Which Of The Following Assets Is Not Depreciated

Imagine a bustling marketplace, vendors hawking their wares, each item slowly losing its luster with every passing day. A shiny new cart becomes weathered, a set of tools blunted with use, even the very scales begin to show their age. But amidst this scene of inevitable decline, one thing retains its intrinsic value, unyielding to the passage of time – the very land upon which the marketplace stands.

This brings us to a crucial concept in accounting and finance: depreciation. While most tangible assets are subject to depreciation, the one asset that typically defies this rule is Land. This article delves into the fascinating world of depreciation, explaining why land is the exception and what makes this distinction so important.

Understanding Depreciation

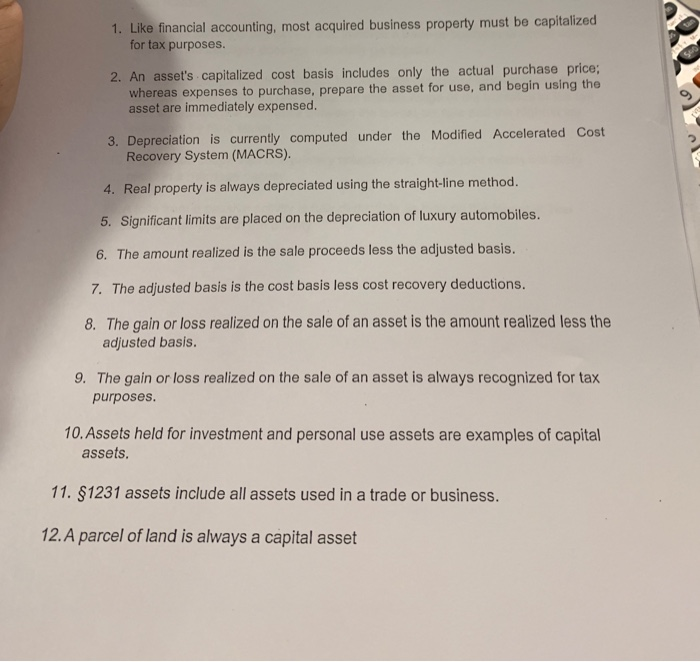

Depreciation, in simple terms, is the accounting method of allocating the cost of a tangible asset over its useful life. It reflects the gradual decline in the value of an asset due to wear and tear, obsolescence, or usage. Think of a delivery truck; its engine wears down, its tires lose tread, and eventually, it becomes less efficient.

Accountants meticulously track this depreciation through various methods. Straight-line depreciation evenly distributes the cost over the asset's life. Accelerated depreciation methods, like double-declining balance, front-load the depreciation, recognizing greater losses earlier. This is particularly useful for assets that rapidly lose value in their initial years.

The purpose of depreciation is twofold. First, it provides a more accurate picture of a company's profitability by matching the cost of an asset to the revenue it generates over time. Second, it impacts a company's tax liability, as depreciation expense is tax-deductible. According to the Internal Revenue Service (IRS), "Depreciation is a deduction you can take for the wear and tear, deterioration, or obsolescence of property."

