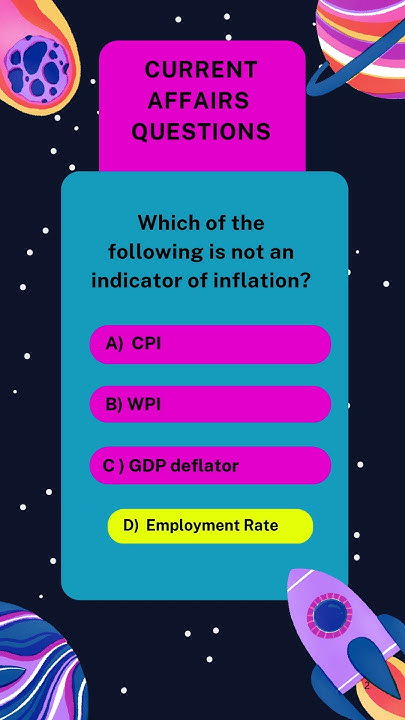

Which Of The Following Is Not An Indicator

The Bureau of Labor Statistics (BLS) recently released a clarification regarding indicators used to gauge economic health, causing ripples among economists and analysts. The statement specifically addressed common misconceptions surrounding lagging, leading, and coincident indicators, emphasizing the importance of using a holistic approach when assessing economic performance.

The central question at the heart of the announcement is: which metric is definitively not a reliable indicator on its own. This question prompted a closer examination of how various data points are interpreted and utilized.

What is the significance of this clarification? It highlights the pitfalls of relying solely on a single data point to understand the complex interplay of economic forces.

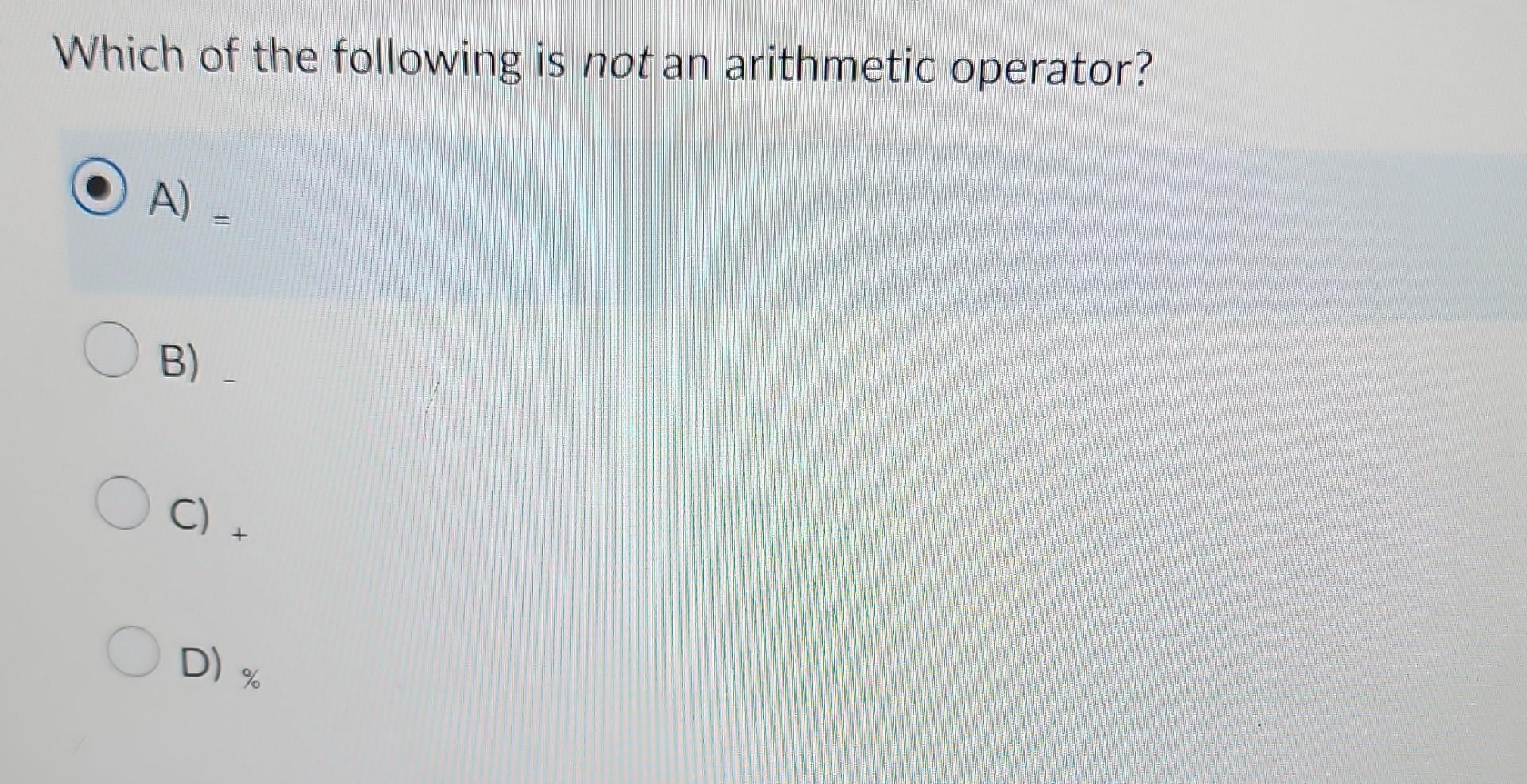

Understanding Economic Indicators

Economic indicators are statistics that provide insight into the current and future state of an economy. They are broadly categorized into three types: leading, coincident, and lagging.

