Which Of The Following Assets Is The Most Liquid

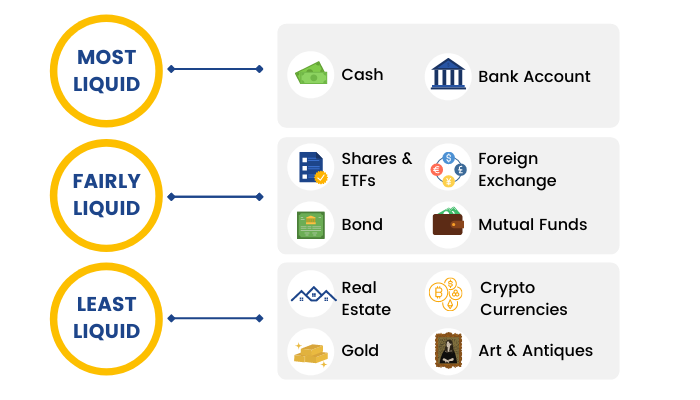

In an era defined by unprecedented economic volatility and rapid technological advancements, the concept of liquidity has moved from a niche financial term to a mainstream concern. Understanding which assets can be most quickly and efficiently converted to cash is no longer solely the domain of Wall Street traders; it's a critical consideration for individuals, small businesses, and large corporations alike.

Navigating this intricate landscape requires a deep understanding of various asset classes, market dynamics, and the subtle factors that can influence liquidity premiums. Identifying the most liquid asset is not a simple, static exercise; it's a dynamic assessment dependent on prevailing economic conditions, market sentiment, and specific circumstances.

The query of which asset boasts supreme liquidity is deceptively complex. This article delves into the nuances of asset liquidity, comparing and contrasting various assets – from cash and short-term government bonds to stocks and real estate – to determine which reigns supreme under different conditions.