The Unique Case of Land

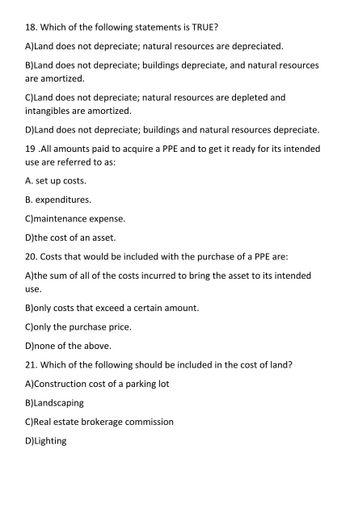

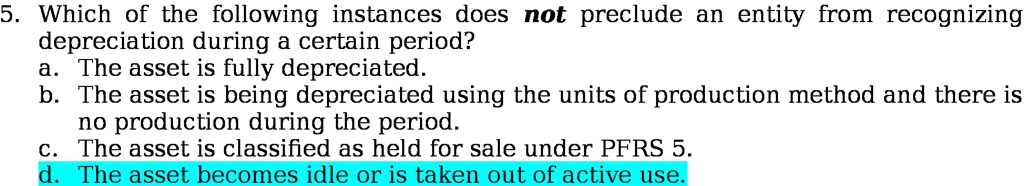

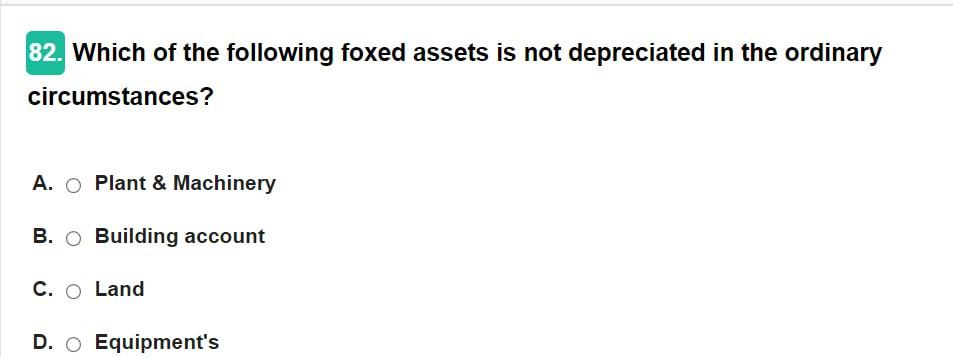

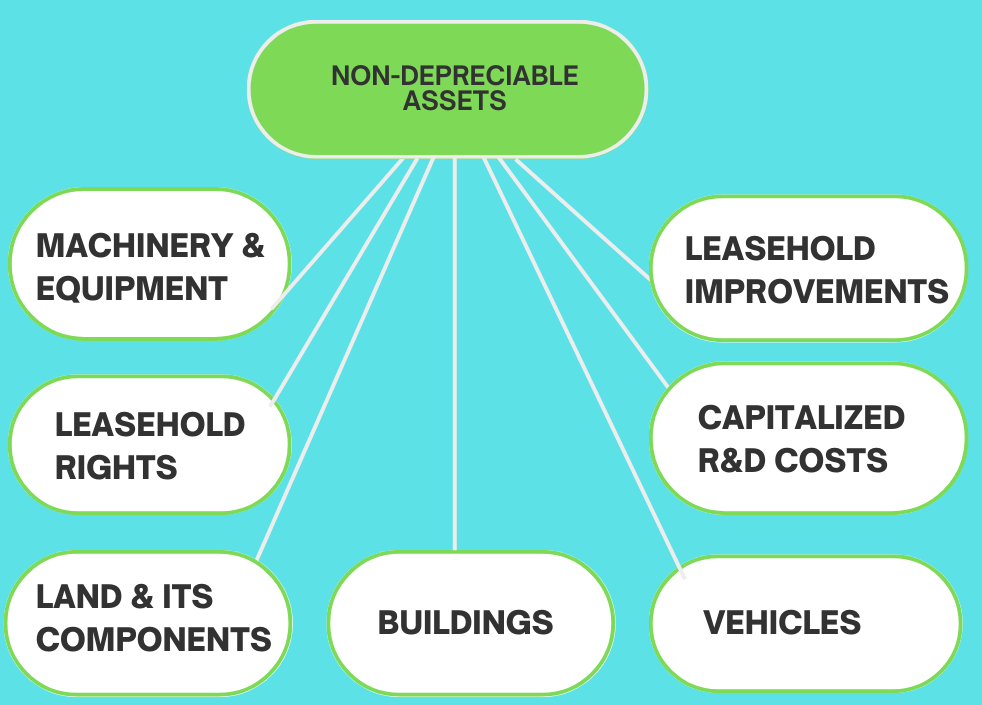

So why is land different? The key lies in its nature. Land is considered to have an indefinite useful life. Unlike buildings, machinery, or equipment, land doesn't typically wear out or become obsolete through normal use.

While land can be subject to environmental changes or alterations, these factors usually affect its market value, not necessarily its inherent usefulness. A parcel of land can still be used for its intended purpose for generations to come.

There are exceptions, of course. If land is used for extracting natural resources, such as minerals or timber, the depletion of those resources is accounted for separately from depreciation. This depletion represents the consumption of a natural resource and is treated differently for accounting purposes.

Moreover, land improvements, such as landscaping, fences, or paving, are *not* considered part of the land itself and are subject to depreciation. These improvements have a finite lifespan and will eventually need replacement or repair.

The Importance of the Distinction

The treatment of land as a non-depreciable asset has significant implications for financial reporting. It affects a company's balance sheet, income statement, and cash flow statement. Misclassifying land could lead to inaccurate financial reporting and misinformed investment decisions.

A company holding a significant amount of land will show a higher asset value on its balance sheet than a company with similar operations that leases land. This difference can impact financial ratios, such as return on assets, which are used by investors to evaluate a company's performance.

Furthermore, understanding the non-depreciable nature of land is crucial for property tax assessments. While the value of land may fluctuate due to market conditions, it is not subject to a gradual reduction in value due to depreciation, unlike buildings and other improvements on the land.

Real-World Examples

Consider a farmer who owns hundreds of acres of farmland. The tractors, barns, and irrigation systems used on the farm are all depreciable assets. However, the farmland itself, the underlying soil, is not. The farmer may improve the land with fertilizers or drainage systems, but those improvements are depreciable, while the land remains as a constant valuable resource.

Now, think of a real estate developer who purchases a plot of land to build a shopping mall. The buildings constructed on the land, the parking lots, and the landscaping are all subject to depreciation. The land itself, the foundation upon which the entire development sits, retains its inherent value and is not depreciated.

Another example is a mining company. The company may purchase land to extract minerals. The cost of the mineral deposits will be subject to depletion. However, the residual value of the land after the minerals are extracted, if any, is not depreciated. It is assessed based on its potential for future use, such as for agriculture or development.

Conclusion

In the complex world of finance, understanding the nuances of asset depreciation is essential. While most tangible assets are destined to lose value over time, land stands apart as a symbol of enduring value. Its indefinite useful life grants it a unique status, impacting financial reporting and investment decisions in profound ways. This distinction highlights the importance of careful accounting practices and a deep understanding of the inherent characteristics of different asset types.

As we navigate the ever-changing landscape of business and investment, let us remember the lesson of the land: Some things, like a solid foundation, retain their worth, reminding us to focus on intrinsic value and long-term stability.