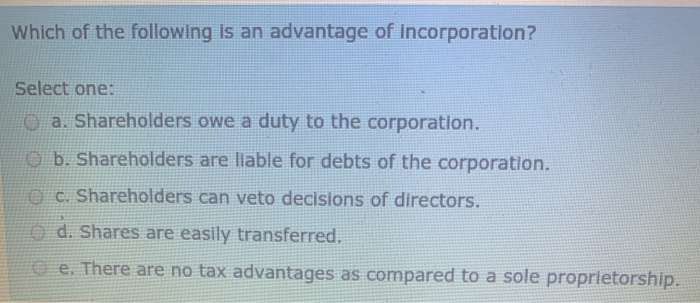

Which Of The Following Is An Advantage Of A Corporation

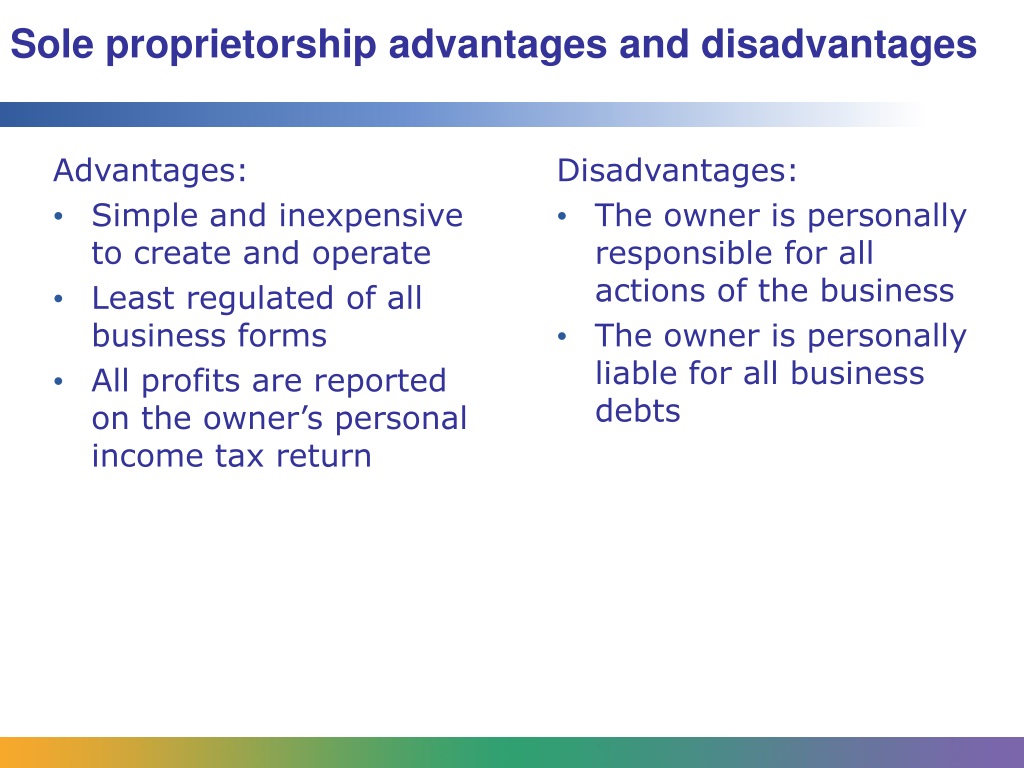

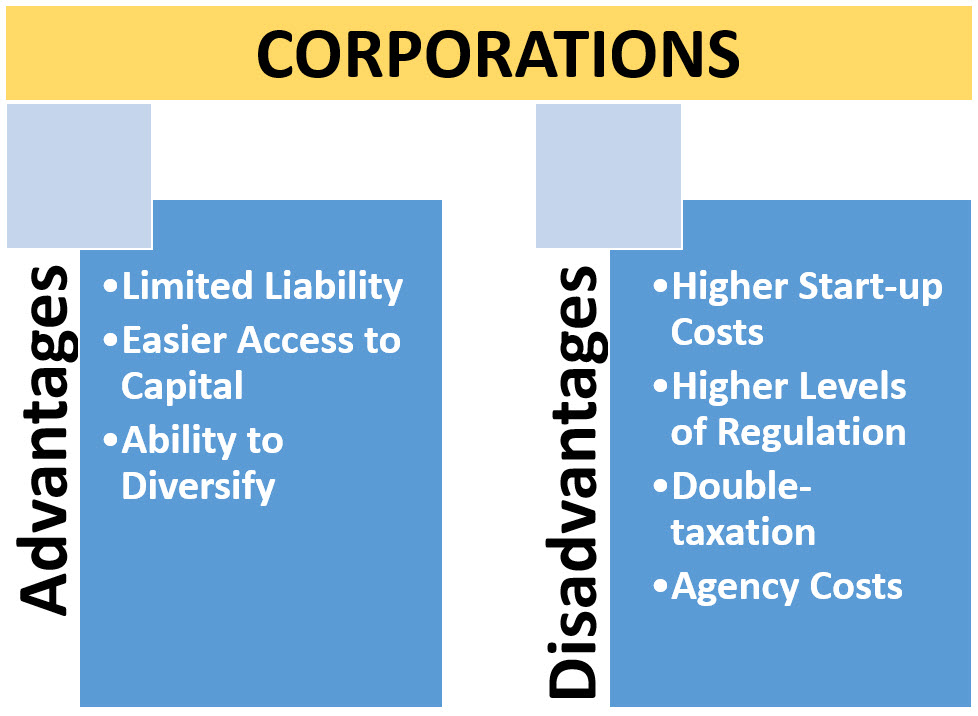

The corporate structure, a cornerstone of modern business, offers a unique set of advantages that fuel economic growth and innovation. Among these, limited liability stands out as a paramount benefit, shielding personal assets from business debts and lawsuits. This protection encourages entrepreneurship and investment, ultimately shaping the landscape of global commerce.

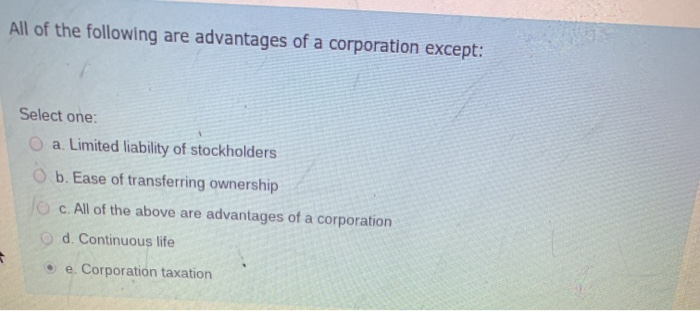

Understanding the advantages of a corporation is crucial for entrepreneurs, investors, and anyone navigating the complexities of the business world. A corporation's structure directly impacts financial risks, growth potential, and long-term sustainability.

So, what are the key advantages of a corporation? This article delves into the core benefits of incorporating, examining the multifaceted reasons why businesses choose this legal structure.