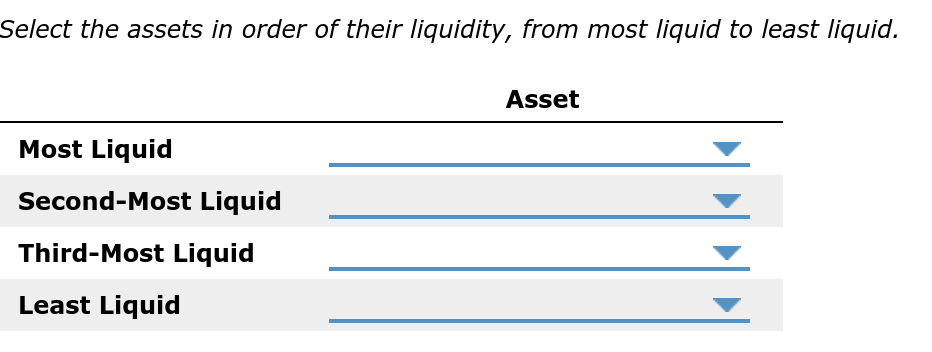

Defining Liquidity: The Essence of Convertibility

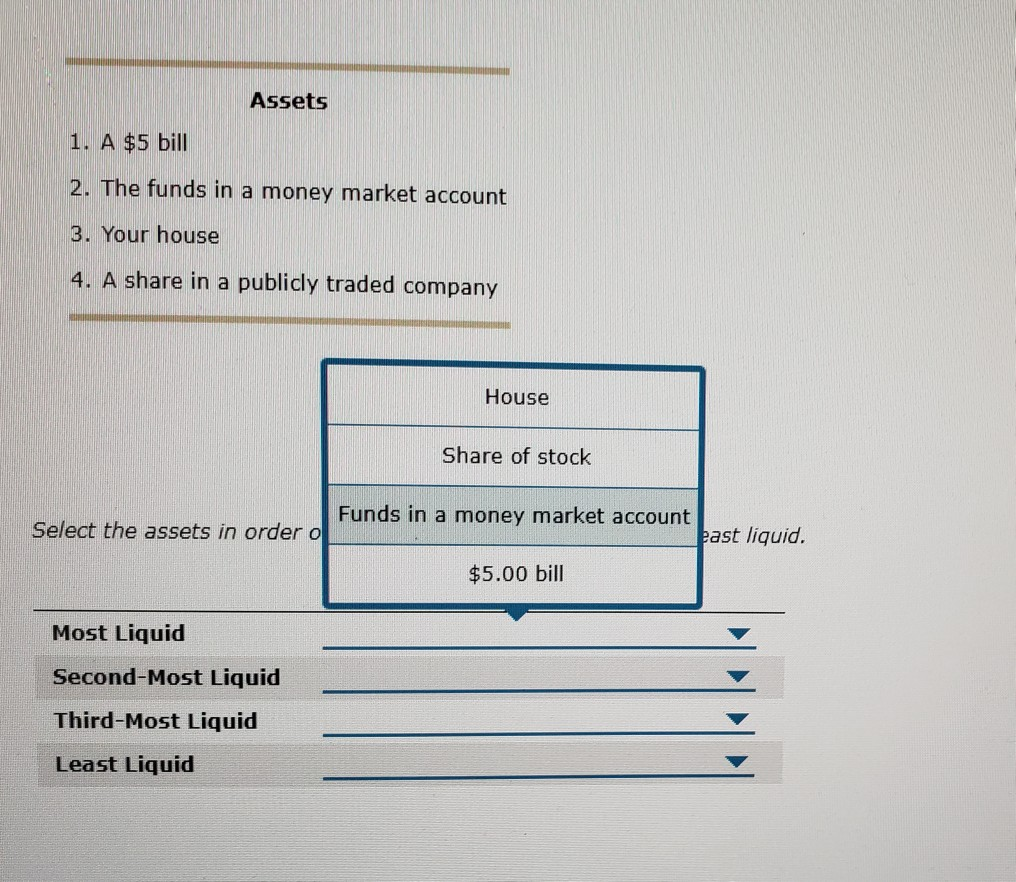

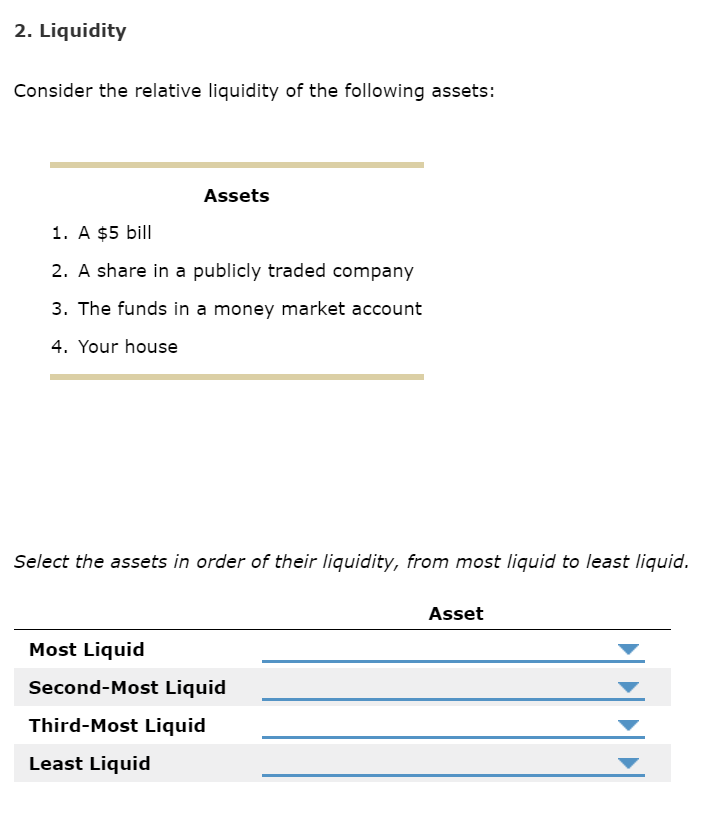

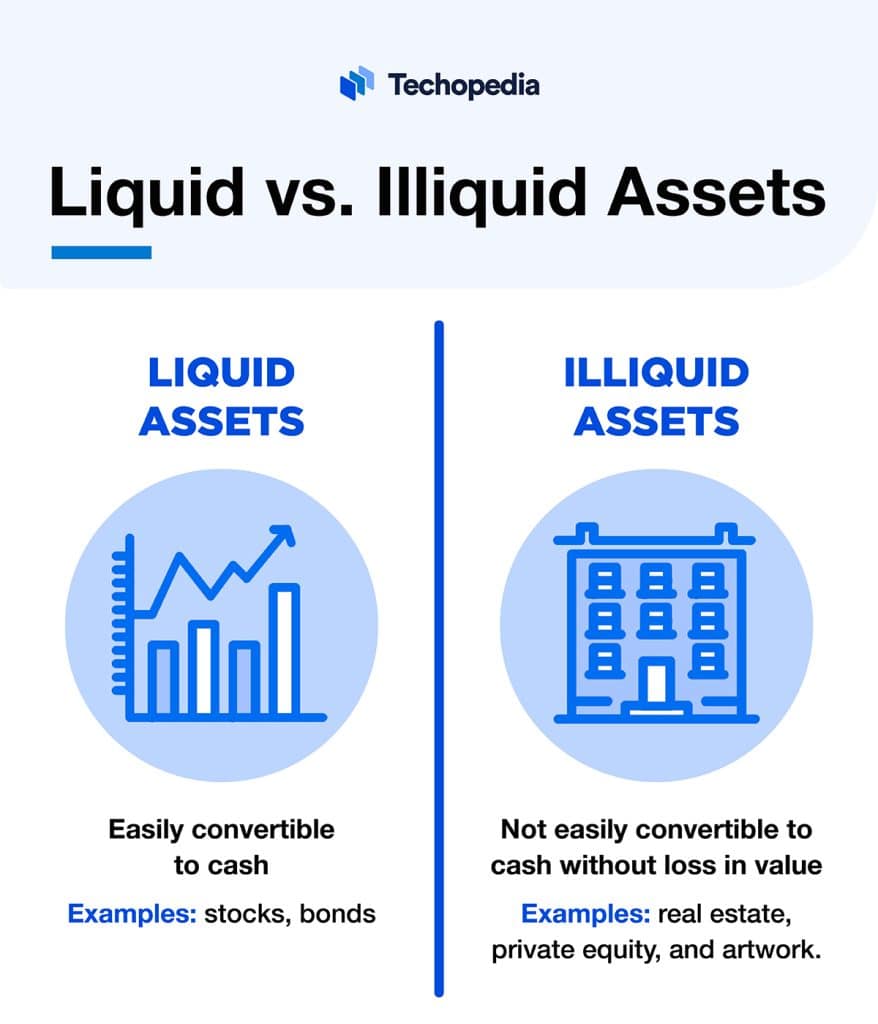

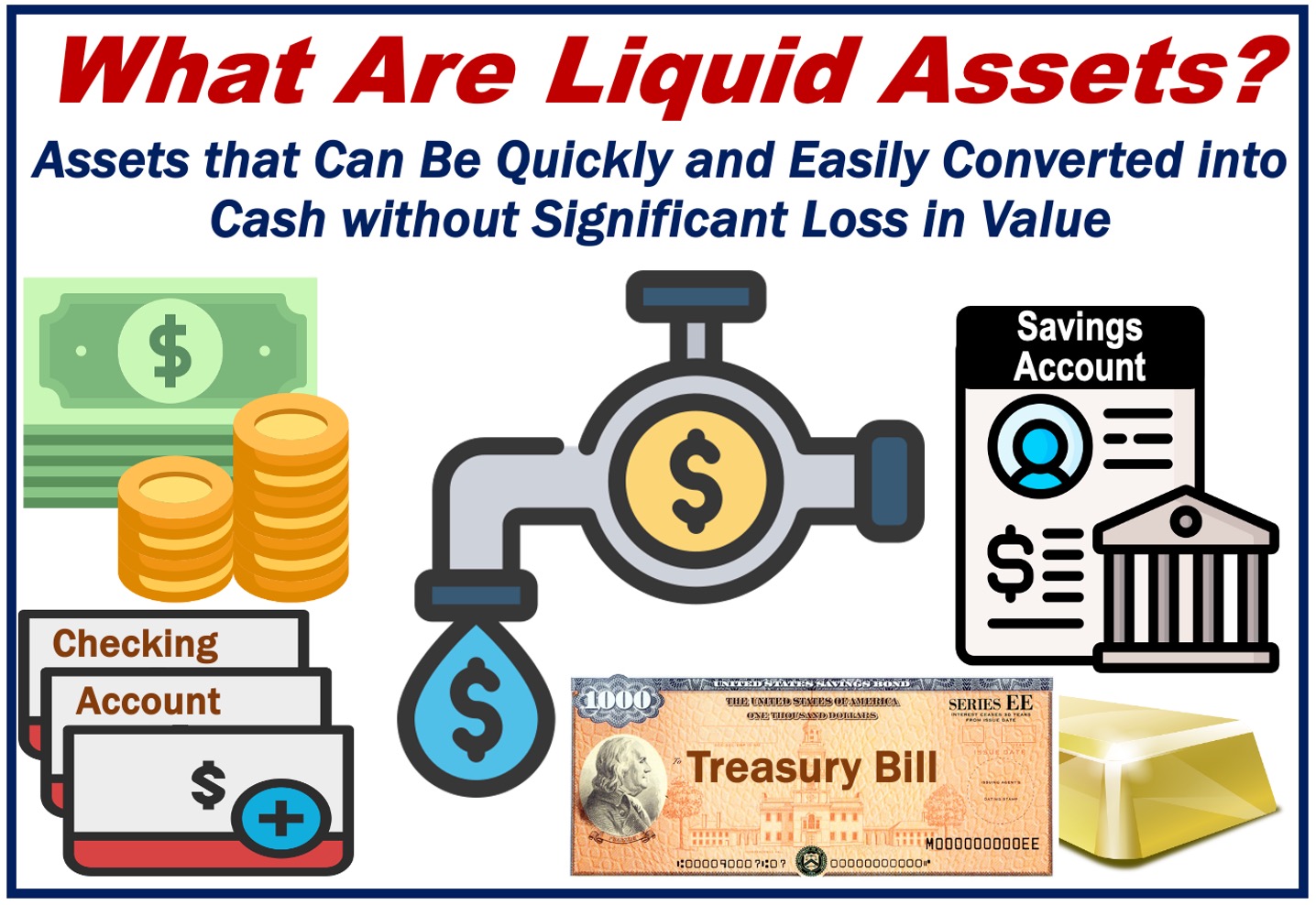

At its core, liquidity refers to the ease with