Which Of The Following Is True Of Internal Control

The collapse of Enron, the WorldCom scandal, and numerous other corporate failures at the start of the 21st century shone a harsh light on the importance of robust internal controls. These events underscored the devastating consequences of inadequate oversight and fraudulent financial reporting, prompting regulatory reforms and a renewed focus on ensuring the reliability and integrity of financial information.

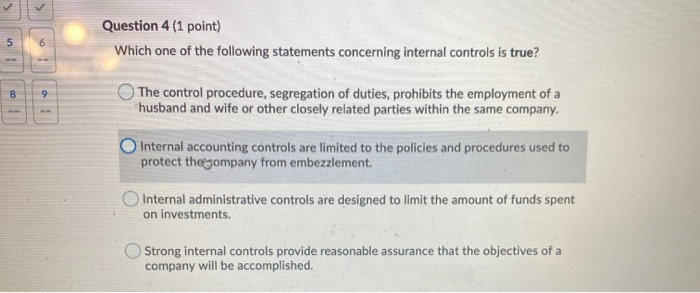

But what exactly constitutes effective internal control? Defining what is true about internal control is more complex than it appears at first glance. This article delves into the core elements of internal control, examining its purpose, key components, limitations, and the responsibilities of various stakeholders, all while considering the evolving landscape of corporate governance and risk management.

The Core of Internal Control

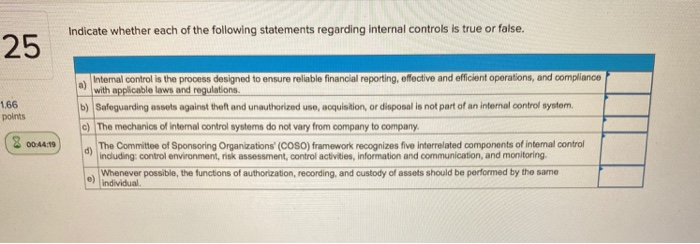

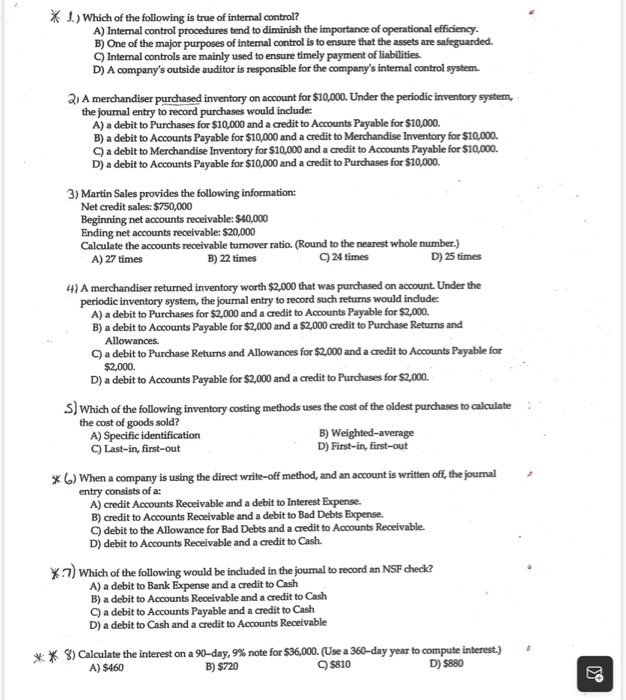

At its heart, internal control is a process designed to provide reasonable assurance regarding the achievement of an entity's objectives relating to operations, reporting, and compliance. The Committee of Sponsoring Organizations (COSO) framework, widely recognized as the leading framework for designing, implementing, and evaluating internal control, defines it as such. Its definition focuses on the process that helps businesses achieve their goals.

