Which Of The Following Is An Asset Source Transaction

Imagine you're running a small lemonade stand on a sunny summer day. The crisp bills you carefully tuck into your cash box after each sale, the pitcher overflowing with sweet lemonade, even the sturdy little table that holds it all – these are all pieces of your growing business. But what happens when you borrow money from your neighbor to buy more lemons? Or when you decide to invest some of your hard-earned profits into a shiny new sign? These everyday business activities are governed by principles that accountants call asset source transactions.

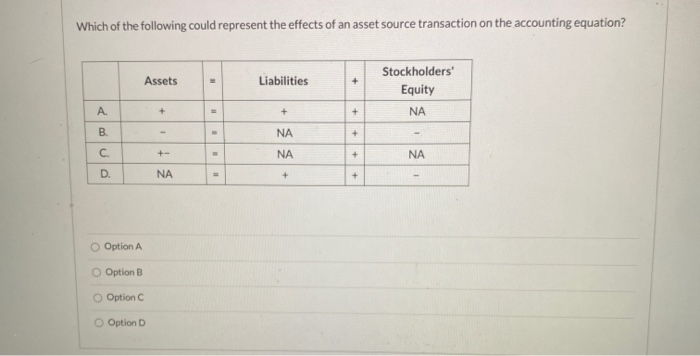

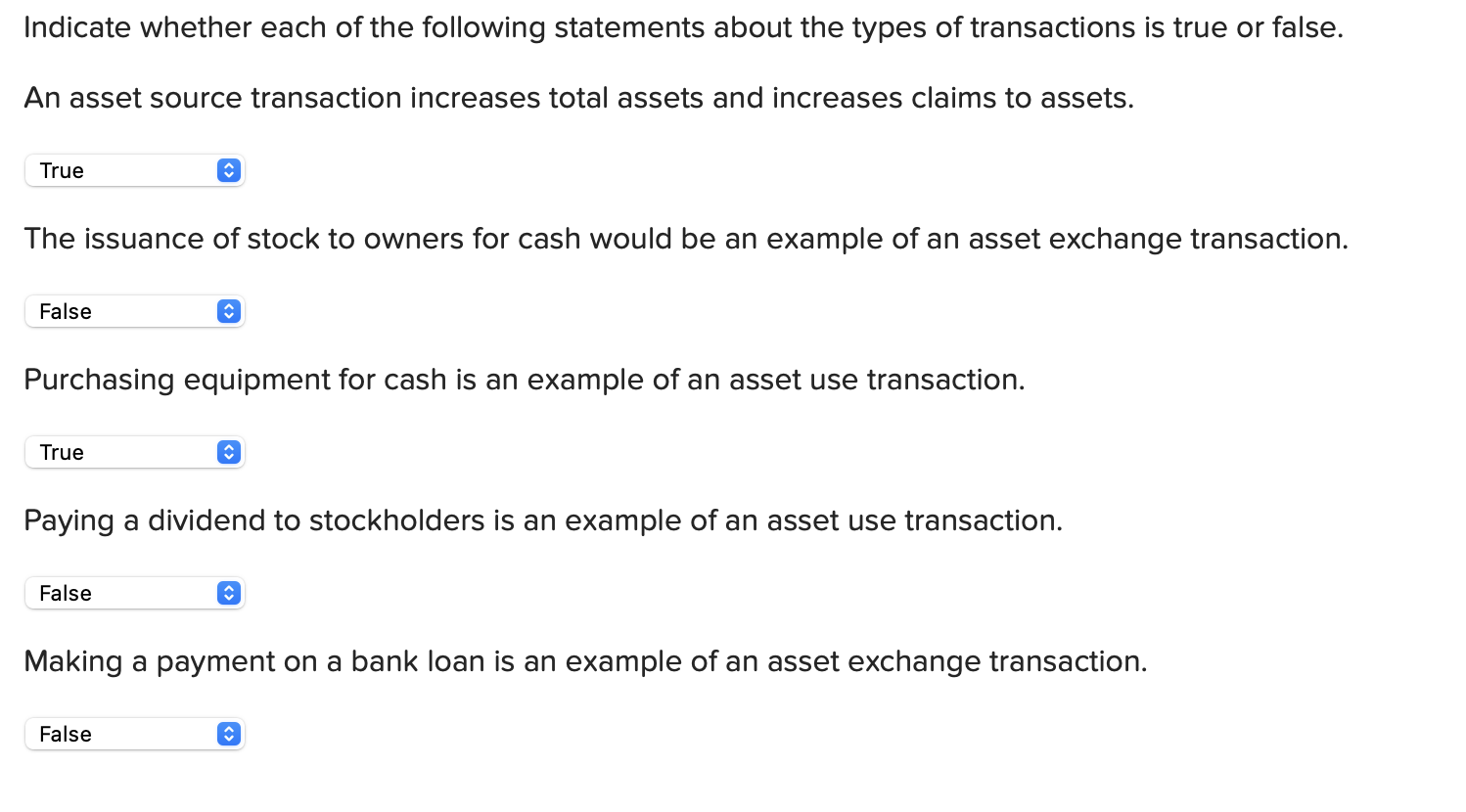

At its heart, an asset source transaction is any business event that increases both the total assets and the total claims (liabilities or equity) of a company. It signifies a fundamental shift in the financial landscape, indicating a change in both what the business owns and who has a claim on those assets. Understanding these transactions is crucial for anyone wanting to grasp the inner workings of accounting and business finance.

The Foundation of Accounting: The Accounting Equation

