Which Of The Following Is A Measure Of Liquidity

For individuals and businesses alike, understanding financial health is paramount. A key component of this understanding lies in assessing liquidity, the ability to meet short-term obligations. But how exactly is liquidity measured?

The quest to determine the best measure of liquidity involves considering various financial ratios. These ratios offer insights into a company’s or individual’s capacity to convert assets into cash quickly and efficiently. This article explores several common liquidity measures and their significance in financial analysis.

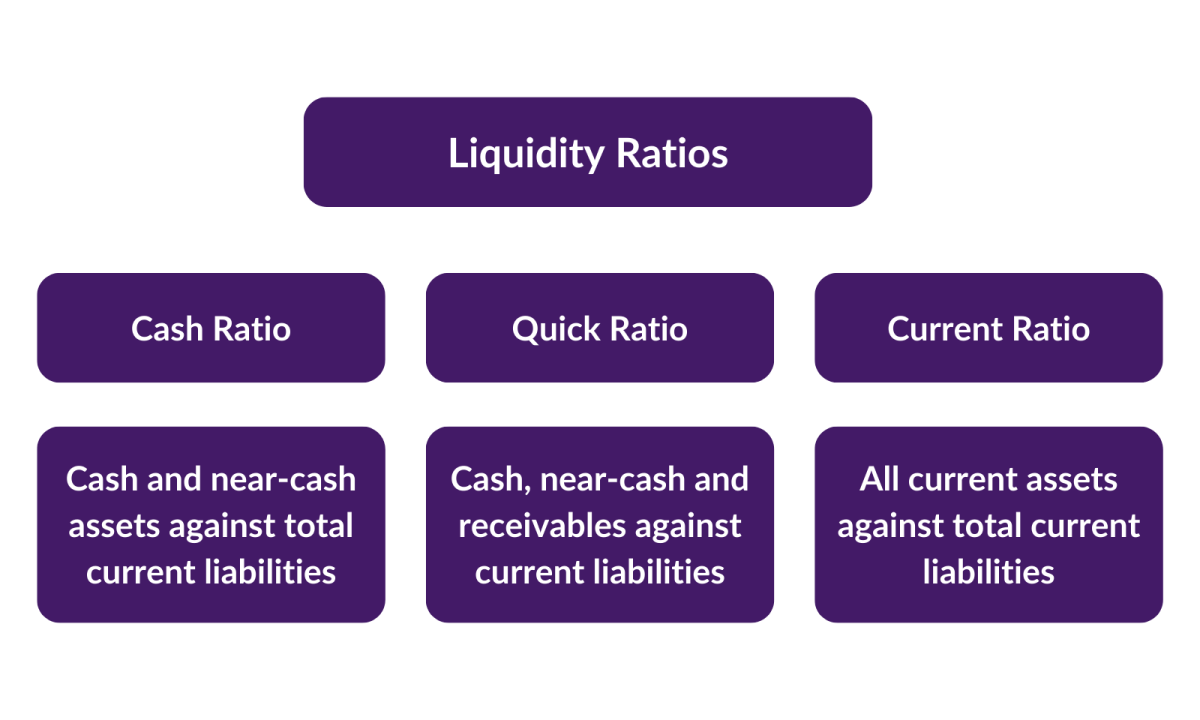

Key Liquidity Ratios Explained

Several ratios are commonly used to assess liquidity. Each provides a slightly different perspective on an entity's ability to meet its immediate financial obligations. Understanding these differences is crucial for accurate financial assessment.