Leading indicators, such as the stock market or new housing permits, tend to change before the economy as a whole does, offering a predictive glimpse into future economic activity.

Coincident indicators, like GDP or personal income, change in tandem with the overall economy, providing a snapshot of the current economic situation.

Lagging indicators, such as the unemployment rate or the consumer price index, change after the economy has already begun to follow a particular pattern, confirming trends that are already underway.

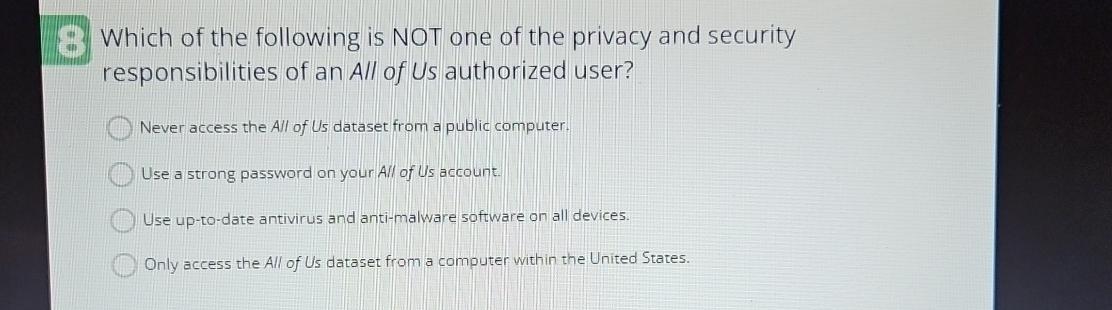

The Misconception: A Single Indicator's Sufficiency

The BLS statement specifically emphasized that no single indicator should be used in isolation to predict or assess economic health. This is because each indicator provides only a partial view, and can be influenced by factors unrelated to the broader economic trend.

For example, a surge in housing permits might be driven by a temporary dip in interest rates, not necessarily an overall optimistic outlook on the economy.

Relying solely on the unemployment rate, which is a lagging indicator, might lead to delayed policy responses, as it reflects past economic conditions rather than future prospects.

The BLS Clarification: Context is Key

The statement pointed out the potential for misinterpretation when indicators are viewed out of context. It strongly advocates for a multi-faceted approach.

“Analyzing economic data requires a comprehensive understanding of the underlying factors driving each indicator,” stated Dr. Anya Sharma, a senior economist at the BLS.

“Focusing on a single data point can lead to inaccurate conclusions and misguided policy decisions.”

Who is Impacted?

This clarification directly impacts a wide range of stakeholders. This includes economists, financial analysts, policymakers, and even the general public.

Investors need to be cautious when making investment decisions based on limited data.

Policymakers must consider a range of factors when formulating economic policy.

Potential Consequences of Misinterpretation

The potential consequences of misinterpreting economic indicators are significant. These consequences range from poor investment choices to ineffective government policies.

For instance, if policymakers solely rely on a booming stock market (a leading indicator) without considering other factors, they might prematurely tighten monetary policy, potentially hindering economic growth.

Conversely, if investors only focus on a low unemployment rate (a lagging indicator) without considering other warning signs, they might overinvest in risky assets, setting themselves up for potential losses.

The Human Angle: Real-World Impact

The impact of economic indicators extends beyond financial markets and government policies. They directly affect the lives of ordinary people.

For example, Sarah Chen, a small business owner, stated she tracks consumer confidence alongside several other data points to anticipate market trends.

She added that this practice helps her to decide on the best time to launch new products and adjust her marketing strategies.

Moving Forward: A Holistic Approach

The BLS’s clarification serves as a reminder of the complexity of economic analysis. It strongly recommends a more nuanced and holistic approach.

By considering a range of indicators, examining the underlying factors driving each indicator, and avoiding the temptation to rely solely on any single data point, analysts and policymakers can gain a more accurate understanding of the economic landscape and make more informed decisions.

The key takeaway is that economic analysis is not about finding the single “magic number” but about understanding the interplay of various forces.

![Which Of The Following Is Not An Indicator [ANSWERED] Which of the following is not an indicator of irrelevant](https://media.kunduz.com/media/sug-question-candidate/20230801012536206641-5032748.jpg?h=512)

![Which Of The Following Is Not An Indicator [MCQ] Which one of the following can be used as an acid–base indicator](https://d1avenlh0i1xmr.cloudfront.net/15795c7c-55fb-44ee-bb5a-116c3738bca4/indicators-of-acids-and-bases-teachoo.jpg)