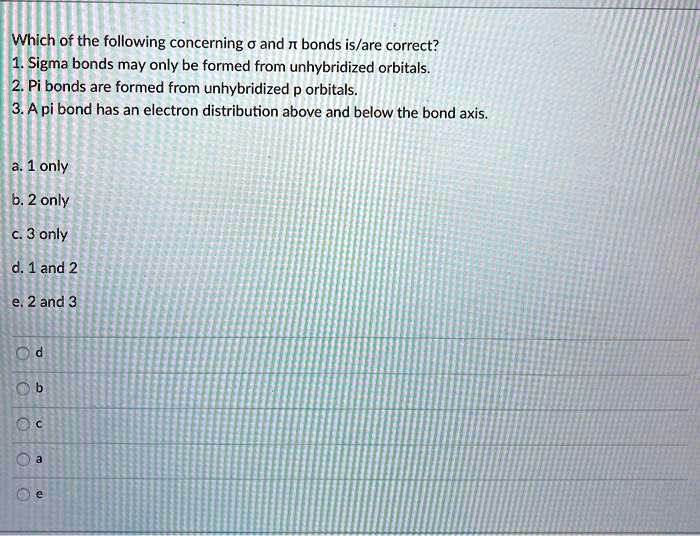

Which Of The Following Are Correct Regarding Bonds

Investors are scrambling to understand the complexities of bond investments amidst fluctuating market conditions. Misinformation abounds, leading to confusion and potential financial missteps; understanding the fundamentals is now crucial.

Bonds, debt securities issued by corporations or governments, can be a cornerstone of a diversified portfolio. However, determining which statements about them are accurate requires careful scrutiny, especially with rising interest rates and economic uncertainty.

Understanding Bond Basics: Fact vs. Fiction

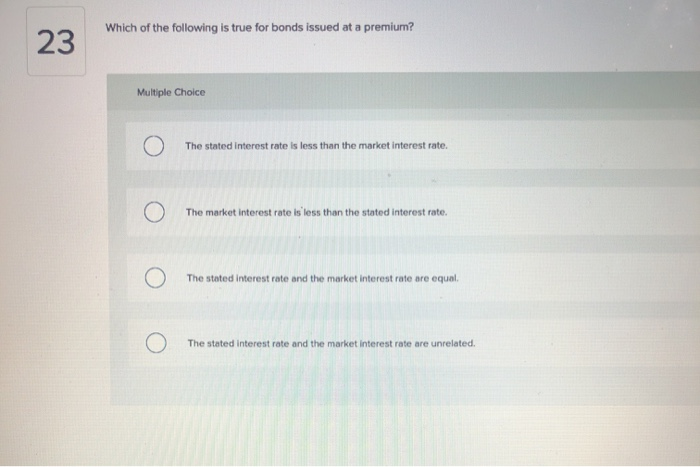

Fact: Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices typically fall, and vice versa, as confirmed by numerous financial analysts.

Fiction: All bonds are risk-free. While government bonds are generally considered safer, corporate bonds carry credit risk, and their prices can fluctuate substantially, says Standard & Poor's report on market volatility.

