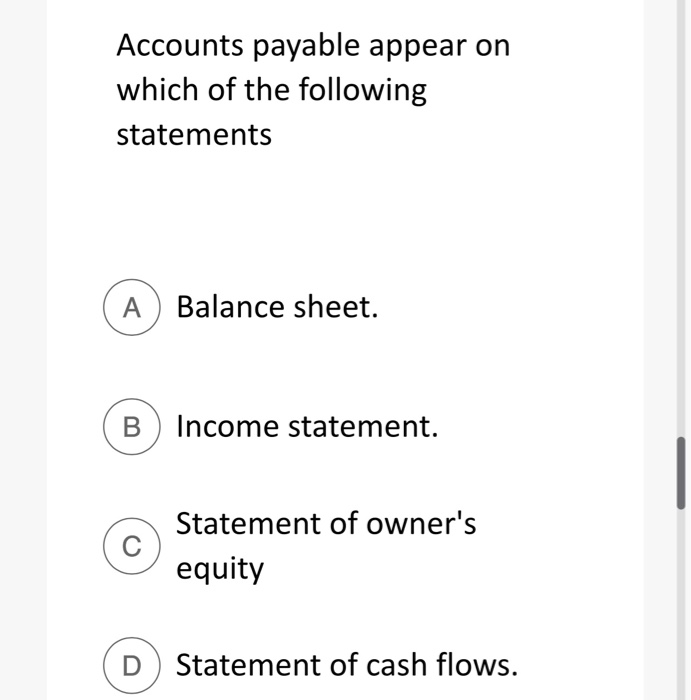

Which Of The Following Statements Is Accurate Regarding Accounts Payable

Imagine a small business owner, Sarah, late into the night, hunched over her laptop. She's wrestling with invoices, receipts scattered across her desk like fallen leaves. The weight of accounts payable is a familiar burden, the ever-present task of managing what her business owes.

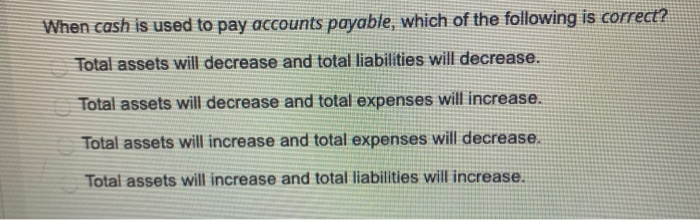

Understanding accounts payable (AP) is crucial for any business, regardless of size. It’s far more than just paying bills; it's about managing cash flow, maintaining supplier relationships, and ensuring financial health. The accurate statement regarding accounts payable is that it represents a company's short-term liabilities owed to its suppliers or vendors for goods or services purchased on credit.

