Which Of The Following Phrases Refers To The Fees

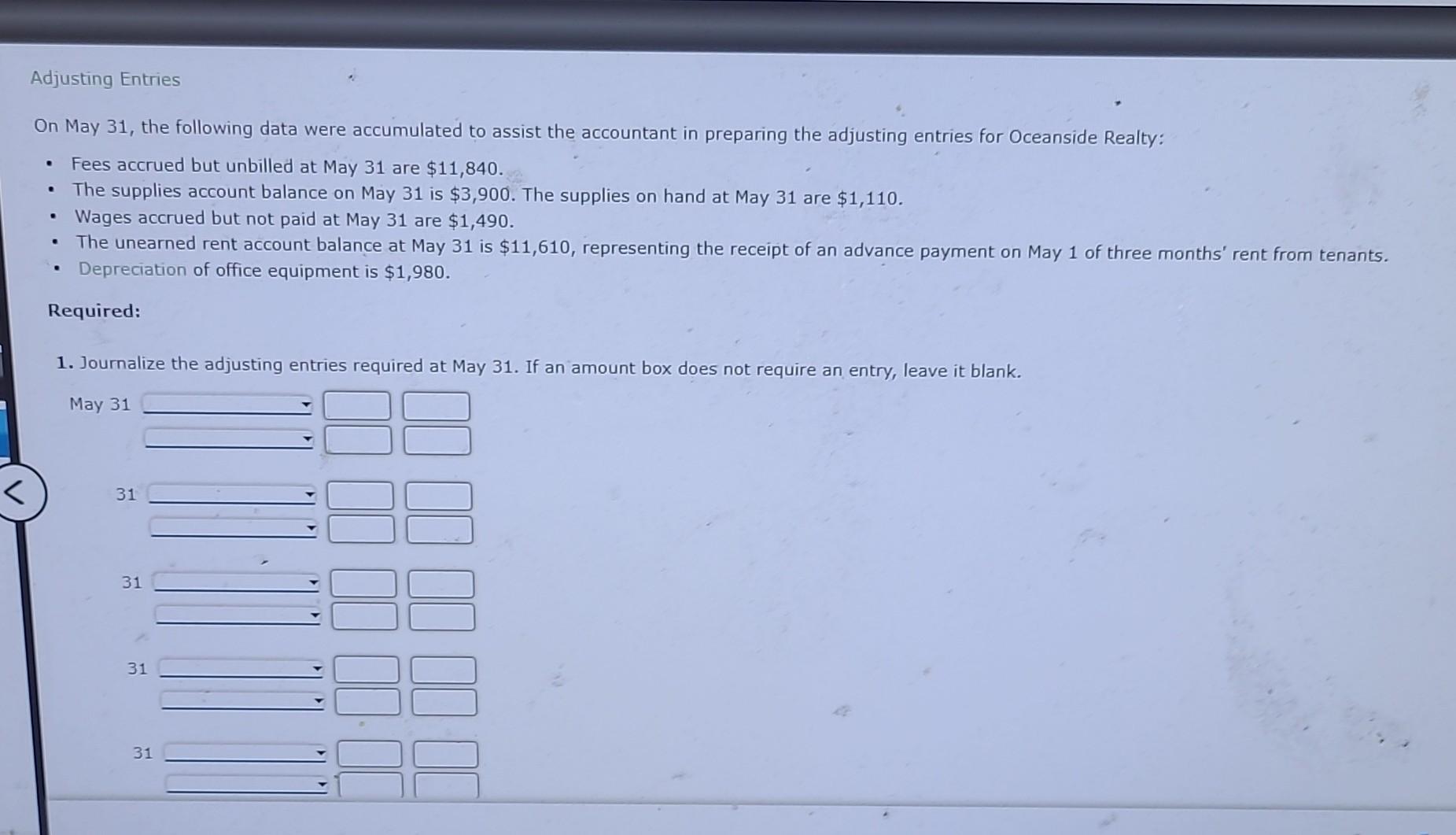

Confusion and outrage are mounting as consumers grapple with hidden and ambiguously labeled charges on their bills. The central question: which of the following phrases *actually* refers to unavoidable fees?

This article dissects the deceptive language used by companies to mask mandatory charges, empowering consumers to identify and challenge these hidden costs. We'll cut through the jargon and clarify the reality behind these fees.

Decoding the Fee Jungle

The battleground for consumer dollars is often fought with words. Companies frequently use misleading terms to disguise mandatory fees, making it difficult for customers to understand the true cost of a service or product.

Consider these common examples:

"Service Charge"

A "service charge" may sound optional, like a tip. But often, it's a mandatory fee tacked onto the bill, covering operational costs. This is especially prevalent in restaurants and hospitality.

"Administrative Fee"

The vague "administrative fee" is a popular culprit. It rarely reflects actual administrative work directly benefiting the customer, serving instead as a pure profit booster.

"Processing Fee"

Transaction-based services often deploy the "processing fee". This fee supposedly covers the cost of processing payments. However, it can be disproportionately high.

"Convenience Fee"

Paying online or through a specific method may trigger a "convenience fee". The irony is often lost on customers already inconvenienced by the initial payment process. Why the extra cost?

"Regulatory Recovery Fee"

More opaque, the "regulatory recovery fee" claims to offset costs associated with complying with regulations. But it’s difficult to verify its legitimacy, shielding companies from scrutiny.

"Shipping and Handling"

While shipping costs are understandable, "handling" is frequently abused. It adds to the delivery price without reflecting actual handling costs.

Who is Responsible?

The responsibility for clarity lies with both the companies imposing the fees and regulatory bodies overseeing them. Opaque language allows companies to exploit consumers.

Federal and state consumer protection agencies must enforce truth-in-advertising laws.

Recent lawsuits against major internet service providers highlight the growing public awareness and pushback against hidden fees. Consumers are demanding transparency.

What You Can Do

Arm yourself with knowledge. Scrutinize every line item on your bills. Challenge any charges that seem ambiguous or unjustified.

Document your efforts. Keep copies of bills, correspondence, and any related documents. This creates a record for potential disputes.

File complaints with consumer protection agencies. Your complaint can contribute to broader investigations and industry reforms.

"The power rests with the consumer," states Senator Elizabeth Warren, a vocal advocate for consumer rights. "By demanding transparency and holding companies accountable, we can fight back against hidden fees."

Moving Forward

The fight for fee transparency is ongoing. Advocacy groups are pushing for legislation requiring companies to clearly disclose all mandatory fees upfront.

Increased public awareness and pressure are crucial to driving meaningful change. The time for hidden fees is over.

Expect continued coverage on this issue as regulatory bodies respond and consumers demand greater clarity. Stay informed, stay vigilant, and demand transparency.

![Which Of The Following Phrases Refers To The Fees [Reading Skills] Complete the following with a phrase from paragraph 3](https://d1avenlh0i1xmr.cloudfront.net/e4981828-3f24-48ae-a864-148ecd391073/slide13.jpg)

![Which Of The Following Phrases Refers To The Fees [FREE] 1) What does "them" refer to? Choose the phrase that completes](https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/d44/9de4ea8b4497640b4684cceebd64b3fa.png)