Which Of The Following Are Signs Of A Market Failure

Economic stability and efficient resource allocation are hallmarks of a thriving society. However, when markets stumble, resources can be misallocated, leading to inefficiencies and societal costs. Recognizing the signs of market failure is crucial for policymakers and citizens alike to understand when intervention may be necessary.

This article explores common indicators of market failure, drawing on economic principles and real-world examples to illustrate these concepts. Understanding these signs is essential for fostering informed discussions about economic policy and promoting a more equitable and efficient economy.

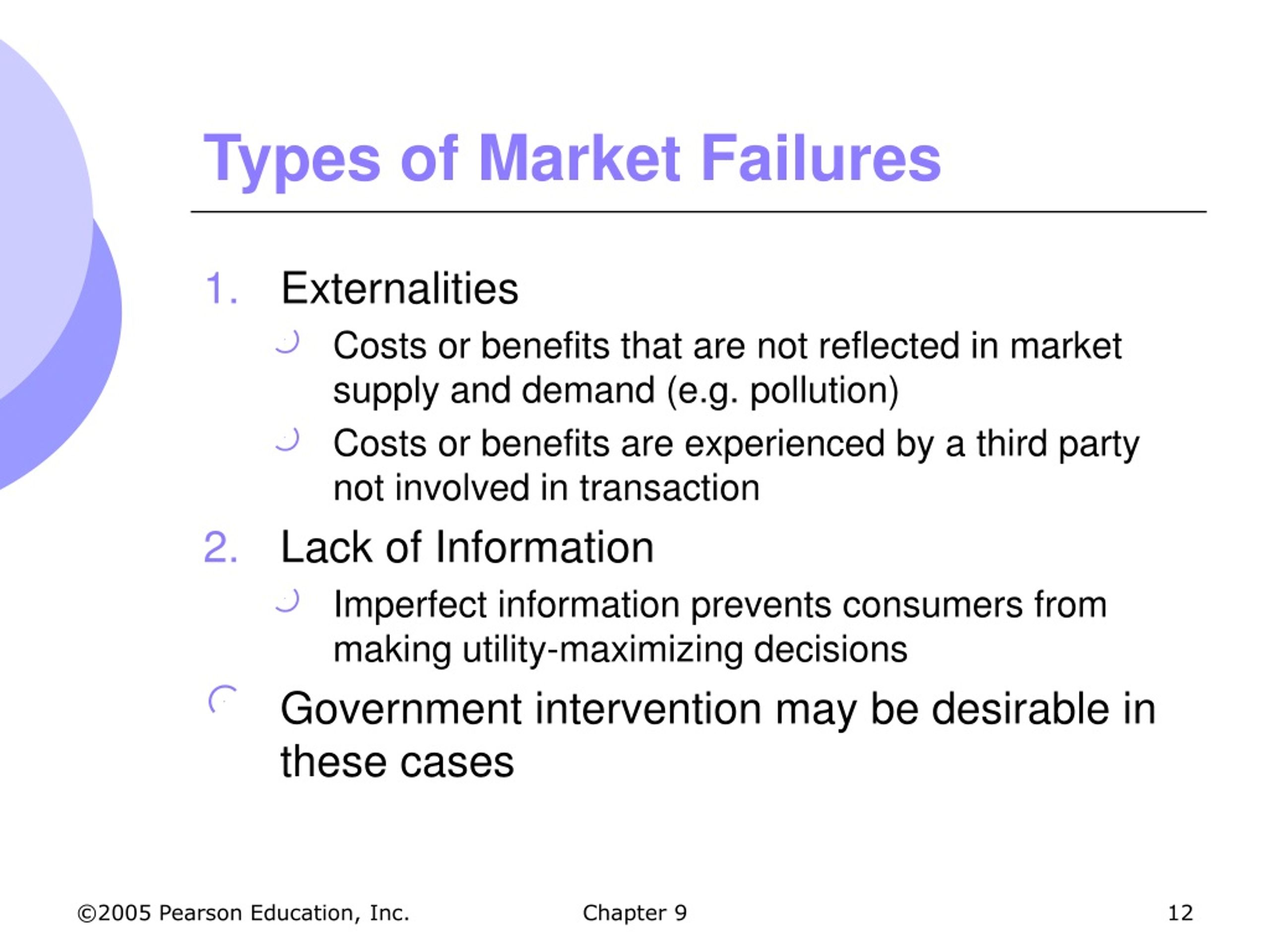

What Exactly is Market Failure?