The Foundation of Accounts Payable

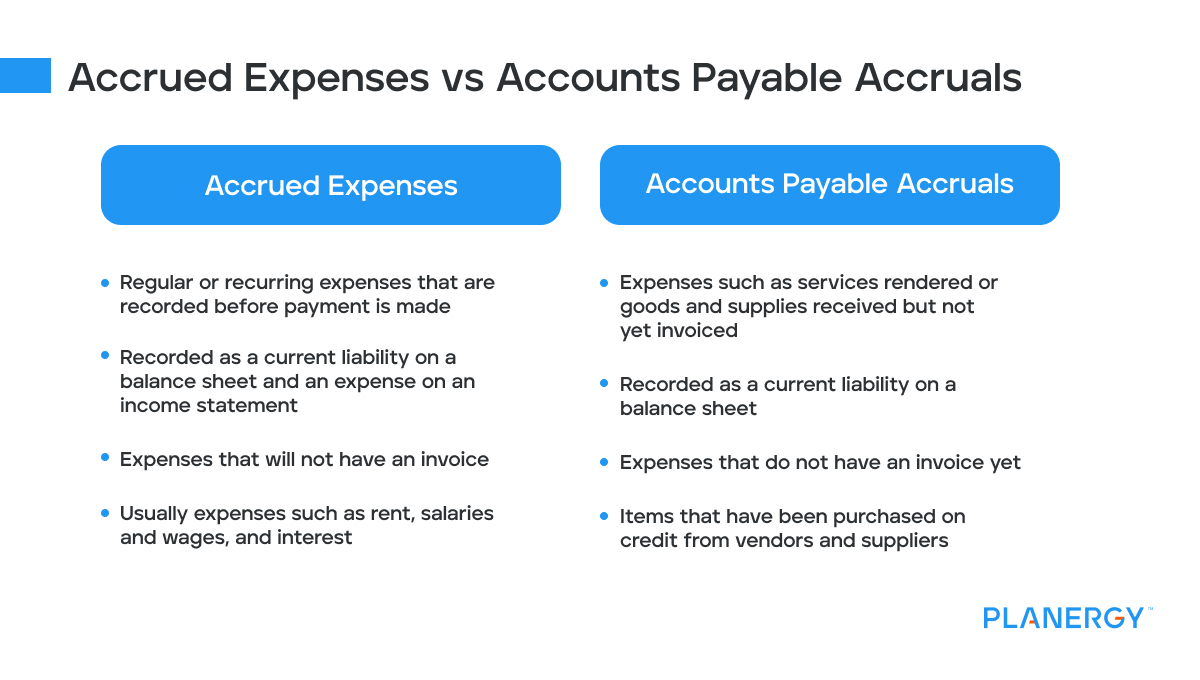

Accounts payable, at its core, is a record of a company's short-term debt. It reflects what the company owes to its vendors and suppliers for goods or services that have been received but not yet paid for.

These transactions are typically made on credit, with payment terms ranging from a few days to several months. This allows businesses to manage their cash flow more effectively.

The Accounts Payable Process: A Closer Look

The accounts payable process generally involves several key steps. It begins with receiving an invoice from a vendor.

The invoice is then verified against a purchase order and receiving report to ensure accuracy. Once verified, the invoice is approved for payment.

Finally, payment is made according to the agreed-upon terms. Accurate record-keeping throughout this process is vital for financial transparency.

The Significance of Accurate Accounts Payable Management

Why is getting accounts payable right so important? The answer lies in its far-reaching impact on a company’s financial stability and relationships.

