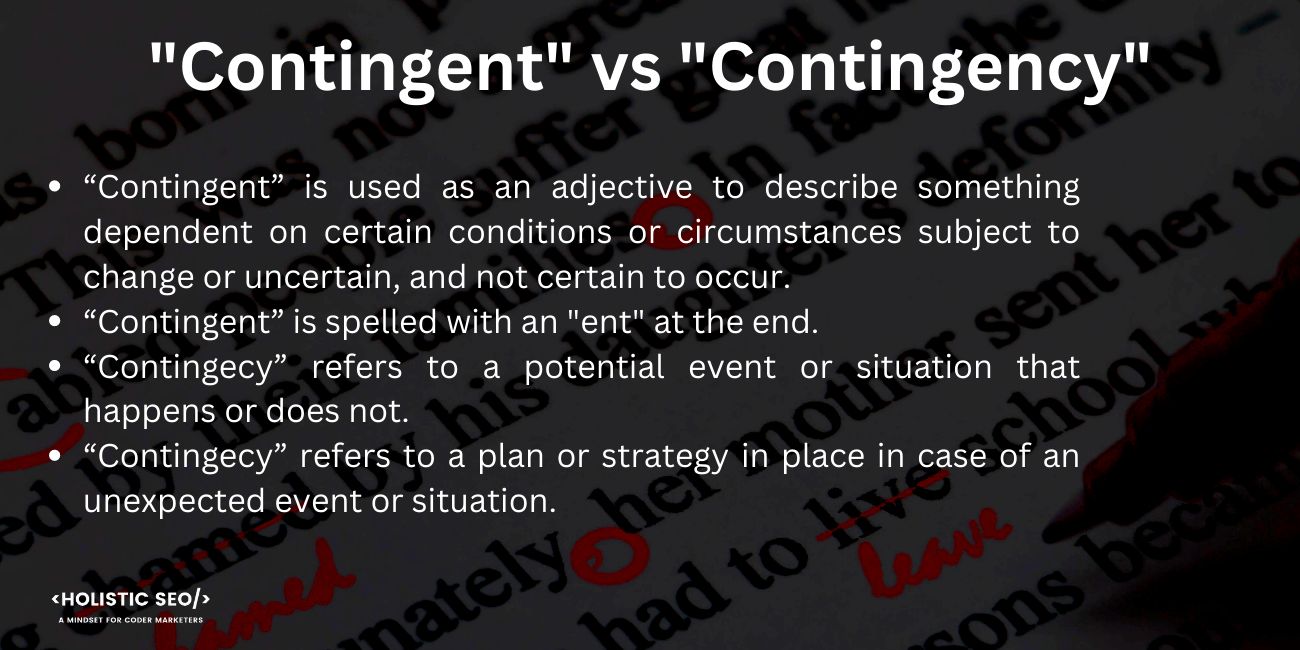

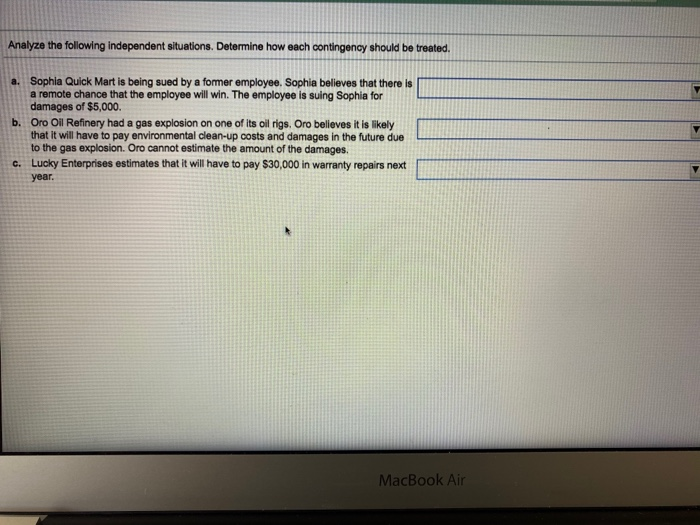

Which Of The Following Statements Is A Contingency

Imagine you're buying a house. Sunlight streams through the windows as you walk through the rooms, picturing your life unfolding within those walls. But a nagging thought lingers: what if the home inspection reveals significant structural damage? Or what if your loan application gets denied?

