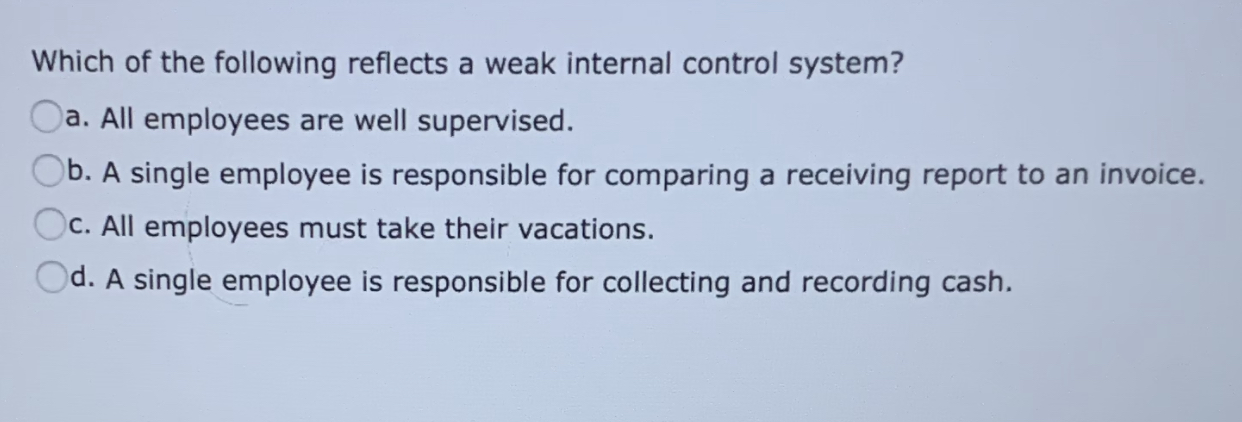

Which Of The Following Reflects A Weak Internal Control System

A company's internal control system is the backbone of its financial and operational integrity. But what happens when that backbone weakens? Identifying the signs of a deficient system is crucial for investors, employees, and anyone who interacts with an organization.

This article will explore common indicators that suggest a company's internal controls are failing. These weaknesses can lead to errors, fraud, and ultimately, financial instability.

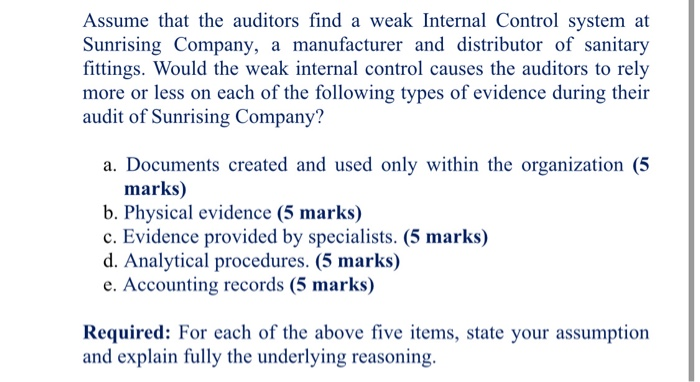

What is Internal Control?

Internal control, according to the Committee of Sponsoring Organizations (COSO) framework, is a process, effected by an entity’s board of directors, management, and other personnel, designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting, and compliance. Think of it as a company's built-in safeguards.

These safeguards are designed to prevent mistakes and fraud, while ensuring information is accurate and reliable. A weak system opens the door to problems.

Signs of a Weak Internal Control System

Several red flags can indicate a deficiency in internal controls. It's important to be vigilant and aware of these signs.