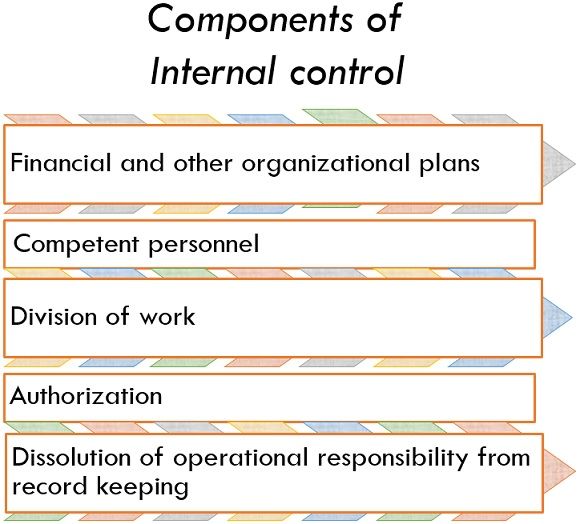

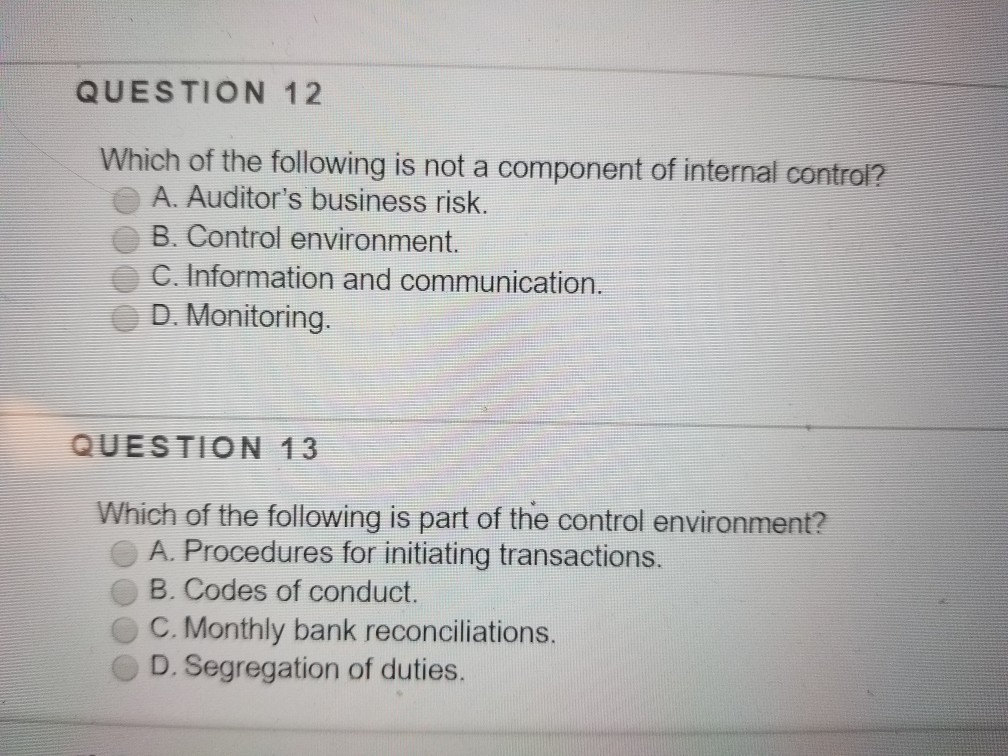

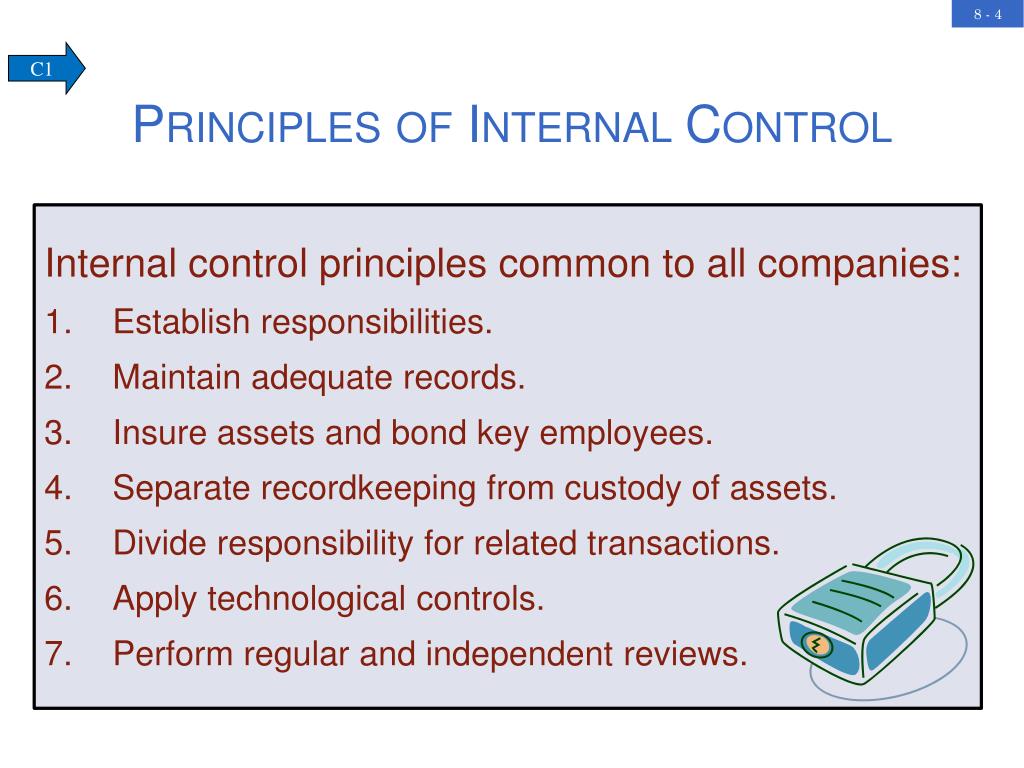

COSO identifies five integrated components of internal control: control environment, risk assessment, control activities, information and communication, and monitoring activities. These components work together in an integrated manner to manage risks and achieve organizational objectives. Effective internal control requires these elements to be present and functioning effectively.

The Five Components Explained

The control environment sets the tone of an organization, influencing the control consciousness of its people. It is the foundation for all other components of internal control, providing discipline and structure. A strong control environment includes integrity and ethical values, commitment to competence, board of directors and audit committee participation, management's philosophy and operating style, organizational structure, assignment of authority and responsibility, and human resource policies and practices.

Risk assessment involves identifying and analyzing relevant risks to the achievement of the entity's objectives, forming a basis for determining how the risks should be managed. Management should establish objectives, categorized into operations, reporting, and compliance, and then identify and assess the risks to achieving these objectives. Risk assessment is forward-looking and helps the organization anticipate and adapt to change.

