Which Is The Best Company To Invest In Share Market

Imagine sitting on a sun-drenched porch, sipping lemonade, and watching your investment portfolio gently blossom. The stock market, often perceived as a labyrinth of numbers and jargon, holds the potential to transform aspirations into tangible realities. But the golden question remains: which company offers the most fertile ground for your hard-earned capital?

This article aims to navigate the complex terrain of the stock market, providing insights to help you make informed investment decisions. It doesn't offer a single definitive "best" company, but rather equips you with the knowledge to identify opportunities that align with your risk tolerance and financial goals.

Understanding Investment Philosophies

Before diving into specific companies, understanding different investment philosophies is crucial. Are you a value investor, seeking undervalued companies with strong fundamentals? Or are you a growth investor, targeting companies with high potential for rapid expansion, even if their current valuations seem lofty?

Your personal investment style will heavily influence which companies resonate with you. Remember, there's no one-size-fits-all approach.

The Allure of Tech Giants

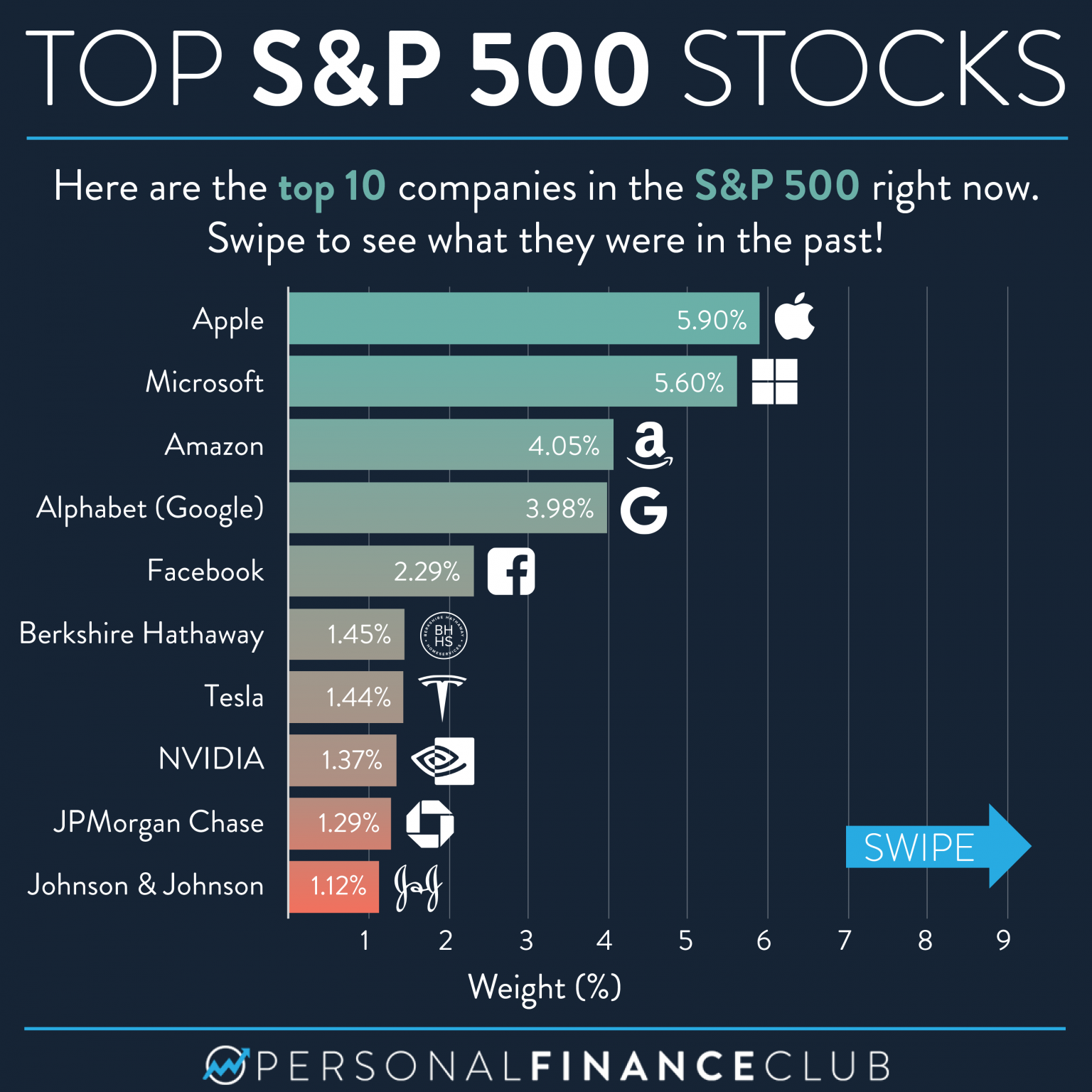

Tech giants like Apple, Microsoft, and Amazon often dominate investment discussions. Their established market positions, innovative products, and substantial cash reserves make them attractive choices. However, it's crucial to analyze their growth prospects and potential challenges.

