Which Of The Following Is Not An Employer Payroll Cost

The relentless pressure on businesses to manage costs is intensifying, especially when it comes to payroll. Understanding the intricacies of employer payroll expenses is no longer just an accounting exercise; it's a critical survival skill in today's competitive landscape. Misinterpreting these costs can lead to inaccurate budgeting, flawed financial projections, and ultimately, compromised profitability.

This article dissects the components of employer payroll costs, clarifying which elements truly belong and, crucially, which do not. By examining official government publications, data from reputable organizations like the Bureau of Labor Statistics (BLS), and insights from payroll experts, we aim to provide a comprehensive guide to navigating this complex financial terrain.

Understanding Employer Payroll Costs: A Deep Dive

At its core, an employer's payroll cost represents the total expense associated with compensating employees. This encompasses more than just the gross wages paid directly to workers.

The "nut graf" of this entire topic boils down to: while direct wages are obviously part of it, many 'hidden' costs are crucial for a firm's economic health.

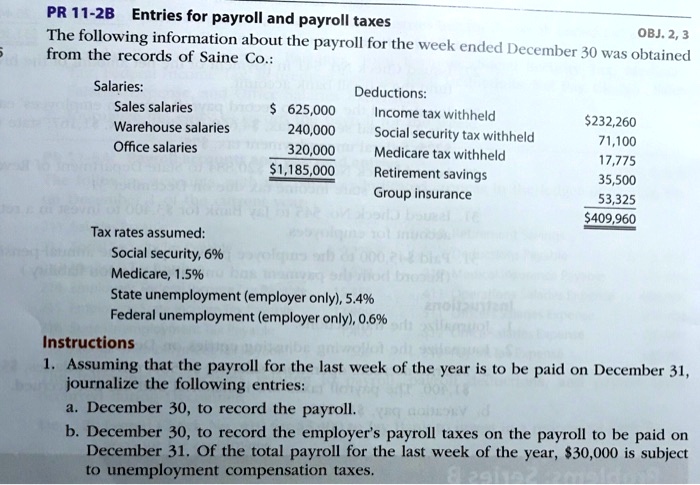

The Core Components of Payroll Costs

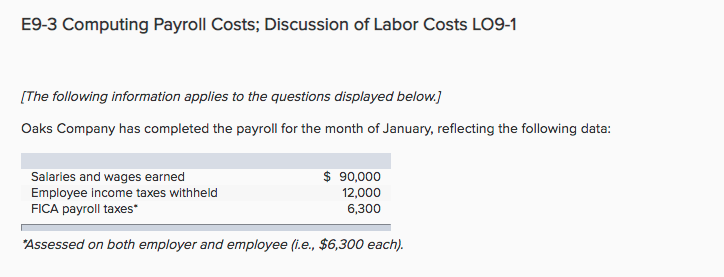

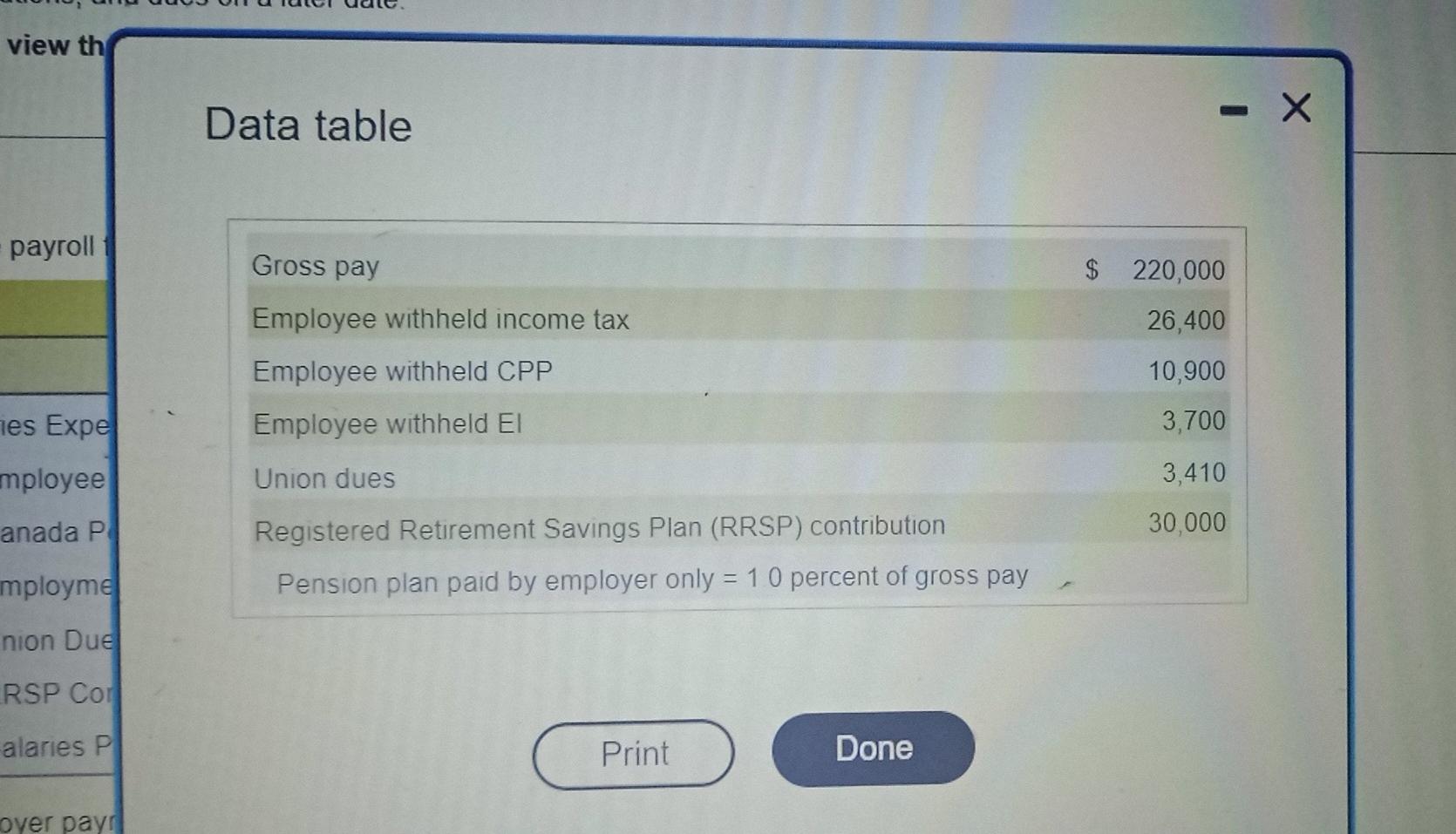

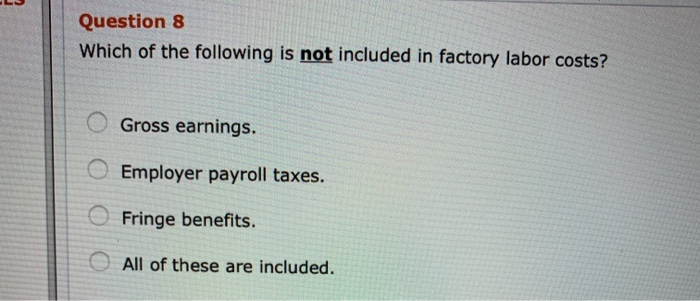

Gross Wages are the foundation. This is the total amount earned by an employee before any deductions.

This includes salaries, hourly wages, commissions, and bonuses.

