Which Of The Following Statements About Opportunity Cost Are True

A financial literacy crisis is brewing as a significant portion of the population struggles to grasp fundamental economic concepts. A recent survey reveals widespread confusion surrounding opportunity cost, a cornerstone of sound decision-making.

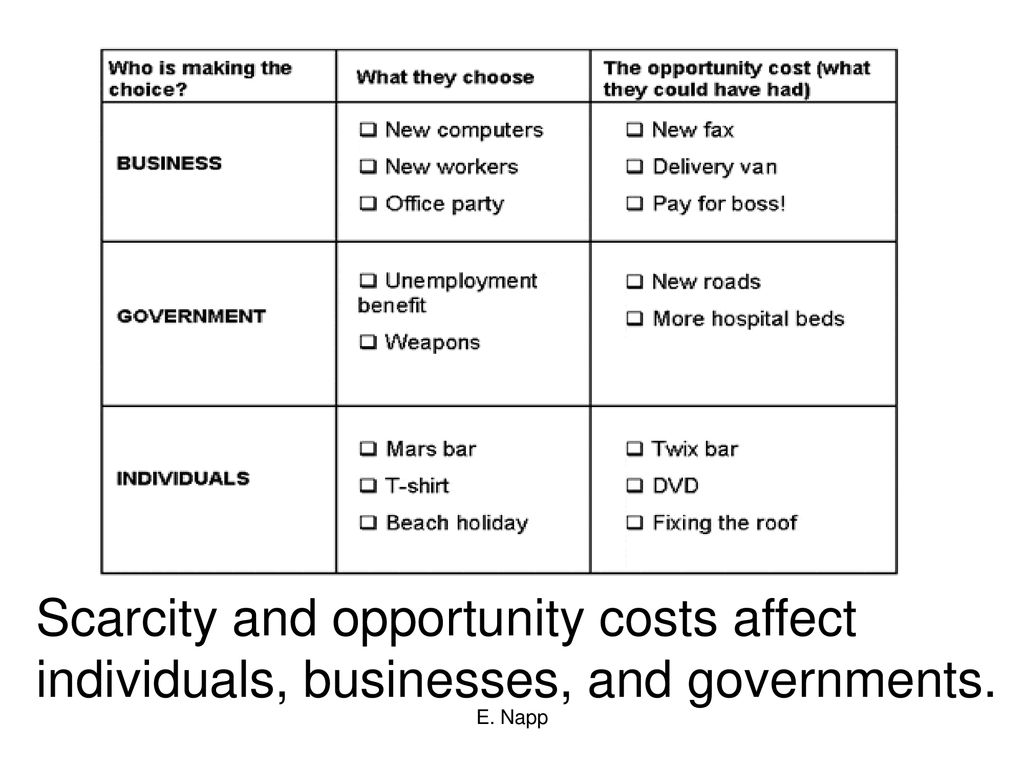

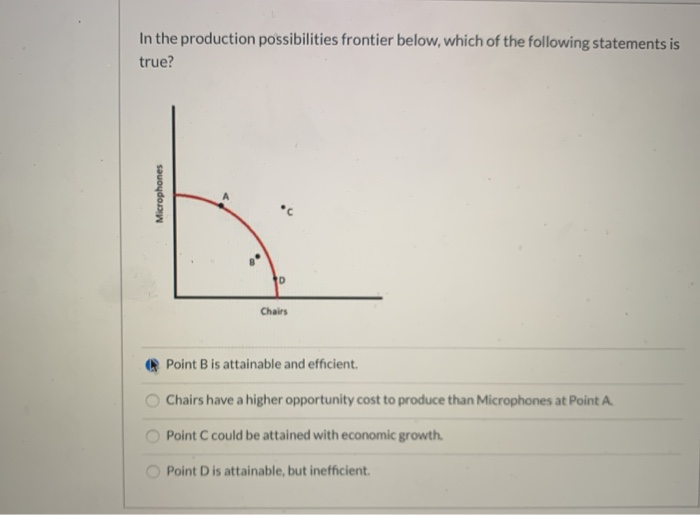

Understanding opportunity cost is crucial for individuals, businesses, and governments to make informed choices about resource allocation. Misconceptions can lead to inefficient spending, missed investment opportunities, and ultimately, economic hardship.

Widespread Misunderstanding of Opportunity Cost

A nationwide poll, conducted by Financial Literacy Now (FLN), assessed understanding of opportunity cost across various demographic groups. The results were alarming. Less than 40% of respondents correctly identified all true statements about opportunity cost from a list of options.