To understand asset source transactions, we must first revisit the fundamental accounting equation: Assets = Liabilities + Equity. This equation is the bedrock of all accounting practices. It dictates that a company's assets (what it owns) are always equal to the sum of its liabilities (what it owes to others) and its equity (the owners' stake in the company).

An asset source transaction, by definition, maintains this balance while increasing both sides of the equation. It is essentially the engine of financial growth, as it brings in resources while also creating a corresponding claim against them. Think of it as planting a seed – it creates both a new plant (asset) and a responsibility to nurture it (liability or equity claim).

Delving Deeper: Identifying Asset Source Transactions

So, what exactly qualifies as an asset source transaction? Let's explore some common scenarios to illustrate the concept.

Borrowing Money from a Bank

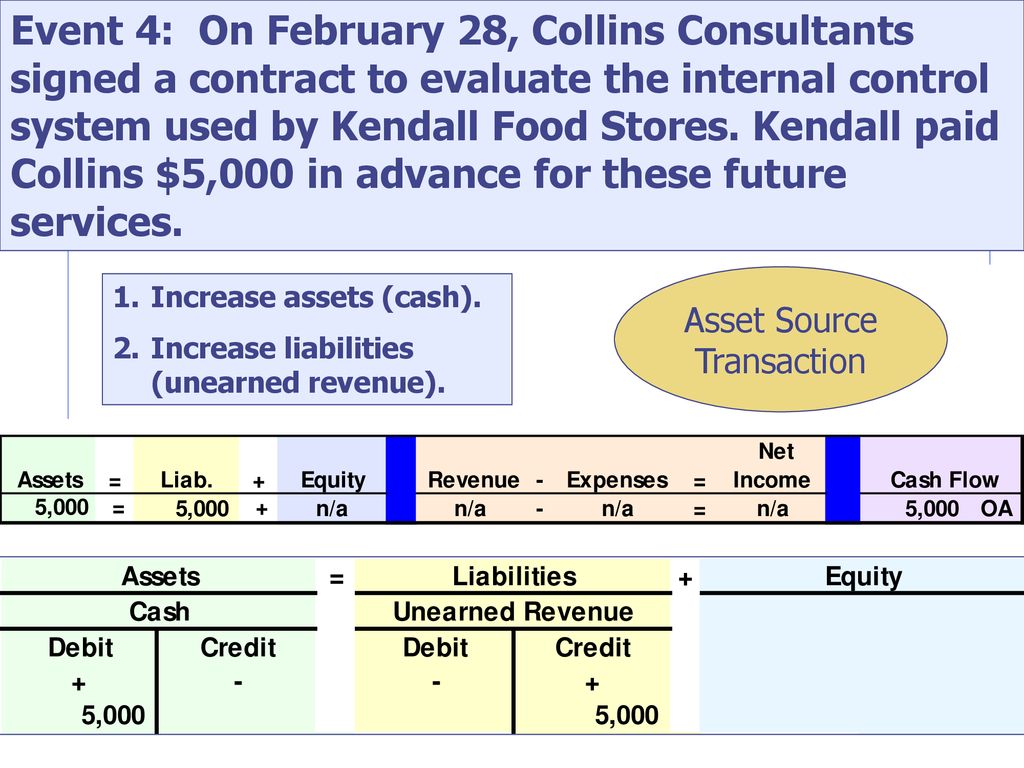

A classic example is securing a loan from a bank. When a company borrows money, it receives cash (an asset) and incurs a liability to repay the loan. The asset, cash, increases, and the liability, accounts payable, also increases, thus maintaining the accounting equation.

