Which Of The Following Statements About Investing Is False

In an era defined by economic uncertainty and fluctuating markets, the pressure to secure financial futures has intensified. Misinformation about investing abounds, leaving many vulnerable to costly mistakes. Separating fact from fiction is paramount for anyone seeking to navigate the complex world of finance and build lasting wealth.

This article aims to debunk common investment myths by dissecting a hypothetical scenario: "Which of the following statements about investing is false?" Through expert insights and evidence-based analysis, we will equip readers with the knowledge necessary to make informed decisions, avoid pitfalls, and achieve their financial goals. Ultimately, we hope to empower readers to distinguish truth from falsehood and invest with confidence. The goal is to increase financial literacy.

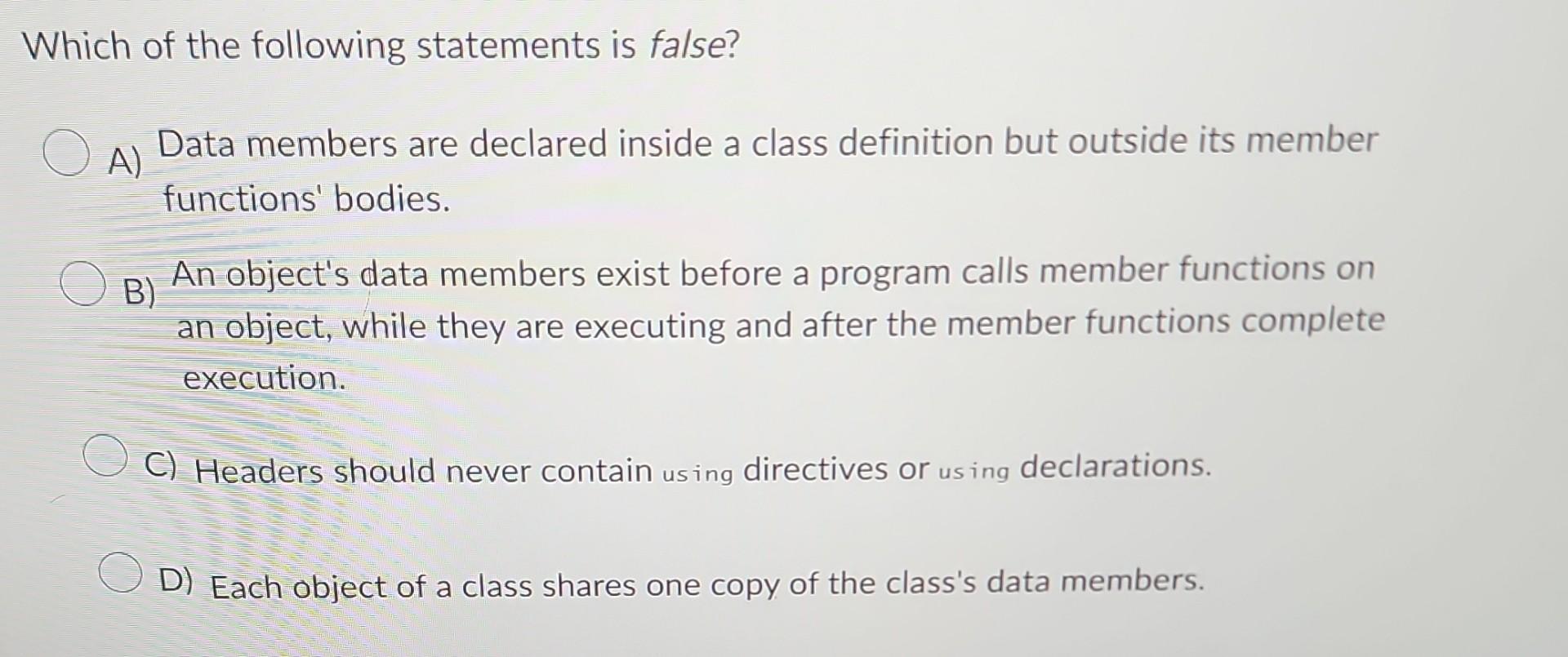

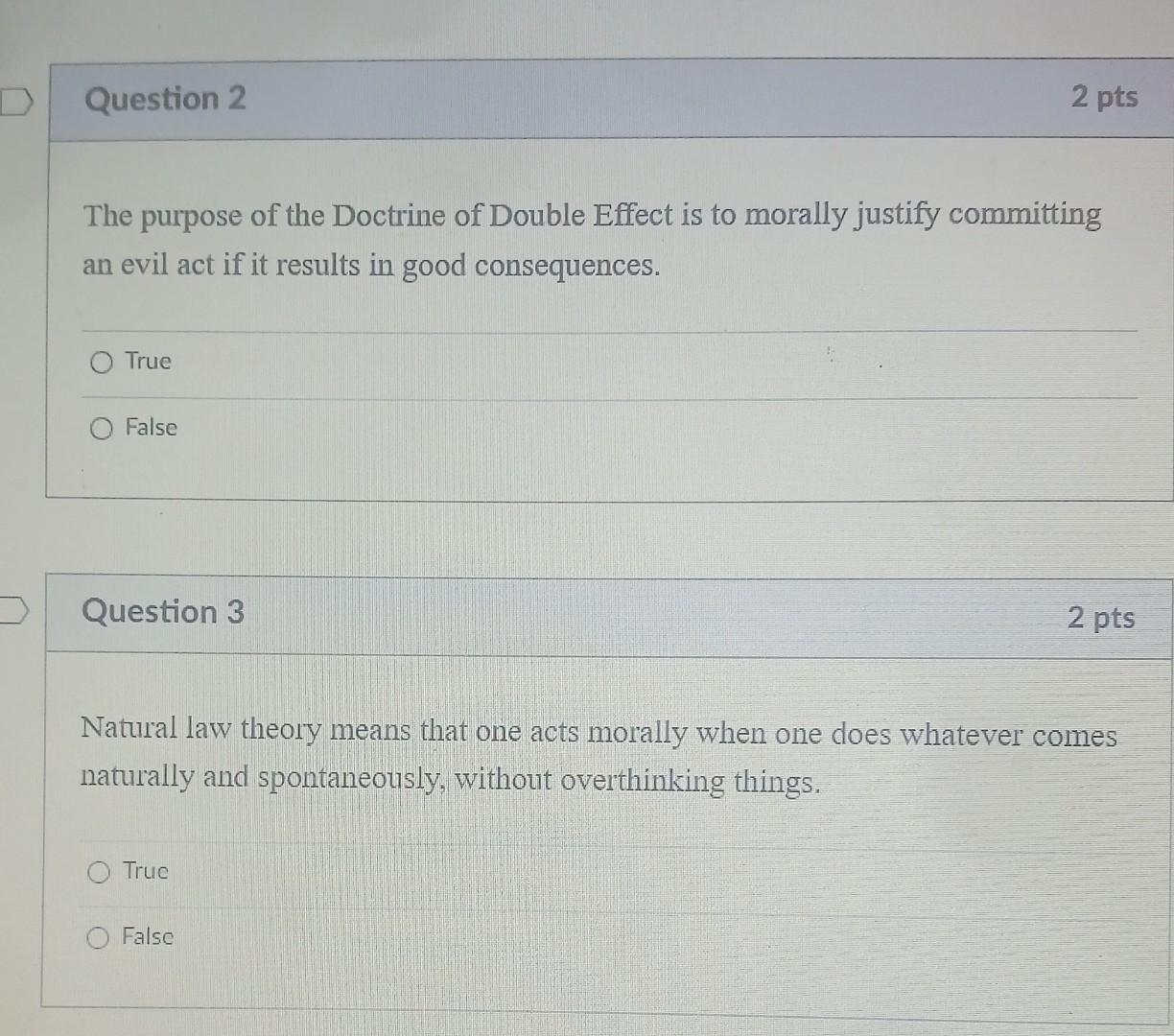

The Hypothetical Scenario: Spotting the Falsehood

Consider this question: Which of the following statements about investing is false?

