Which Of The Following Is Not Considered An Asset

Confusion and misinformation are spreading rapidly online regarding what constitutes an asset, leading to potentially damaging financial decisions. The critical question sparking debate: Which of the following is not considered an asset?

Amidst escalating financial uncertainty, it's vital to understand the core principles of asset classification. A recent surge in online quizzes and social media polls has highlighted a significant knowledge gap, particularly concerning items with debatable or perceived value.

Defining Assets: The Core Principles

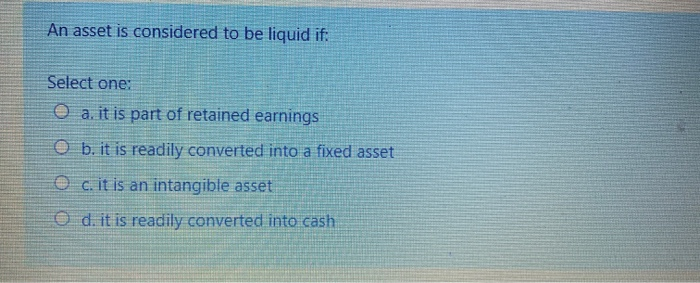

An asset, in financial terms, is generally defined as something that has economic value and is expected to provide future benefit. This benefit can take many forms, including generating income, appreciating in value, or providing a service.