Key Considerations for Bond Investors

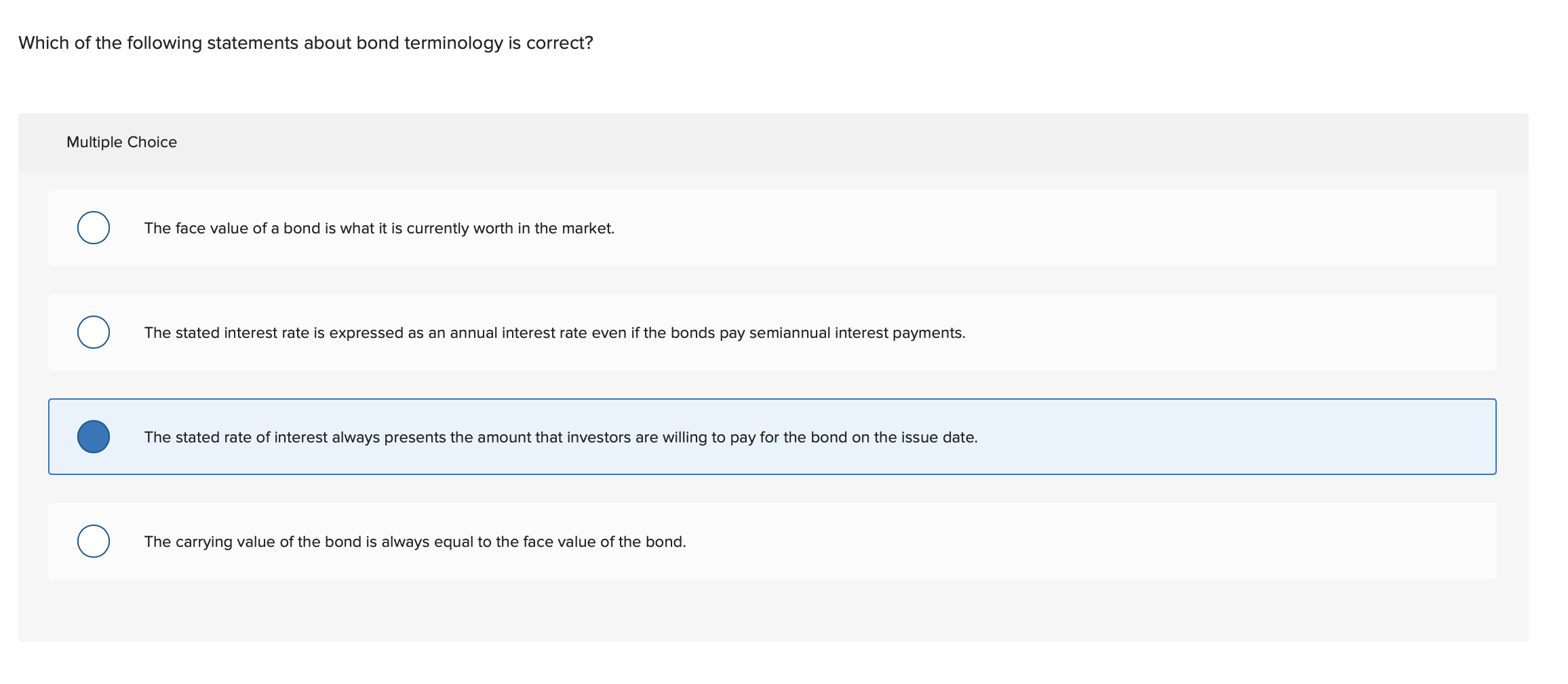

Fact: Bond yields represent the return an investor receives on a bond. Yield to maturity (YTM) considers the bond's current market price, par value, coupon interest rate, and time to maturity.

Fiction: A high coupon rate always equals a good investment. A high coupon rate might reflect a higher risk associated with the issuer or prevailing market conditions, according to a Bloomberg analysis released this week.

