Which Of The Following Is Considered The Most Liquid Asset

Financial markets are in a frenzy as investors grapple with understanding the ultimate liquid asset. The answer might surprise you: it's cash.

Understanding liquidity is paramount in today's volatile economy, influencing everything from personal finance to corporate strategy. This article cuts through the noise to definitively identify the most liquid asset and why it matters.

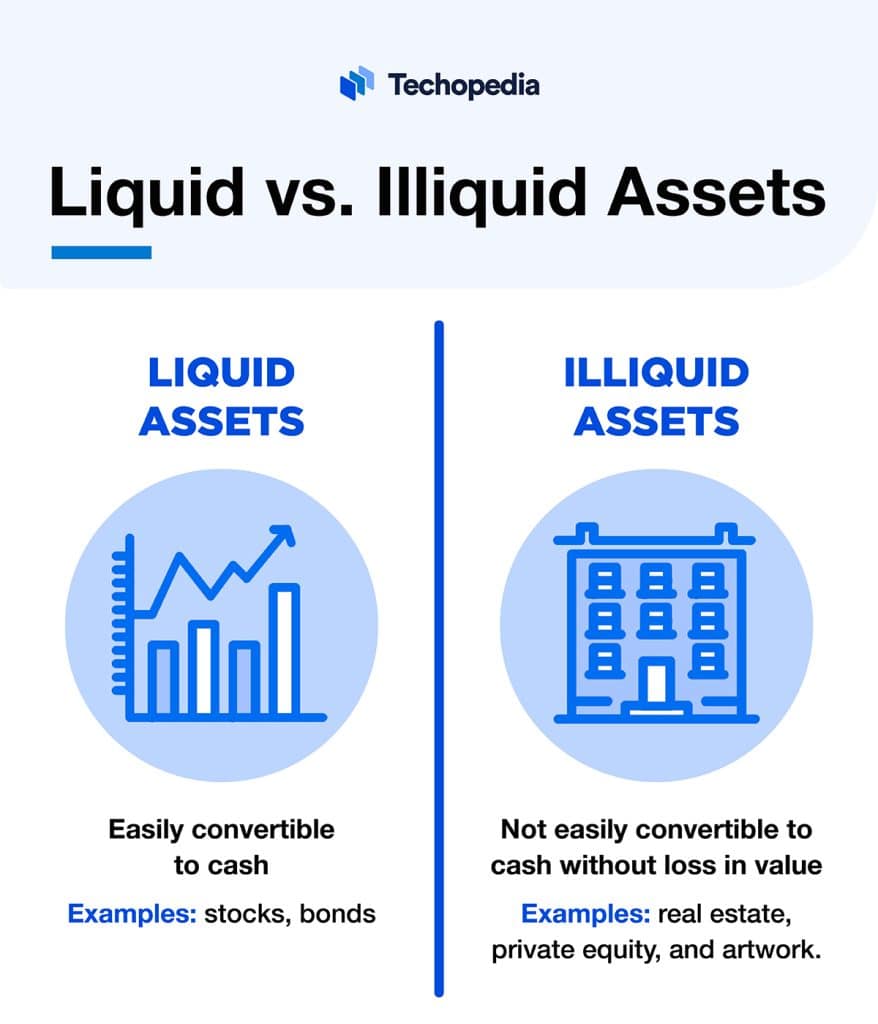

Defining Liquidity

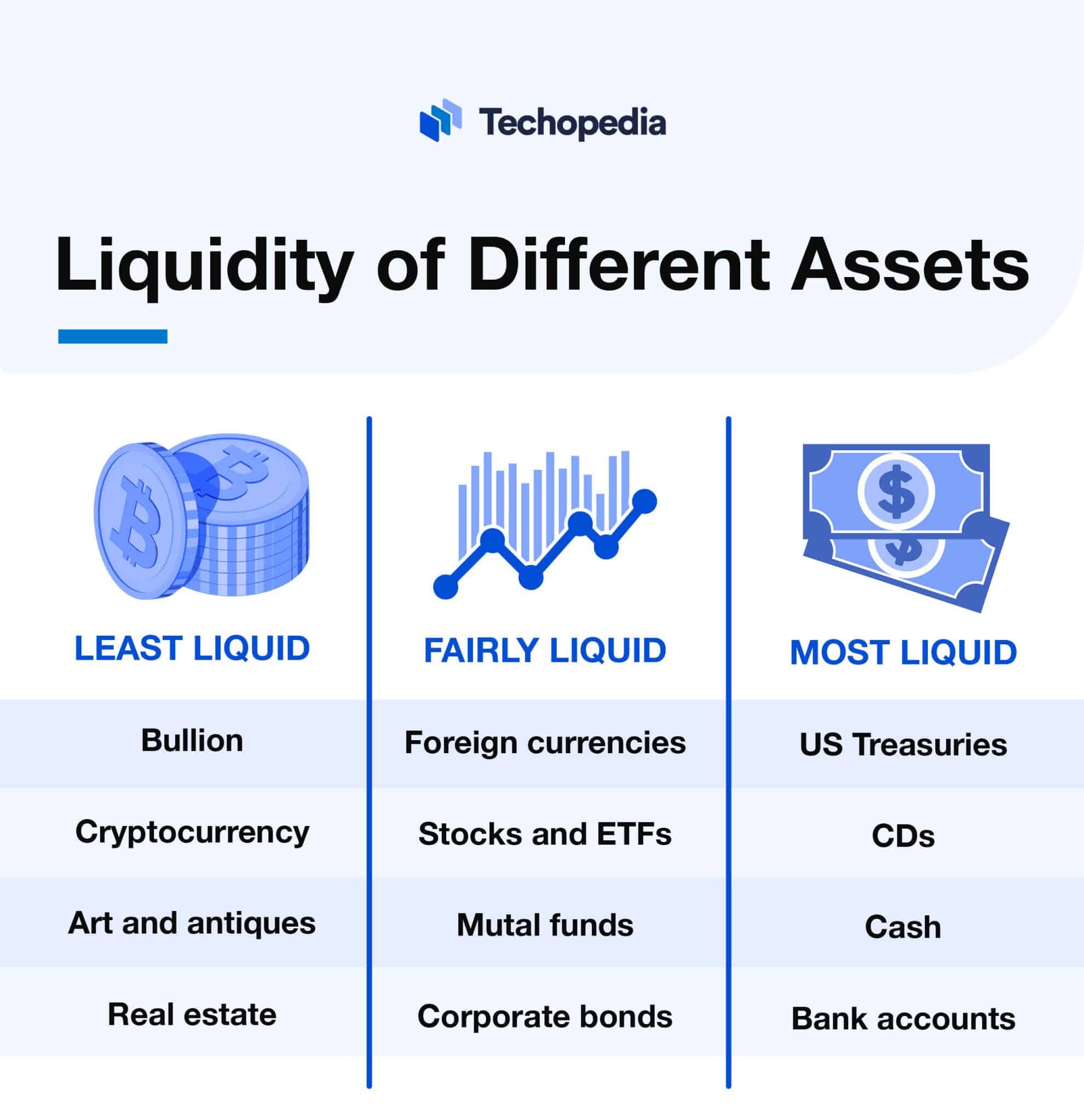

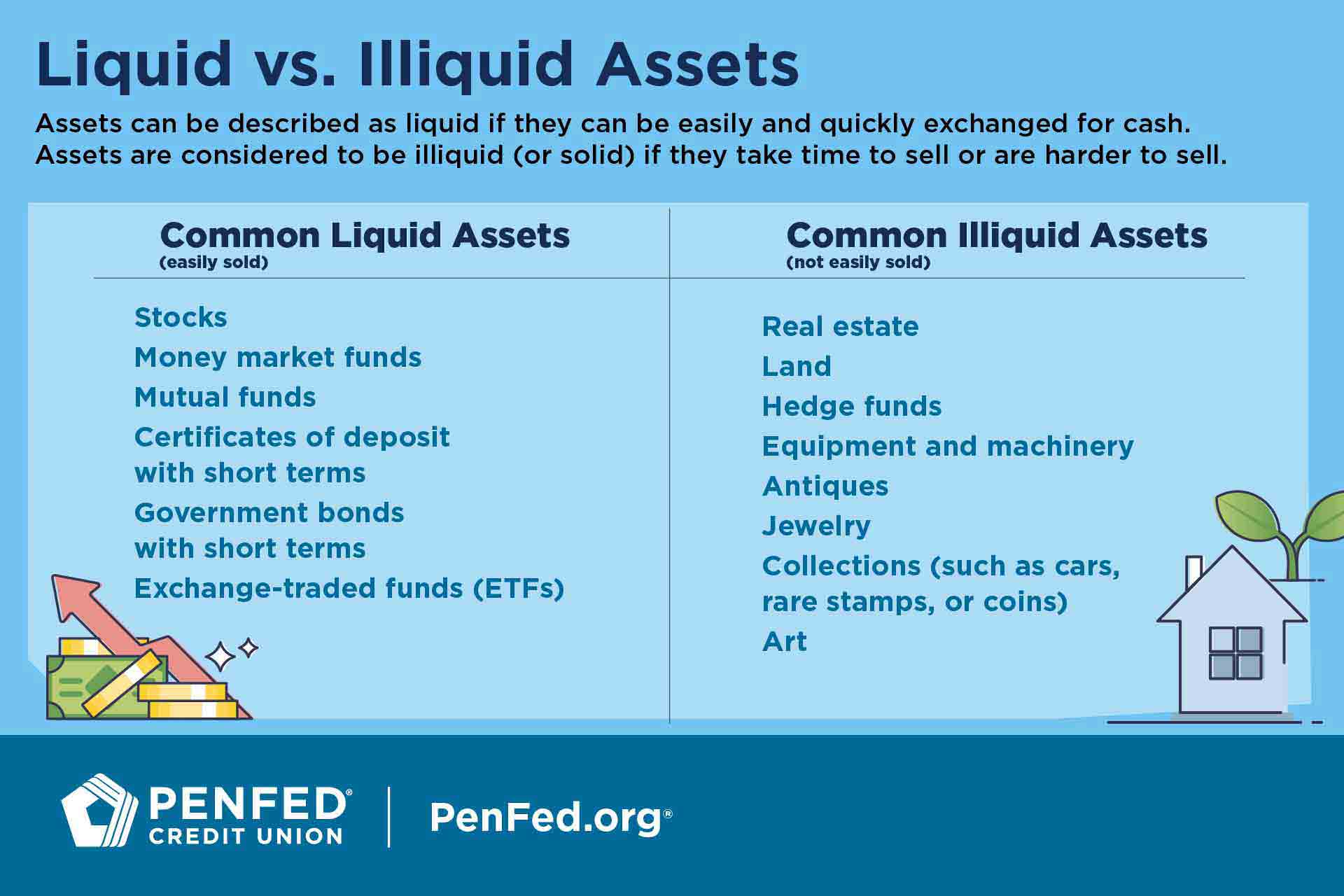

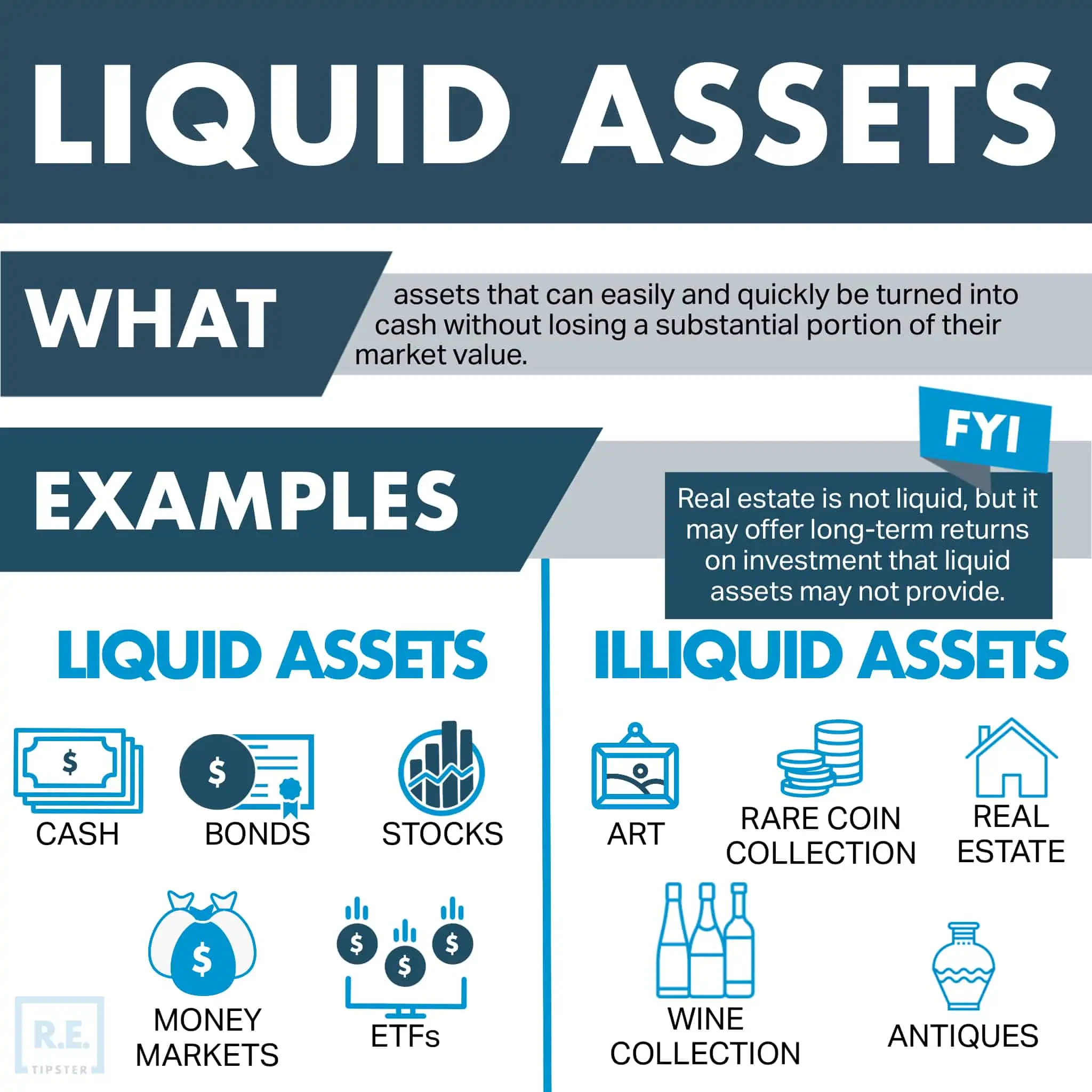

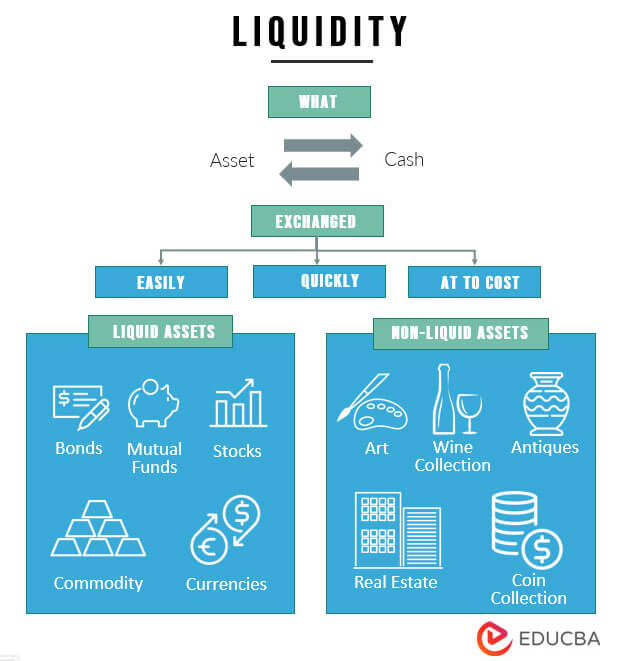

Liquidity refers to the ease with which an asset can be converted into cash without significant loss of value. A highly liquid asset can be sold quickly and easily at or near its fair market value.

