Which Of The Following Statement Is True About Variable Expenses

Urgent: Businesses must understand variable expenses to maintain financial stability. Misunderstanding these costs can lead to inaccurate budgeting and potential financial distress.

Variable Expenses: Separating Fact from Fiction

This article cuts through the confusion surrounding variable expenses, providing clarity on their true nature. We address the critical question: Which statement accurately describes variable expenses?

What are Variable Expenses?

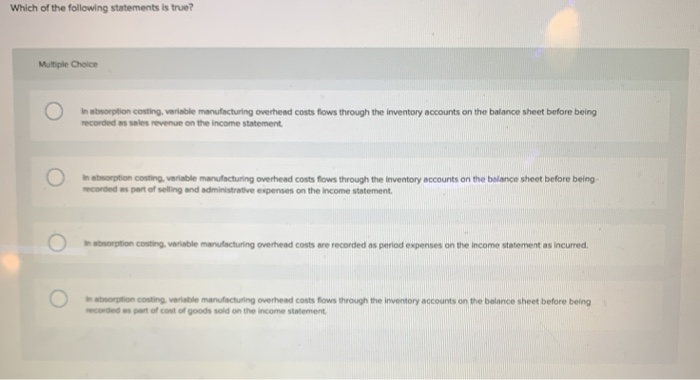

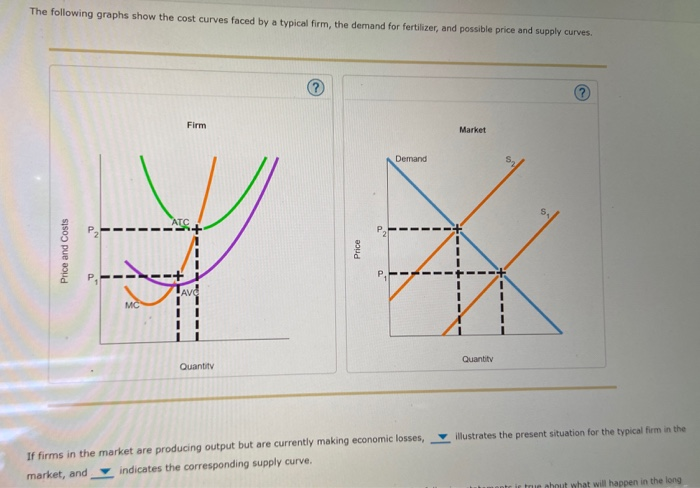

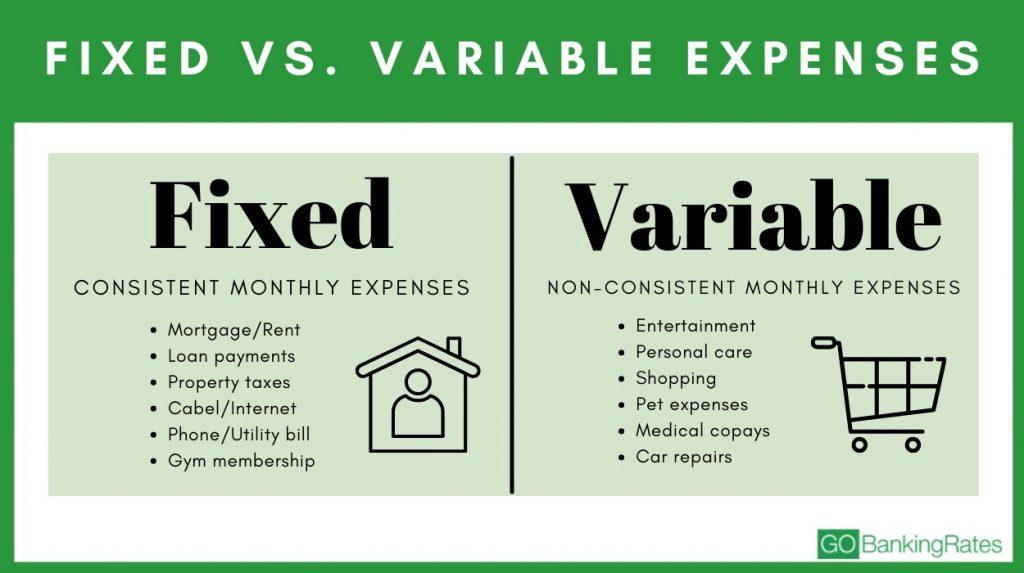

Variable expenses fluctuate in direct proportion to changes in production volume or sales activity. They are dynamic, unlike fixed expenses which remain constant regardless of output.

Examples include raw materials, direct labor, and sales commissions. Think of them as costs that rise and fall with your business activity.