Consider a small bakery obtaining a $10,000 loan to purchase a new oven. The bakery's cash account increases by $10,000, and its loan payable account (a liability) also increases by $10,000. This represents an influx of capital that strengthens the company's ability to operate.

Receiving Cash for Services Rendered

When a company provides services to a customer and receives cash payment, it's another type of asset source transaction. The company's cash increases (an asset), and its retained earnings (part of equity) also increases because the company has generated revenue.

For example, a consulting firm completes a project for a client and receives $5,000. The firm's cash balance increases by $5,000, and its retained earnings also increases by $5,000, reflecting the profit earned from the service.

Receiving Investments from Owners

Sometimes, a business needs an infusion of capital from its owners. This occurs when owners invest cash or other assets into the business. The company receives cash (an asset), and the owners' equity increases, reflecting their increased ownership stake.

Imagine that the owner of a landscape company invests an additional $20,000 in cash into the business. The company's cash account increases by $20,000, and the owner's equity also increases by $20,000. This strengthens the company's financial position.

Selling Goods for Cash

If a company sells goods and receives cash immediately, it is another example of an asset source transaction. Cash, an asset, goes up. At the same time, the retained earnings, which is part of the equity section of the balance sheet goes up.

If a clothing store sells a dress for $100 cash, their cash assets and retained earnings both increase by $100.

Why are Asset Source Transactions Important?

Understanding asset source transactions is more than just an academic exercise. It provides valuable insights into a company's financial health and growth trajectory. These transactions are crucial for several reasons.

Firstly, they provide a clear picture of how a company is financing its operations. Are they relying on debt? Are they attracting investment from owners? The answers to these questions paint a picture of the company's financial stability and risk profile.

Secondly, tracking asset source transactions helps managers make informed decisions about resource allocation. By understanding where their assets are coming from, they can better manage their liabilities and equity, maximizing profitability and growth.

Thirdly, and perhaps most importantly, asset source transactions impact a company's creditworthiness. Lenders and investors scrutinize these transactions to assess the company's ability to repay debts and generate returns on investment. A healthy balance sheet, reflecting sound asset source management, is essential for attracting capital.

Differentiating Asset Source Transactions from Other Transactions

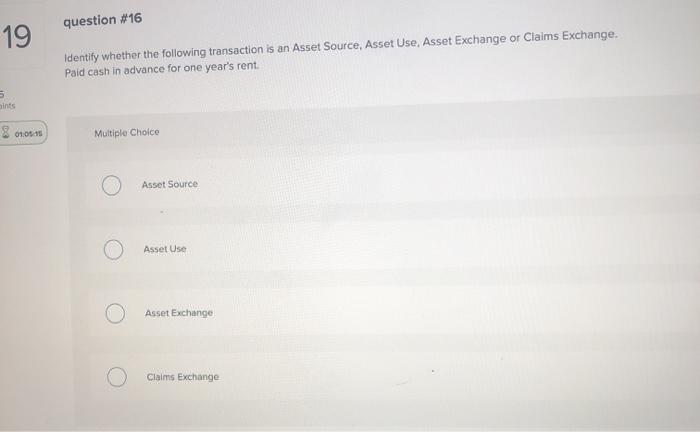

It's important to distinguish asset source transactions from other types of transactions that might affect a company's financial position. For example, an asset exchange transaction, such as purchasing equipment with cash, involves exchanging one asset for another without affecting liabilities or equity. Similarly, asset use transactions decrease both assets and claims (liabilities or equity).

Consider paying off a loan. This reduces both cash (an asset) and loans payable (a liability), thereby decreasing both sides of the accounting equation. This is not an asset source transaction, but rather an asset use transaction.

Real-World Examples: Beyond the Textbook

The principles of asset source transactions apply to businesses of all sizes, from the smallest lemonade stand to the largest multinational corporation. Let's consider a few real-world examples.

A tech startup secures venture capital funding: This represents an asset source transaction. The company receives cash (an asset), and its equity increases, reflecting the investors' ownership stake.

A retail company issues bonds to finance expansion: Again, this is an asset source transaction. The company receives cash (an asset) from the bond issuance and incurs a liability to repay the bondholders.

Conclusion: The Building Blocks of Financial Growth

Asset source transactions are the building blocks of financial growth. They represent the inflow of resources that fuel a company's operations and expansion. By understanding these transactions, business owners, managers, and investors can gain valuable insights into a company's financial health and potential.

As you navigate the world of business and finance, remember the fundamental accounting equation and the vital role of asset source transactions. They are the foundation upon which successful and sustainable enterprises are built. By grasping these concepts, you empower yourself to make informed decisions and navigate the complex world of finance with greater confidence and clarity.