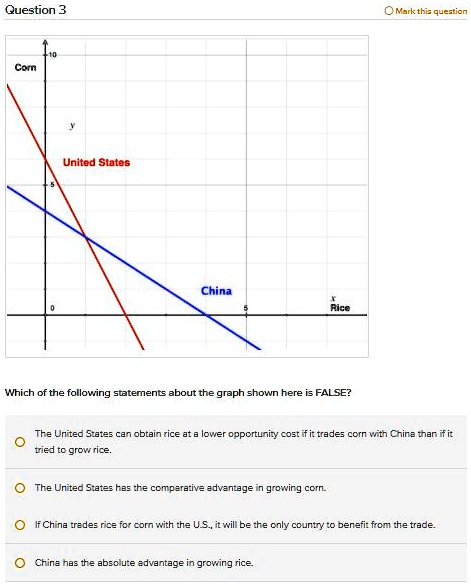

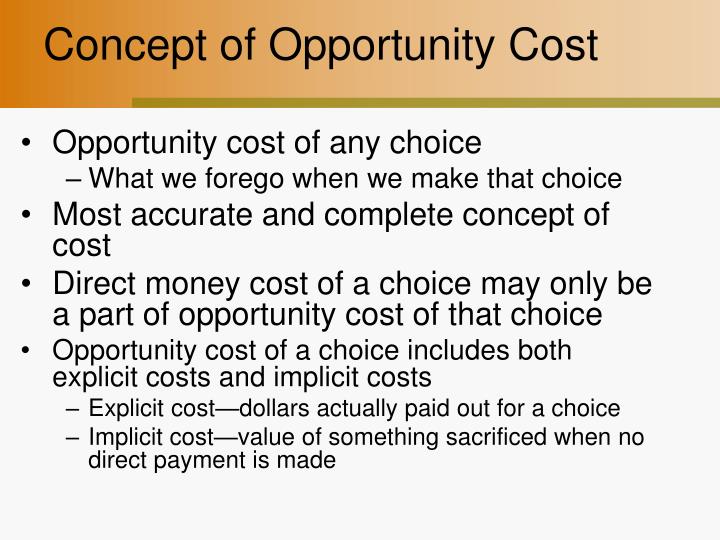

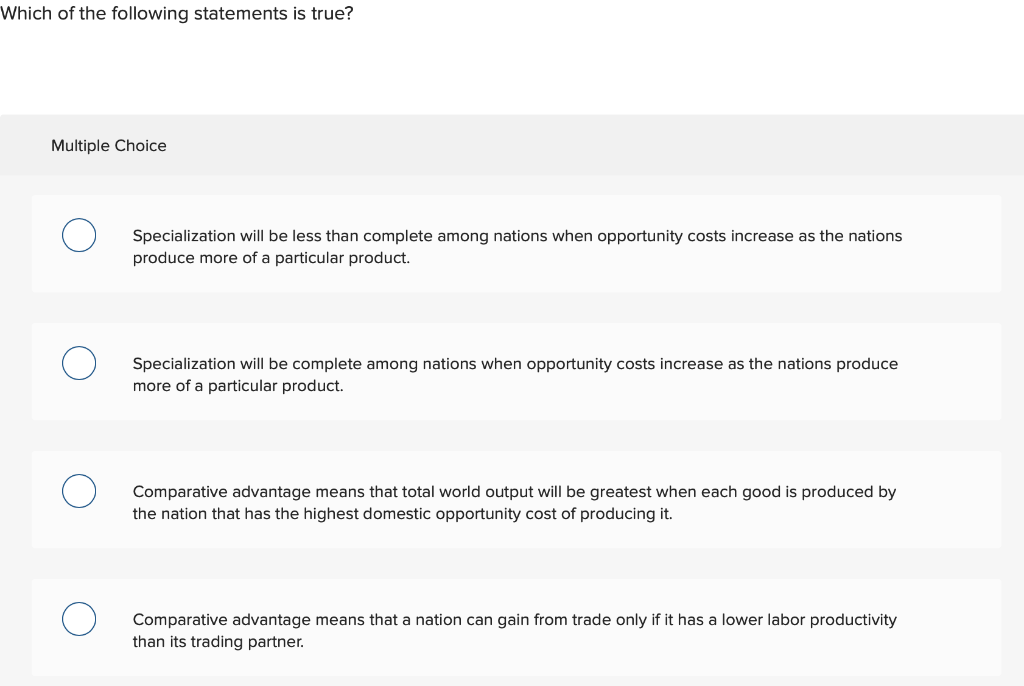

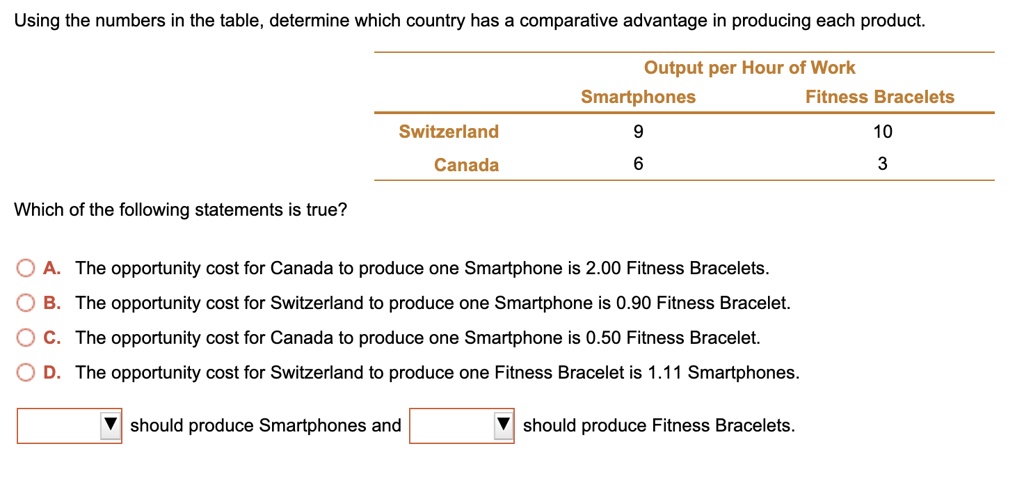

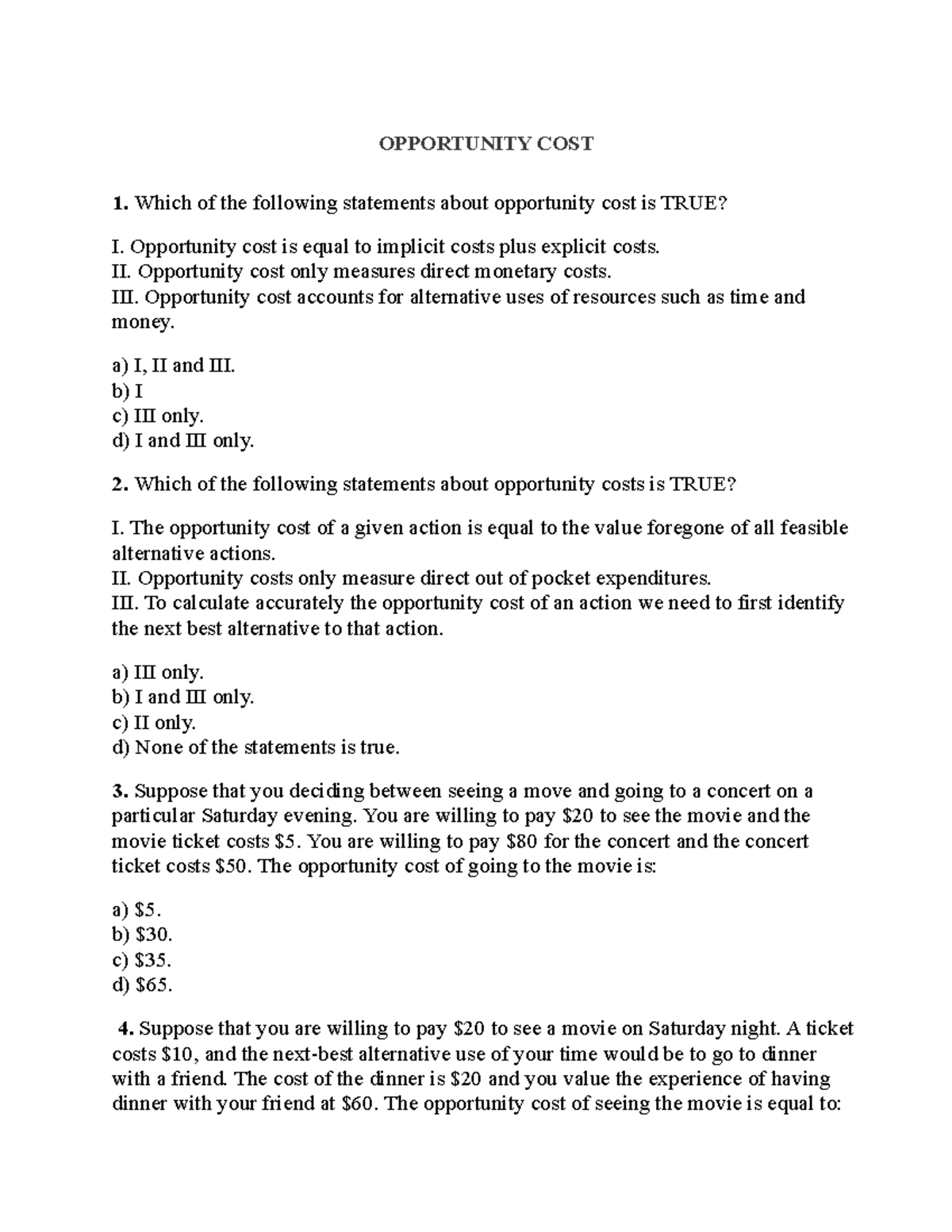

The survey presented participants with several statements about opportunity cost and asked them to identify which were accurate. The correct statements included: "Opportunity cost is the value of the next best alternative foregone," "Opportunity cost is a factor in every decision we make," and "Opportunity cost is subjective and can vary from person to person."

Key Findings: What's True, What's False

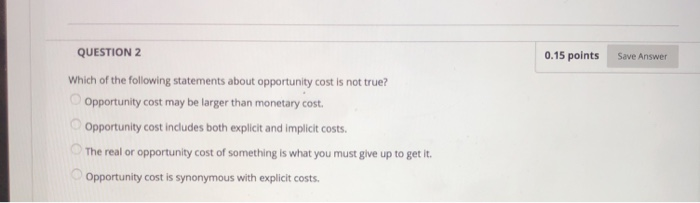

Many participants incorrectly believed that opportunity cost only applies to monetary decisions. They failed to recognize its relevance in time management, career choices, and even everyday activities like deciding what to eat for lunch.