A) Investing is only for the wealthy.

B) Diversification reduces risk.

C) Past performance guarantees future returns.

D) You should always time the market to maximize profits.

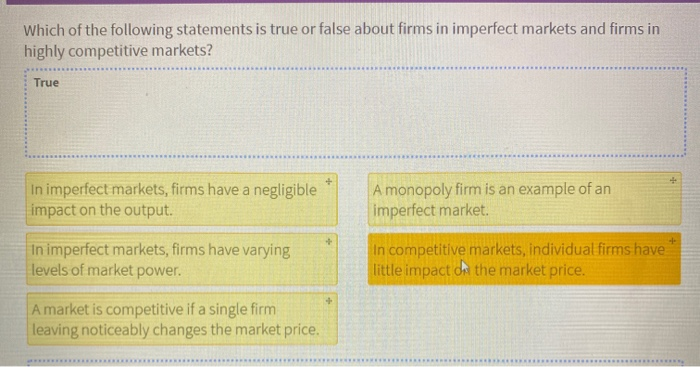

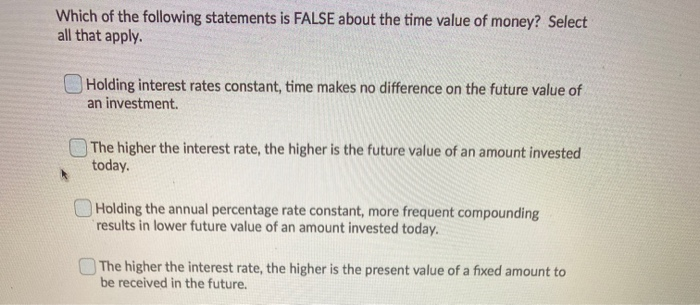

Myth 1: Investing is Only for the Wealthy

The assertion that investing is solely for the wealthy is demonstrably false. Modern investment platforms and fractional shares have democratized access. This allows individuals with even modest savings to participate in the market.

Many low-cost index funds and ETFs require minimal initial investments, breaking down traditional barriers. The idea that investing requires substantial capital is outdated and inaccurate.

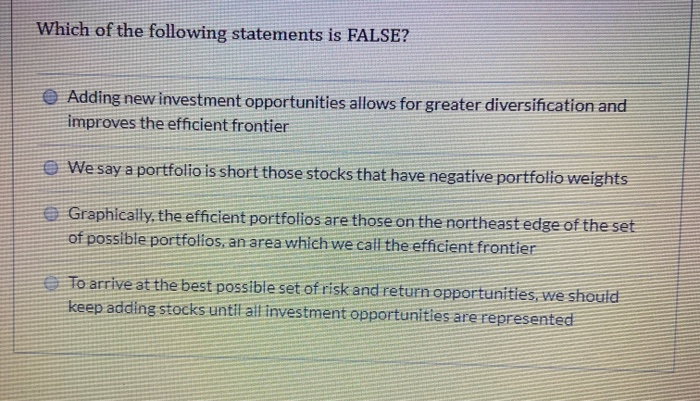

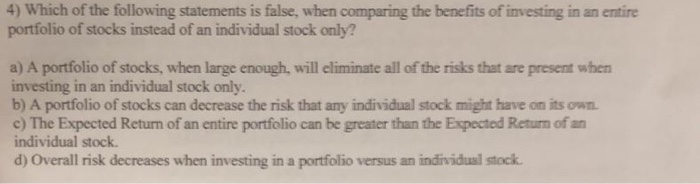

Myth 2: Diversification Reduces Risk

Diversification, spreading investments across various asset classes, sectors, and geographic regions, is a fundamental principle of risk management. It helps to mitigate the impact of any single investment performing poorly.