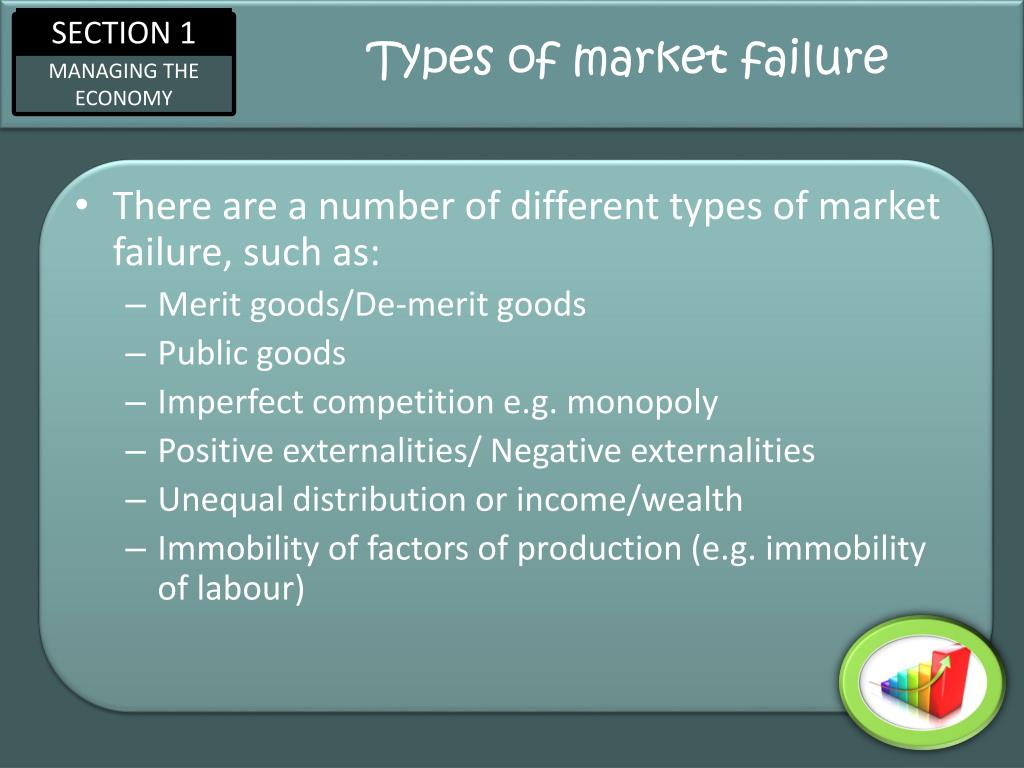

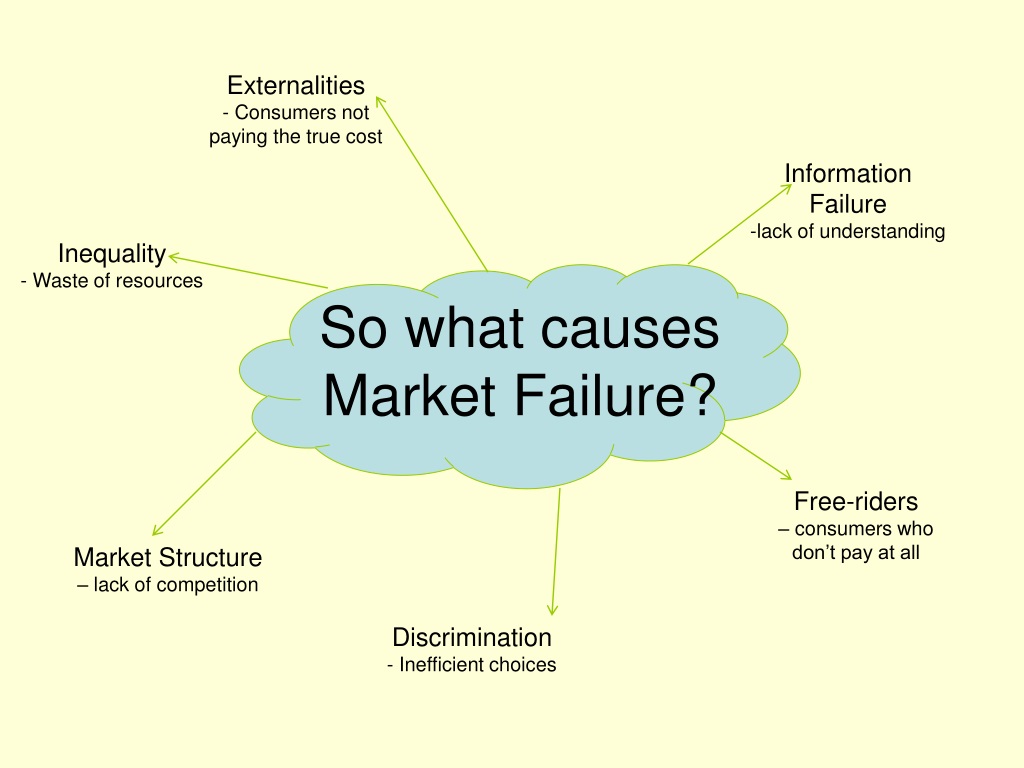

Market failure occurs when the free market fails to allocate resources efficiently, resulting in a situation where total welfare is not maximized. This can happen for various reasons, leading to undesirable outcomes for society.

Several key indicators signal that a market may be failing.

Externalities: The Hidden Costs and Benefits

Externalities are costs or benefits that affect a third party who did not choose to incur that cost or benefit. A classic example is pollution from a factory, which imposes health costs on nearby residents who did not consume the factory's products.

Conversely, a positive externality might be the benefit enjoyed by neighbors of someone who maintains a beautiful garden. Since the market price of the factory's goods doesn't reflect the pollution cost, and the gardener isn't compensated for the neighborhood benefit, the market fails to allocate resources efficiently.

"When externalities are present, the price mechanism alone cannot ensure optimal resource allocation," explains Dr. Eleanor Vance, an economics professor at the University of City. "Intervention, such as taxes or subsidies, may be needed to correct the market."

Public Goods: The Challenge of Non-Excludability

Public goods are non-excludable, meaning it's impossible to prevent people from consuming the good even if they don't pay for it, and non-rivalrous, meaning one person's consumption doesn't diminish the good available to others. National defense is a primary example.

Because individuals can benefit from the good without paying (the free-rider problem), private markets often under-provide public goods. Government intervention, through taxation and direct provision, is typically necessary to ensure an adequate supply.

Information Asymmetry: When Knowledge is Power

Information asymmetry exists when one party in a transaction has more information than the other. This can lead to adverse selection, where the less informed party is more likely to engage in transactions that are disadvantageous to them.

The used car market is a common example. Sellers typically know more about the car's condition than buyers, leading to a situation where only lower-quality cars are offered for sale at lower prices, driving away sellers of high-quality cars. This reduces overall market efficiency.

Monopolies and Market Power: The Control of Supply