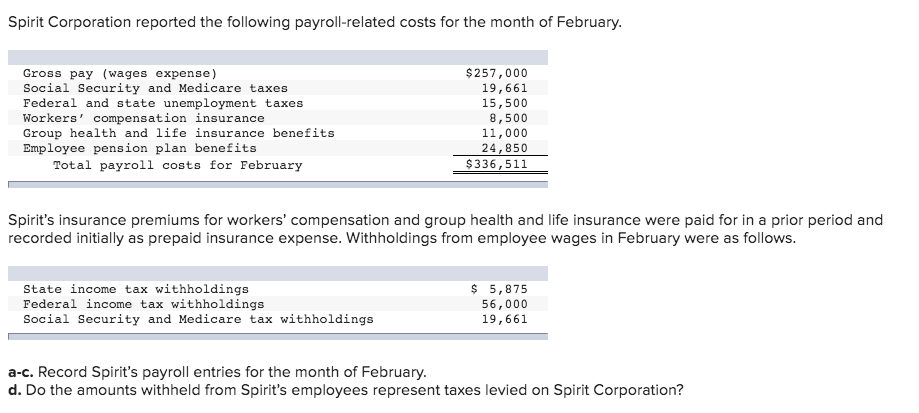

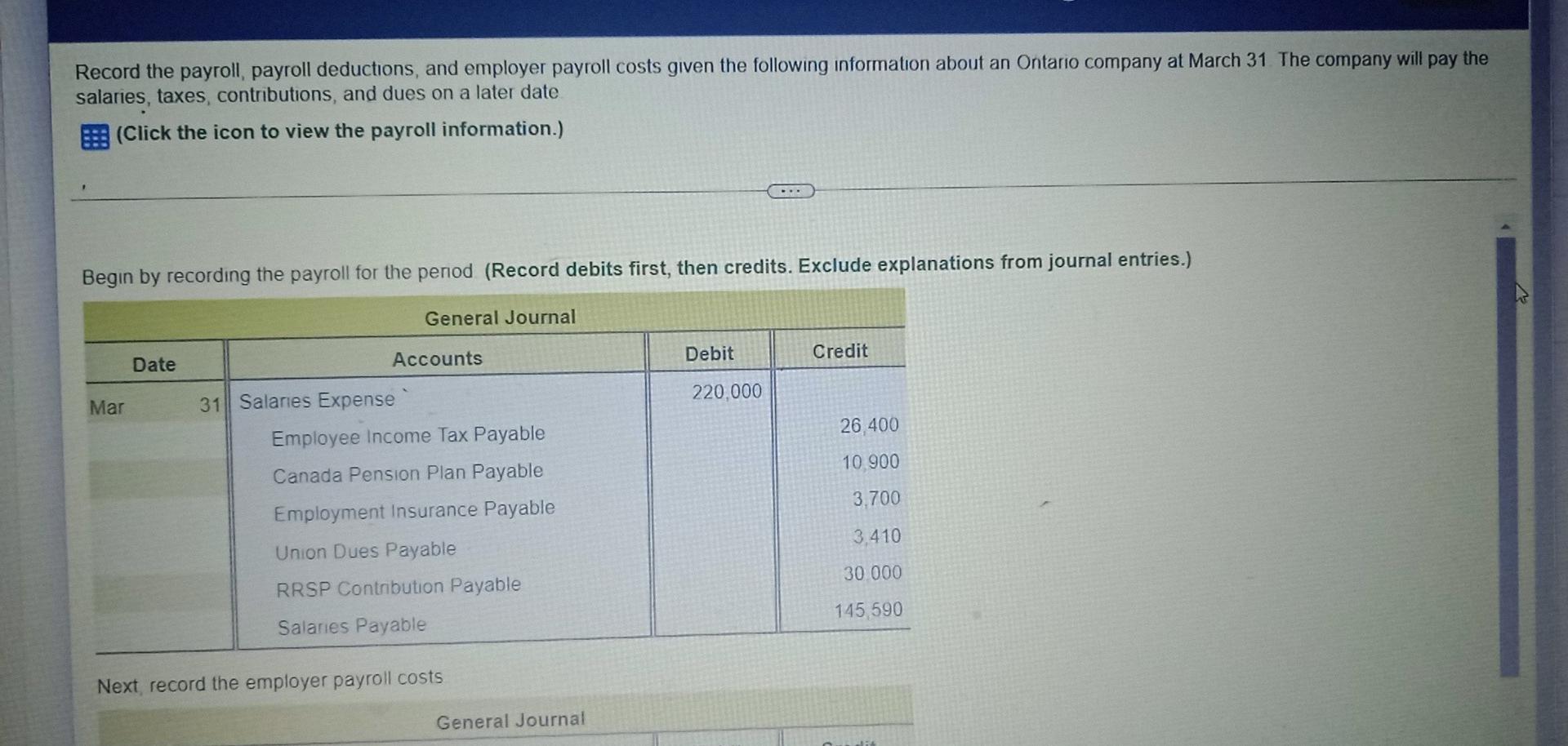

