Which Of The Following Is True About Corporate Ownership

Imagine a bustling city, a vibrant tapestry of businesses interwoven like threads in a grand design. From the corner bakery with its warm, yeasty aroma to the towering skyscraper housing a multinational corporation, each entity plays a part in the economic symphony. But who truly owns these enterprises? The answer, it turns out, is far more nuanced than a simple name on a deed.

This article delves into the complexities of corporate ownership, clarifying common misconceptions and exploring the diverse structures that define who controls the assets, profits, and direction of a company. Understanding these structures is crucial for investors, employees, and anyone interested in the inner workings of the modern economy.

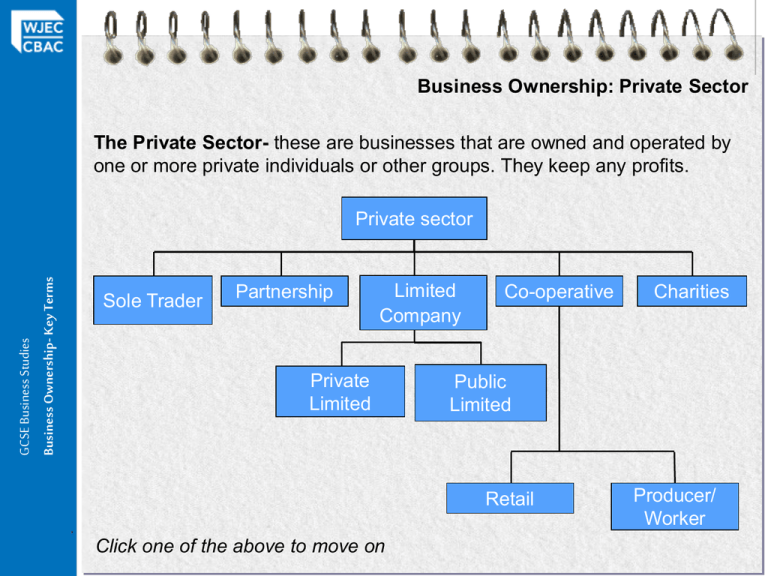

The Foundation: Understanding Corporate Structures

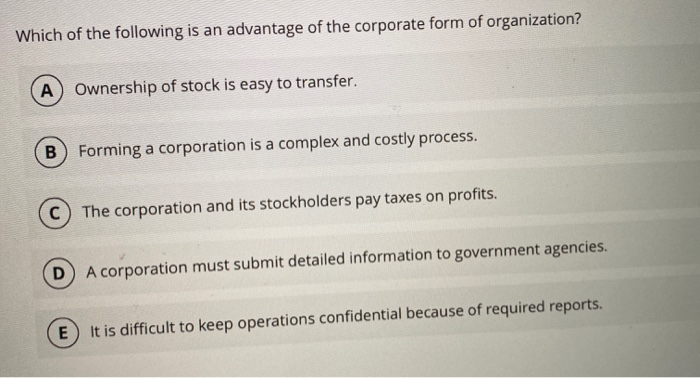

Before we can dissect ownership, it's essential to grasp the basic building blocks of corporate structure. The most common forms include sole proprietorships, partnerships, limited liability companies (LLCs), and, of course, corporations. Each offers varying levels of liability protection and impacts how ownership is defined and managed.

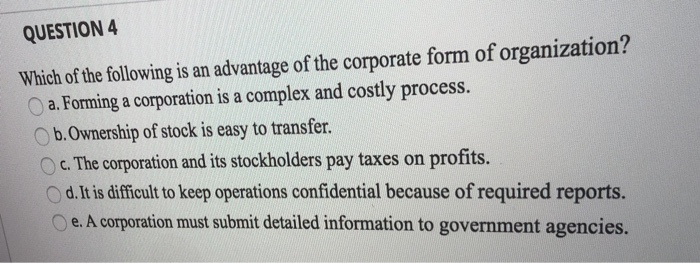

For instance, in a sole proprietorship, the business and the owner are legally one and the same. All profits belong directly to the owner, but so does all liability. Contrast this with a corporation, which is treated as a separate legal entity, shielding the owners (shareholders) from personal liability for the company's debts and obligations.

