Which Of The Following Is Not An Inventory

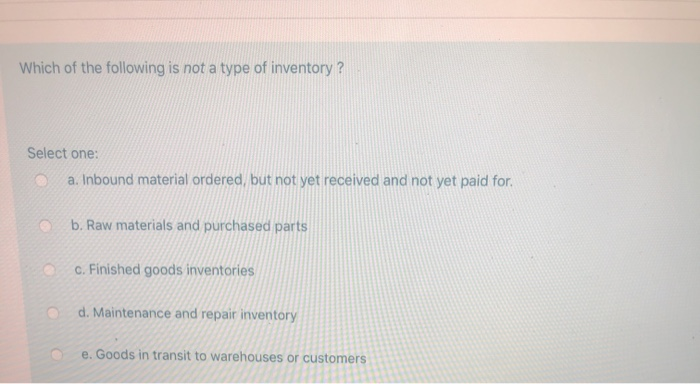

The seemingly simple question, "Which of the following is not an inventory?" can unlock a complex understanding of corporate finance and supply chain management. Misclassifying an item can have significant repercussions on a company's financial statements, tax obligations, and overall operational efficiency.

At its core, defining inventory isn't merely about what's physically on hand. It's about ownership, intent, and stage within the production or sales cycle. Understanding these nuances is critical for accurate accounting and strategic decision-making.

Defining Inventory: More Than Just Goods on Hand

Inventory, according to standard accounting principles, encompasses assets a company intends to sell to customers in the ordinary course of business. These are items actively held for sale, in the process of production for sale, or materials and supplies to be consumed in production.

The key differentiator lies in the intent to sell or use in production leading to a sale. Without this intention, an item doesn't qualify as inventory, regardless of its physical presence.

Common Misconceptions and Examples

One frequent area of confusion arises with fixed assets. Fixed assets, such as machinery or equipment used in production, are often physically located alongside inventory but are not intended for sale.

These assets are used to *create* the inventory, not to become inventory themselves. Similarly, land owned by a company, even if it houses a warehouse full of inventory, is not itself inventory.

Another crucial distinction lies with items held for internal use. Consider office supplies like paper and pens. These are expensed as incurred, not treated as inventory, because they are consumed internally and don't directly contribute to the creation of a product for sale.

Scrutinizing Specific Cases

Consider a manufacturing company. Raw materials like steel or plastic, work-in-progress items undergoing assembly, and finished goods ready for shipment are all clearly classified as inventory.

However, the molds used to shape the plastic, though essential to the production process, are not inventory. They represent a long-term investment in the production process, not items to be sold.

In a retail setting, goods displayed on shelves are undoubtedly inventory. The shopping carts used by customers, while crucial to the sales process, are not intended for sale and therefore are not classified as inventory.

The Role of Ownership

Ownership is a critical element in determining whether an item qualifies as inventory. If a company holds goods on consignment, where it displays and sells items owned by another party, those goods aren't considered the company's inventory.

The consignor retains ownership until the goods are sold to the end customer. Only goods the company legally owns and intends to sell are classified as inventory.

Similarly, goods in transit can present challenges. The terms of sale (e.g., FOB shipping point or FOB destination) dictate when ownership transfers, which directly impacts which party should classify the goods as inventory.

Impact on Financial Statements

The correct classification of inventory directly impacts a company's financial statements. Misclassifying fixed assets as inventory, for instance, could overstate current assets and distort key financial ratios.

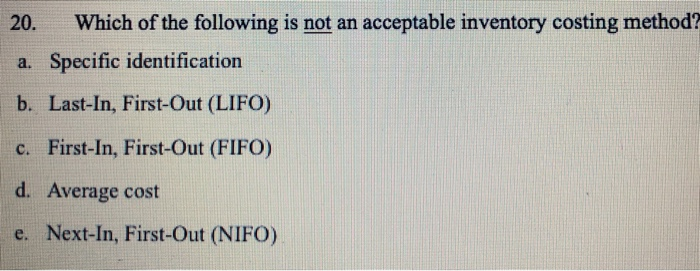

This can mislead investors and lenders, affecting their perception of the company's financial health. Furthermore, inventory is subject to various valuation methods (e.g., FIFO, LIFO, weighted average), each impacting the cost of goods sold and ultimately net income.

Therefore, inaccurate inventory classification can significantly skew profitability metrics. Tax implications also arise, as inventory is subject to specific tax regulations and reporting requirements.

Looking Ahead: Best Practices for Inventory Management

To ensure accurate inventory classification, companies should establish clear accounting policies and procedures. Regular physical inventory counts are crucial to reconcile book inventory with actual inventory on hand.

Implementing robust inventory management software can automate tracking and classification processes. Ongoing training for accounting and operations staff is essential to maintain a consistent understanding of inventory principles.

By adhering to these best practices, businesses can minimize errors in inventory classification, leading to more accurate financial reporting and informed decision-making. Ultimately, a clear understanding of what *doesn't* constitute inventory is just as vital as knowing what does.