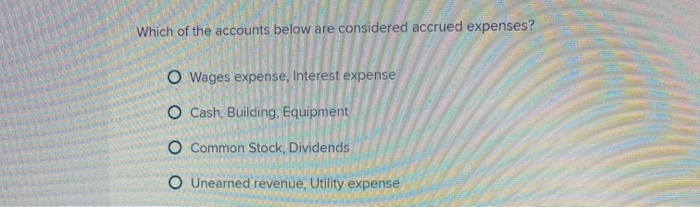

Which Of The Accounts Below Are Considered Accrued Expenses

Businesses face a critical accounting challenge: correctly identifying accrued expenses. Misclassification can lead to inaccurate financial reporting and potentially impact profitability assessments.

This article cuts through the complexity, clarifying which accounts definitively qualify as accrued expenses and highlighting the potential pitfalls of misidentification. Get the facts now to ensure your financial statements are accurate and compliant.

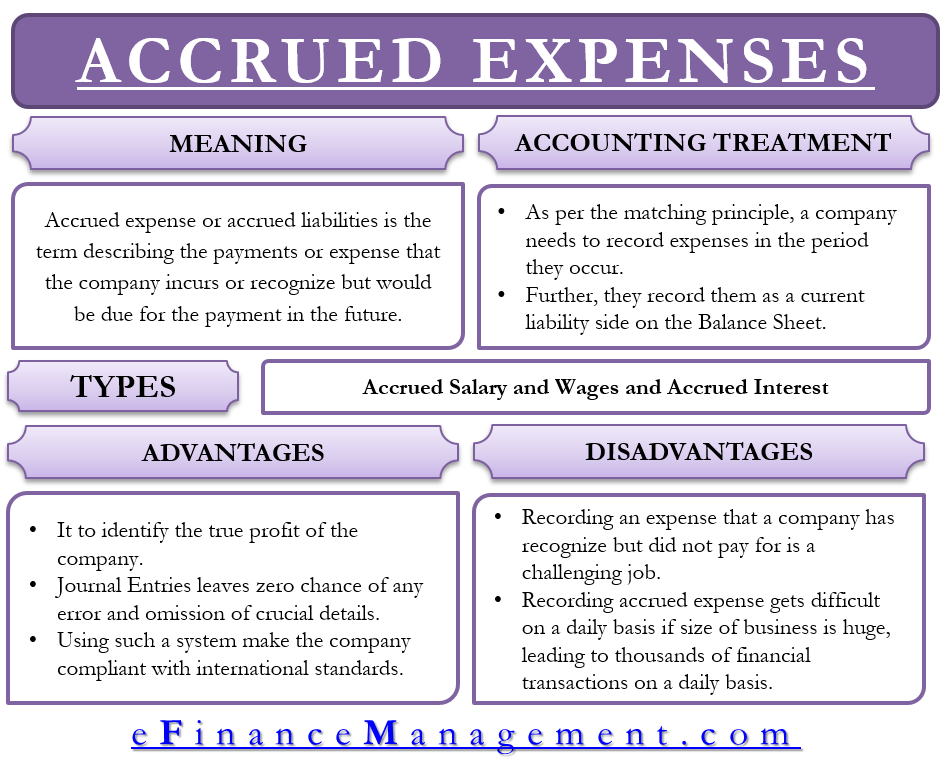

What are Accrued Expenses?