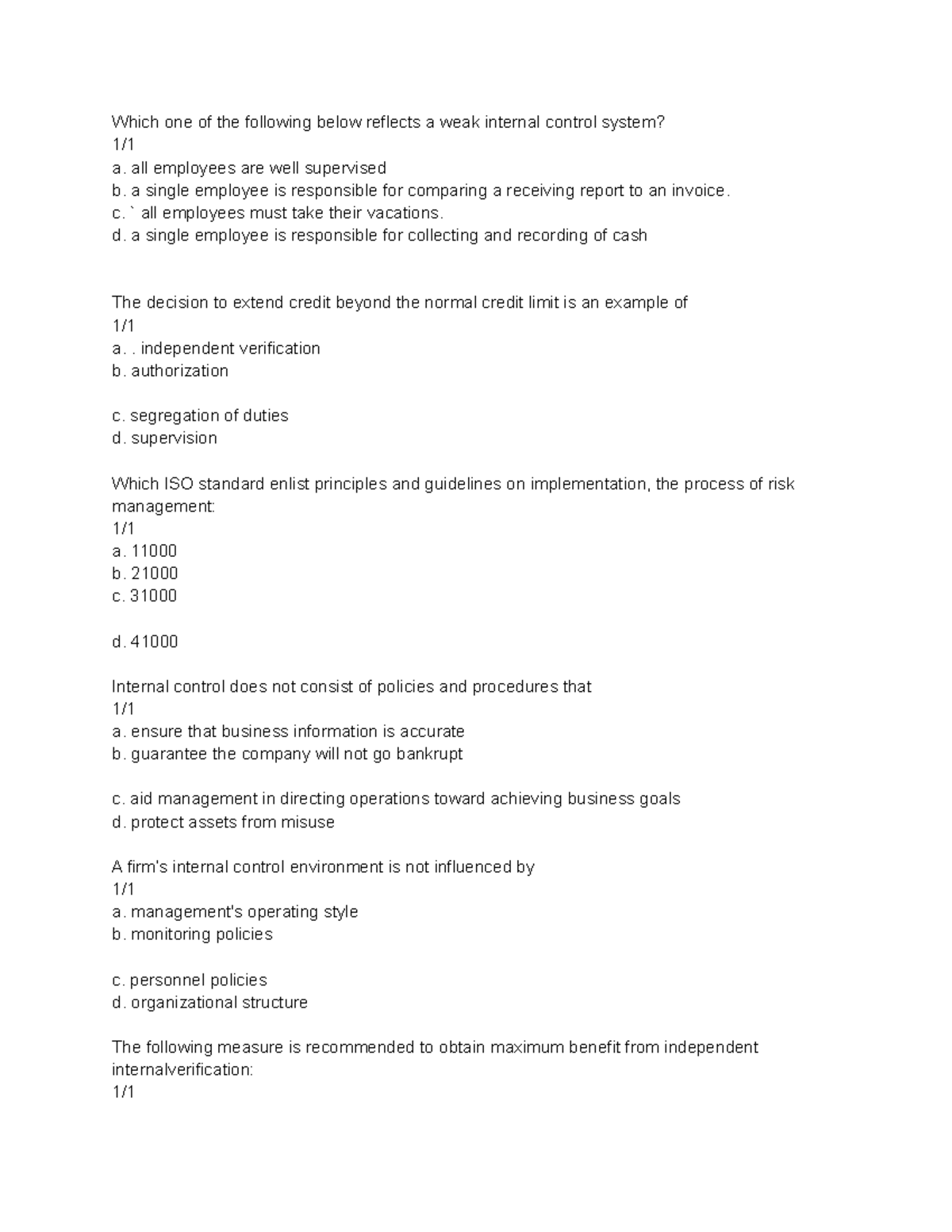

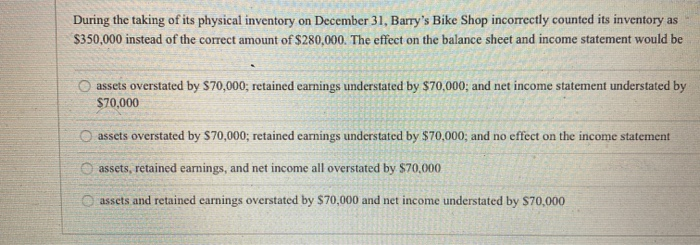

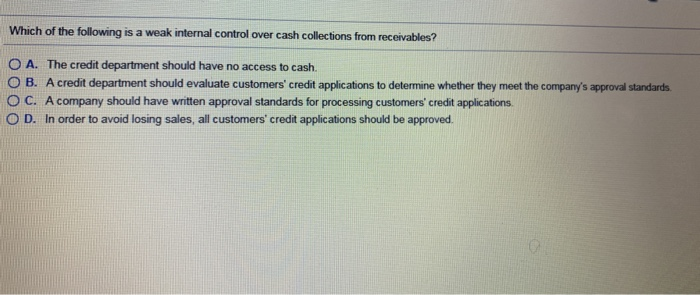

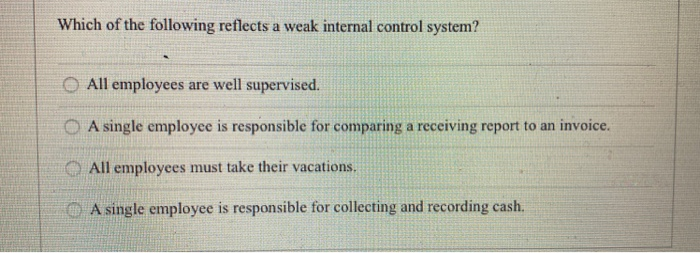

Lack of Segregation of Duties

When one person has too much control over a process, the risk of errors or fraud increases significantly. This is a key sign of a weak internal control system.