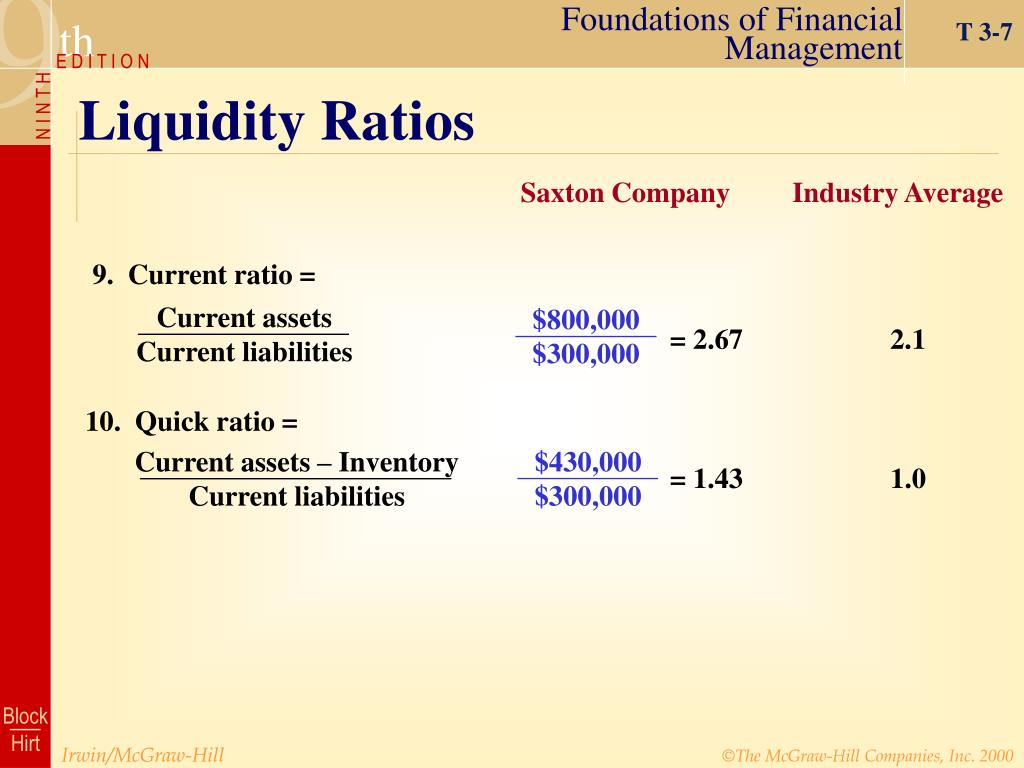

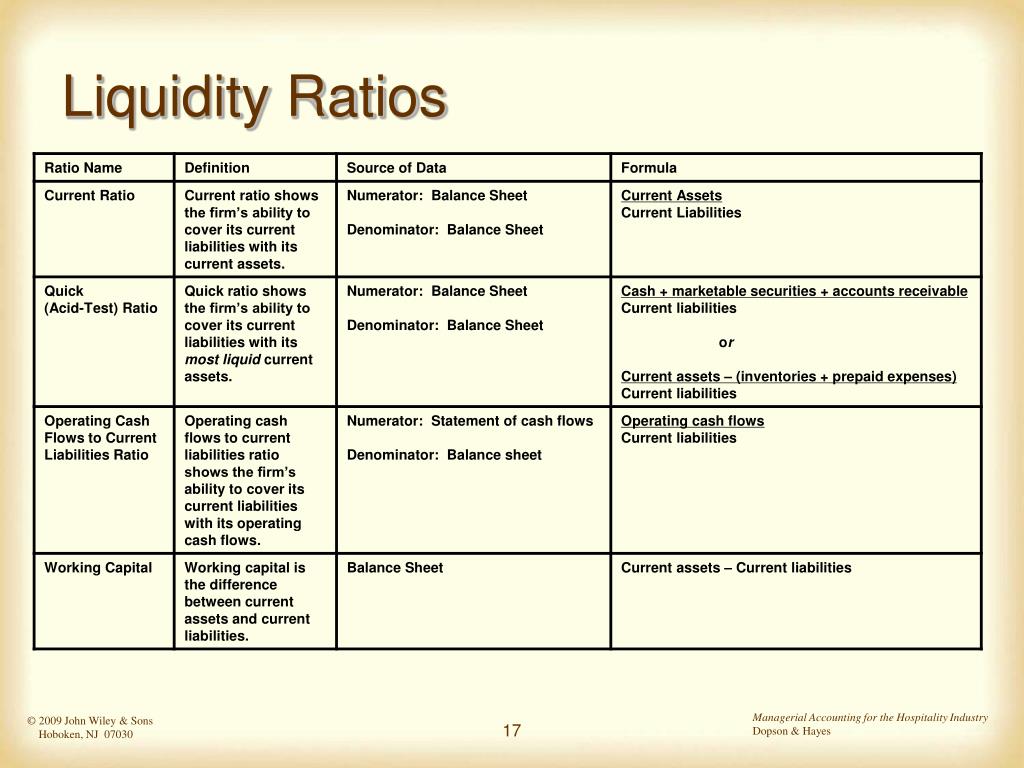

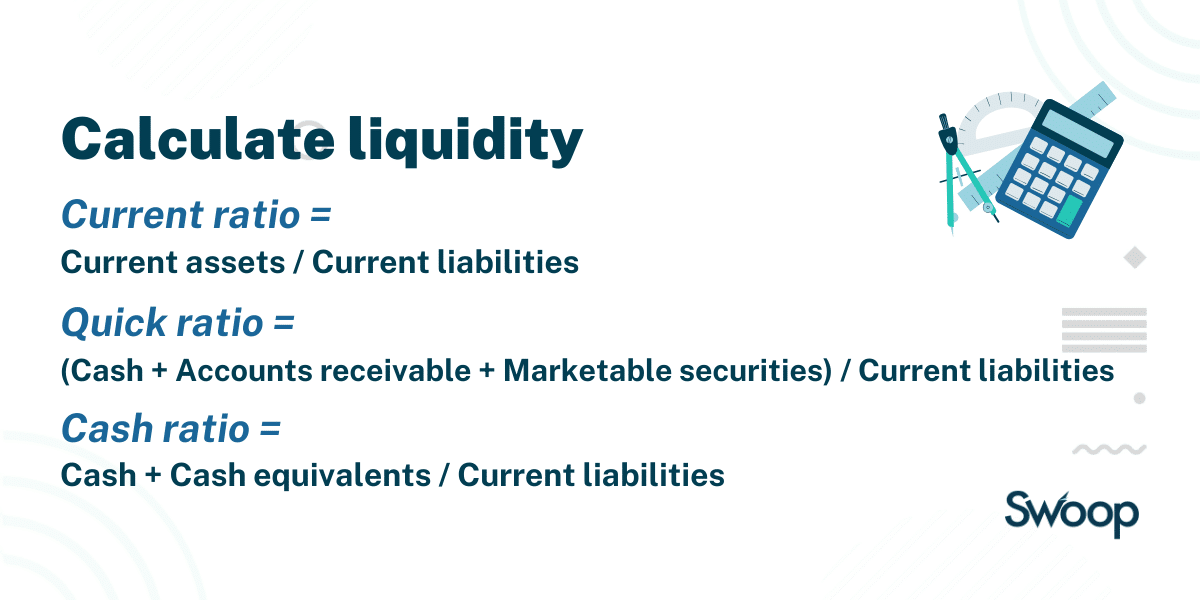

Current Ratio

The current ratio is perhaps the most widely recognized liquidity measure. It is calculated by dividing current assets by current liabilities. A current ratio of 1.0 or higher generally indicates that an entity has sufficient current assets to cover its current liabilities.

A higher ratio suggests greater liquidity, implying a stronger ability to meet short-term obligations. However, an excessively high ratio may indicate that the entity is not efficiently utilizing its current assets.

Quick Ratio (Acid-Test Ratio)

The quick ratio, also known as the acid-test ratio, is a more conservative measure of liquidity. It excludes inventory from current assets. This is because inventory may not be easily converted into cash.

The formula is: (Current Assets - Inventory) / Current Liabilities. This ratio provides a more realistic view of an entity's ability to meet its short-term obligations with its most liquid assets.

Cash Ratio

The cash ratio is the most conservative of the three ratios. It measures the ability to meet short-term obligations using only cash and cash equivalents. This is calculated as (Cash + Cash Equivalents) / Current Liabilities.

A higher cash ratio indicates a very strong liquidity position. However, it might also suggest that the entity is holding too much cash instead of investing it for potentially higher returns.