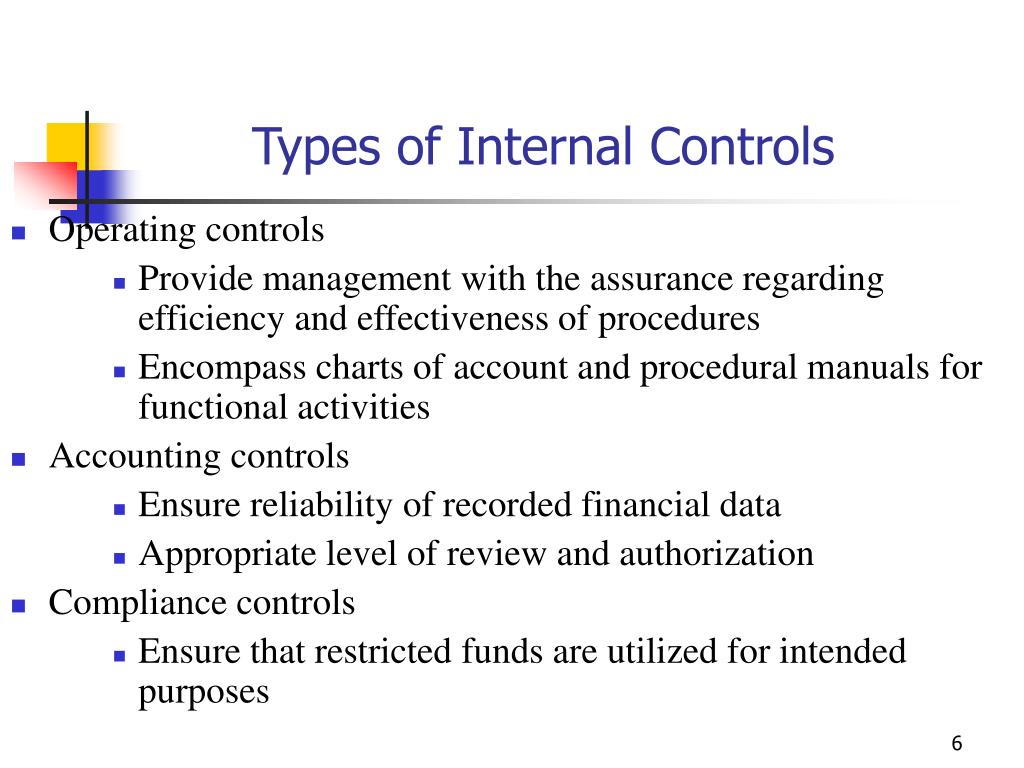

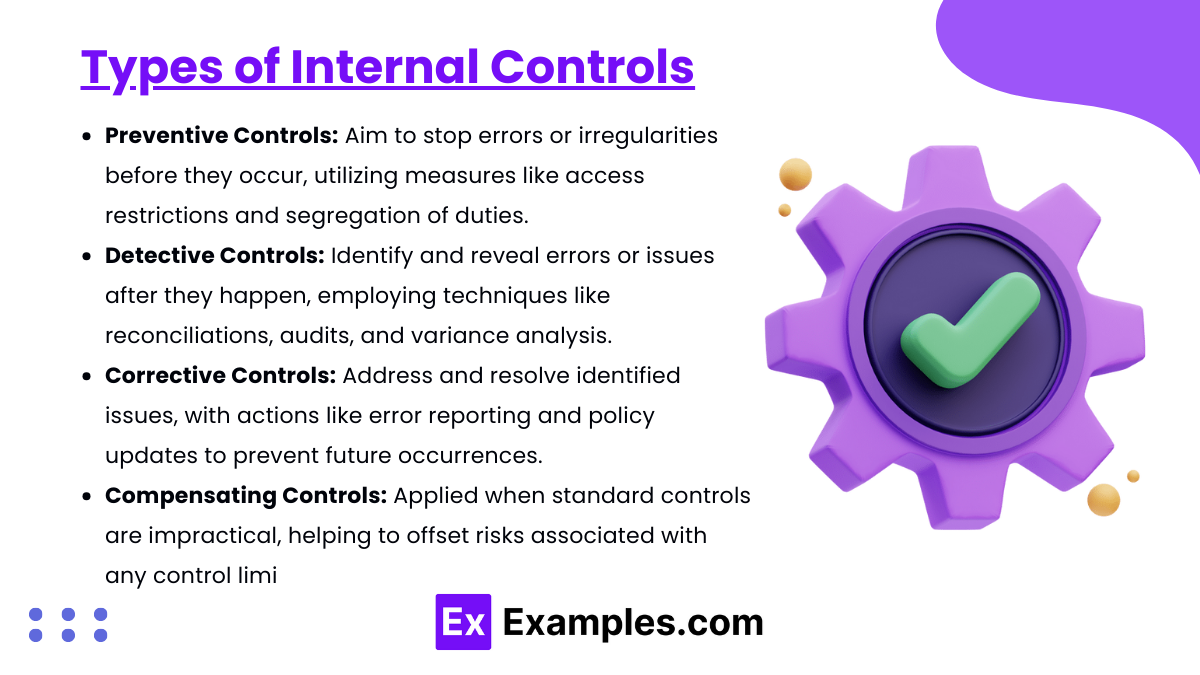

Control activities are the actions established through policies and procedures that help ensure that management directives to mitigate risks to the achievement of objectives are carried out. These activities occur at all levels and functions of the organization. They include approvals, authorizations, verifications, reconciliations, reviews of operating performance, and security of assets.