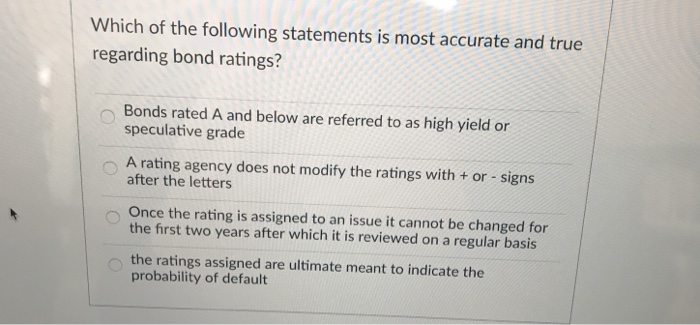

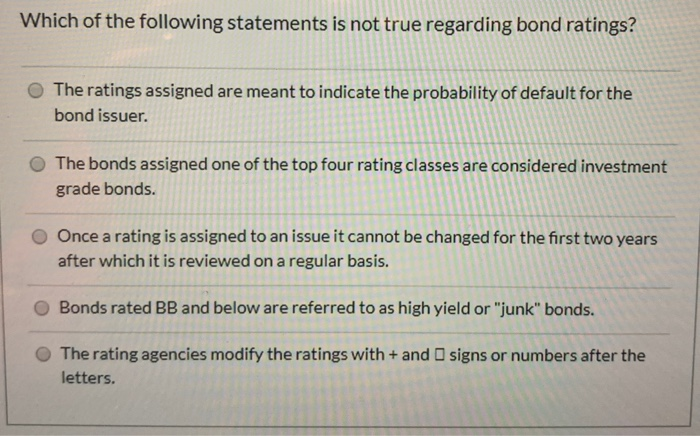

Fact: Bond ratings, issued by agencies like Moody's and Fitch, assess the creditworthiness of bond issuers. Higher ratings generally indicate lower risk of default.

Fiction: Holding a bond to maturity guarantees a profit. While it guarantees receiving the par value at maturity, it doesn't protect against inflation eroding the purchasing power of the returns, warned Janet Yellen, the Secretary of the Treasury, in a recent statement.

Navigating the Bond Market Today

Fact: Diversification is critical in bond investing. Spreading investments across different issuers, maturities, and credit ratings helps mitigate risk, states a white paper published by Vanguard.

Fiction: Individual investors should only buy individual bonds. Bond funds and ETFs offer diversification and professional management, making them accessible options, explained Christine Lagarde, president of the European Central Bank, during a recent economic forum.

Fact: Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation. Their principal adjusts with changes in the Consumer Price Index (CPI).

Fiction: Bond investments are only suitable for retirees. Bonds can play a role in portfolios of all ages, offering stability and income, as emphasized by financial advisors at Goldman Sachs.

The Importance of Due Diligence

Investing in bonds requires careful research and understanding of associated risks. Consulting with a qualified financial advisor is essential to determine if bonds align with your investment goals and risk tolerance.

Always verify information from multiple sources and scrutinize the creditworthiness of bond issuers. Ignoring these steps can lead to significant financial losses.

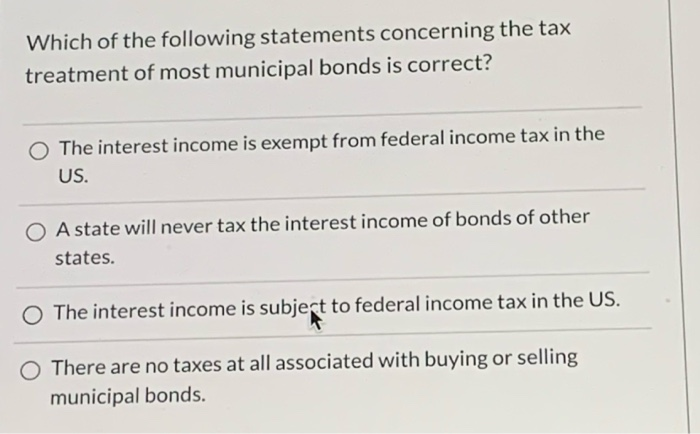

The SEC (Securities and Exchange Commission) provides resources on bond investing, including investor alerts and educational materials. Utilize these to enhance your understanding.

What to Do Next

Monitor economic indicators and interest rate trends closely. These factors significantly impact bond prices and yields. Review your bond portfolio regularly.

Consider your individual financial situation and long-term investment objectives. Reassess your bond allocation to ensure it remains appropriate for your needs. Seek professional advice before making any major investment decisions.

Stay informed about market updates and bond-related news. A well-informed investor is better equipped to navigate the complexities of the bond market and make sound financial choices; this according to recent report from the Federal Reserve.