Which Is The First Step Toward Financial Literacy

Financial instability plagues millions. But experts agree: the journey to security begins with a single, crucial step.

This article cuts through the complexity, revealing the foundational element of financial literacy and empowering readers to take immediate action toward a brighter financial future. Understanding this first step is paramount for everyone, regardless of income or background.

Understanding Your Current Financial Situation

The bedrock of financial literacy isn't investing or budgeting, but understanding exactly where you stand right now. This involves a comprehensive assessment of your income, expenses, assets, and liabilities.

According to a 2023 study by the National Financial Educators Council, only 41% of adults have a clear understanding of their monthly expenses. This lack of awareness sets individuals up for financial missteps.

Income: The Money Coming In

Start by documenting all sources of income. This includes your salary, any side hustles, investments, or government benefits you receive.

Be precise. Include net income (after taxes and deductions), providing a realistic picture of your available funds.

Expenses: Where Your Money Goes

Track your spending meticulously for at least a month. Use budgeting apps, spreadsheets, or even a simple notebook.

Categorize expenses as fixed (rent, mortgage, loan payments) and variable (groceries, entertainment, transportation). Fixed expenses are easy to track; variable ones require more attention.

A 2022 report from the Bureau of Labor Statistics found that housing, transportation, and food account for over 60% of average household expenses. Knowing this can help you pinpoint potential areas for savings.

Assets: What You Own

List everything you own that has monetary value. This includes cash, savings accounts, investments (stocks, bonds, real estate), and personal property (cars, jewelry).

Estimate the current market value of each asset. This provides a clear picture of your overall net worth.

Liabilities: What You Owe

Document all your debts, including credit card balances, student loans, mortgages, and personal loans.

Note the interest rates and minimum payments for each debt. This information is critical for prioritizing debt repayment.

The Federal Reserve reported in 2024 that total household debt in the US reached a record high. Understanding your debt obligations is crucial for preventing financial distress.

Analyzing Your Financial Snapshot

Once you've gathered all the data, take time to analyze your financial situation. Calculate your net worth (assets minus liabilities).

Identify areas where you're overspending. Look for opportunities to reduce expenses or increase income.

Determine your debt-to-income ratio. This is the percentage of your monthly income that goes toward debt payments. A high ratio can indicate financial vulnerability.

Tools and Resources

Several resources can help you track your finances. Budgeting apps like Mint and YNAB (You Need a Budget) offer automated tracking and reporting features.

Spreadsheet templates are available online for free. Financial literacy websites like Investopedia and NerdWallet provide valuable information and tools.

"Taking the first step toward understanding your finances is the most important decision you can make," says Sarah Johnson, a certified financial planner at Acme Financial Advisors. "It's the foundation upon which all other financial decisions are built."

Next Steps

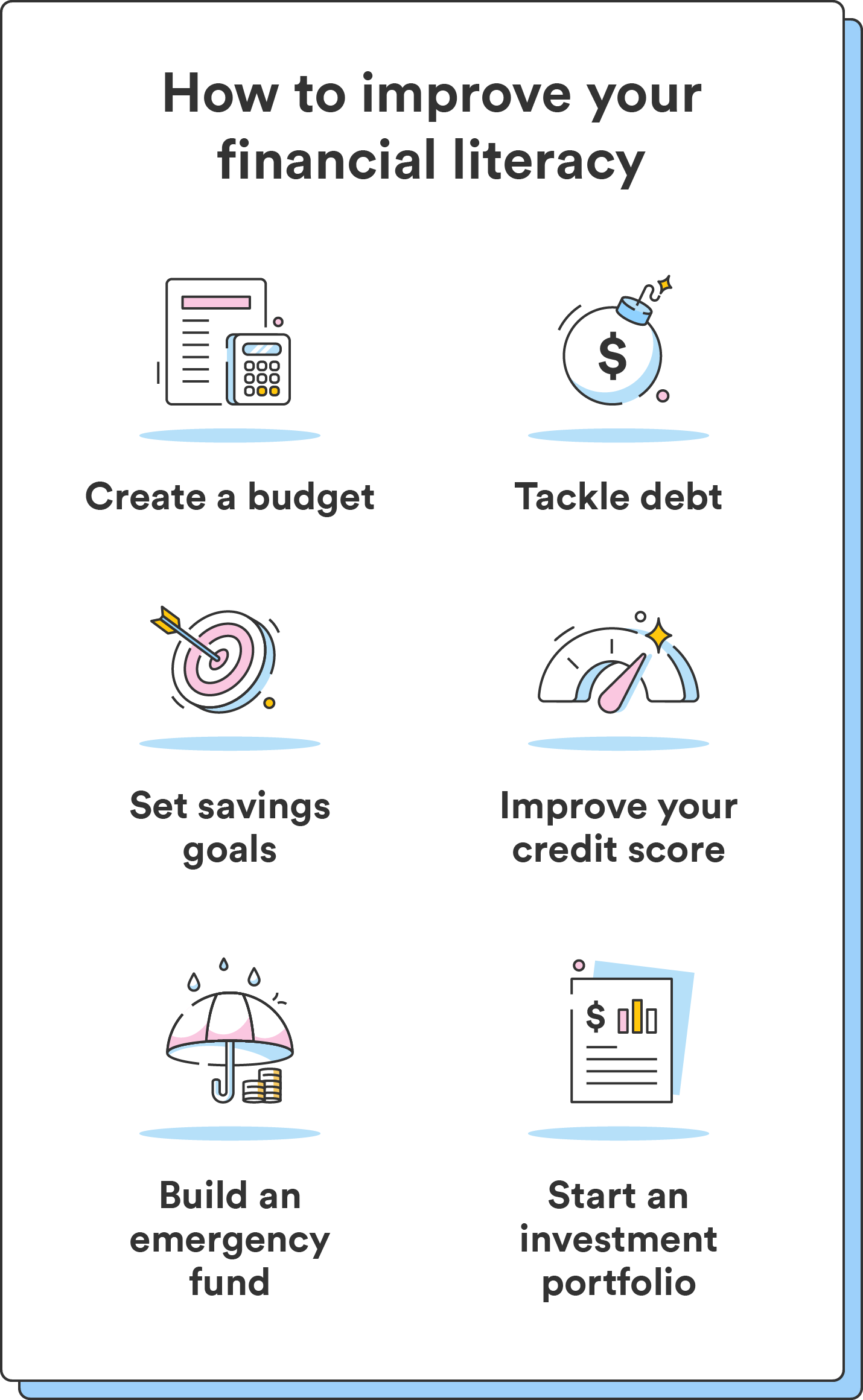

Now that you understand your financial landscape, create a budget. This will help you allocate your resources effectively.

Prioritize debt repayment. Focus on paying down high-interest debt first.

Set financial goals. What do you want to achieve financially? (e.g., save for a down payment, retire early).

Financial literacy is an ongoing process. Stay informed, seek professional advice when needed, and regularly review your financial situation.