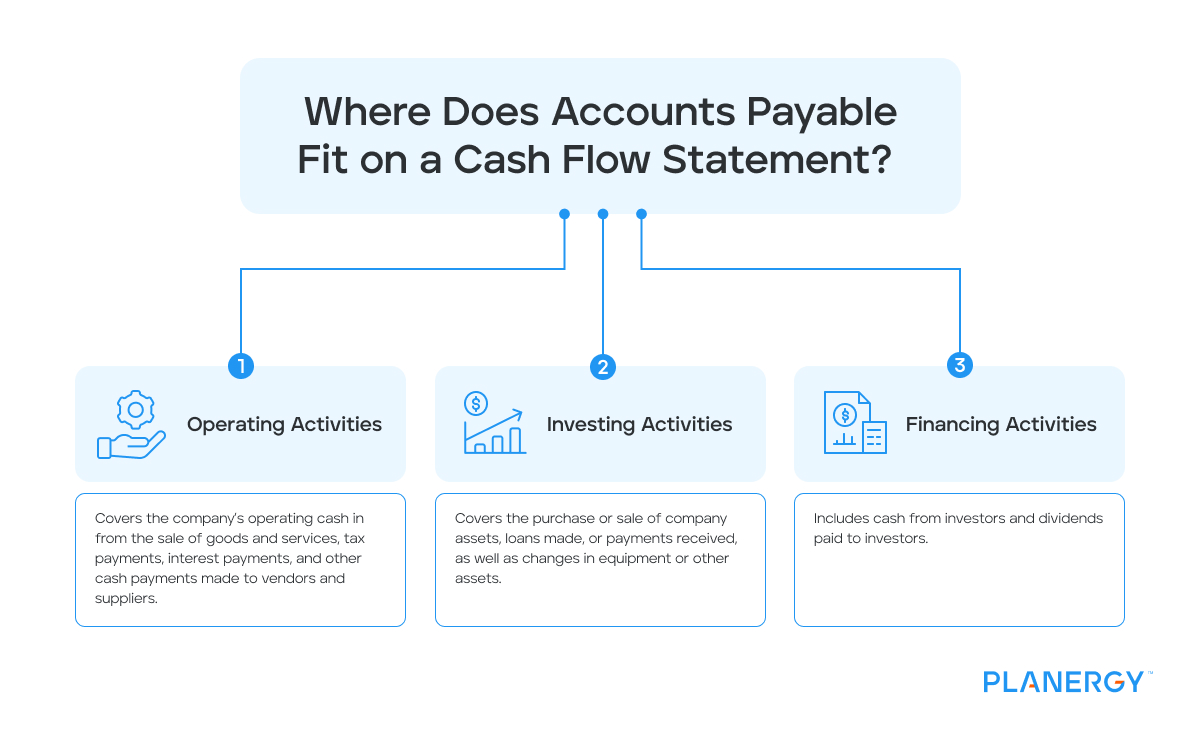

Effective AP management contributes directly to a healthy cash flow. By strategically managing payment schedules, businesses can optimize their working capital.

Poorly managed AP can strain relationships with suppliers. Late or missed payments can damage trust and potentially lead to unfavorable terms or even discontinued supply.

Key Benefits of a Well-Managed AP System

A robust accounts payable system yields numerous benefits. These advantages extend beyond simply paying bills on time.

Negotiating better payment terms with suppliers becomes easier with a history of timely payments. This leads to cost savings and improved cash flow.

Taking advantage of early payment discounts can also significantly reduce expenses. Many suppliers offer discounts for payments made before the due date.

Strong accounts payable practices provide better visibility into spending. This helps businesses identify areas where they can cut costs and improve efficiency.