A monopoly occurs when a single firm controls the entire market for a particular good or service. This allows the monopolist to restrict output and charge higher prices than would prevail in a competitive market.

Similarly, firms with significant market power can influence prices and reduce consumer welfare. Anti-trust laws and regulations are often used to prevent monopolies and promote competition.

Inequality: A Failure to Distribute Fairly

Extreme inequality in income and wealth distribution can also be considered a form of market failure. While markets may efficiently allocate resources based on purchasing power, they don't necessarily guarantee a fair distribution of outcomes.

This can lead to social unrest and undermine the long-term stability of the economy. Government policies, such as progressive taxation and social safety nets, are often implemented to address inequality.

Real-World Examples and Their Impact

The 2008 financial crisis provides a stark example of market failure. Excessive risk-taking by financial institutions, coupled with inadequate regulation, led to a collapse of the housing market and a global recession.

Another example is the ongoing debate surrounding climate change. The failure of markets to fully account for the environmental costs of carbon emissions has led to a build-up of greenhouse gases and potential catastrophic consequences. Carbon taxes and other policies aim to correct this market failure.

The opioid crisis also demonstrates how information asymmetry and market incentives can lead to disastrous outcomes. Aggressive marketing of opioid painkillers, combined with a lack of awareness about their addictive potential, contributed to widespread addiction and overdose deaths. This is why the CDC issued the new warning.

Addressing Market Failure: The Role of Intervention

Recognizing the signs of market failure is just the first step. The appropriate policy response depends on the specific circumstances.

Options include regulation, taxation, subsidies, public provision of goods and services, and promoting competition. Each approach has its own advantages and disadvantages, and careful consideration is needed to ensure that intervention is effective and doesn't create unintended consequences.

Ultimately, understanding the indicators of market failure is crucial for building a more prosperous and equitable society. By recognizing these signs and implementing appropriate policies, we can strive for a world where resources are allocated efficiently, and everyone has the opportunity to thrive.

:max_bytes(150000):strip_icc()/Market-Failure-V3-ab96ad16afee413ea84ce9c9fe30038d.jpg)