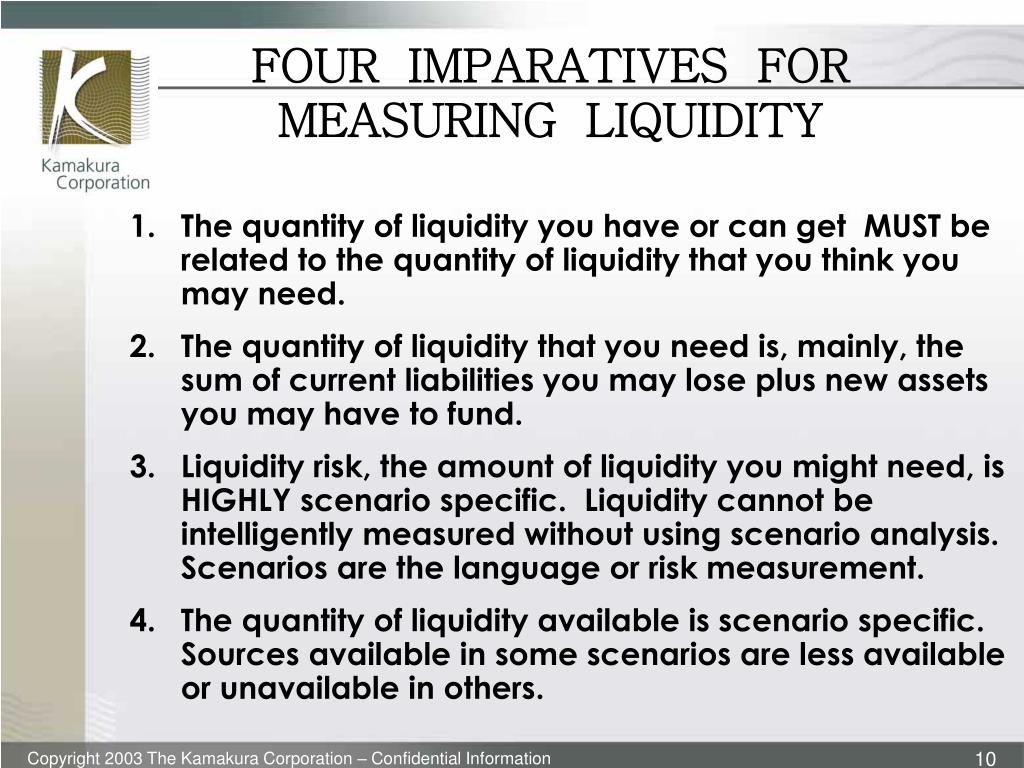

Interpreting Liquidity Ratios: Context is Key

While the ratios themselves provide numerical insights, interpreting them requires context. Industry benchmarks, historical trends, and specific circumstances all play a role in determining what constitutes a healthy liquidity position.

For example, a retail business with high inventory turnover might be comfortable with a lower quick ratio than a manufacturing company with a long production cycle. Comparing a company’s ratios to its competitors can also provide valuable perspective.

Furthermore, changes in liquidity ratios over time can signal potential problems. A consistently declining current ratio could indicate increasing difficulties in meeting short-term obligations. Careful monitoring of these trends is essential for proactive financial management.

Beyond Ratios: Other Factors to Consider

Liquidity assessment is not solely reliant on ratios. Qualitative factors also play a significant role. Access to credit lines, the predictability of cash flows, and the overall economic environment can all influence an entity's liquidity position.

A company with a strong line of credit may be able to manage a lower current ratio than a company without such access. Similarly, businesses operating in stable industries with predictable cash flows may require less liquid assets on hand.

Understanding these qualitative factors in conjunction with quantitative ratios provides a more holistic view of liquidity. It also gives stakeholders a better picture of their financial standing.

The Impact of Liquidity on Financial Health

Adequate liquidity is critical for maintaining financial stability. Without sufficient liquid assets, businesses may struggle to pay suppliers, meet payroll obligations, or take advantage of growth opportunities.

Individuals facing liquidity challenges may be forced to take on high-interest debt or sell assets at unfavorable prices. Managing liquidity effectively is therefore crucial for both short-term survival and long-term prosperity.

In conclusion, while the current ratio, quick ratio, and cash ratio are all measures of liquidity, the quick and cash ratios are seen as more conservative and stringent metrics. They all work together to make up a well-rounded overview of liquidity. The most appropriate measure will depend on the specific context and the level of conservatism desired in the assessment.

:max_bytes(150000):strip_icc()/terms_l_liquidityratios_FINAL-d2c8aea76ba845b4a050eacd22566cae.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_Template_liquidity.aspcopy-30676aef2e424e55bd5ab2b1a8e54b44.jpg)