Which Is Not A Type Of Business Organization

Confusion reigns as aspiring entrepreneurs grapple with basic business structures. Many are struggling to differentiate between legitimate business types and misnomers, leading to potential legal and financial pitfalls.

This article cuts through the noise, definitively answering the question: Which is NOT a type of business organization? The incorrect option commonly mistaken for a legitimate structure is revealed below.

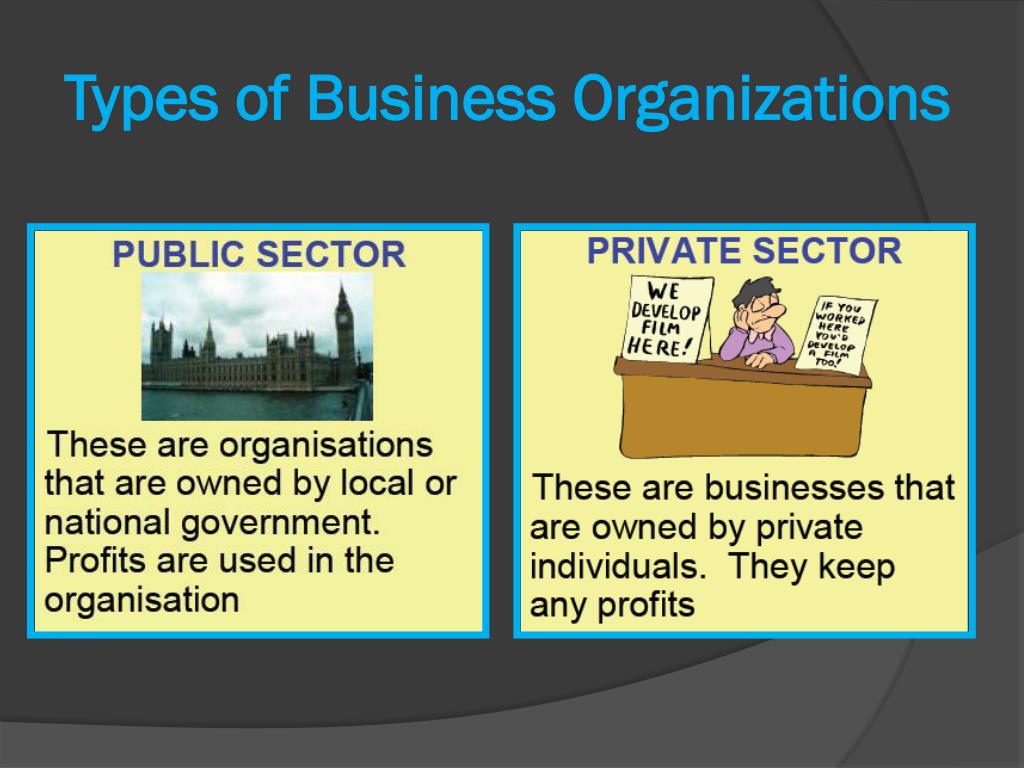

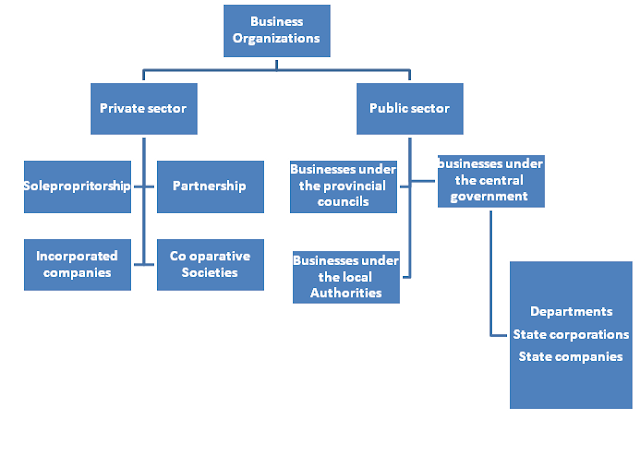

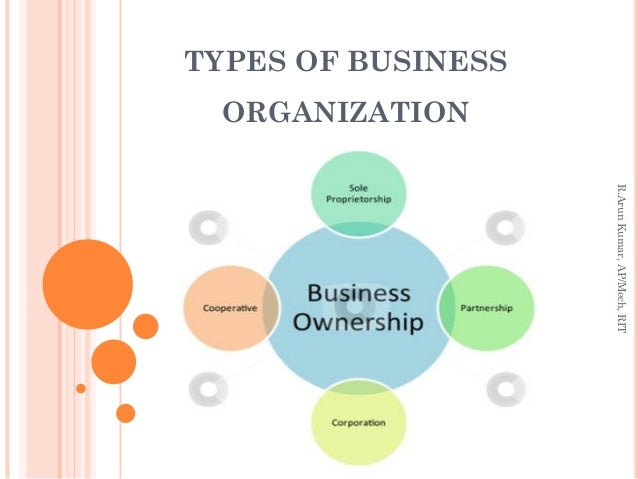

The Four Pillars of Business Formation

Understanding the core business structures is critical for success. The primary types of business organizations recognized legally and financially are:

- Sole Proprietorship

- Partnership

- Limited Liability Company (LLC)

- Corporation

Each structure offers distinct advantages and disadvantages regarding liability, taxation, and administrative burden.

The Mistaken Identity: "General Company" Debunked

The term “General Company” is often erroneously used, creating confusion. It is not a recognized legal business entity in most jurisdictions.