Information and communication are essential for enabling the organization to carry out its internal control responsibilities. Information systems produce reports, containing operational, financial and compliance-related information, that make it possible to run and control the business. Communication is necessary internally and externally to provide information needed to carry out day-to-day controls.

Monitoring activities are ongoing evaluations, separate evaluations, or some combination of the two used to ascertain whether each of the five components of internal control are present and functioning. Ongoing evaluations are built into the normal, recurring activities of an entity. Separate evaluations are conducted periodically to provide a focused assessment of internal control.

What Internal Control Is NOT

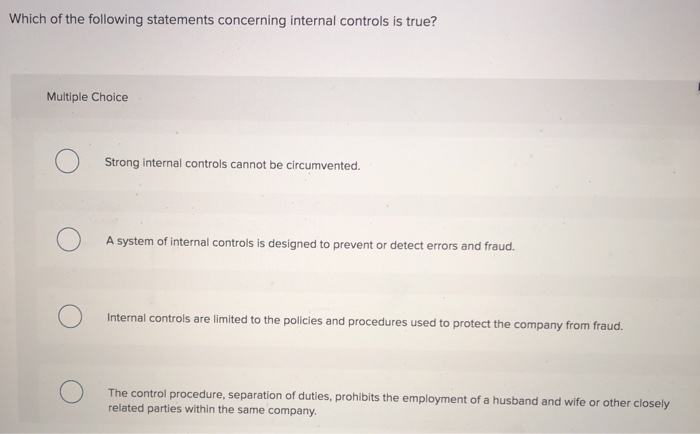

It is crucial to understand what internal control is *not*. Internal control is *not* a guarantee that an organization will achieve its objectives. It only provides reasonable assurance, not absolute assurance, because of inherent limitations. These limitations include the possibility of human error, faulty judgment, collusion, and management override.

Internal control is also *not* a substitute for good management. It is a tool that management uses to help it achieve its objectives, but it does not replace the need for sound judgment and effective leadership. A culture of ethics is crucial.

Responsibilities for Internal Control

Everyone in an organization has a role to play in internal control. Management is responsible for designing, implementing, and maintaining an effective system of internal control. The board of directors provides oversight of management's responsibilities for internal control. Internal auditors play a crucial role by independently evaluating the effectiveness of the system of internal control.

External auditors also assess internal control as part of their financial statement audits. While their primary responsibility is to express an opinion on the fairness of the financial statements, they also communicate any significant deficiencies or material weaknesses in internal control to management and the audit committee. Auditors should exercise due care and professional skepticism.

The Evolving Landscape

The digital age presents new challenges and opportunities for internal control. The rise of cloud computing, artificial intelligence, and other emerging technologies requires organizations to adapt their internal controls to address new risks. Cyber security has become one of the most critical aspects of internal control, as organizations face increasing threats from cyberattacks and data breaches.

Furthermore, the increasing complexity of business operations and the globalization of markets require organizations to implement more sophisticated internal control systems. Organizations must also consider regulatory changes, such as the Sarbanes-Oxley Act (SOX), which requires public companies to maintain effective internal control over financial reporting.

Conclusion

Understanding what is true about internal control is vital for organizations seeking to achieve their objectives, maintain the integrity of their financial information, and comply with applicable laws and regulations. Effective internal control is not a one-time fix but an ongoing process that requires continuous monitoring and improvement. By embracing the principles of internal control and adapting to the evolving landscape, organizations can enhance their resilience, protect their assets, and build trust with stakeholders.

As businesses continue to grapple with ever-increasing risks and complexities, internal control will remain a critical element of corporate governance and risk management. Emphasizing the role of ethics and compliance is very important. The ability to adapt and improve in light of new challenges will separate successful organizations from those vulnerable to fraud, error, and failure.