which an asset can be bought or sold in the market without significantly affecting its price. A highly liquid asset can be converted to cash quickly and with minimal loss of value.

Several factors determine an asset's liquidity, including the depth of the market, the presence of willing buyers and sellers, and the transaction costs involved.

Cash: The Undisputed King?

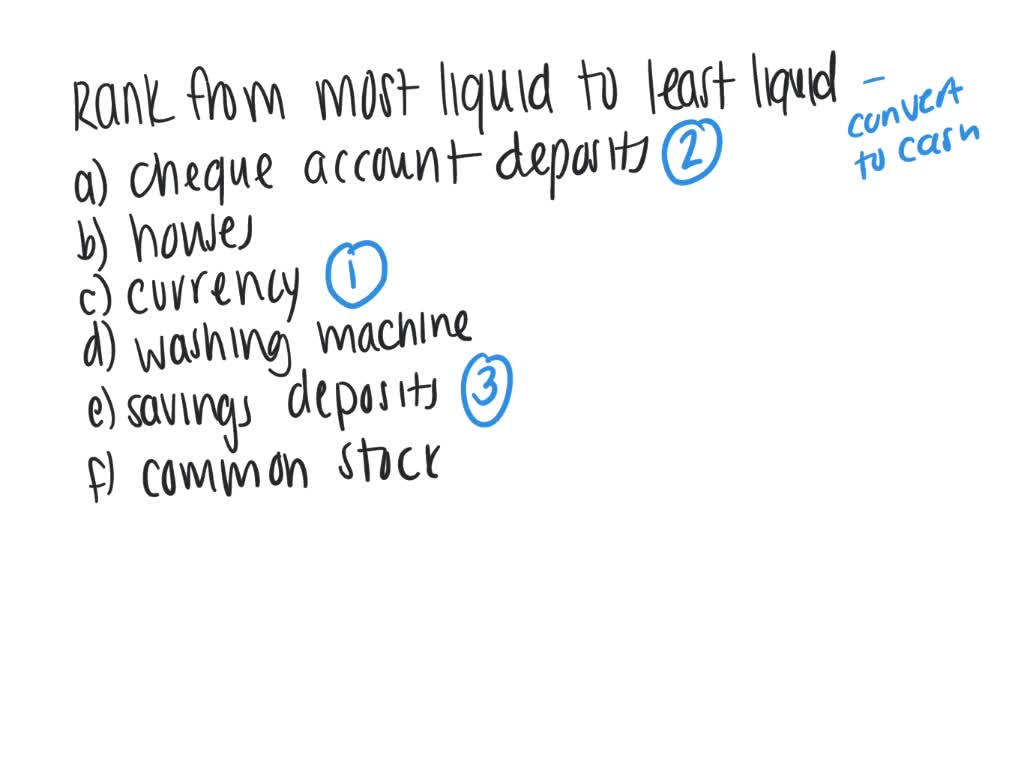

Unquestionably, cash is often considered the most liquid asset. Currency in its physical form, or funds held in readily accessible checking or savings accounts, represents immediate purchasing power.