It is a generic descriptor and lacks the legal standing of a Sole Proprietorship, Partnership, LLC, or Corporation. Avoid using this term when officially forming your business.

Using "General Company" could create legal gaps if you plan on conducting business activity. Your company must be officially registered under legal structure.

Digging Deeper: The Correct Options

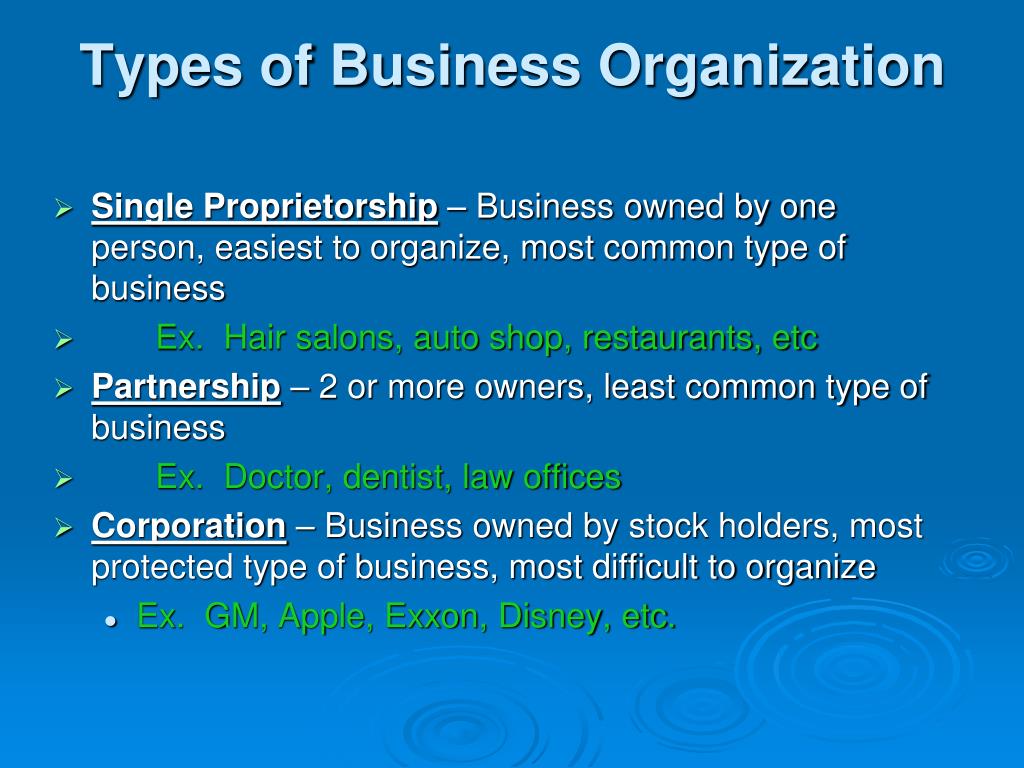

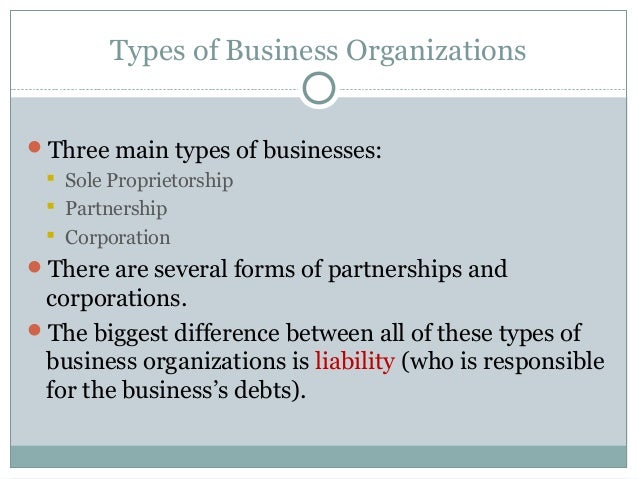

A Sole Proprietorship is the simplest structure, where the business is owned and run by one person, with no legal distinction between the owner and the business. The owner is personally liable for business debts.

A Partnership involves two or more individuals who agree to share in the profits or losses of a business. Partners typically share in the business’s operational and financial obligations. This may create a complex legal structure with high level of responsibility of each partner.

An LLC offers limited liability to its owners (members), protecting their personal assets from business debts and lawsuits. It provides the liability protection of a corporation with the tax advantages of a partnership.

A Corporation is a separate legal entity from its owners (shareholders), offering the strongest protection from liability. It can raise capital more easily but faces more complex regulations and potentially higher taxes.

Why Does This Matter?

Choosing the wrong business structure can have severe consequences. It can lead to personal liability for business debts, unfavorable tax implications, and difficulty in securing funding.

Furthermore, incorrect formation may result in legal challenges, penalties, and the inability to operate legally. Selecting the correct legal structure is key to operating business and to avoid future legal disputes.

Consult with legal and financial professionals to ensure you choose the most appropriate structure for your specific needs and circumstances.

Key Takeaway: Legality Matters

The critical point is that "General Company" lacks legal recognition. It is not a suitable option when forming your business.

Always prioritize established legal structures like Sole Proprietorship, Partnership, LLC, or Corporation to protect yourself and your business.

Research thoroughly and seek expert advice to make informed decisions about your business's organizational structure. This is key for success and for compliance with the law.