For instance, regulatory scrutiny and increasing competition could impact their future performance. Diversification, even within the tech sector, is often a prudent strategy.

Exploring Emerging Markets

Emerging markets offer exciting growth opportunities, but also come with increased risks. Companies in countries like India, Brazil, and China can experience rapid growth as these economies develop. However, political instability and currency fluctuations can impact returns.

Thorough research and understanding the specific market dynamics are essential before investing in emerging markets.

The Significance of Due Diligence

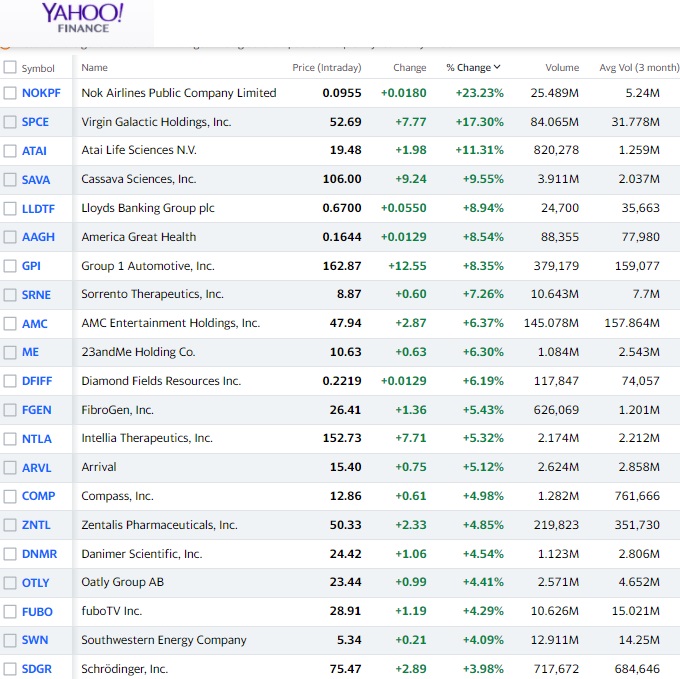

Regardless of the sector or company, due diligence is paramount. This involves analyzing financial statements, reading industry reports, and understanding the company's competitive landscape. Reputable sources like the Securities and Exchange Commission (SEC) filings and reports from established financial institutions can provide valuable insights.

Don't rely solely on hearsay or opinions from online forums. Informed decisions are built on solid research.