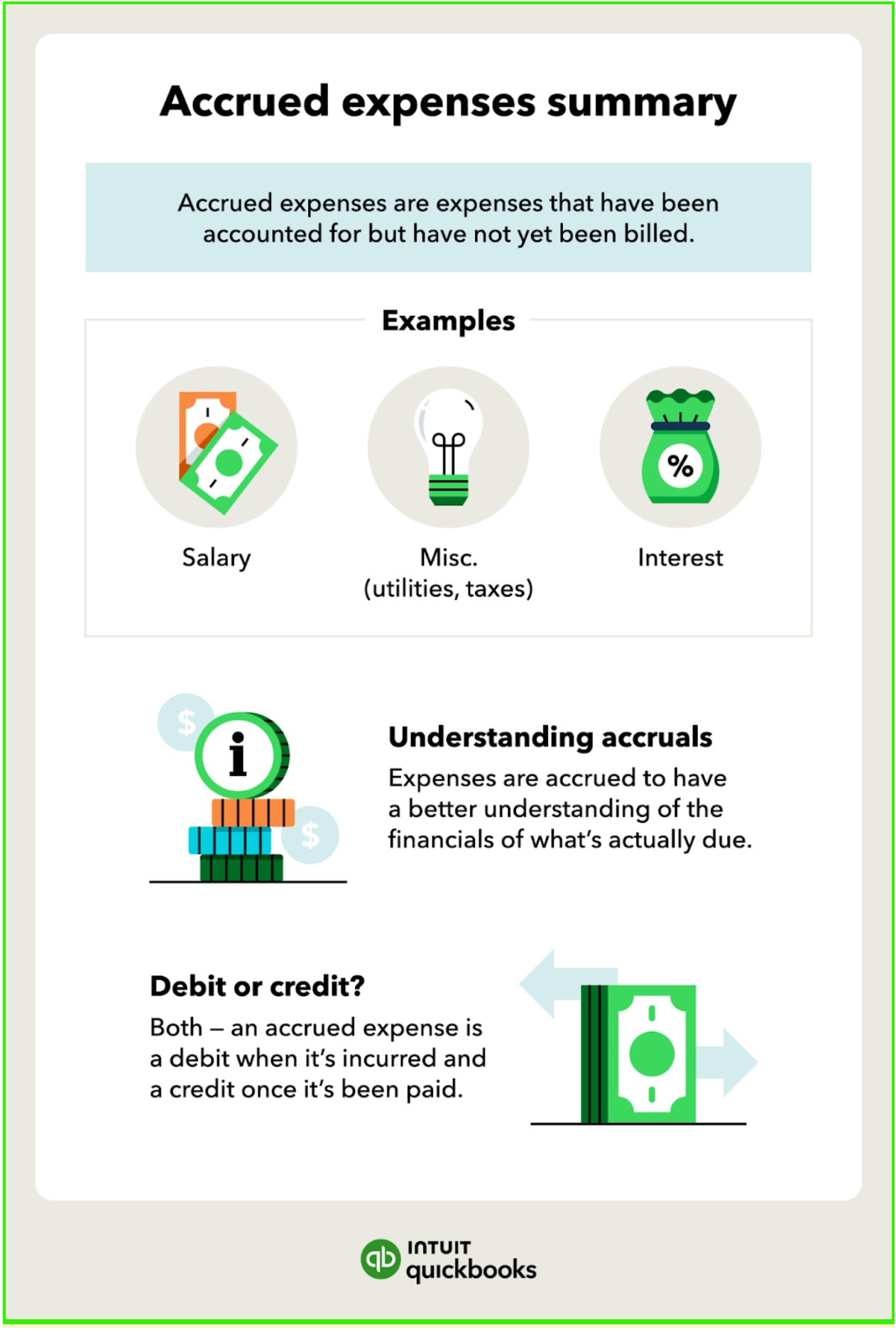

Accrued expenses represent liabilities for goods or services received, but for which payment has not yet been made. These are expenses that have been incurred but not yet billed or formally invoiced by the supplier.

Accrued expenses are a crucial part of accrual accounting, matching revenues with the expenses incurred to generate those revenues in the same accounting period.

Common Examples of Accrued Expenses

Several account types commonly fall under the umbrella of accrued expenses. Let's examine some of the most frequent and how they fit the definition.