For example, if one employee is responsible for both authorizing payments and reconciling bank statements, they could easily manipulate the books without detection. Segregation of duties ensures that no single person has complete control over a transaction.

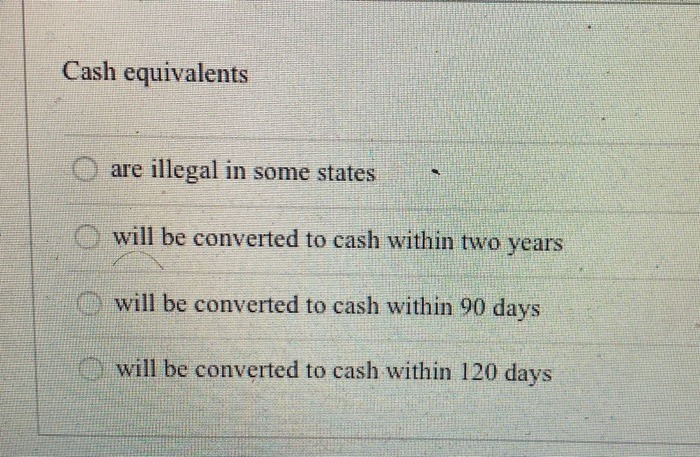

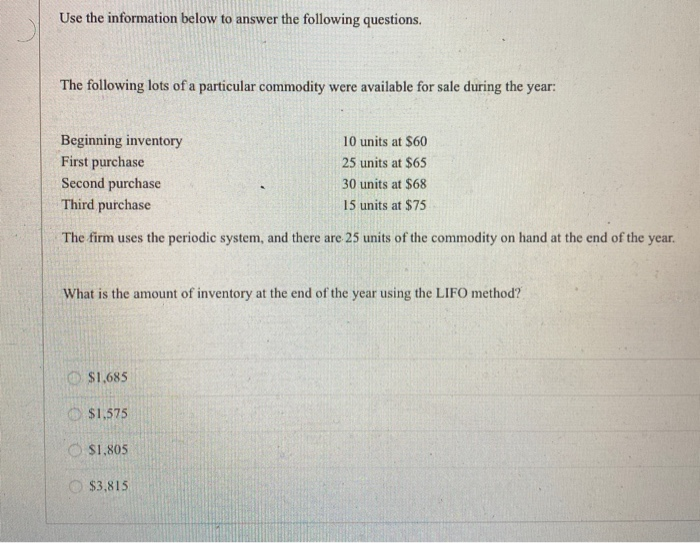

Inadequate Documentation

A strong internal control system relies on clear and comprehensive documentation. Without proper documentation, it's difficult to track transactions, identify errors, and hold individuals accountable.

This includes everything from written policies and procedures to records of transactions and approvals. Inadequate documentation creates an environment where errors and fraud can easily occur undetected.

Override of Controls

When management frequently overrides existing controls, it sends a dangerous message. It suggests that the rules don't matter and undermines the entire system.

This can happen when management is under pressure to meet financial targets or wants to avoid scrutiny. Such actions erode the effectiveness of the controls and create opportunities for abuse.

Insufficient Oversight by Management and the Board

Management and the board of directors play a crucial role in overseeing the internal control system. They are ultimately responsible for ensuring that it is effective and operating as intended.

If management or the board is not actively involved in monitoring the system, weaknesses can go unnoticed and unaddressed. This lack of oversight can lead to serious problems down the road.

High Employee Turnover

High employee turnover, especially in key accounting or finance roles, can disrupt internal controls. When employees leave frequently, knowledge and expertise are lost, and the risk of errors increases.

New employees may not be properly trained on internal controls, and the lack of continuity can create opportunities for fraud. This instability weakens the entire system.

Frequent Errors and Irregularities

A high number of errors, especially those that go undetected for long periods, suggests that internal controls are not working effectively. These errors could be due to a variety of factors, such as inadequate training, poor documentation, or a lack of oversight.

Irregularities, such as unauthorized transactions or missing documents, are even more concerning. They could be signs of deliberate fraud or manipulation.

Poor Tone at the Top

The "tone at the top" refers to the ethical atmosphere created by management. If management is not committed to integrity and ethical behavior, it can create an environment where employees feel pressure to cut corners or even commit fraud.

A poor tone at the top can undermine even the best-designed internal control system. Employees are more likely to follow the example set by management, regardless of the written policies.