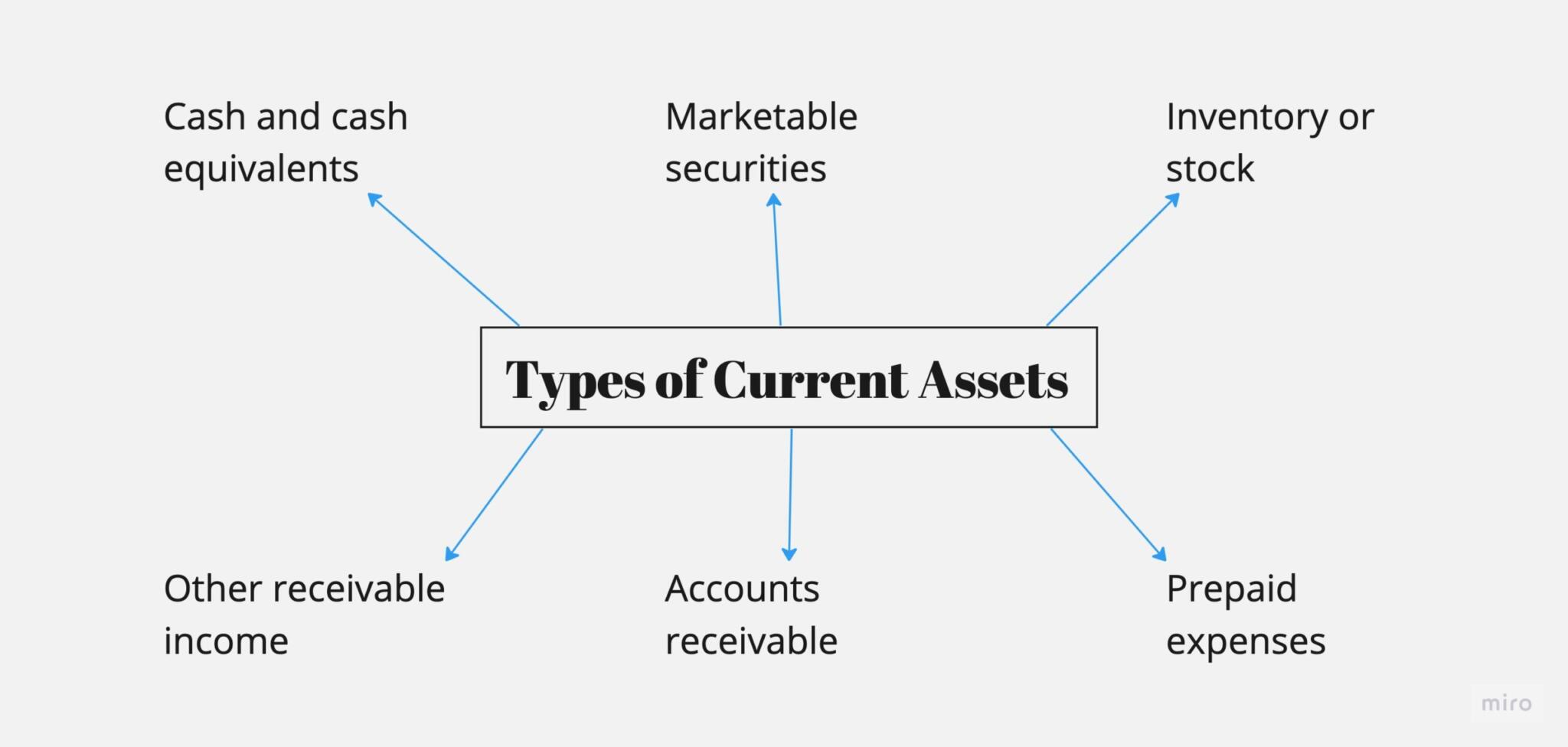

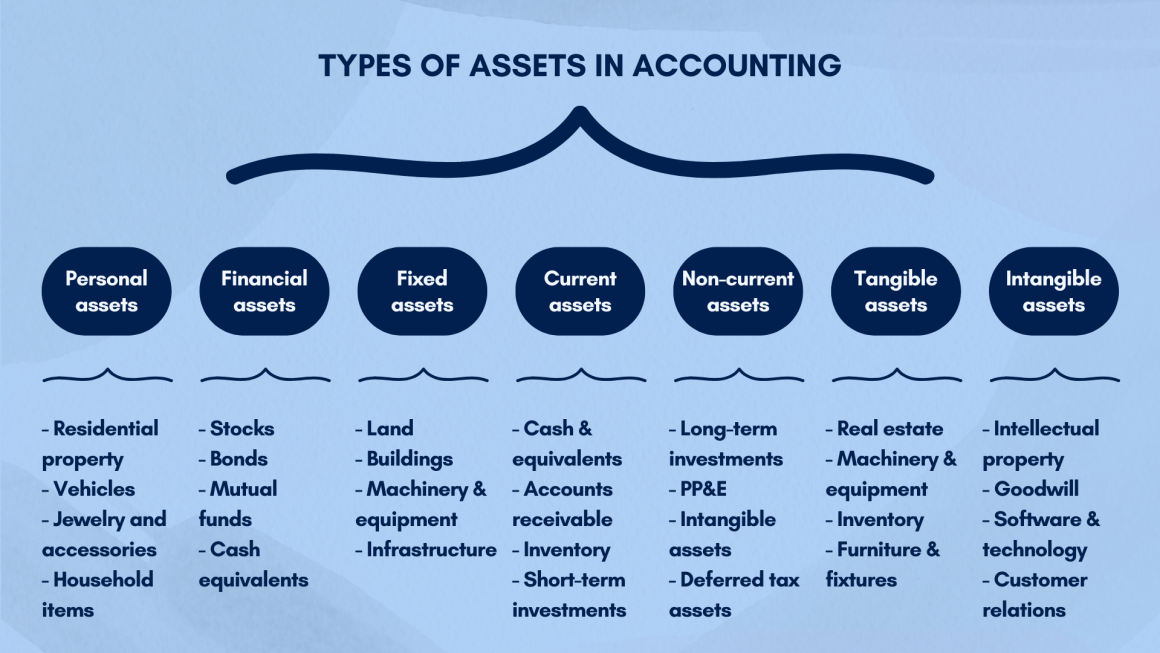

Common Asset Categories

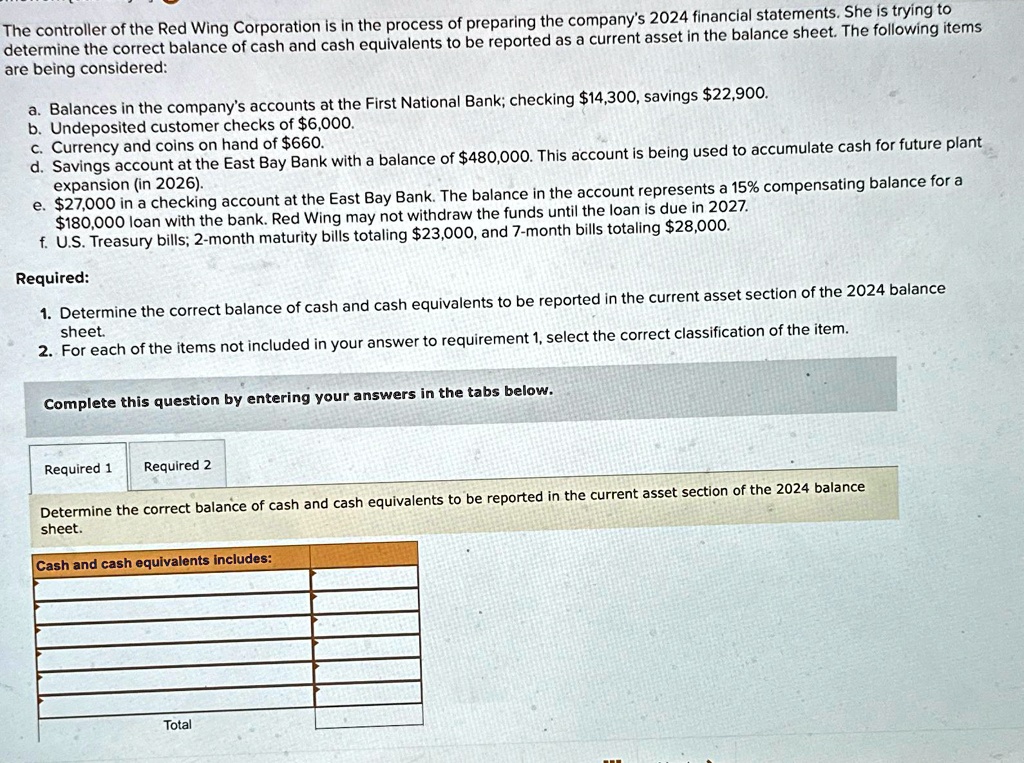

Traditional asset categories include cash, accounts receivable, real estate, stocks, bonds, and intellectual property. These assets are usually easily convertible to cash or contribute directly to a business's or individual's financial well-being.

Tangible assets are physical items like property, plant, and equipment (PP&E). Intangible assets lack physical form but hold value, such as patents or trademarks.

The Misconception: Liabilities vs. Assets

The current confusion stems from mistaking liabilities and expenses for assets. A liability is an obligation to pay someone else money or provide a service in the future, directly opposing the concept of an asset.

For example, a loan is a liability for the borrower, not an asset. Similarly, expenses like rent or utilities, while necessary for operation, do not represent future economic benefit and are not categorized as assets.

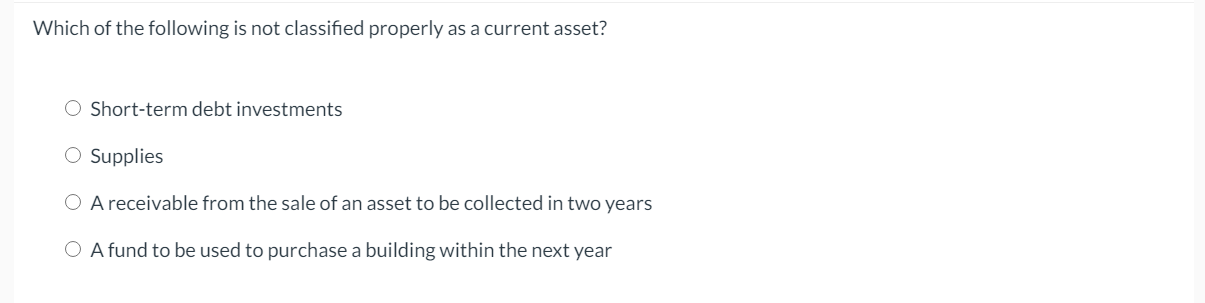

The Key Question: Identifying Non-Assets

Often, the question "Which of the following is not an asset?" presents a list including options like: cash, accounts receivable, a mortgage, and inventory. The correct answer in this scenario is almost always the mortgage.

A mortgage is a loan taken to purchase a property; it's a debt obligation. While the property itself is an asset, the mortgage is a liability against that asset.

Data Reveals Knowledge Gaps

A recent survey conducted by the National Financial Literacy Council (NFLC) revealed that 37% of respondents incorrectly identified a mortgage as an asset. This highlights a significant need for improved financial education, especially concerning fundamental concepts.

The NFLC's data, collected from a sample of 1,500 adults across the United States, points to widespread misunderstanding. The survey also indicated that younger adults (ages 18-34) struggled more with asset identification than older demographics.