As Warren Buffett famously stated, "Diversification is protection against ignorance." While diversification doesn't eliminate risk entirely, it significantly reduces exposure to unsystematic risk, the risk specific to individual companies or industries.

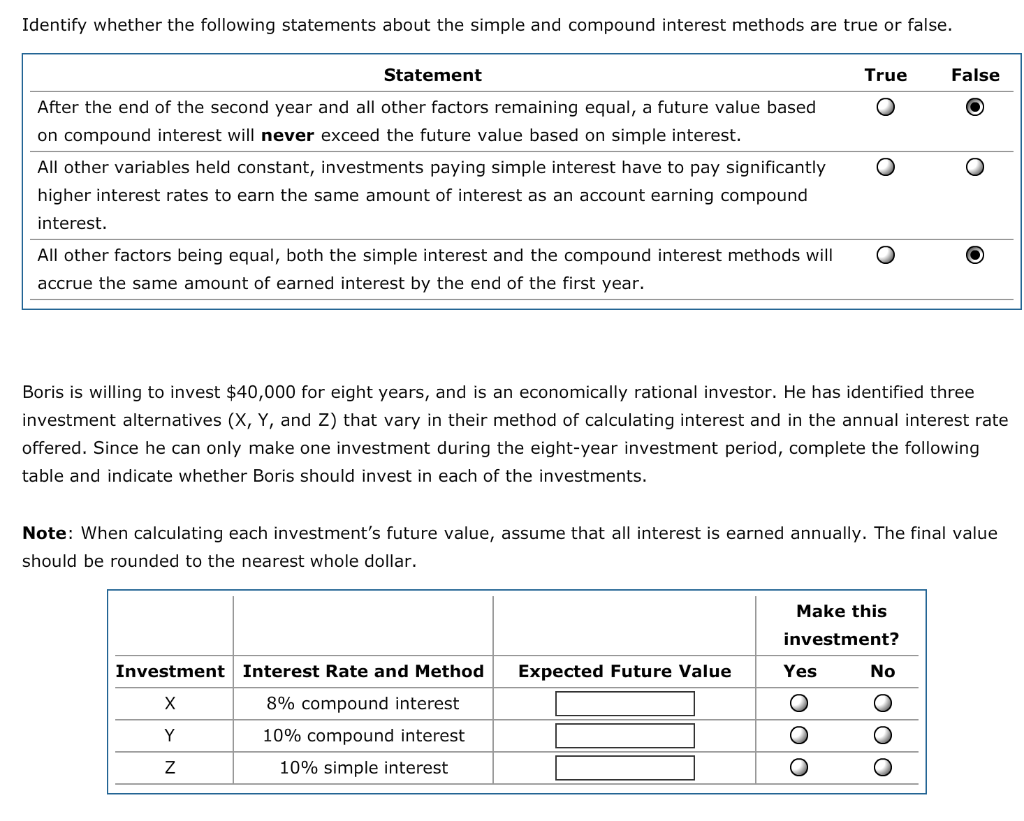

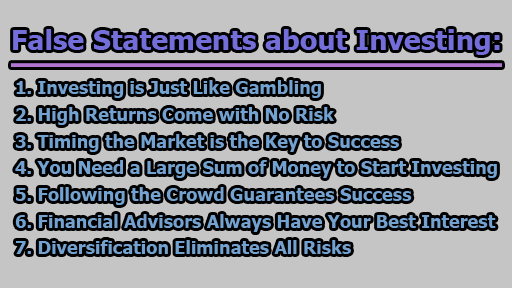

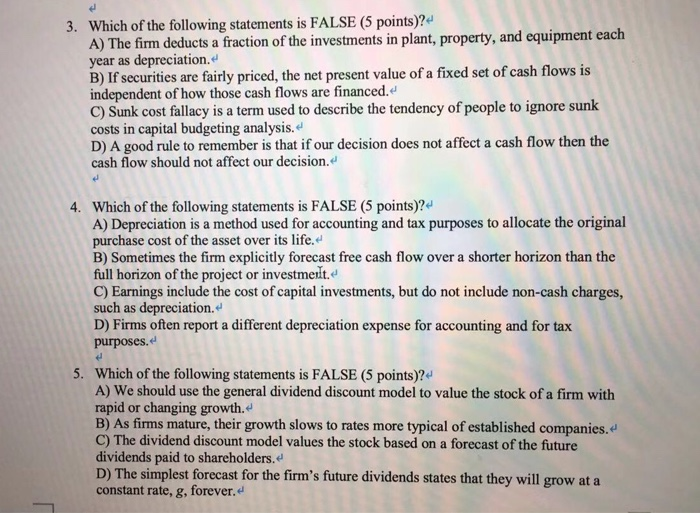

Myth 3: Past Performance Guarantees Future Returns

The statement that past performance guarantees future returns is a dangerous fallacy. Investment performance is influenced by a multitude of factors, including economic conditions, market sentiment, and unforeseen events.

Regulatory disclaimers universally acknowledge that past performance is not indicative of future results. Relying solely on historical data to predict future outcomes is a recipe for disappointment and financial loss.

Myth 4: You Should Always Time the Market

The notion that one can consistently time the market – buying low and selling high – is widely debunked by financial experts. Market timing requires accurately predicting short-term market fluctuations, a feat virtually impossible to achieve consistently.

Studies have shown that investors who attempt to time the market often underperform those who adopt a buy-and-hold strategy. Missing just a few of the market's best days can significantly erode returns.

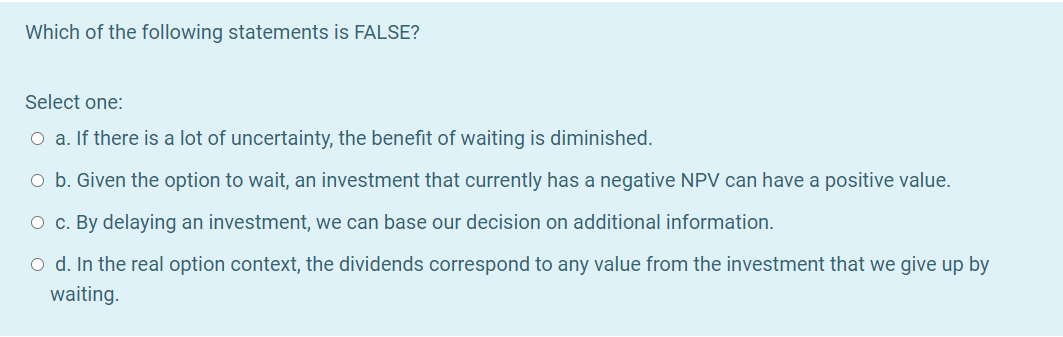

The Correct Answer and Its Implications

Based on the above analysis, the false statements are A) Investing is only for the wealthy and D) You should always time the market to maximize profits. These are significant misconceptions that can deter individuals from building long-term wealth.

Understanding these false assumptions empowers individuals to adopt more rational and effective investment strategies. By recognizing these myths, people are more likely to start investing.

Expert Opinions and Research Findings

Numerous studies support the importance of diversification and the futility of market timing. Research consistently demonstrates that diversified portfolios tend to generate more stable and predictable returns over the long term.

According to a study by Dalbar Inc., the average investor significantly underperforms market indices due to emotional decision-making and attempts at market timing. Expert investors advocate a disciplined, long-term approach to investing, focusing on asset allocation and consistent contributions.

Moving Forward: Investing with Confidence

By dispelling common investment myths and embracing evidence-based strategies, individuals can navigate the financial landscape with greater confidence and achieve their long-term financial goals. Financial literacy is an ongoing process.

Seek advice from qualified financial advisors, conduct thorough research, and adopt a disciplined approach to investing. Remember that investing is a journey, not a sprint, and patience and perseverance are key to success.

The takeaway is clear: debunking investment myths and fostering financial literacy are essential steps towards empowering individuals to build a secure financial future.