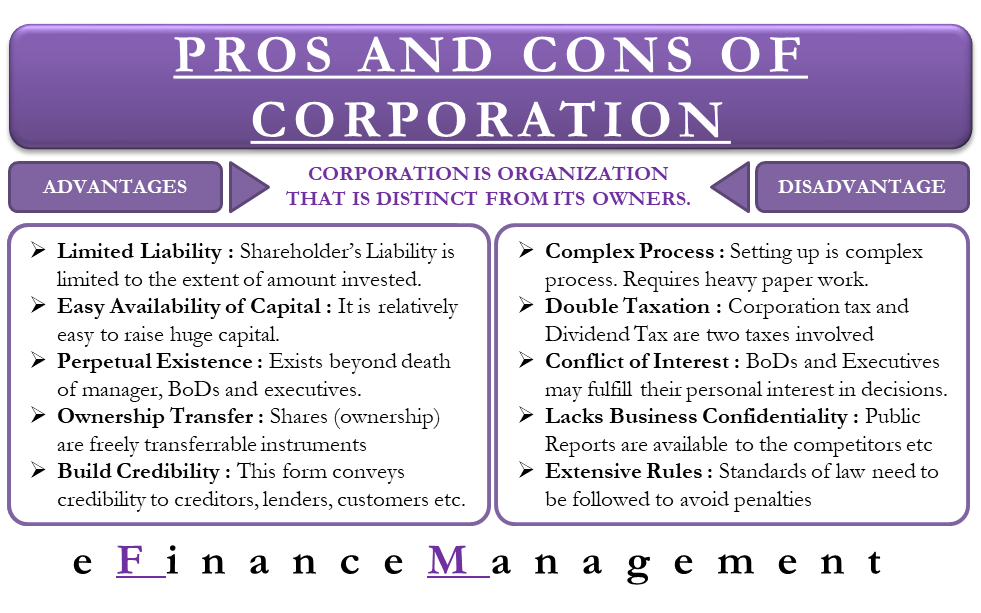

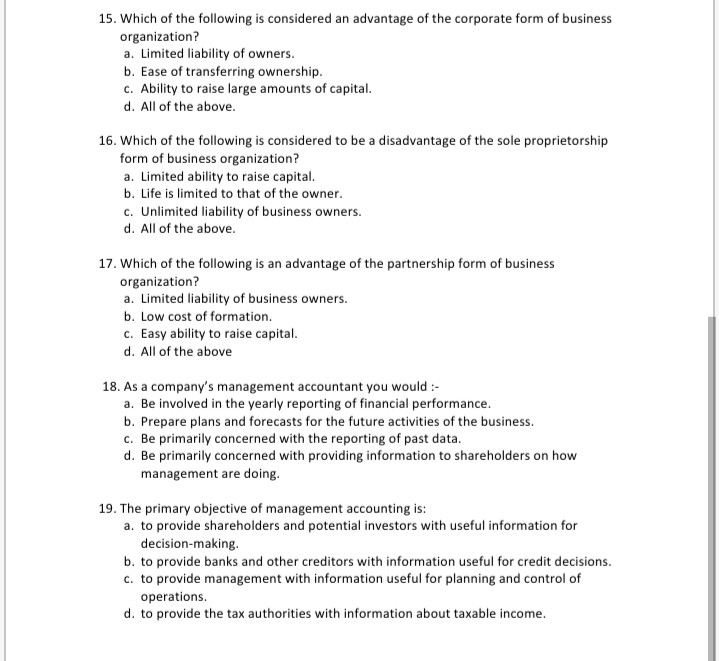

The Cornerstone: Limited Liability

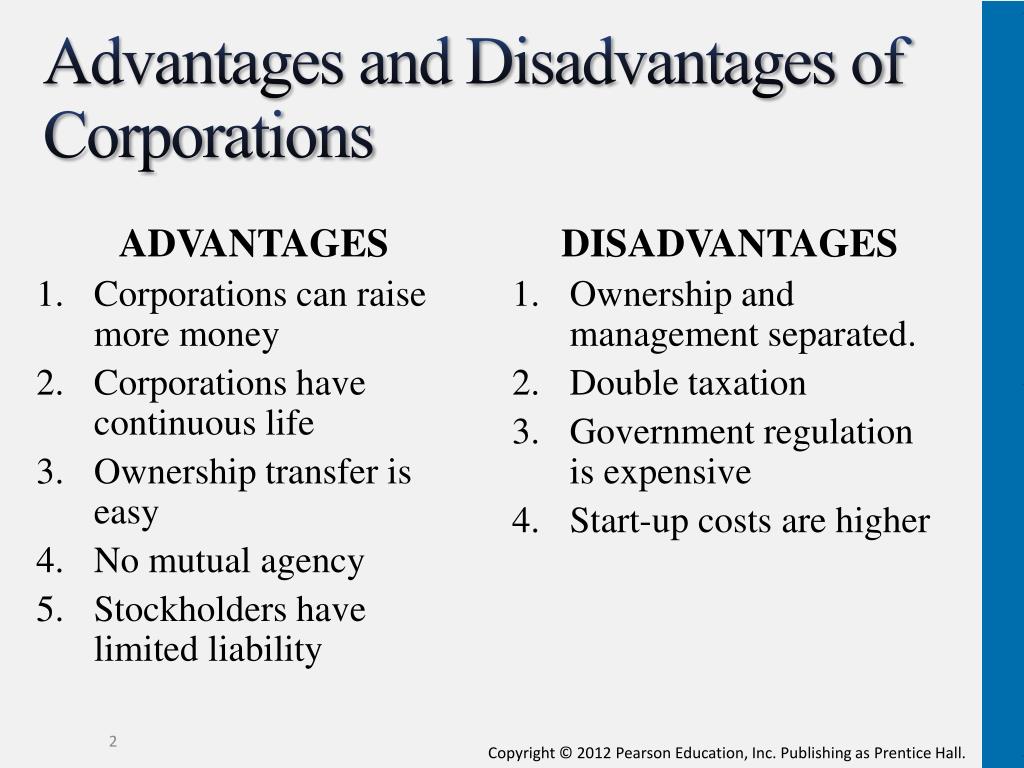

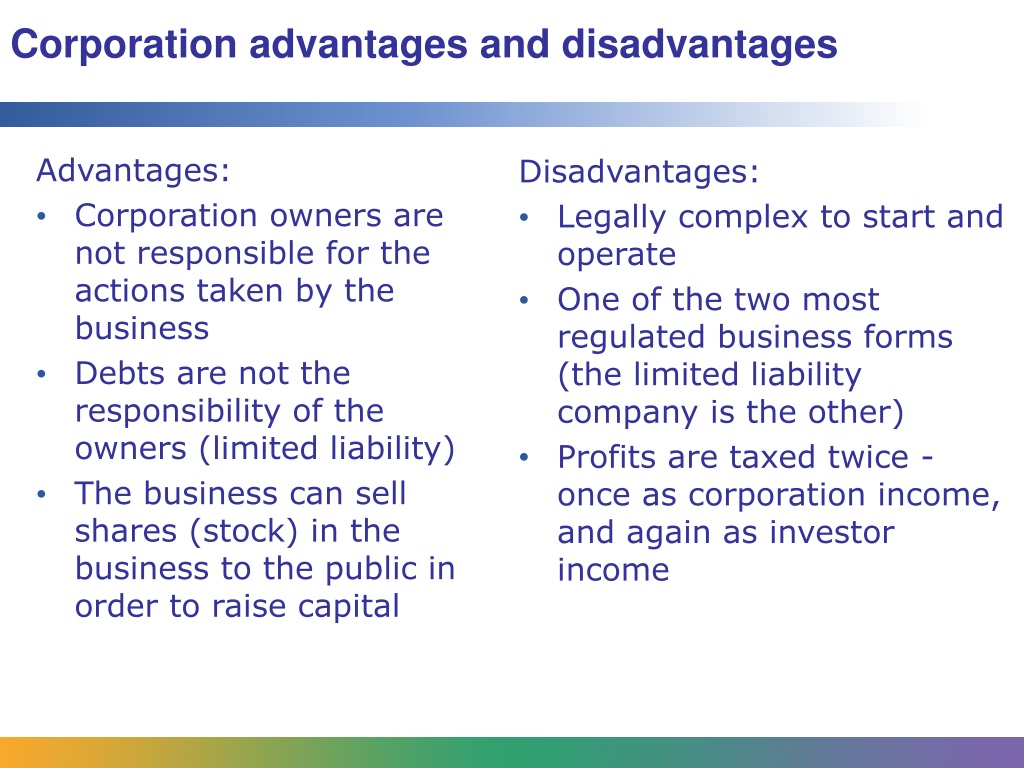

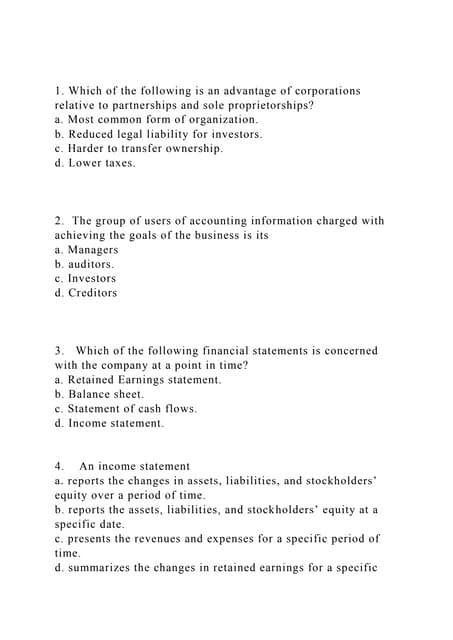

The most significant advantage of a corporation is undoubtedly limited liability. This means the personal assets of the shareholders, directors, and officers are generally protected from the corporation's debts and liabilities. Creditors can only pursue the assets of the corporation itself, not the personal belongings of those involved.

This protection is vital in attracting investment, as investors are more willing to risk capital when their personal wealth is not on the line. Without limited liability, the risk of entrepreneurship would be substantially higher, potentially stifling innovation and economic development.

Raising Capital: A Clear Pathway

Corporations find it easier to raise capital than other business structures, such as sole proprietorships or partnerships. Corporations can sell stock, or equity, to investors, allowing them to raise large sums of money. This is achieved through initial public offerings (IPOs) or private placements.

Selling bonds, a form of debt financing, is another option available to corporations. Access to broader funding sources enables corporations to pursue ambitious growth strategies, invest in research and development, and expand operations on a larger scale.

