Which Of The Following Is Not A Fixed Expense

Understanding personal finance can feel like navigating a maze, especially when differentiating between fixed and variable expenses. Many individuals struggle to categorize their spending, leading to inaccurate budgeting and financial planning. This article clarifies the distinction, focusing on identifying which common expenses are not fixed.

The ability to distinguish between fixed and variable expenses is crucial for effective budgeting and financial management. Fixed expenses are predictable and consistent, while variable expenses fluctuate. Incorrect categorization can lead to financial instability and difficulty in achieving financial goals.

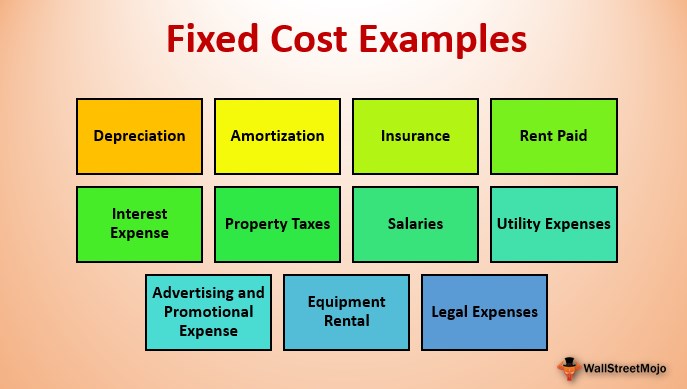

Defining Fixed Expenses

Fixed expenses are costs that remain relatively constant from month to month. These expenses are predictable and do not change based on usage or consumption. Examples typically include rent or mortgage payments, loan repayments, and insurance premiums.

These expenses provide a stable baseline in a budget. Understanding them allows for accurate forecasting of minimum monthly expenditures.

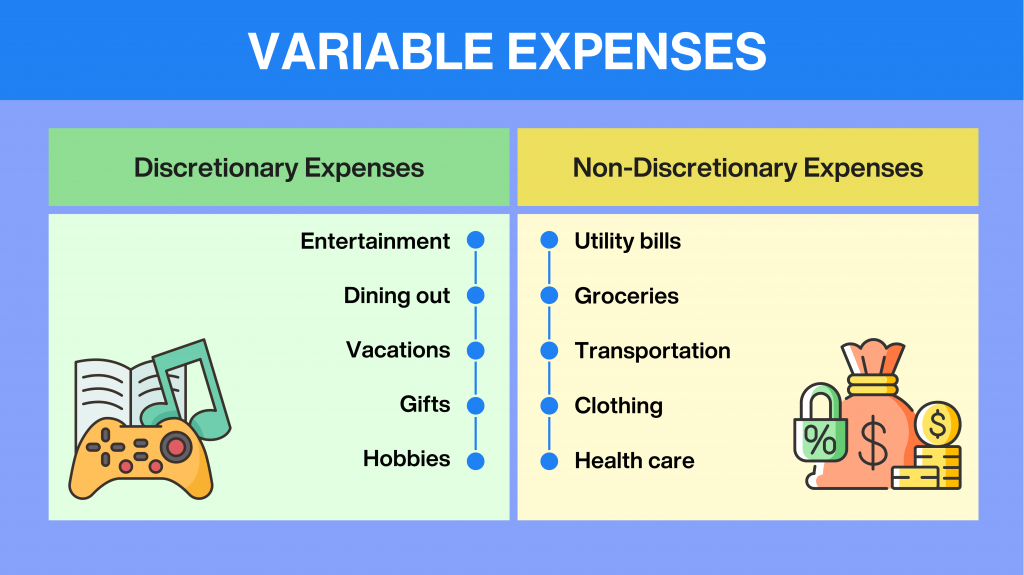

Variable Expenses: The Fluctuating Costs

In contrast, variable expenses are costs that change from month to month. The amount spent on these items depends on factors such as consumption, needs, and lifestyle choices. Examples include groceries, utilities, transportation, and entertainment.

Variable expenses offer opportunities for cost reduction through conscious spending habits.

Identifying Non-Fixed Expenses

Several common expenses are often mistakenly considered fixed, but are actually variable. Understanding the difference is essential for effective budgeting.

Groceries fall into this category. While the need for food is constant, the amount spent can vary greatly depending on meal planning, dining out habits, and the choice of grocery stores.

Similarly, utilities such as electricity, water, and gas fluctuate based on usage and seasonal changes. Higher consumption during summer months due to air conditioning, or winter months due to heating, will increase utility bills.

Transportation costs are another example of a variable expense. Fuel costs, public transport fares, and vehicle maintenance expenses fluctuate depending on the distance traveled and the frequency of use.

Entertainment is almost always a variable expense. Spending on movies, concerts, sporting events, and dining out can vary significantly from month to month.

Clothing purchases are another example. While the need for clothing exists, the frequency and amount spent on these purchases are not fixed and depend on individual preferences and sales.

The Impact on Budgeting and Financial Planning

Recognizing the difference between fixed and variable expenses significantly impacts budgeting and financial planning. By understanding which expenses can be controlled, individuals can prioritize saving, reduce debt, and achieve their financial goals.

Accurate expense categorization allows for the creation of realistic budgets. Individuals can identify areas where they can cut back spending to allocate more funds toward saving or debt repayment.

Moreover, understanding variable expenses allows for proactive financial planning. Individuals can anticipate fluctuations in spending and adjust their budget accordingly.

Expert Opinions and Recommendations

Financial advisors emphasize the importance of tracking expenses to gain a clear understanding of spending habits. Tools like budgeting apps and spreadsheets can help individuals monitor their income and expenses, identifying patterns and areas for improvement.

According to the Certified Financial Planner Board of Standards, creating a budget based on accurate expense categorization is crucial for long-term financial success.

The Consumer Financial Protection Bureau (CFPB) recommends reviewing spending habits regularly and making adjustments to the budget as needed.

Conclusion

In conclusion, differentiating between fixed and variable expenses is critical for effective financial management. While fixed expenses provide a stable foundation, variable expenses offer opportunities for cost control. Recognizing which expenses are not fixed, such as groceries, utilities, transportation, entertainment, and clothing, empowers individuals to make informed financial decisions and achieve their financial goals. By carefully monitoring and managing these variable costs, individuals can improve their financial stability and secure their future.

![Which Of The Following Is Not A Fixed Expense M3-4 Identifying Accrual Basis Expenses [LO 3-2] The following](https://cdn.numerade.com/ask_images/0cff9723d5cc4645ba379ed23e24b6f8.jpg)