Which Of The Following Best Represents Fiat Money

The seemingly simple question of what best represents fiat money has become a focal point in ongoing debates about the nature of modern currency, its value, and its stability. From government-issued banknotes to digital representations of national currencies, the definition is more nuanced than it appears, impacting everything from personal finance to global economic policy. The discussion highlights the critical understanding of the foundation upon which our monetary system rests.

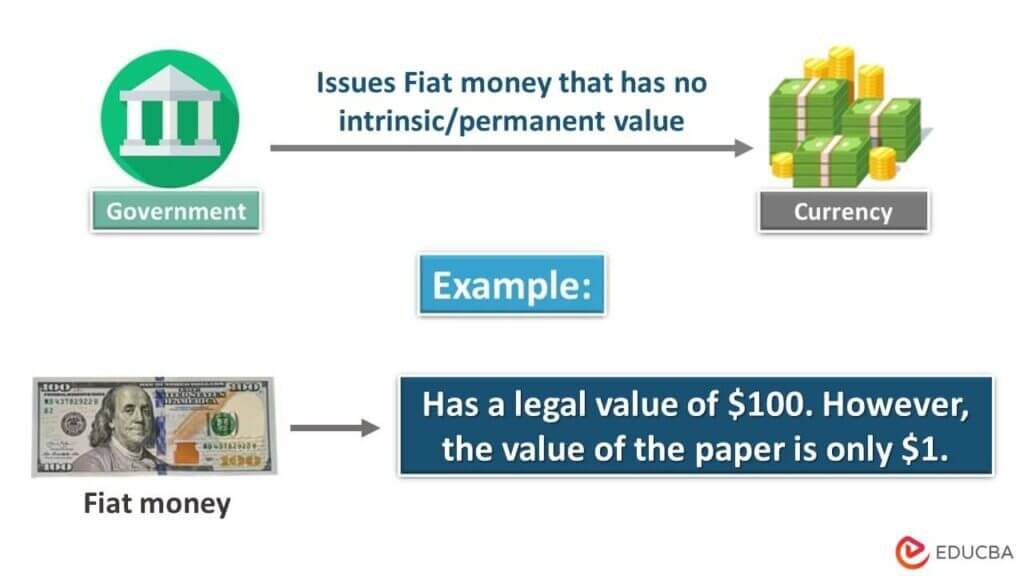

At its core, this question touches upon the very essence of fiat money: its value is not derived from intrinsic worth or backed by a physical commodity, but rather by government decree and the public’s trust in the issuing authority. Understanding this distinction is essential for comprehending the complexities of modern finance and the potential risks and rewards associated with different forms of currency.

What is Fiat Money?

