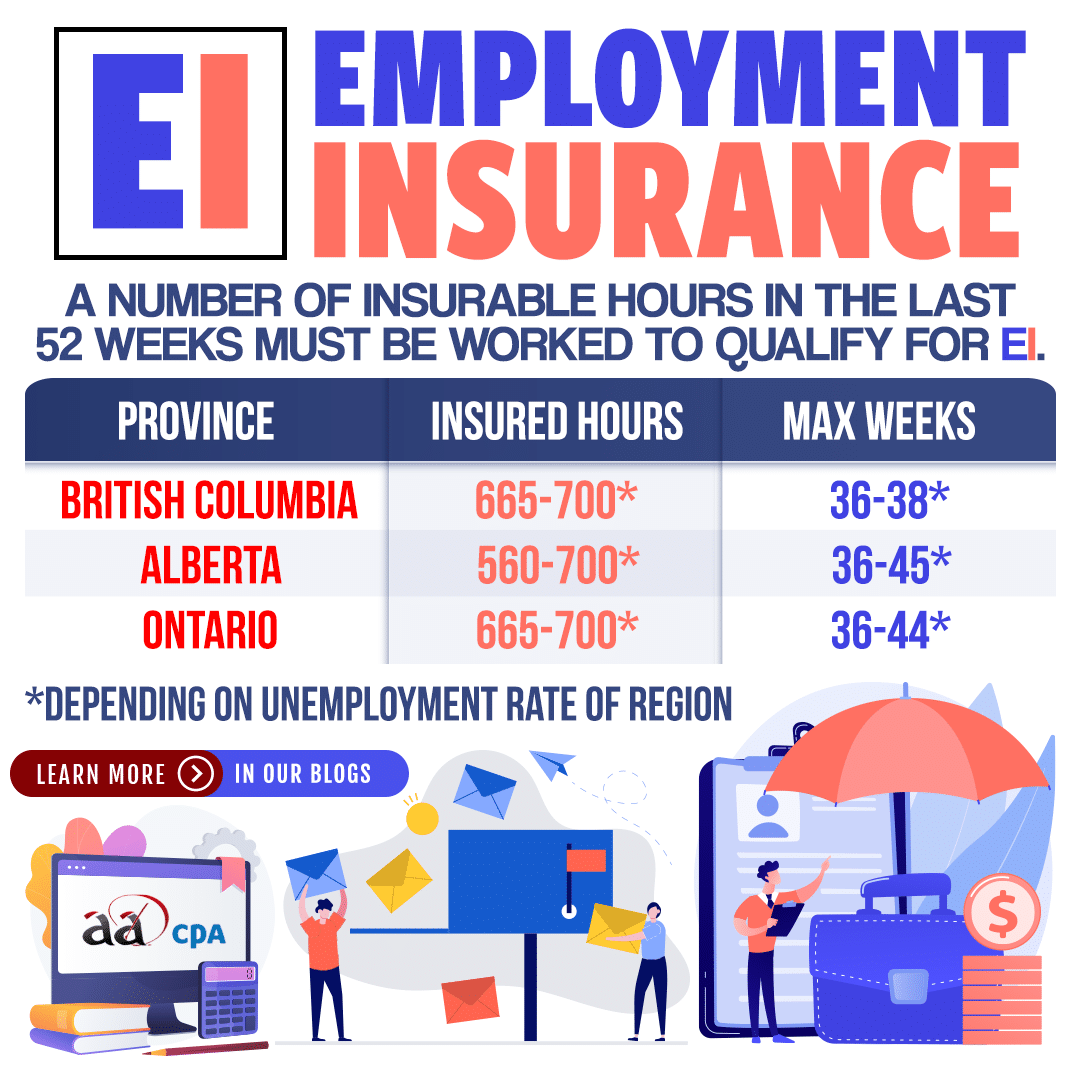

The duration of EI benefits is not unlimited. The length of time you can receive EI depends on the number of insurable hours you've worked in the qualifying period and the unemployment rate in your region. These factors determine how long you will receive financial assistance.

Some regions with higher unemployment rates offer extended benefits. However, these extensions are not permanent and are subject to change based on economic conditions.

Myth 4: EI Covers Self-Employment (Automatically)

While EI does offer some support for self-employed individuals through the EI Special Benefits for Self-Employed People program, it's not automatic. Self-employed individuals must opt into the program and pay premiums to be eligible for benefits like maternity, parental, sickness, and compassionate care benefits. This is a voluntary program for those who chose to enroll.

Simply being self-employed does not automatically entitle you to EI. Enrollment and premium payments are required for coverage.

Myth 5: EI Provides Comprehensive Career Counseling

EI primarily offers financial assistance. While it may connect individuals with resources for job searching, it doesn't provide intensive, personalized career counseling. Job search assistance is very high level and generic.

Individuals looking for in-depth career guidance might need to seek out additional services. There are services available that provide career counseling through private or government funding.

Myth 6: EI Replaces Long-Term Disability Insurance

EI is designed for temporary unemployment. It is *not* a substitute for long-term disability insurance, which provides income replacement for individuals who are unable to work due to prolonged illness or injury. EI is a tool for a job search, disability insurance is a source of income replacement for medical situations.

Individuals facing long-term health issues should explore disability insurance options. Many workplaces offer disability insurance programs.

The Significance of Understanding EI Limitations

Recognizing what EI doesn't offer is crucial for financial planning and personal responsibility. It allows individuals to make informed decisions about their financial security and seek out alternative resources when needed.

Misunderstandings about EI can lead to financial hardship. Relying solely on EI without understanding its limitations can create significant challenges during periods of unemployment.

Navigating the System: Tips and Resources

For Canadians seeking clarity on EI, several resources are available. The official Government of Canada website provides detailed information on eligibility criteria, benefit rates, and application processes.

Local employment centers and community organizations often offer guidance and support. These resources can help individuals navigate the complexities of the EI system and explore other available programs.

Beyond EI: Exploring Alternative Support Systems

When EI falls short, individuals should explore other avenues of support. Provincial social assistance programs, emergency funds, and community charities can provide additional assistance during times of financial difficulty. It's wise to not rely soley on one resource.

Networking and connecting with industry contacts can also be valuable. Building a strong professional network can open doors to new job opportunities and support during job searches.

Conclusion: Empowering Individuals Through Knowledge

Sarah, after researching EI and understanding its limitations, felt a sense of relief mixed with renewed determination. She realized that EI was a valuable resource, but not a complete solution. She began exploring other options, such as updating her resume and networking with former colleagues.

Understanding the nuances of EI empowers individuals to make informed decisions and proactively plan for their financial future. By dispelling common myths and providing clarity on its limitations, this article aims to equip Canadians with the knowledge they need to navigate periods of unemployment with greater confidence and resilience. It's not a perfect system, but it's a start.

The journey of job searching can be daunting, but knowledge is a powerful tool. Understanding what EI is *not* helps pave the way for a more secure and informed path forward.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/GQZXWIHVMREOFN4XVT3UWUCTTU.jpg)