Accrued Salaries and Wages

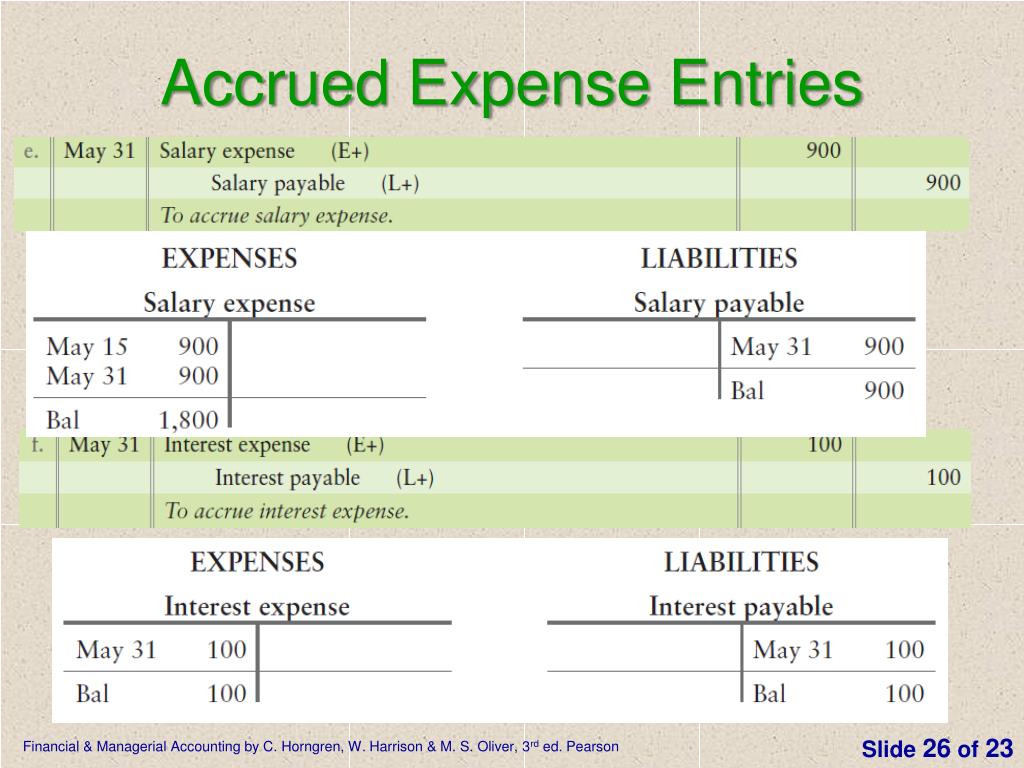

Accrued salaries and wages are a prime example. If employees have worked during the period, but haven’t been paid yet (for example, if the pay period ends after the month-end), the unpaid wages are an accrued expense.

This reflects the company's obligation to pay employees for work already performed.