Its inherent liquidity stems from its universal acceptance as a medium of exchange. Transaction costs associated with using cash are typically negligible.

Short-Term Government Bonds: A Close Contender

Short-term government bonds, particularly Treasury Bills, are frequently touted as highly liquid assets, nearing the liquidity of cash. These bonds are backed by the full faith and credit of the government, making them virtually risk-free.

Their short maturity terms mean they can be easily sold in the secondary market without significant price fluctuations. The market for U.S. Treasury Bills is exceptionally deep and active, ensuring quick execution of trades.

Stocks: Liquidity with Caveats

Stocks, particularly those of large-cap companies traded on major exchanges like the New York Stock Exchange (NYSE) or NASDAQ, offer a degree of liquidity. Large trading volumes and numerous market participants facilitate relatively quick buying and selling.

However, stock prices can be volatile, and selling a large volume of shares quickly can impact the price, diminishing liquidity. Furthermore, brokerage fees and capital gains taxes erode the net proceeds.

Real Estate: An Illiquid Giant

In stark contrast to the aforementioned assets, real estate is generally considered highly illiquid. Selling a property typically involves a lengthy and complex process, including listing the property, finding a buyer, negotiating terms, and completing the legal paperwork.

This process can take months, or even years, depending on market conditions and the specific property. Transaction costs, including realtor commissions, legal fees, and transfer taxes, can be substantial.