Why This Matters

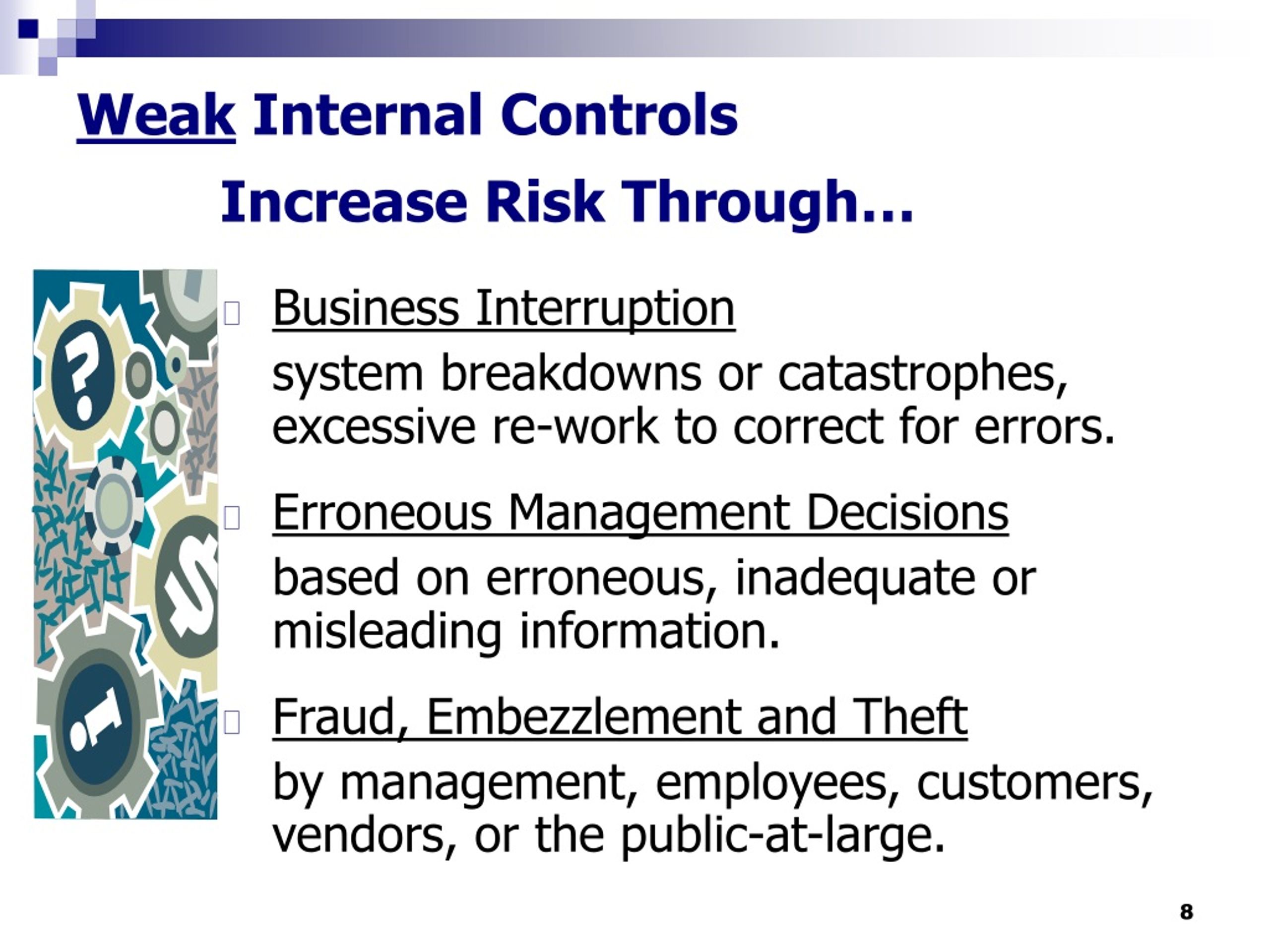

Weak internal controls can have serious consequences. These weaknesses can lead to financial losses, reputational damage, and even legal penalties.

Investors rely on accurate financial information to make informed decisions. Employees need a safe and ethical work environment. Stakeholders depend on the organization to operate responsibly.

The Sarbanes-Oxley Act (SOX) requires publicly traded companies to establish and maintain effective internal controls over financial reporting. Failure to comply with SOX can result in significant penalties.

Conclusion

Identifying and addressing weaknesses in internal controls is essential for the long-term success of any organization. By being vigilant and proactive, companies can protect themselves from errors, fraud, and other risks.

A strong internal control system is not just a compliance requirement; it is a fundamental building block of a well-managed and trustworthy organization.