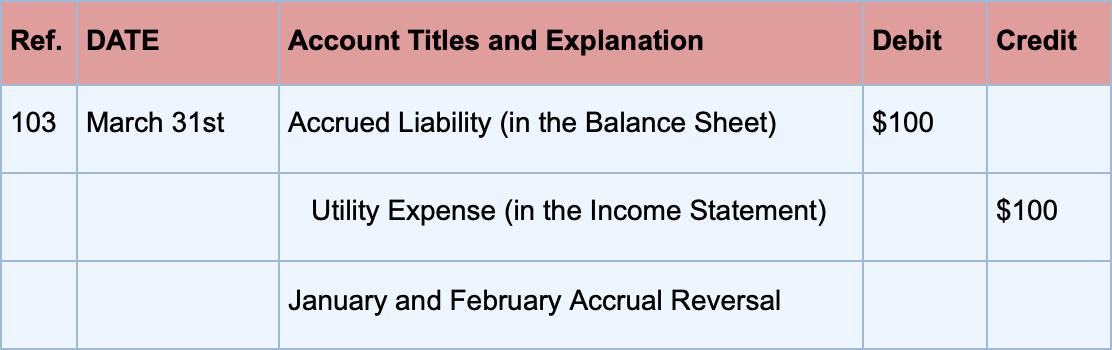

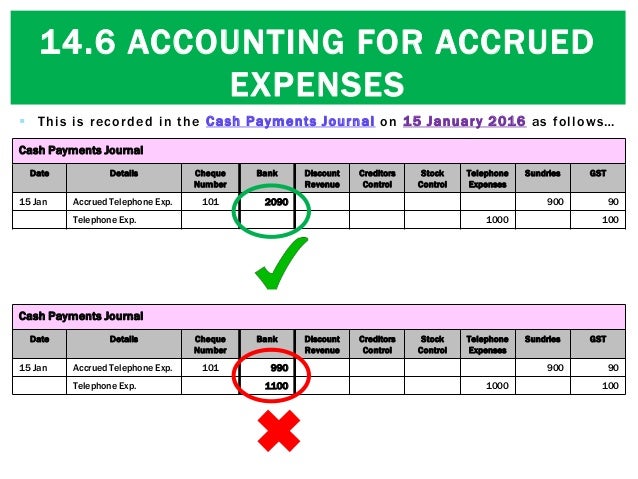

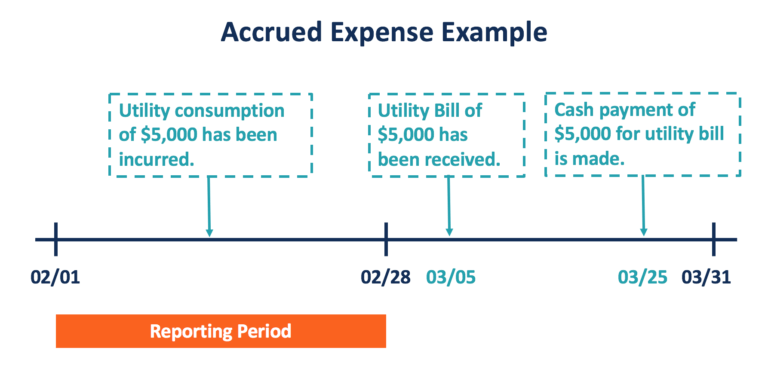

Accrued Utilities

Utilities like electricity, gas, and water are usually billed in arrears. The company uses the service throughout the month, but the invoice arrives the following month.

The estimated cost of utilities consumed but not yet billed at the end of the accounting period is an accrued expense. This ensures the expense is recognized in the correct period.

Accrued Interest

Interest on loans or other debt instruments often accrues daily. Even if the interest payment isn't due until the next accounting period, the portion of interest expense related to the current period must be accrued.

This ensures accurate reporting of interest expense and the corresponding liability.

Accrued Taxes

Companies often accrue taxes like property taxes or payroll taxes. These expenses are incurred regularly but not necessarily paid at the same frequency.

The accrued portion of these taxes represents a liability until the payment is made.

Accounts That Are NOT Accrued Expenses

It is just as important to understand what is not considered an accrued expense. Certain accounts are commonly mistaken for accruals, leading to accounting errors.

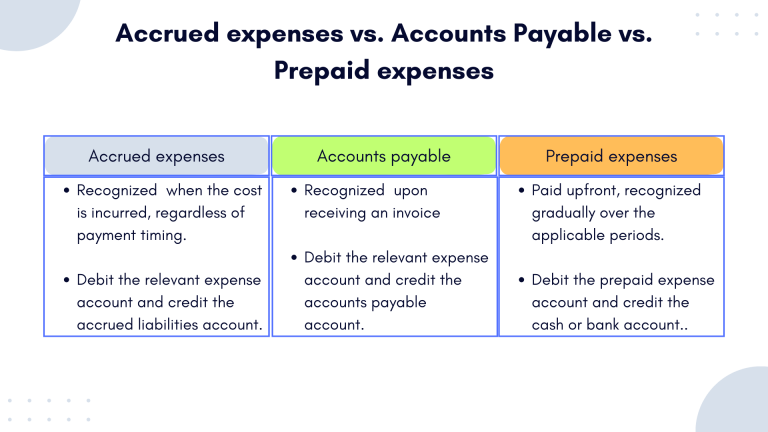

Prepaid Expenses

Prepaid expenses are the opposite of accrued expenses. They represent payments made in advance for goods or services that will be used in the future.

For example, insurance premiums paid in advance are prepaid expenses, not accrued.

Deferred Revenue

Deferred revenue (also known as unearned revenue) represents payments received for goods or services that have not yet been delivered or performed.

This is a liability, but it's not an accrued expense. It reflects an obligation to provide future goods or services.