The Role of Shareholders

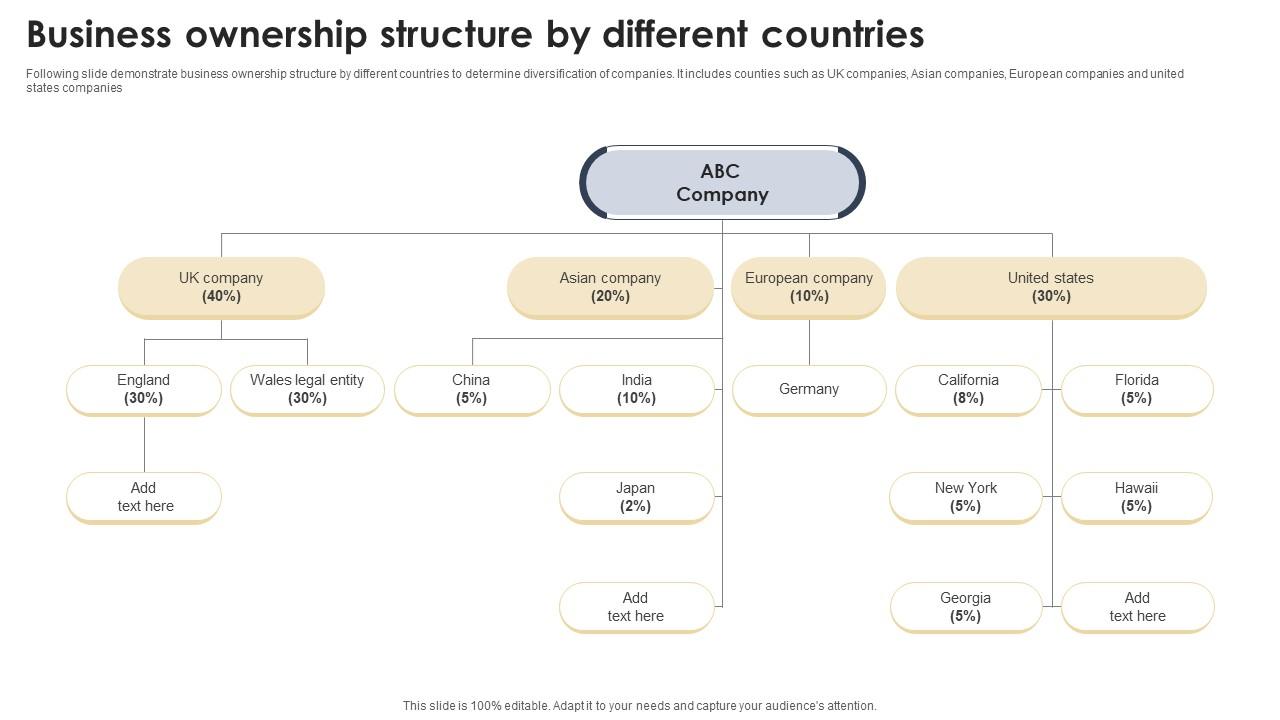

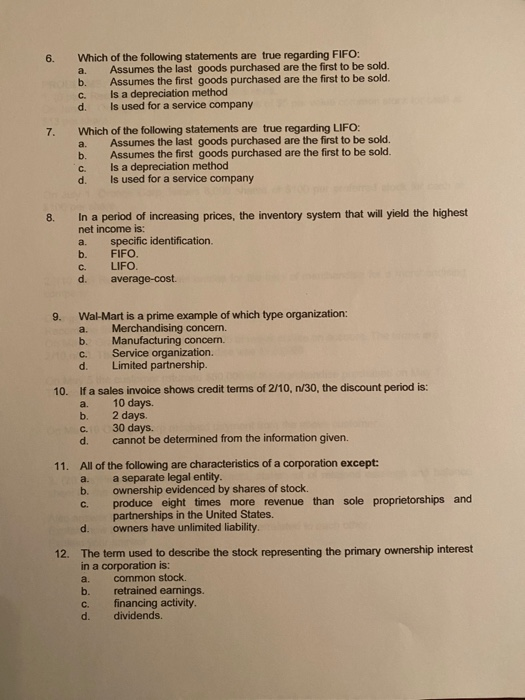

When discussing corporate ownership, the concept of shareholders is paramount. Shareholders own stock in the company, representing a proportional claim on its assets and earnings. These shares can be either privately held or publicly traded on stock exchanges.

The more shares an individual or entity owns, the greater their influence over the company's decisions. This influence can manifest in voting rights on important matters, such as electing board members and approving mergers or acquisitions.

However, it's crucial to remember that shareholders are not directly responsible for the day-to-day operations of the company. This responsibility lies with the board of directors and the executive management team, who are accountable to the shareholders.

Public vs. Private Ownership: A Key Distinction

A fundamental distinction in corporate ownership lies between publicly traded and privately held companies. Publicly traded companies, like Apple or Microsoft, offer shares for sale to the general public on stock exchanges.

This allows for widespread ownership and increased access to capital, but it also brings greater regulatory scrutiny and reporting requirements. The Securities and Exchange Commission (SEC) in the United States, for example, mandates detailed financial disclosures from publicly traded companies to protect investors.