These "what ifs" are more than just worries; they represent contingencies, essential clauses in agreements that protect parties involved. This article explores the concept of contingencies, specifically answering the question: Which of the following statements is a contingency? We will examine their importance and how they shape various transactions, providing clarity and peace of mind in often complex situations.

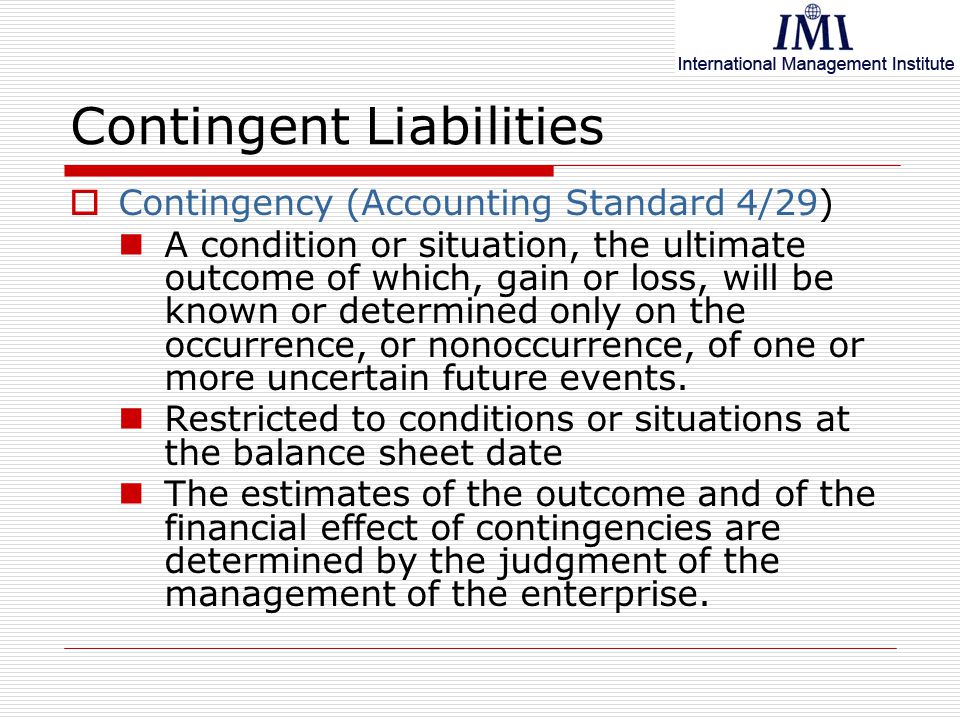

Understanding Contingencies: A Safety Net

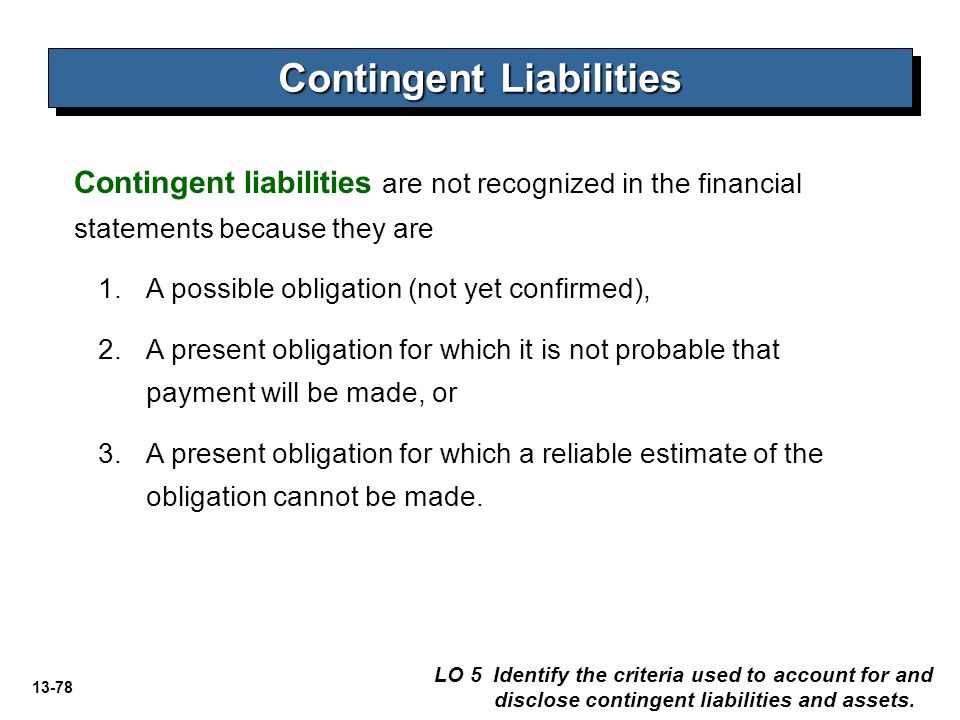

A contingency, in legal terms, is a condition that must be met before a contract becomes binding. It's essentially a "safety net" provision, allowing one or both parties to withdraw from the agreement without penalty if a specific event occurs or fails to occur.

Think of it as an 'if-then' statement embedded within a contract. "If" a specific condition isn't met, "then" the agreement can be terminated. This safeguard is used across many fields, including real estate, finance, and even employment.

To illustrate, consider the most frequent use of a contingency: Real estate transactions offer prime examples, protecting buyers from unforeseen financial burdens or hidden property flaws. If a home inspection reveals serious problems, a buyer with an inspection contingency can walk away from the deal.

Common Types of Contingencies

Several common types of contingencies frequently appear in contracts, each addressing a specific concern. Understanding these can empower you to navigate agreements with greater confidence. The main common examples are:

Financial Contingency: This protects the buyer in a real estate deal. It allows the buyer to back out of the purchase if they can't secure financing (like a mortgage) within a specified timeframe. Without it, the buyer could lose their earnest money deposit if they fail to get a loan.

Appraisal Contingency: This allows the buyer to withdraw if the property's appraised value is lower than the agreed-upon purchase price. This is crucial because lenders won't typically loan more than the appraised value, preventing buyers from overpaying.

Inspection Contingency: This gives the buyer the right to have the property professionally inspected. If the inspection reveals significant defects (e.g., structural issues, mold, or pest infestations), the buyer can negotiate repairs, request a price reduction, or terminate the contract.

Sale of Property Contingency: This protects a buyer who needs to sell their current home before they can purchase a new one. It allows them to back out of the new purchase if they can't sell their existing property within a certain timeframe. This protects from the stress of carrying two mortgages.

Title Contingency: Ensures that the seller has a clear and marketable title to the property. If title issues (e.g., liens, encumbrances, or ownership disputes) arise, the buyer can terminate the agreement.