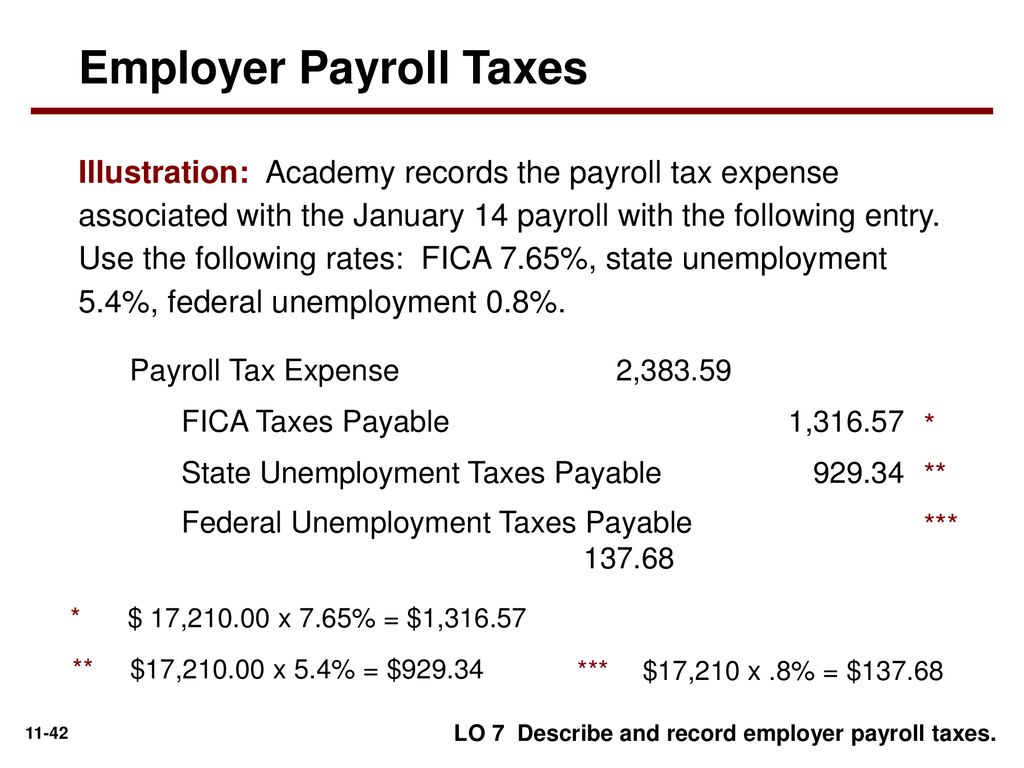

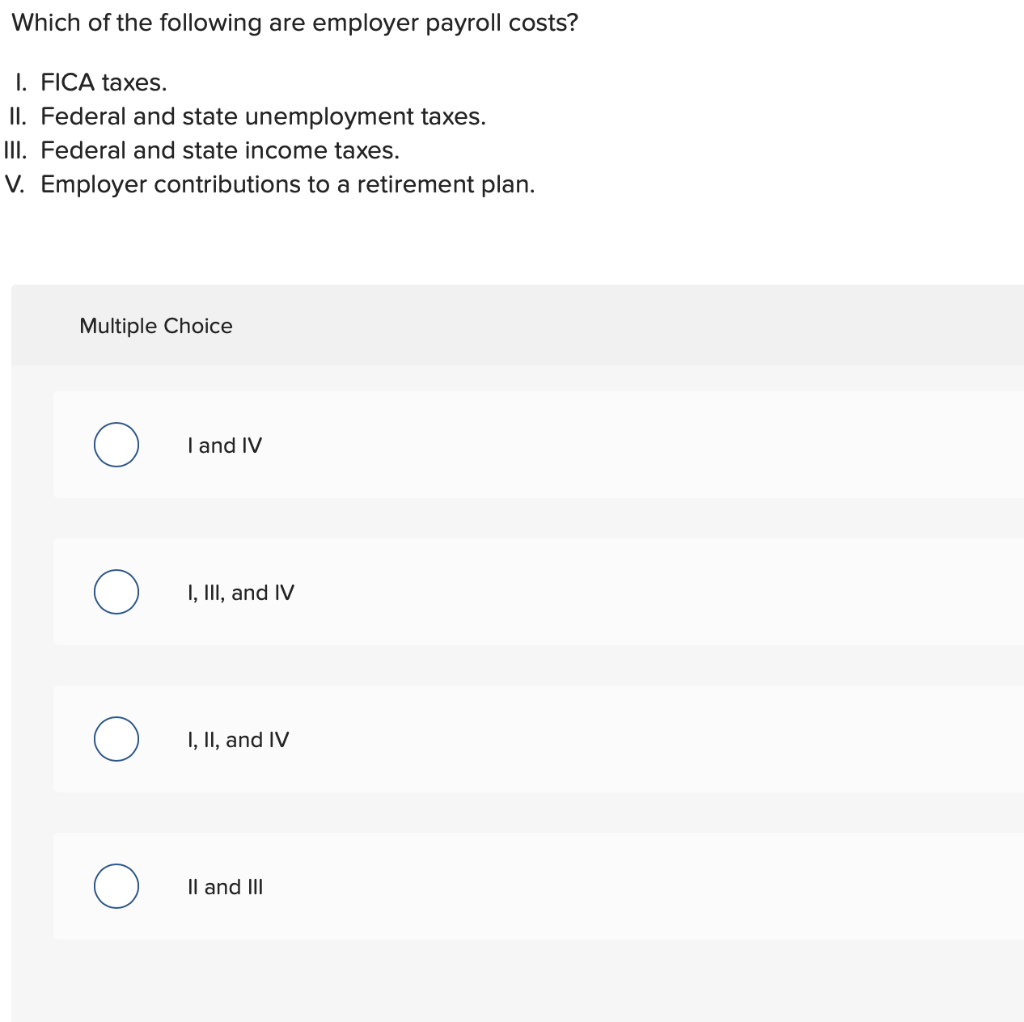