The Crucial Distinction

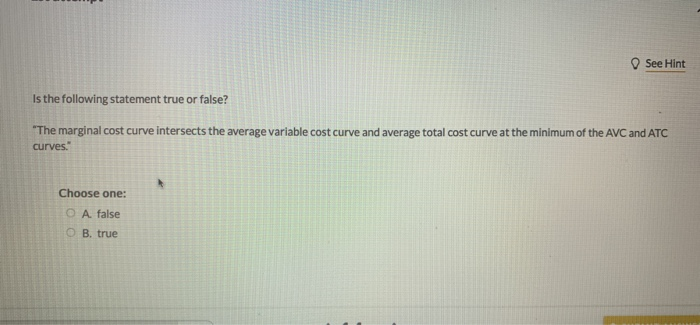

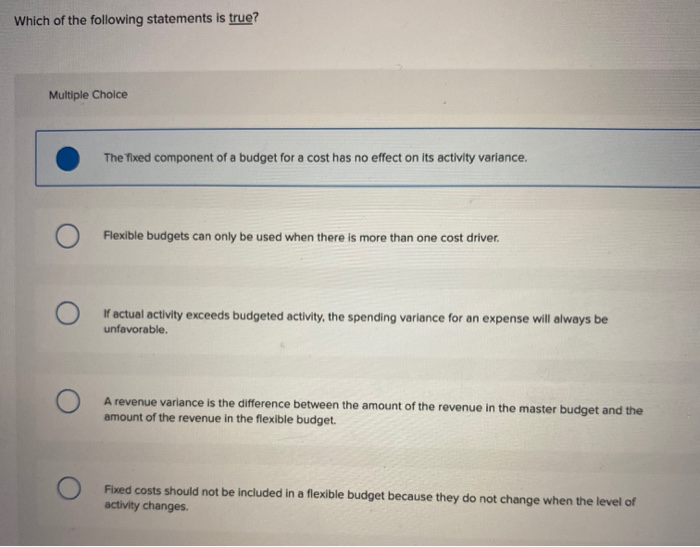

The core question revolves around identifying the true definition of a variable expense. Several statements are commonly made, but only one is fundamentally correct.

It's vital to differentiate between expenses that merely change over time and those that change directly with activity levels.

Identifying the Accurate Statement

The true statement is: Variable expenses change in direct proportion to changes in production volume. This encapsulates the essence of their variability.

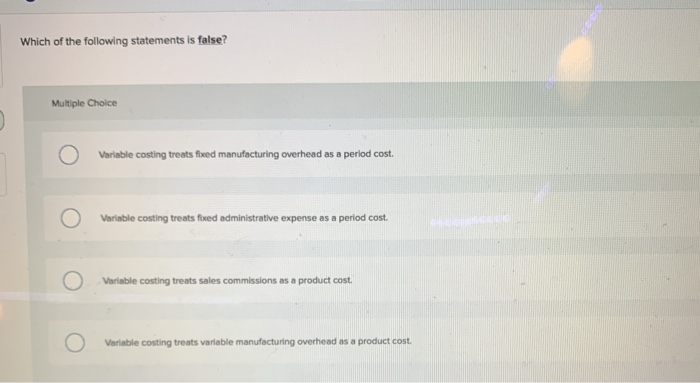

Incorrect statements might suggest they are fixed, change unpredictably, or are related to administrative costs.

Why This Matters

Understanding this distinction is paramount for accurate cost accounting. Proper cost accounting ensures precise pricing strategies.

It also informs effective inventory management and overall financial forecasting. Ignoring this can have significant ripple effects.

Examples in Action

Consider a bakery: the cost of flour is a variable expense. As the bakery produces more bread, it requires more flour, directly increasing the flour cost.

Conversely, the bakery's rent is a fixed expense. It remains the same regardless of how much bread is baked.

Data and Insights

According to a 2023 report by the Small Business Administration (SBA), businesses often miscategorize expenses, leading to inaccurate financial projections.

This miscategorization can be especially detrimental during periods of rapid growth or economic downturn. It can affect the company's cash flow.

A survey by PwC showed that nearly 40% of small businesses struggle with accurate expense tracking.

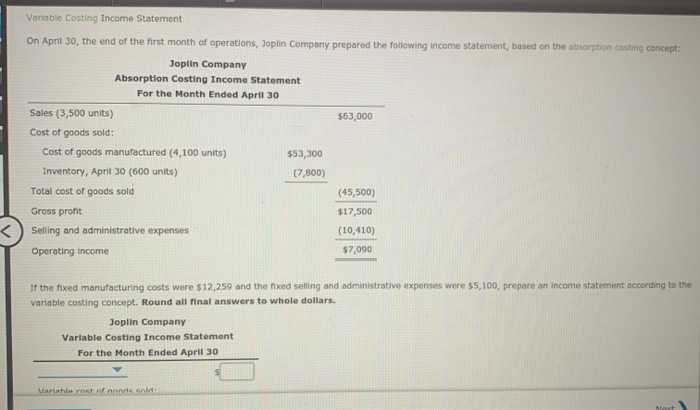

The Impact on Profitability

Accurate variable expense tracking directly impacts profitability analysis. Knowing the true cost of goods sold is essential for setting competitive prices.

It helps businesses identify areas where they can reduce costs and improve efficiency. It provides the data necessary for making informed business decisions.

Common Misconceptions

One common misconception is that all expenses that fluctuate are variable. Some expenses might change due to external factors like inflation, but that doesn't make them inherently variable.

Another is that variable expenses are always controllable. While businesses can influence production volume, external factors can also impact these expenses.

The Role of Technology

Modern accounting software offers tools for tracking variable expenses effectively. These tools can automate calculations and provide real-time insights into cost fluctuations.

They also enable businesses to perform scenario planning and assess the impact of changes in production volume. Technology can be a powerful asset in cost management.

Expert Opinions

"Understanding variable expenses is fundamental to financial management," says Dr. Anya Sharma, a professor of accounting at Wharton. "Businesses must accurately track and analyze these costs to make informed decisions."

John Miller, a certified public accountant (CPA), adds, "Misclassifying variable expenses can lead to significant errors in budgeting and forecasting. It's a mistake that can cost businesses dearly."

Next Steps and Ongoing Developments

Businesses should review their expense tracking methods immediately. They should consult with accounting professionals to ensure accuracy and compliance.

Ongoing education and training for staff is crucial. This includes training on expense categorization and analysis.

Stay informed about changes in accounting standards and regulations. Continuous improvement is key to maintaining financial health.