Assets like real estate or specialized equipment are considered illiquid because selling them can take time and may require accepting a lower price.

The Contenders

Several assets are often touted for their liquidity, including stocks, bonds, and precious metals.

However, each has its own set of conditions that affect how quickly they can be converted to cash.

Stocks, while generally liquid, can experience price swings based on market conditions and company performance.

Bonds can also fluctuate in value, and selling them before maturity might incur penalties.

Precious metals, like gold and silver, require finding a buyer and may involve transaction costs.

The Unquestionable Champion: Cash

Cash, in its physical form (currency) or readily accessible bank accounts, is unequivocally the most liquid asset.

It represents immediate purchasing power and doesn't require any conversion process.

Cash is accepted as a medium of exchange everywhere, eliminating the need to find a buyer or negotiate a price.

Why Cash Reigns Supreme

The defining characteristic of cash is its immediacy. It's the benchmark against which all other assets are measured for liquidity.

Unlike other assets, cash does not carry the risk of price depreciation upon immediate sale, because it is already the medium of exchange. Cash is the base unit used for all transactions.

According to data from the Federal Reserve, the total amount of US currency in circulation is currently over $2 trillion, demonstrating its widespread acceptance and use.

The Importance of Liquidity

Maintaining a sufficient level of liquid assets is crucial for individuals and businesses alike.

It provides a safety net for unexpected expenses, investment opportunities, or economic downturns.

A lack of liquidity can lead to financial distress and forced sales of other assets at unfavorable prices.

Real-World Examples

Imagine needing to cover a sudden medical bill or repair a broken appliance. Having cash readily available provides peace of mind and prevents accruing debt.

Businesses with strong cash reserves are better positioned to weather economic storms and capitalize on emerging opportunities.

During the 2008 financial crisis, companies with sufficient cash flow were able to acquire distressed assets at bargain prices.

Looking Ahead

While other assets offer potential for higher returns, their liquidity comes at a cost. Investors and financial managers must assess their risk tolerance.

The Federal Reserve continues to monitor monetary conditions and adjust interest rates, which impacts the overall availability of cash in the economy.

Individuals should regularly evaluate their financial portfolios and adjust their asset allocation to ensure they have adequate liquid reserves.