Privately held companies, on the other hand, do not offer shares to the public. Ownership is typically concentrated among a smaller group of individuals, families, or private equity firms. This structure allows for greater control and flexibility, but it also limits access to capital and can make it harder to attract top talent.

The Influence of Institutional Investors

Beyond individual shareholders, institutional investors play a significant role in shaping corporate ownership. These include mutual funds, pension funds, insurance companies, and hedge funds, which manage large pools of capital on behalf of others.

Due to the sheer size of their holdings, institutional investors wield considerable influence over corporate governance. They can actively engage with management to advocate for changes in strategy, executive compensation, or environmental and social policies.

Moreover, the voting power of institutional investors can be decisive in shareholder votes on key issues. Their involvement can promote greater accountability and transparency, but it also raises questions about potential conflicts of interest and the impact of short-term investment horizons.

Beyond Stocks: Other Forms of Ownership

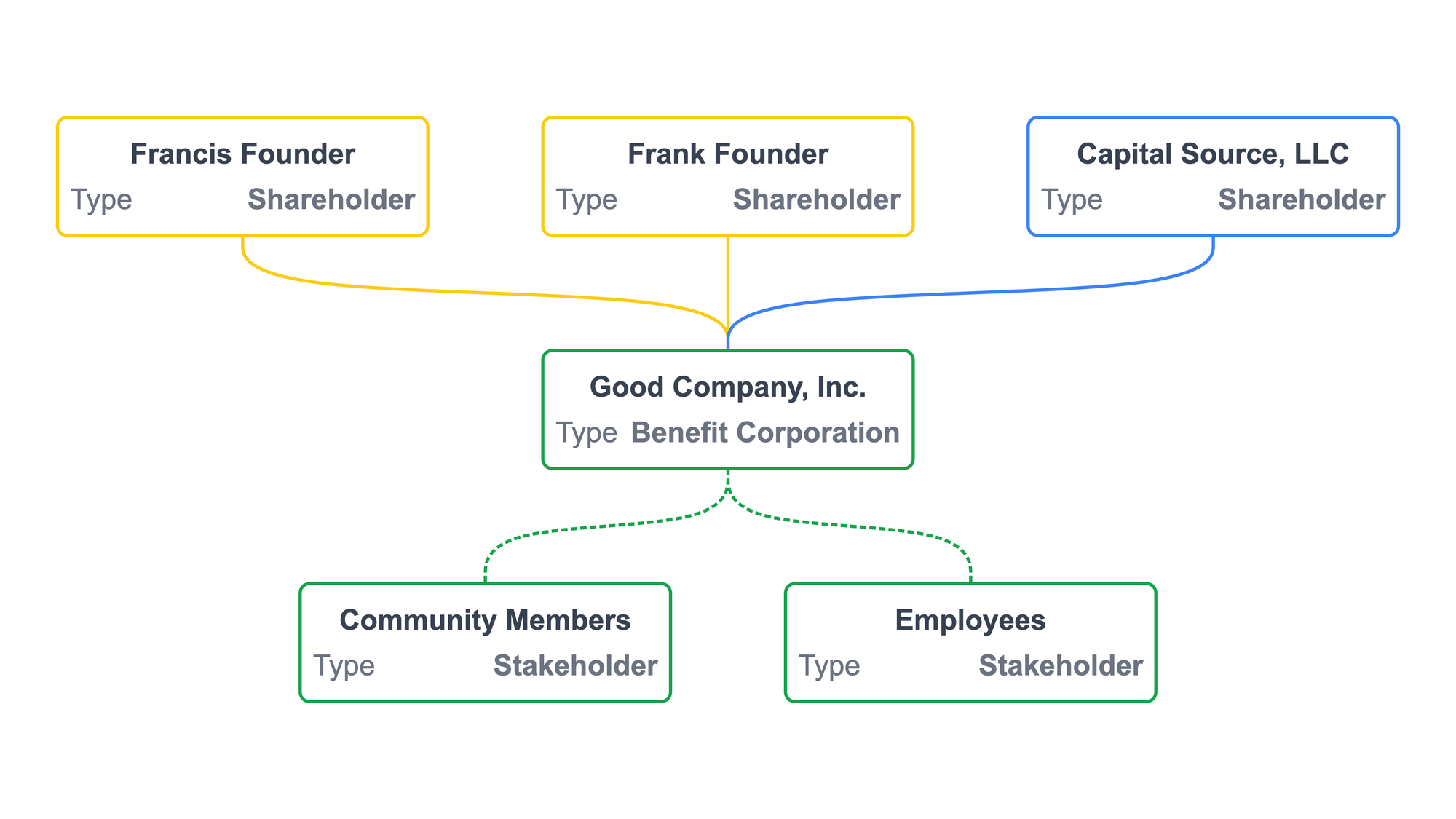

While stock ownership is the most common form of corporate ownership, it's not the only one. Other avenues include partnerships, employee stock ownership plans (ESOPs), and cooperative ownership models.