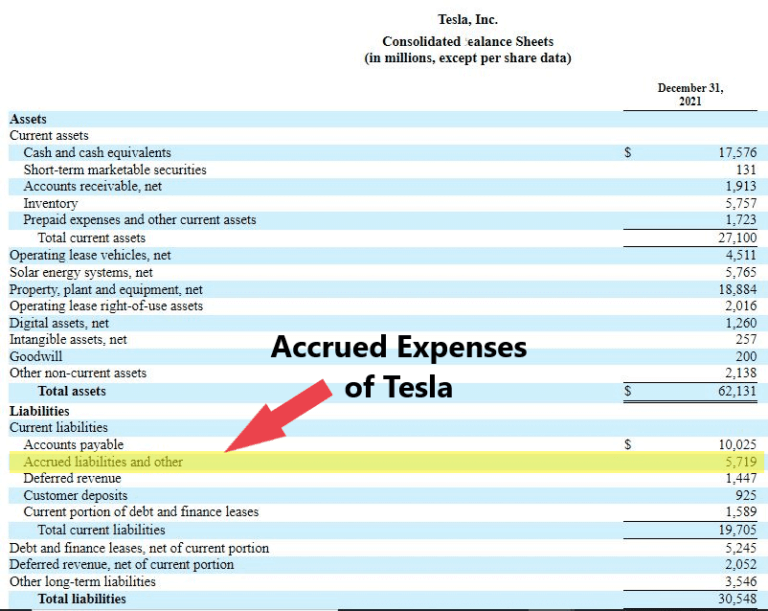

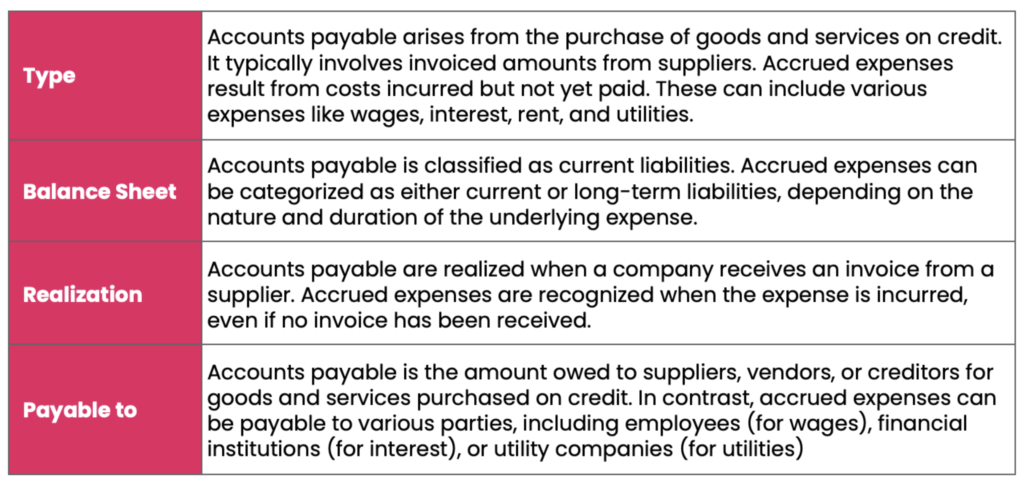

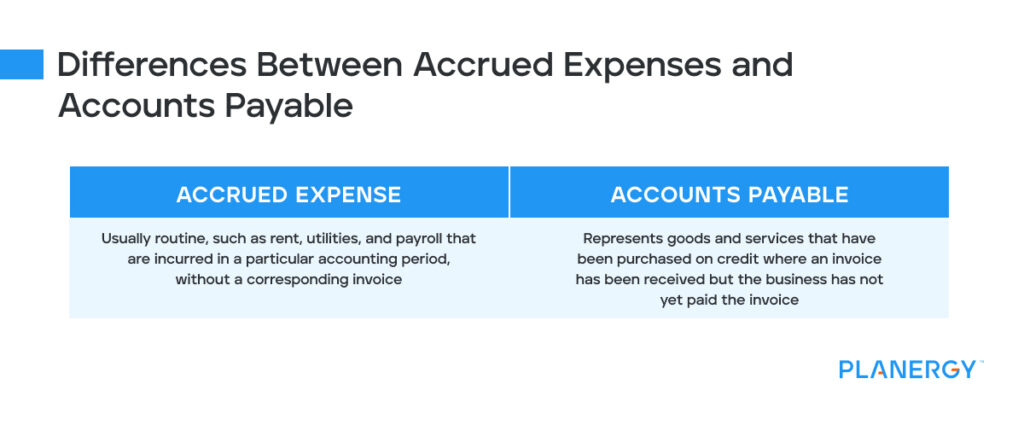

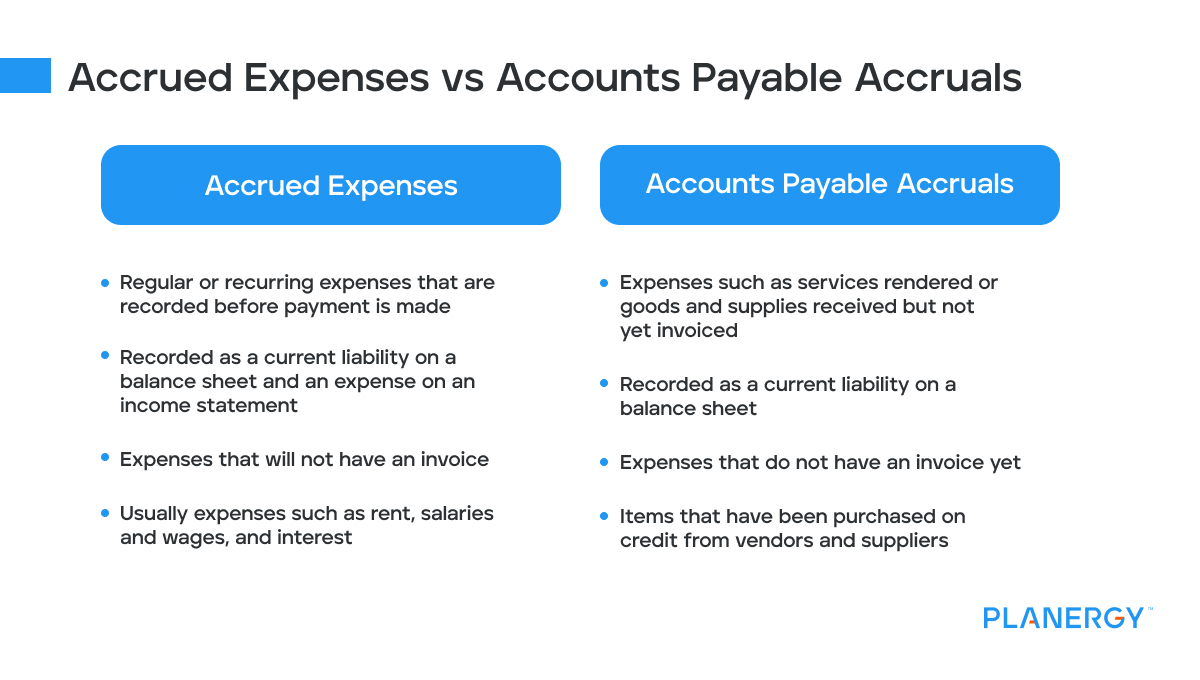

Accounts Payable

While accounts payable represents obligations to suppliers, it's generally not considered an accrued expense *unless* the invoice hasn't been received. If an invoice exists for goods or services already received, it’s categorized as accounts payable.

If the company knows it owes for services provided but hasn't received an invoice, it would be an accrued expense. The crucial difference is the presence of an invoice.

Why Accurate Identification Matters

Correctly identifying and accounting for accrued expenses is crucial for several reasons. It ensures that financial statements accurately reflect a company’s financial position and performance.

Inaccurate reporting can mislead investors, creditors, and other stakeholders, potentially affecting investment decisions or loan terms. Failure to accurately record accrued expenses violates the matching principle under Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), resulting in financial statement errors.

Consequences of Misclassification

Misclassifying accrued expenses can lead to significant financial statement distortions. Understating expenses can inflate profits in the current period, while overstating them can artificially deflate profits.

This can impact key financial ratios, such as the debt-to-equity ratio or profitability ratios, which are used by investors and analysts to evaluate a company’s financial health. Furthermore, misclassification can result in inaccurate tax liabilities.

Next Steps: Ensuring Accuracy

Businesses should implement robust internal controls to ensure accurate identification and recording of accrued expenses. Regularly review expense accounts to identify potential accruals and implement a consistent process for estimating and recording these expenses.

Training accounting staff on the proper identification and treatment of accrued expenses is also essential. Consulting with a qualified accountant or auditor can help businesses ensure compliance with accounting standards and maintain accurate financial records.