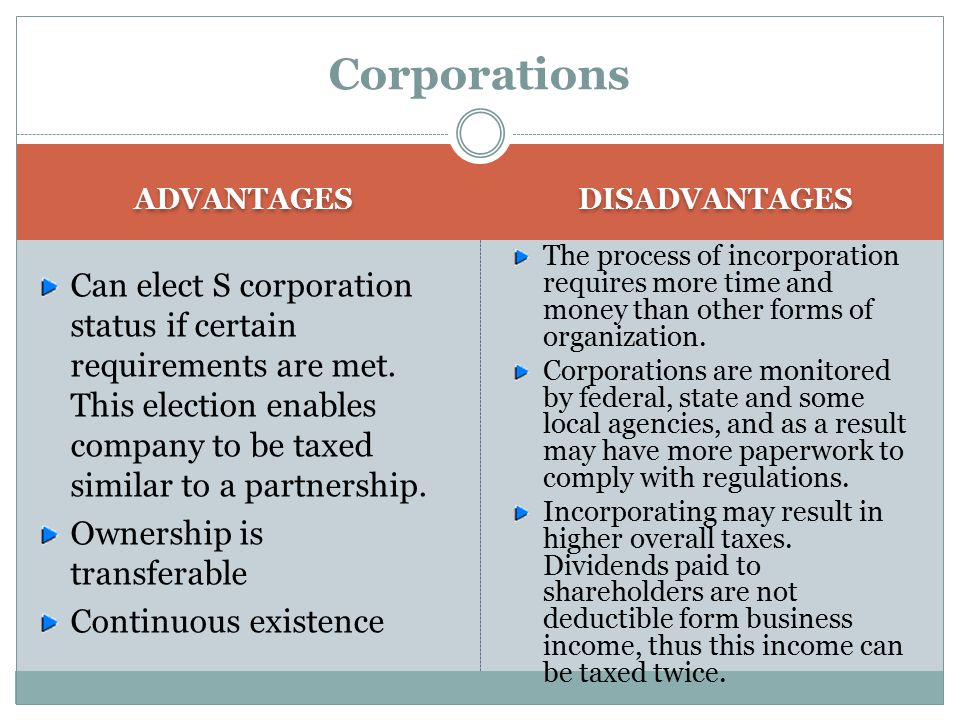

Perpetual Existence: A Long-Term Vision

Unlike sole proprietorships or partnerships that dissolve upon the death or withdrawal of an owner, a corporation can have a perpetual existence. This means the corporation can continue to operate even if ownership changes or if the original founders are no longer involved.

This continuity fosters stability and allows the corporation to plan for the long term. It also reassures investors and customers that the business is reliable and committed to its future.

Transferability of Ownership: Seamless Transitions

Ownership in a corporation is easily transferable through the sale of stock. This makes it simple for investors to buy and sell their ownership interests without disrupting the operation of the business. The easy transfer of ownership ensures liquidity for investors and facilitates the efficient allocation of capital.

The ease of transferability also makes it attractive for succession planning. Owners can easily pass on their ownership to family members or sell their shares to new investors.

Tax Advantages: Strategic Opportunities

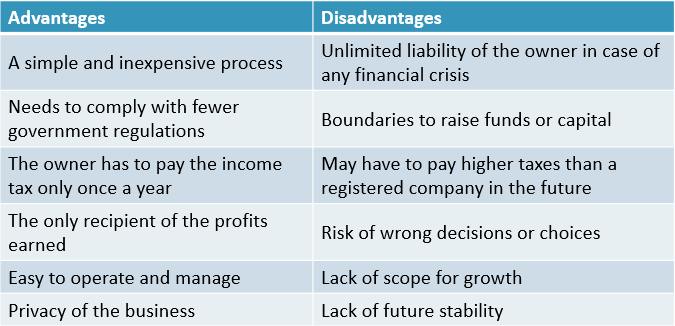

While corporate tax laws can be complex, corporations can sometimes benefit from certain tax advantages. For example, they can deduct certain business expenses that sole proprietorships or partnerships cannot.

Furthermore, the corporate tax rate may, in some instances, be lower than the individual income tax rate, depending on the specific tax laws and the owner's income bracket. Consulting with a tax advisor is crucial to navigate these complexities and optimize tax strategies.

Attracting Talent: Building a Strong Workforce

Corporations can often offer more attractive benefits packages to employees, including health insurance, retirement plans, and stock options. This helps them attract and retain top talent, which is essential for driving innovation and achieving business goals.

A skilled and motivated workforce is a critical asset for any corporation. Competitive compensation and benefits packages can give corporations a significant edge in the labor market.