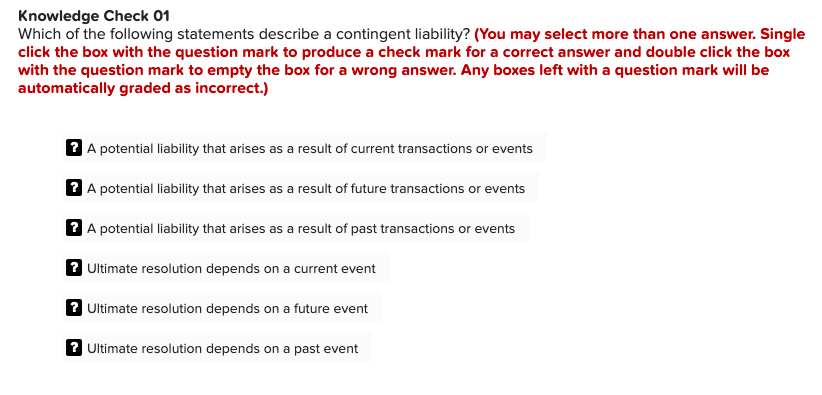

Which Statement is a Contingency? Answering the Question

Now, addressing the initial question: Which of the following statements is a contingency? The answer depends on the context and how the statement is phrased within a contractual agreement.

However, the key is to look for a statement that creates a condition for the agreement to move forward. Here are some examples, demonstrating the difference between an outright agreement and one containing a contingency:

Not a Contingency: "The buyer will purchase the property for $500,000." This is a simple agreement to purchase, with no conditions attached.

Contingency: "This agreement is contingent upon the buyer obtaining a mortgage at an interest rate not exceeding 6%." This introduces a condition - securing a specific mortgage - that must be met for the purchase to proceed. If the buyer can't secure a mortgage at or below 6%, they can withdraw from the deal.

Not a Contingency: "The seller agrees to repair the leaky faucet." This is a direct obligation of the seller.

Contingency: "This agreement is contingent upon a satisfactory inspection of the roof by a licensed roofing contractor." The purchase is dependent on the outcome of an inspection, granting the buyer protection.

Therefore, the statement that includes a specific condition that must be satisfied is the contingency.

The Broader Significance of Contingencies

Contingencies are not just legal technicalities; they play a vital role in fostering fair and transparent transactions. They provide a framework for managing risk, ensuring that parties aren't forced into unfavorable positions due to unforeseen circumstances.

For instance, in the employment sector, a contingency might be tied to the successful completion of a background check or drug screening. This protects the employer from potential liabilities and ensures a safe work environment.

Moreover, contingencies contribute to market stability by discouraging reckless behavior. Buyers are less likely to make impulsive decisions if they know they have avenues for backing out if things go wrong. This fosters confidence and encourages responsible participation in the market.

Negotiating Contingencies: A Collaborative Process

The inclusion and terms of contingencies are often subject to negotiation between parties. While some contingencies are standard practice (e.g., inspection contingency in real estate), others may be customized to address specific concerns or circumstances.

For instance, a buyer might request a longer inspection period if the property is particularly complex or old. Similarly, a seller might try to limit the scope of the inspection contingency to only cover major structural issues.

Successful negotiation of contingencies requires open communication and a willingness to compromise. Both parties should clearly understand their rights and obligations, seeking legal counsel if necessary to ensure their interests are protected.

The Importance of Legal Advice

While a general understanding of contingencies is helpful, it's crucial to seek legal advice when entering into any significant agreement. An attorney can review the contract, explain the implications of different contingencies, and help you negotiate terms that are favorable to your position.

Remember, contingencies are designed to protect your interests, but they can also be complex and nuanced. A lawyer can help you navigate the legal landscape, ensuring that you're making informed decisions and minimizing your risk.

Legal advice can save you from potential financial pitfalls and prevent disputes down the road. The cost of legal representation is often a worthwhile investment, especially when dealing with substantial transactions like purchasing a home or starting a business.

Conclusion: Navigating Uncertainty with Confidence

Contingencies are an invaluable tool for navigating the inherent uncertainties of agreements. By understanding their purpose and function, individuals and businesses can protect themselves from unforeseen risks and make more informed decisions.

Think of contingencies as a bridge over troubled waters, offering a safe passage when things don't go as planned. Embrace their value.

As you move forward, remember to approach agreements with careful consideration, seek legal counsel when needed, and utilize contingencies strategically to safeguard your interests and navigate the path towards a successful outcome.