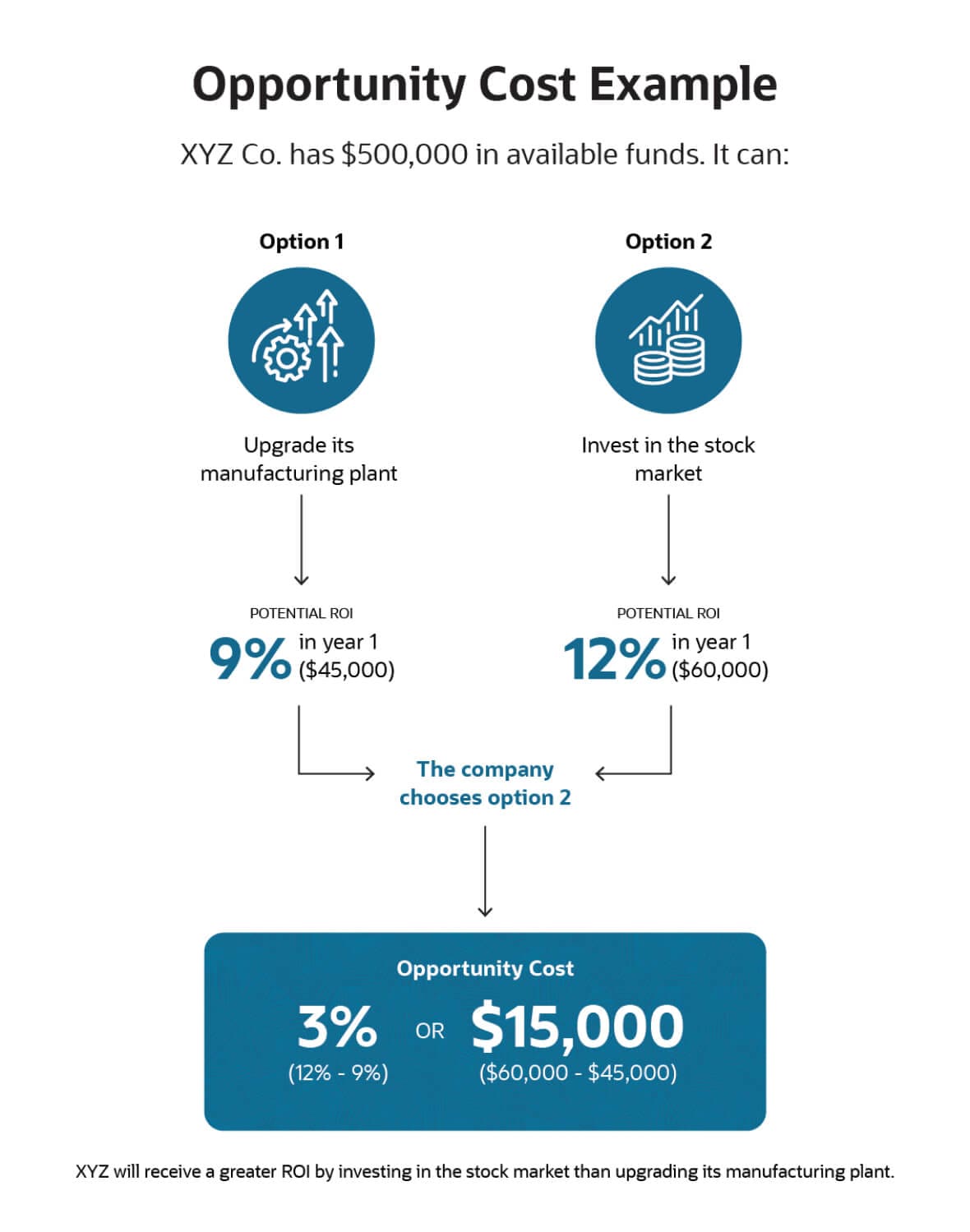

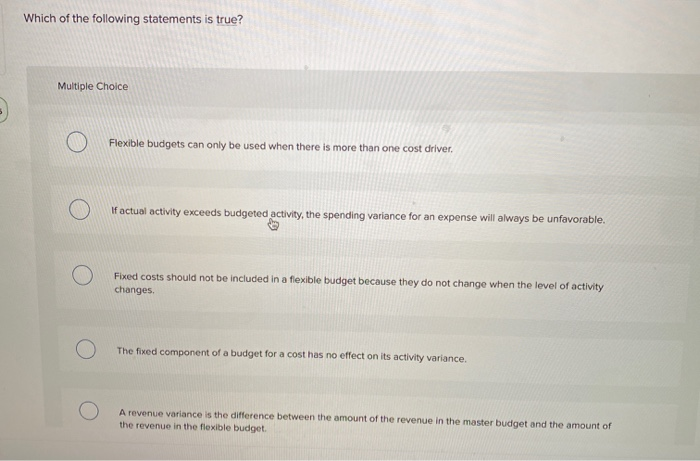

Another common misconception was that opportunity cost is the sum of all potential alternatives. This demonstrates a lack of understanding that it's specifically the *next best* alternative that defines the opportunity cost.

Furthermore, a significant percentage thought opportunity cost is always easily quantifiable in dollar terms. This ignores the inherent difficulty in assigning a precise monetary value to intangible benefits or experiences.

Demographic Disparities

The survey data revealed significant disparities in understanding across different demographic groups. Younger adults (18-25) and those with lower levels of education consistently demonstrated the weakest grasp of opportunity cost.

Individuals from lower-income households also struggled more than their wealthier counterparts. This highlights the importance of targeted financial literacy programs for vulnerable populations.

“These findings underscore a critical need for improved financial education initiatives,” stated Dr. Anya Sharma, lead researcher at FLN. “A lack of understanding of opportunity cost has far-reaching consequences for individual financial well-being and overall economic stability.”

Real-World Implications

The lack of understanding has real-world consequences. Individuals might choose a lower-paying job with better benefits without fully considering the long-term financial implications.

Businesses might invest in projects with a low return, failing to recognize more lucrative alternatives. Governments might allocate resources to inefficient programs, hindering economic growth.

Consider the decision to pursue a college degree. The opportunity cost isn't just tuition fees. It also includes the potential income earned during the years spent studying instead of working.

The Way Forward

FLN is advocating for increased financial literacy education in schools and communities. They are developing online resources and workshops to help people better understand opportunity cost and other essential economic concepts.

Several organizations, including the National Council on Economic Education (NCEE), are partnering with FLN to promote financial literacy. These collaborative efforts aim to reach a broader audience and address the widespread knowledge gap.

The immediate focus is on developing targeted educational materials that address the specific misconceptions identified in the survey. These resources will be freely available online and through community centers.

Immediate Action Needed

Raising awareness is crucial. Individuals are encouraged to seek out resources and educational materials to improve their understanding of opportunity cost.

Policymakers are urged to prioritize financial literacy education in schools and communities. Investing in financial literacy is an investment in the future economic well-being of the nation.

The situation demands urgent action to equip individuals with the financial knowledge they need to make informed decisions and secure their financial futures. The consequences of inaction are simply too great.