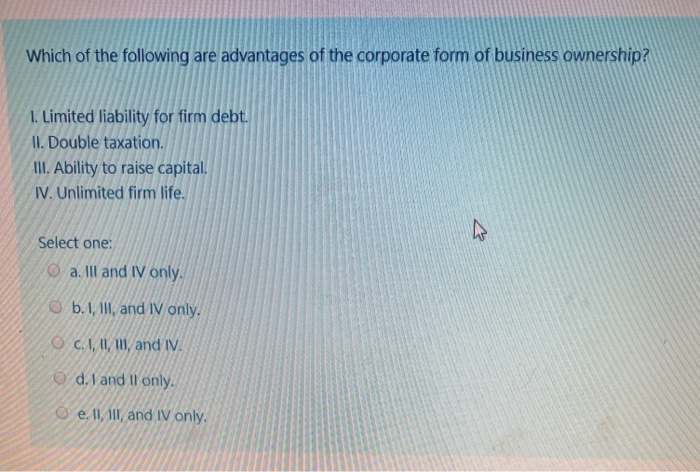

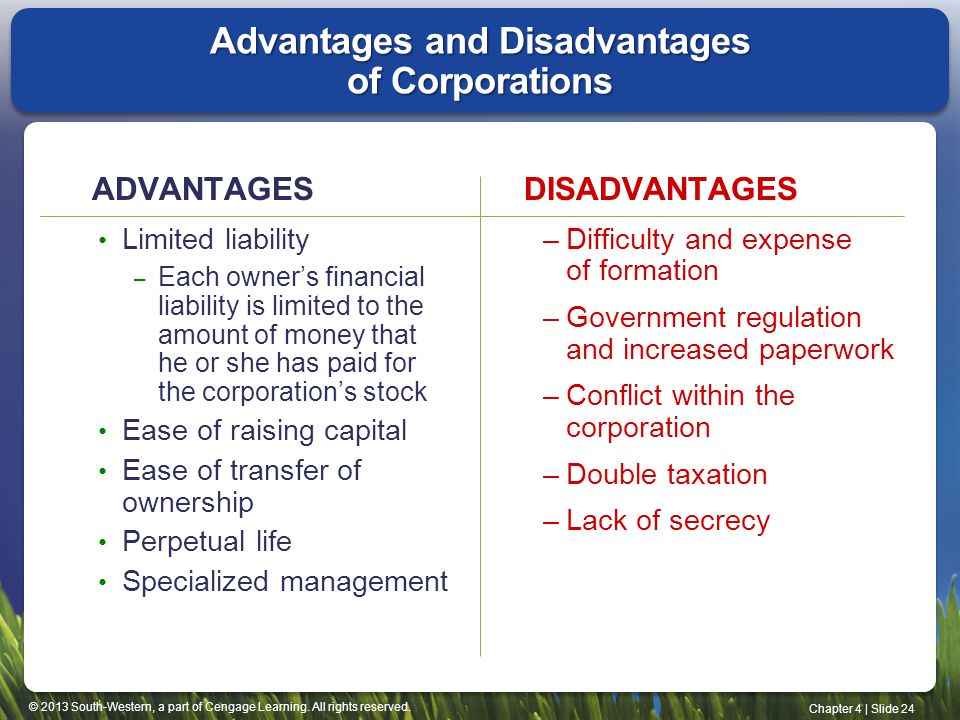

The Downsides: A Balanced Perspective

While the advantages of a corporation are considerable, it is important to acknowledge the potential drawbacks. These can include more complex regulatory requirements and the possibility of double taxation (corporate income tax and individual income tax on dividends).

The formation and maintenance of a corporation can also be more expensive than other business structures. Entrepreneurs should carefully weigh the pros and cons before deciding whether to incorporate.

A Case Study: The Impact of Incorporation

Consider the hypothetical example of "TechStart," a promising software startup. Initially operating as a sole proprietorship, TechStart struggled to attract significant investment. After incorporating, TechStart gained access to venture capital and was able to scale its operations and develop innovative new products.

The protection of limited liability gave investors the confidence to invest in TechStart. TechStart highlights the transformative power of incorporation in unlocking growth potential.

Conclusion: Strategic Choice for Growth

Choosing the right business structure is a critical decision for any entrepreneur. While various options exist, the corporate structure offers unique advantages, particularly limited liability, that can be instrumental in attracting investment, fostering growth, and ensuring long-term sustainability.

Carefully weighing the advantages and disadvantages, and seeking professional advice, will ensure that the chosen structure aligns with your business goals and risk tolerance.

The ability to protect personal assets, raise capital, and attract top talent makes the corporation a powerful engine for economic progress.