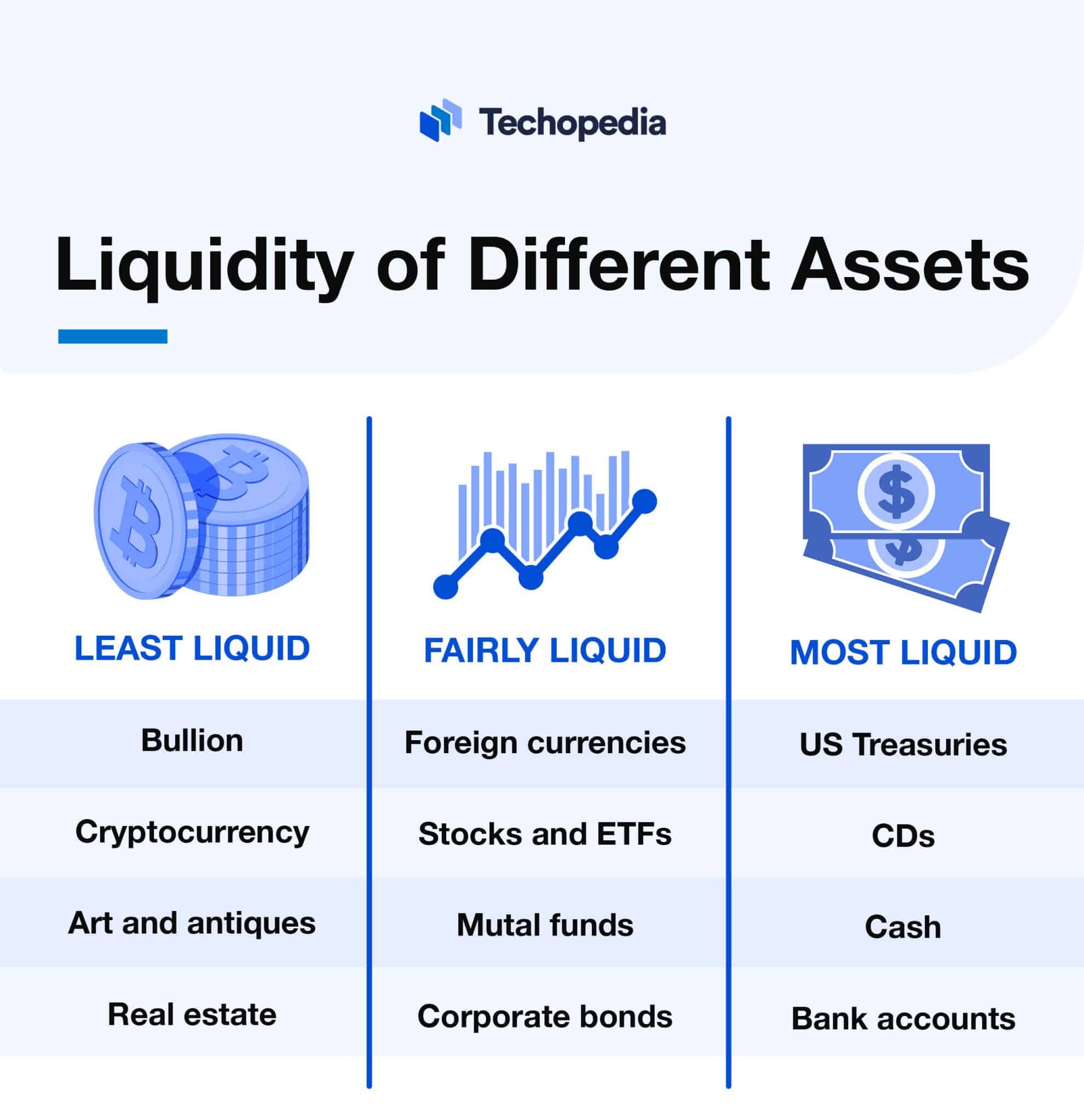

Other Assets: A Spectrum of Liquidity

Various other assets fall somewhere along the liquidity spectrum. Commodities, such as gold and silver, can be relatively liquid, especially when traded on major exchanges.

Cryptocurrencies, while often touted for their potential, exhibit varying degrees of liquidity depending on the specific coin and the exchange on which it is traded. Collectibles, art, and certain types of alternative investments are generally considered illiquid due to their specialized markets and the difficulty in finding willing buyers quickly.

The Role of Market Conditions

The liquidity of an asset is not static; it fluctuates with market conditions. During periods of economic uncertainty or financial crisis, even traditionally liquid assets can become less so.

For example, the 2008 financial crisis saw a significant decline in the liquidity of many financial instruments, including some mortgage-backed securities that were previously considered relatively liquid.

Similarly, during periods of high volatility, the bid-ask spreads on stocks tend to widen, making it more costly to execute trades quickly.

Conclusion: Context is Key

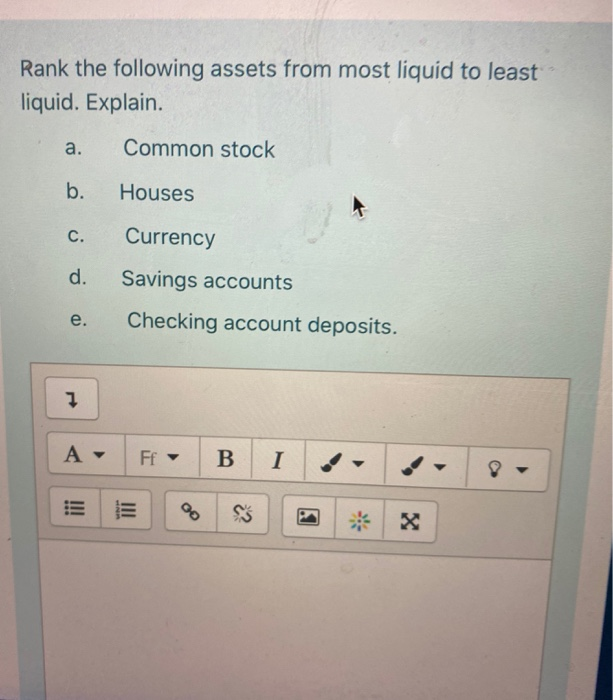

While cash is generally considered the most liquid asset due to its immediate purchasing power, short-term government bonds, particularly Treasury Bills, offer a close second. Stocks can offer liquidity under normal market conditions, while real estate remains inherently illiquid.

Ultimately, determining the most liquid asset is not a definitive answer. The optimal choice depends on individual circumstances, risk tolerance, and the prevailing economic environment.

Understanding the nuances of asset liquidity is crucial for making informed financial decisions and managing risk effectively. As financial markets continue to evolve, the importance of liquidity will only continue to grow, underscoring the need for investors to stay informed and adapt their strategies accordingly.