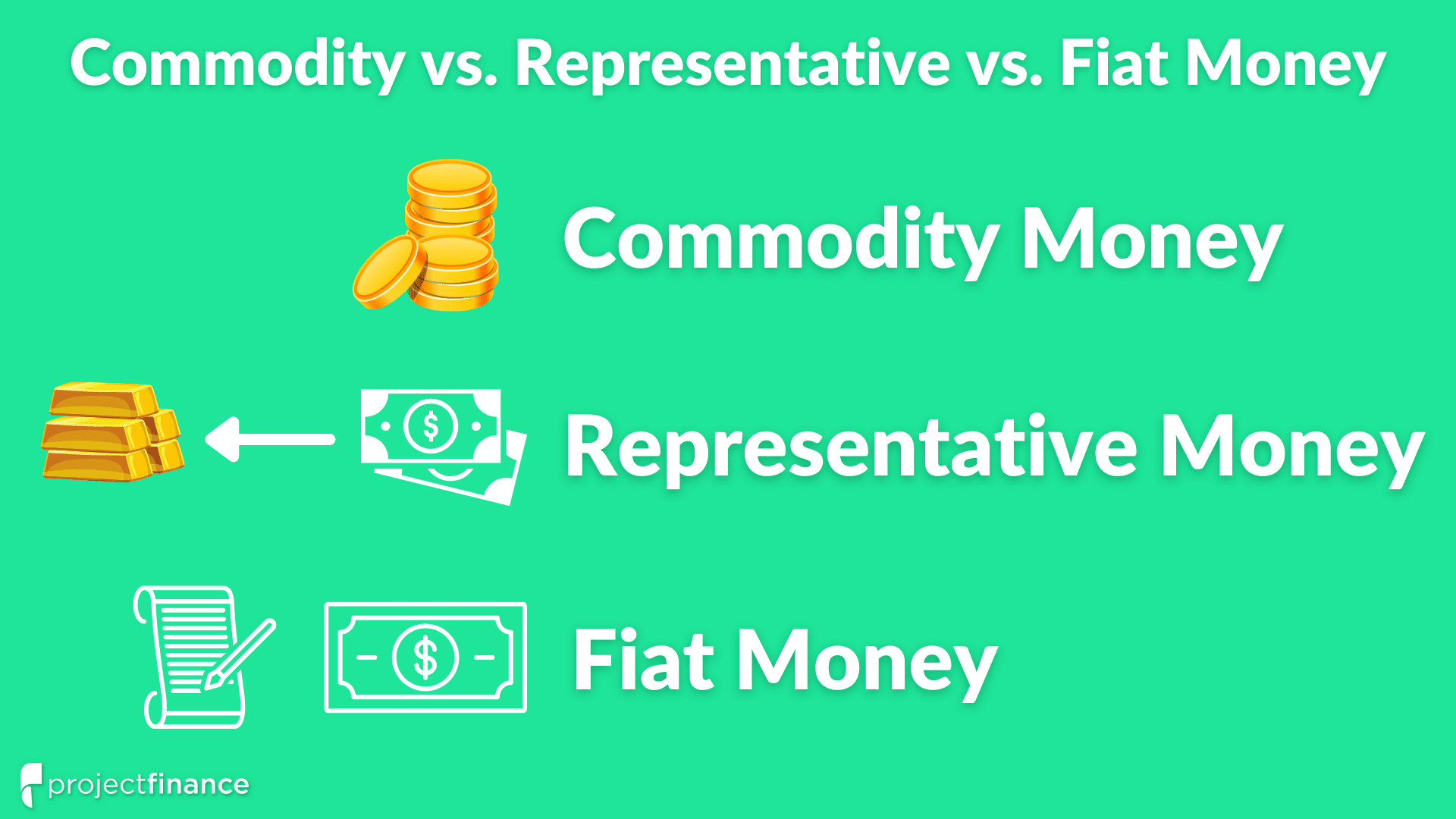

The term "fiat" comes from Latin, meaning "let it be done." This implies that fiat money is valuable simply because the government declares it so, and people accept it as a medium of exchange. Unlike commodity-backed currencies, such as gold or silver certificates, fiat money has no inherent value.

The value of fiat money is maintained through the interaction of supply and demand, and the stability of the issuing government. Central banks, such as the Federal Reserve in the United States or the European Central Bank in the Eurozone, play a crucial role in managing the money supply and maintaining its value.

Key Characteristics of Fiat Money

Several key features distinguish fiat money from other forms of currency:

Lack of Intrinsic Value

This is the defining characteristic. Fiat money isn't valuable because of the material it's made from.

Government Backing

The government declares it legal tender, meaning it must be accepted for payment of debts, both public and private.

Controlled Supply

Central banks manage the supply of fiat money to control inflation and stimulate economic growth.

Examples of Fiat Money

The most common examples of fiat money include:

- The U.S. Dollar

- The Euro

- The Japanese Yen

- The British Pound

All of these currencies are not backed by any physical commodity and derive their value from government decree and public trust.

The Debate: Which Best Represents Fiat Money?

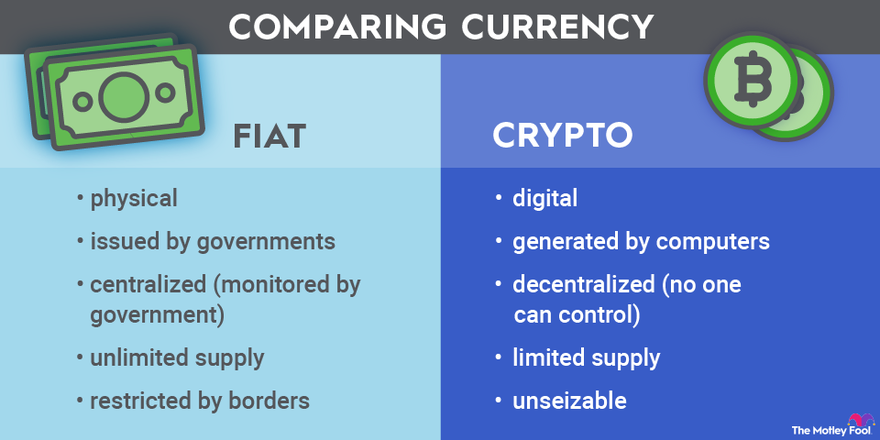

While the above currencies are clear examples, the question of which *best* represents fiat money often arises in discussions about cryptocurrencies and digital currencies. Some argue that certain cryptocurrencies, particularly those not pegged to a traditional asset, share characteristics with fiat money.

However, there are also critical differences. Most cryptocurrencies are decentralized, meaning they are not controlled by a central authority like a government or central bank.

This lack of central control is a key distinction, as the government backing and controlled supply are fundamental to the traditional definition of fiat money.

The Significance of Government Backing

The unwavering faith in the government's commitment to maintain the currency's stability is crucial. This trust allows for the seamless operation of economic activities and maintains the value of fiat money.

Without this trust, the value of fiat money can quickly erode, leading to hyperinflation and economic instability, as seen in historical examples such as Zimbabwe and Venezuela.

The Role of Central Banks

Central banks play a key role in controlling inflation and guiding economic policies. They achieve this by adjusting interest rates, managing money supply, and ensuring the stability of the banking system.

These actions affect the overall economy and the value of fiat money.

Potential Impact and Future Considerations

The ongoing debate surrounding the definition and representation of fiat money has significant implications for the future of finance.

As digital currencies and blockchain technology continue to evolve, the lines between traditional fiat money and decentralized digital assets may become increasingly blurred. This could lead to new challenges and opportunities for governments, central banks, and individuals.

Understanding the characteristics and limitations of fiat money is crucial for navigating the evolving financial landscape and making informed decisions about investments and economic policy. The question of what best represents fiat money is not merely an academic exercise; it is a fundamental inquiry into the nature of value and trust in the modern world.

:max_bytes(150000):strip_icc()/Term-f-fiat-money_Final-953bce87486c4f88b5e47de741268c74.png)

![Which Of The Following Best Represents Fiat Money [Class 12 Economics] What is Intrinsic Value and Fiat money - teachoo](https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/ded9211f-b6eb-4747-91a2-3f6769baa886/concept-of-fiat-money---teachoo.jpg)