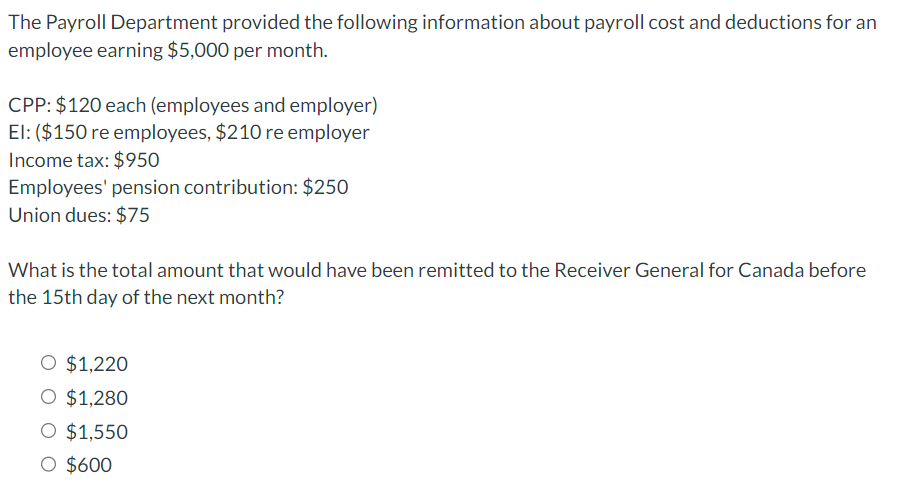

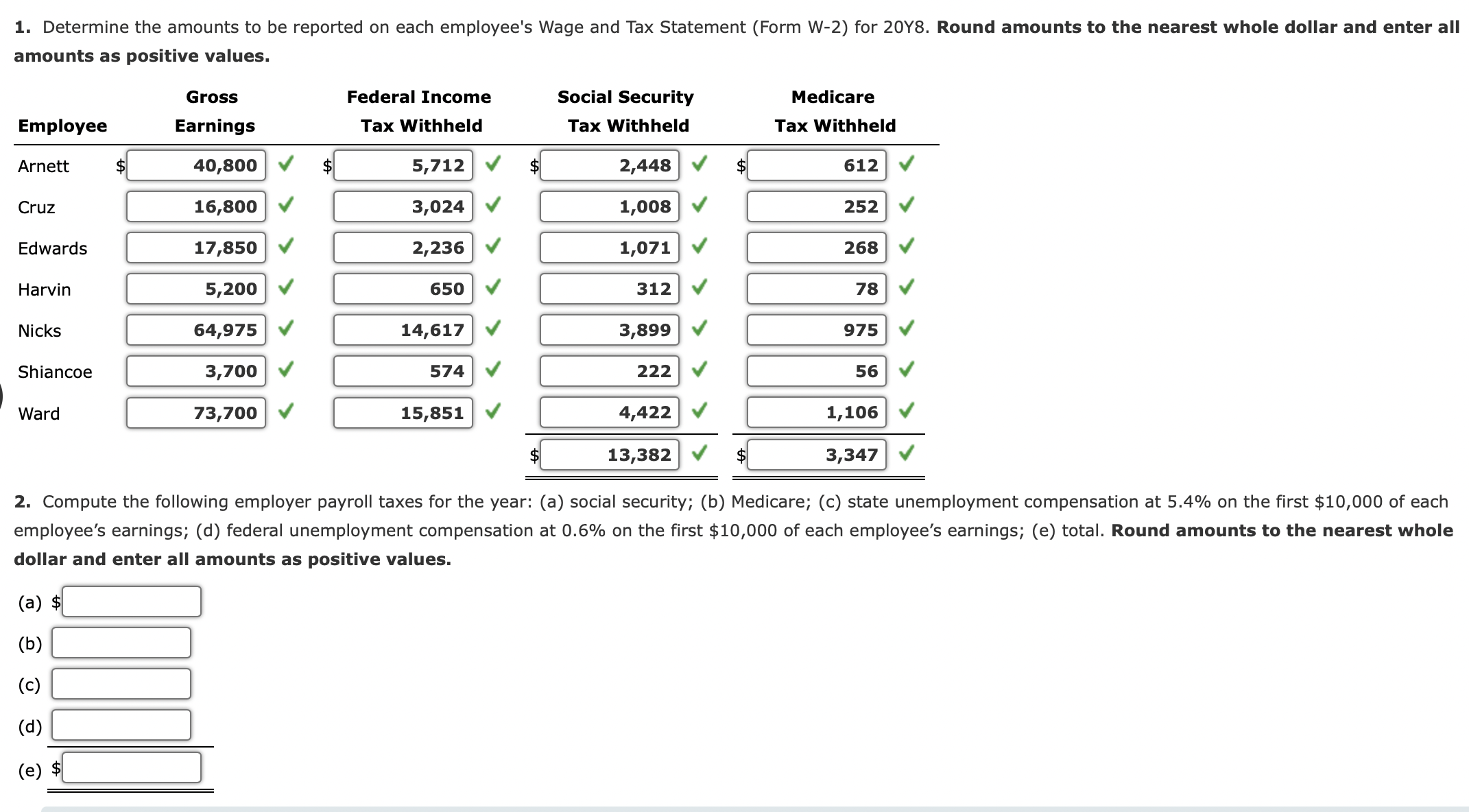

Payroll Taxes form a substantial portion of employer expenses. These are taxes levied on employers based on their payroll.