Beware of Misleading Information

The internet is rife with inaccurate financial advice, contributing to the current confusion. Social media influencers and unverified sources often oversimplify or misrepresent complex financial concepts.

Consumers are urged to seek information from reputable sources, such as certified financial planners (CFPs) and accredited financial institutions. Reliance on unverified information can lead to costly mistakes.

Expert Commentary

“It's crucial to differentiate between what you own and what you owe,” stated Dr. Anya Sharma, a professor of finance at the University of California, Berkeley. “Confusing liabilities with assets can severely distort your financial picture and lead to poor investment decisions.”

John Miller, a certified financial planner at Miller & Associates, emphasizes the importance of a clear understanding. "Accurate asset identification is the foundation of sound financial planning. Without it, you're essentially building on sand.”

Moving Forward: Improving Financial Literacy

Increased financial education initiatives are urgently needed to address the current knowledge gap. Schools, community organizations, and government agencies all have a role to play in promoting financial literacy.

The NFLC is launching a national campaign to improve financial literacy through online resources and community workshops. Individuals are encouraged to seek out these resources to enhance their understanding of asset management and financial planning.

Individuals need to carefully evaluate financial information before acting. Seek professional advice and consult multiple sources to ensure accuracy and avoid costly errors.

![Which Of The Following Is Not Considered An Asset [Solved] Common categories of a classified balance | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/04/660a5f0c399e9_724660a5f0c361ff.jpg)