Partnerships involve two or more individuals who agree to share in the profits or losses of a business. Ownership is typically defined by the partnership agreement, which outlines the roles, responsibilities, and equity stakes of each partner.

ESOPs, on the other hand, offer employees an opportunity to own stock in their company, aligning their interests with those of the shareholders. This can boost employee morale, productivity, and retention, but it also requires careful planning and regulatory compliance.

Cooperative ownership models, prevalent in sectors like agriculture and consumer goods, empower members to collectively own and control the business. This fosters a sense of community and shared responsibility, but it can also present challenges in decision-making and capital allocation.

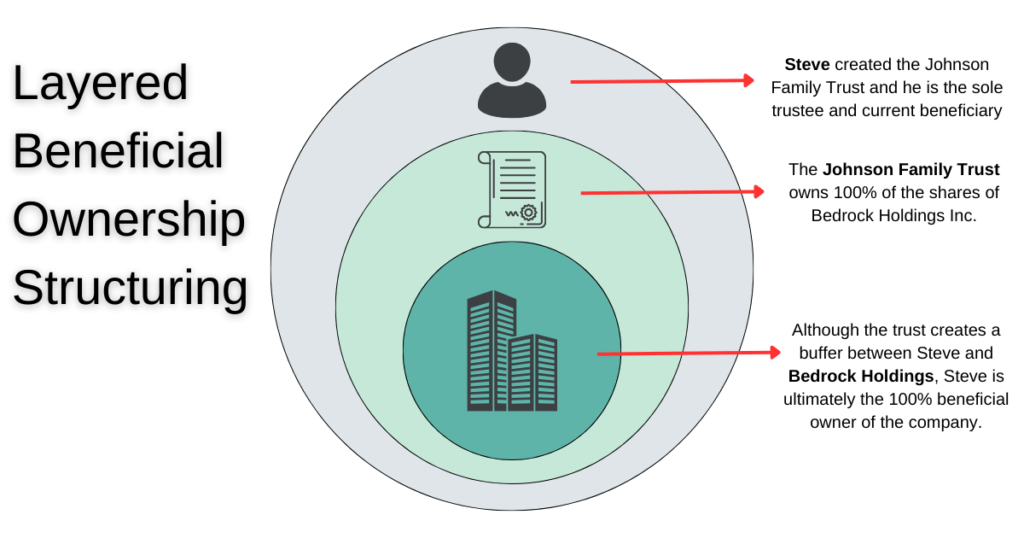

The Rise of Beneficial Ownership Transparency

In recent years, there has been a growing push for greater transparency in beneficial ownership. This refers to the individuals who ultimately own or control a company, even if their names are not directly listed on official documents.

"Cracking down on anonymous shell companies and requiring disclosure of beneficial ownership information is essential to combat money laundering, tax evasion, and other illicit activities."

These measures aim to prevent the use of shell companies and other opaque structures to conceal illicit funds and evade taxes. Increased transparency can promote fairer competition, reduce corruption, and strengthen the integrity of the financial system.

Ownership and Corporate Social Responsibility

The question of corporate ownership is inextricably linked to corporate social responsibility (CSR). Shareholders, as owners, have a vested interest in the long-term sustainability and ethical conduct of the company.

Increasingly, investors are considering environmental, social, and governance (ESG) factors when making investment decisions. They are seeking companies that prioritize sustainability, diversity, and ethical business practices.

This trend is driving companies to adopt more responsible business models and to engage with stakeholders on issues of concern. It also highlights the growing recognition that corporate ownership entails not only financial rights but also social responsibilities.

The Future of Corporate Ownership

The landscape of corporate ownership is constantly evolving. The rise of digital platforms, decentralized technologies, and new ownership models is reshaping the way businesses are structured and controlled.

Crowdfunding, for example, allows individuals to invest small amounts of capital in early-stage ventures, democratizing access to ownership opportunities. Blockchain technology has the potential to facilitate more transparent and efficient ownership transfers.

As we move forward, it's essential to adapt our understanding of corporate ownership to these new realities. This requires a commitment to transparency, accountability, and responsible business practices.

Ultimately, the true essence of corporate ownership lies not just in possessing shares or assets, but in embracing the responsibilities that come with them. By fostering a culture of stewardship and ethical conduct, we can ensure that corporations contribute to a more equitable and sustainable future for all.