Federal Insurance Contributions Act (FICA) taxes, encompassing Social Security and Medicare taxes, are mandatory. Employers must match the employee's contributions.

Federal and state unemployment taxes (FUTA and SUTA) also fall under this category. These taxes fund unemployment benefits for eligible workers.

Beyond the Basics: Benefits and Other Expenses

Employee Benefits add another layer of cost. These can include health insurance, retirement plans (such as 401(k) contributions), life insurance, and disability insurance.

The employer's contribution to these benefits is considered part of payroll costs. Paid time off (PTO), including vacation time, sick leave, and holidays, also represents a significant expense.

Workers' Compensation Insurance is a mandatory insurance that covers medical expenses and lost wages for employees injured on the job. Premiums are paid by the employer.

This cost varies depending on the industry and the employer's safety record.

The Misconception: What Is *Not* an Employer Payroll Cost?

Determining what *doesn't* constitute a payroll cost is just as important as understanding what does. Certain expenses, while related to employees, are classified differently for accounting and tax purposes.

Identifying these distinctions is key to accurate financial management.

Expenses Related to Recruitment and Training

Recruitment Costs, such as advertising job openings, using recruitment agencies, and conducting background checks, are *not* considered direct payroll costs.

These are typically categorized as operating expenses or administrative expenses. Similarly, Training Costs, including the cost of training programs, materials, and instructors, are treated separately.

While essential for employee development, these expenses are not directly tied to payroll. However, the wages paid to employees during training *are* considered a payroll cost.

Expenses Associated with Facilities and Equipment

Office Supplies and Equipment used by employees are *not* payroll costs. These are classified as operating expenses.

The same applies to Rent, Utilities, and Other Facility Costs. Although employees utilize these resources, they are not directly tied to their compensation.

Legal and Professional Fees

Legal Fees related to employment lawsuits or compliance matters are *not* considered payroll costs. These expenses are generally categorized as legal expenses.

Similarly, Accounting Fees for payroll processing and tax preparation are often classified as administrative expenses, separate from direct payroll costs.

The Grey Area: Employee Perks

Certain employee perks can be tricky to categorize. Some perks, like company-provided meals or gym memberships, may be considered taxable benefits and included in the employee's taxable income, thus indirectly impacting payroll taxes.

However, the cost of providing these perks is not a direct payroll expense; instead, it is recorded as a separate benefit expense.

Why Accurate Classification Matters

Correctly classifying expenses is critical for several reasons. Accurate financial reporting is essential for compliance with accounting standards and tax regulations.

Misclassifying expenses can lead to errors in financial statements and potentially trigger audits or penalties. Furthermore, accurate cost analysis is vital for effective budgeting and resource allocation.

Understanding true payroll costs allows businesses to make informed decisions about staffing levels, compensation strategies, and benefit offerings.

Looking Ahead: The Evolving Landscape of Payroll Costs

The landscape of employer payroll costs is constantly evolving. Changes in legislation, such as increases in minimum wage or modifications to tax laws, can significantly impact payroll expenses.

The growing popularity of remote work arrangements also presents new challenges, including navigating different state and local tax regulations. Staying informed about these changes is essential for maintaining compliance and controlling costs.

Ultimately, a thorough understanding of what constitutes – and what *doesn't* constitute – an employer payroll cost is crucial for financial stability and sustained success. By focusing on accurate classification and diligent monitoring, businesses can navigate the complexities of payroll and ensure a healthy bottom line.

![Which Of The Following Is Not An Employer Payroll Cost Solved E10-3 Recording Payroll Costs [LO 10-2] McLoyd | Chegg.com](https://media.cheggcdn.com/study/e43/e4320075-c24c-457d-b99c-083366832a4d/image.png)