The Importance of Diversification

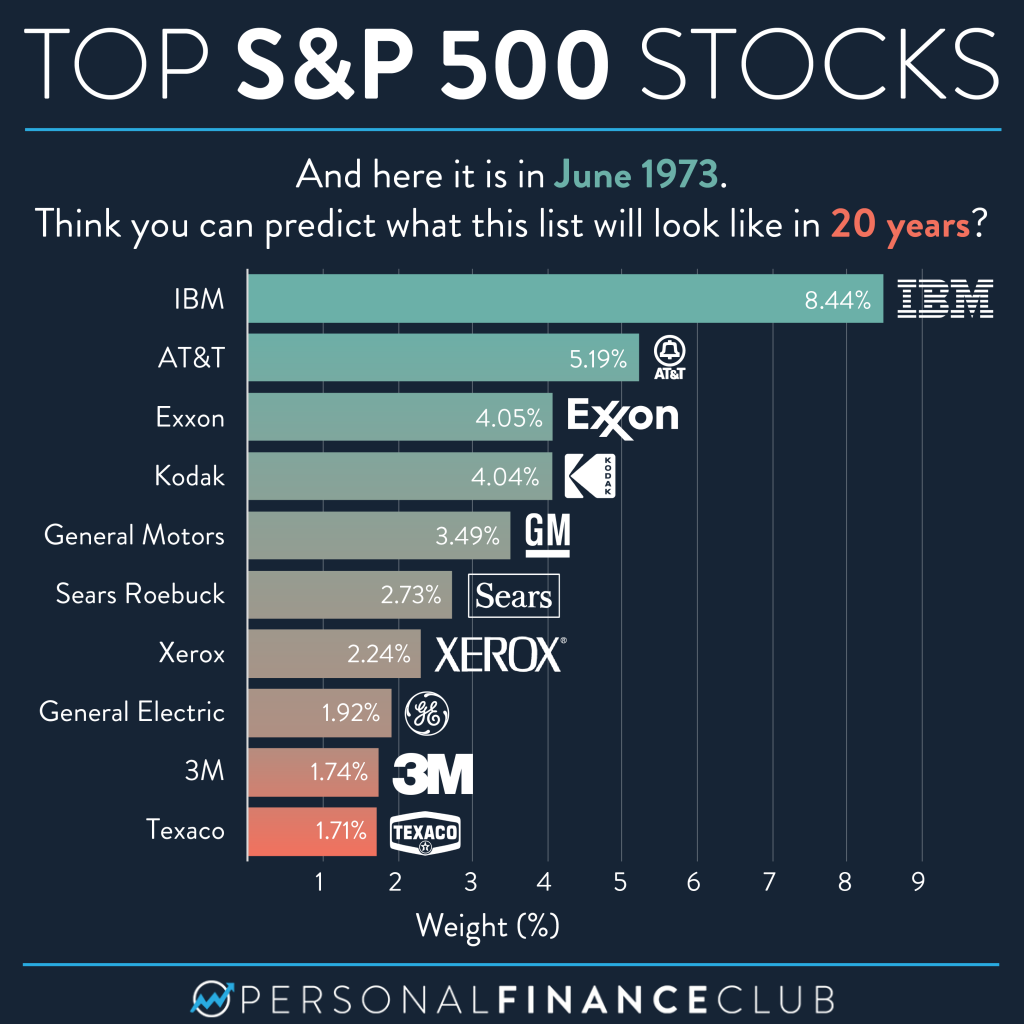

Legendary investor Warren Buffett famously said, "Don't put all your eggs in one basket." Diversification is a cornerstone of sound investment strategy. Spreading your investments across different sectors, industries, and asset classes can mitigate risk.

A well-diversified portfolio is more resilient to market fluctuations.

Seeking Professional Advice

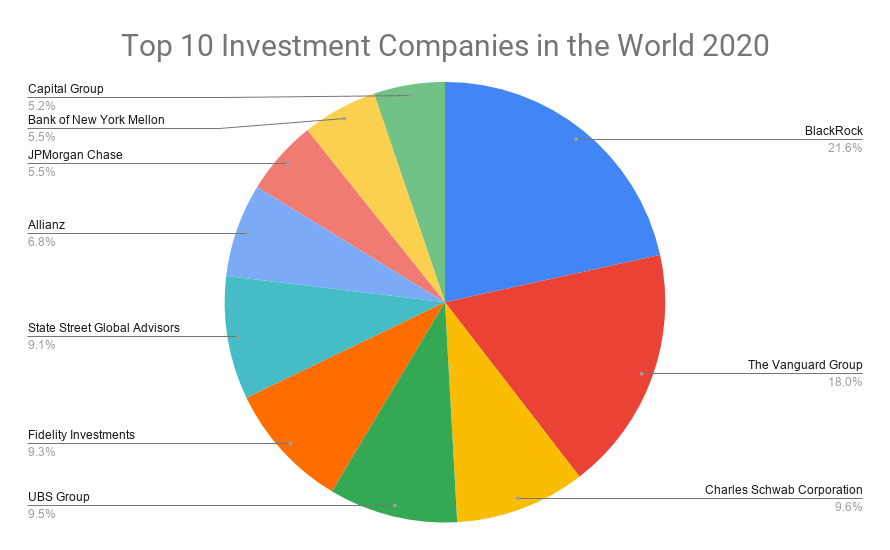

Navigating the stock market can be overwhelming. Consider consulting with a qualified financial advisor who can provide personalized guidance. They can help you assess your risk tolerance, develop an investment strategy, and manage your portfolio.

Financial advisors can offer objective advice and help you stay on track toward your financial goals.

"The best investment you can make is an investment in yourself... The more you learn, the more you'll earn." - Warren Buffett

Beyond the Bottom Line

Increasingly, investors are considering environmental, social, and governance (ESG) factors when making investment decisions. Companies with strong ESG practices are often seen as more sustainable and responsible in the long run.

ESG investing can align your investments with your values.

Ultimately, the "best" company to invest in is subjective and depends on your individual circumstances. There's no magic formula. Instead, it's about aligning your investments with your risk tolerance, financial goals, and values. Careful research, a diversified portfolio, and perhaps the guidance of a financial advisor are the keys to unlocking the stock market's potential and achieving your financial aspirations.