Common Misconceptions About Accounts Payable

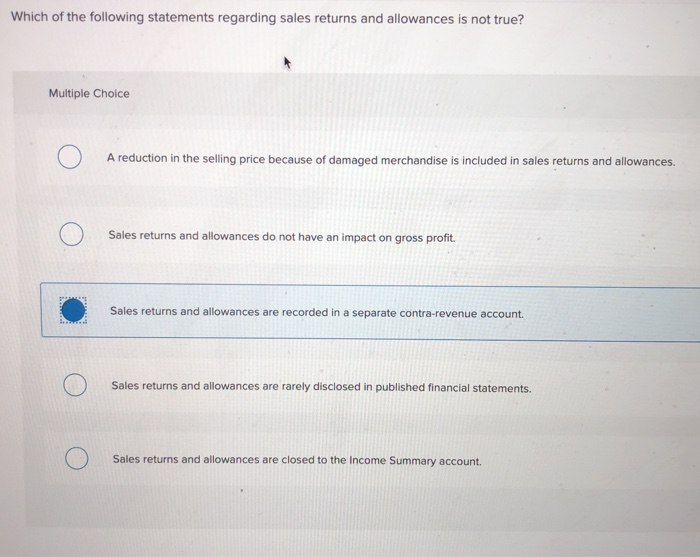

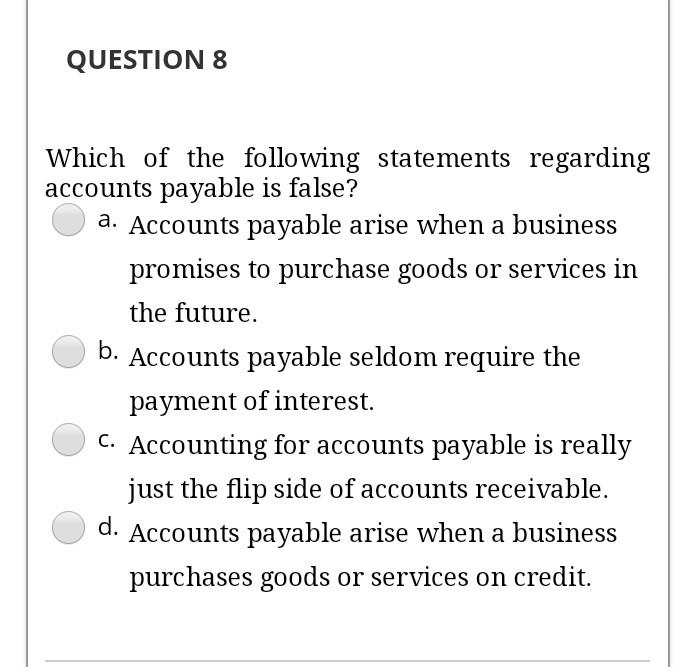

Several common misconceptions surround accounts payable. These misunderstandings can lead to errors and inefficiencies.

One common misconception is that AP is simply a clerical task. In reality, it requires strategic planning and careful execution.

Another misconception is that all invoices should be paid immediately. While prompt payment is important, strategically managing payment schedules is key to optimizing cash flow.

The Impact of Technology on Accounts Payable

Technology has revolutionized accounts payable processes in recent years. Automation and digital solutions have brought significant improvements.

Automated invoice processing reduces manual data entry and minimizes errors. This frees up AP staff to focus on more strategic tasks.

Electronic payment systems streamline the payment process and improve efficiency. This reduces the risk of late payments and strengthens supplier relationships.

Cloud-based AP solutions provide greater accessibility and collaboration. This allows businesses to manage their accounts payable from anywhere with an internet connection.

Accounts Payable vs. Accounts Receivable

It’s crucial to differentiate accounts payable from accounts receivable (AR). While both relate to financial transactions, they represent opposite sides of the coin.

Accounts payable represents what a company owes to others. Accounts receivable represents what others owe to the company.

Managing both AP and AR effectively is essential for maintaining a healthy financial position. A balance between these two areas is critical for sustainable growth.

Best Practices for Effective Accounts Payable Management

Implementing best practices is crucial for maximizing the benefits of accounts payable management. These practices ensure accuracy, efficiency, and strong supplier relationships.

Establishing clear payment policies and procedures is fundamental. This includes defining payment terms, approval processes, and documentation requirements.

Regularly reconciling AP accounts ensures accuracy and helps identify discrepancies. This prevents errors from snowballing into larger problems.

Maintaining strong communication with suppliers is essential. Addressing any concerns promptly and resolving disputes fairly strengthens relationships.

The Role of Internal Controls in Accounts Payable

Implementing strong internal controls within the accounts payable process is vital for preventing fraud and errors. These controls safeguard the company’s assets.

Segregation of duties ensures that no single individual has complete control over the entire AP process. This reduces the risk of fraudulent activities.

Requiring multiple levels of approval for invoices helps prevent unauthorized payments. This adds an extra layer of security to the process.

Regular audits of the AP process can identify weaknesses and ensure compliance with policies. This helps maintain the integrity of the system.

The Future of Accounts Payable

The field of accounts payable continues to evolve with advancements in technology. Artificial intelligence (AI) and machine learning are poised to play a significant role.

AI-powered solutions can automate tasks such as invoice processing and fraud detection. This further enhances efficiency and accuracy.

Real-time analytics provide valuable insights into spending patterns and vendor performance. This enables businesses to make more informed decisions.

Blockchain technology could potentially revolutionize AP by providing a secure and transparent platform for transactions. This could streamline payments and reduce the risk of fraud.

Sarah, armed with a clearer understanding of accounts payable, can now approach her tasks with greater confidence. She knows that effective AP management is not just about paying bills; it's about building a financially stable and sustainable business.

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)