Which Of The Following Statements Is Correct Regarding Common Stock

The nuances of common stock can be deceptively complex, often tripping up even seasoned investors. Misunderstanding fundamental aspects can lead to costly errors in portfolio management and investment decisions. A seemingly simple question – “Which of the following statements is correct regarding common stock?” – can unravel a web of market dynamics, shareholder rights, and corporate governance.

At the heart of the matter lies the critical understanding of ownership, risk, and reward associated with common stock. This article delves into the core attributes of common stock. We'll examine its role in corporate finance, and its implications for individual investors. Our analysis will draw on established financial principles and current market practices, clarifying key concepts and providing a clear understanding of this fundamental investment vehicle.

Ownership and Shareholder Rights

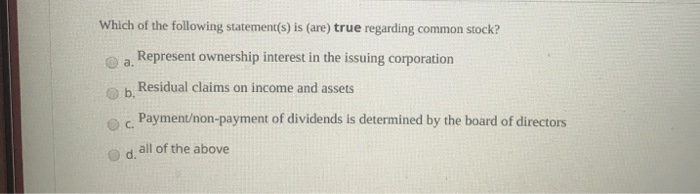

Common stock represents a fractional ownership in a corporation. This ownership grants shareholders certain rights, primarily the right to vote on corporate matters.

Shareholders typically vote on the election of directors and significant company actions. This includes mergers and acquisitions, and amendments to the corporate charter.

However, these voting rights are usually proportional to the number of shares owned. Thus, those with larger stakes wield greater influence.

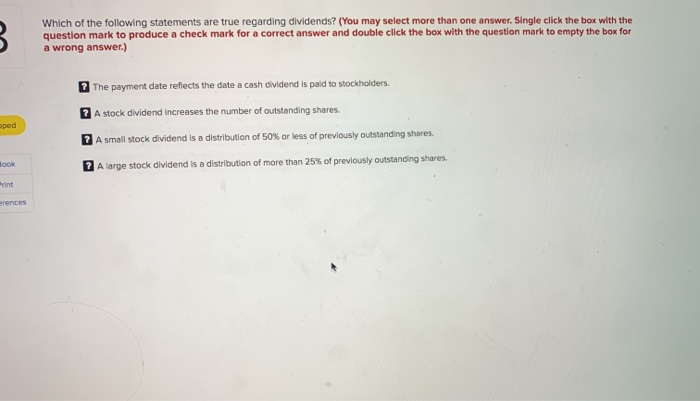

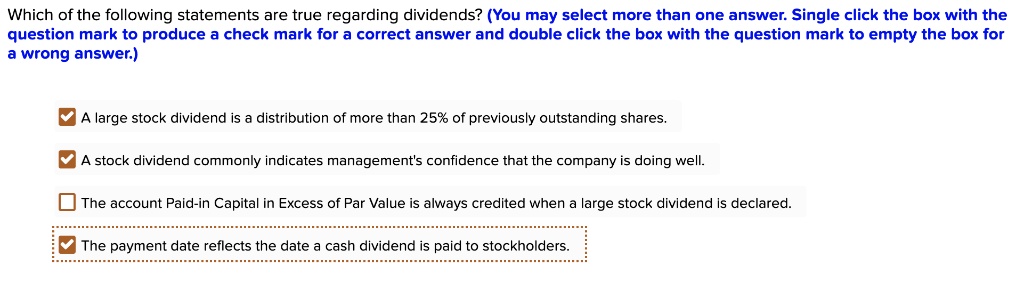

Dividends and Distributions

Common stockholders may receive dividends, which are distributions of the company's profits. The payment of dividends is not guaranteed.

It's determined by the board of directors, based on the company's financial performance and strategic objectives. Companies can choose to reinvest profits for growth.

This reinvestment might mean no dividends are paid at all.

Liquidation Priority and Residual Claim

In the event of a company's liquidation, common stockholders have a residual claim on assets. This means they are paid only after all other creditors are satisfied.

These creditors include bondholders, banks, and preferred stockholders. The inherent risk is that common stockholders may receive little to nothing in a liquidation.

That is especially true if the company's assets are insufficient to cover its liabilities.

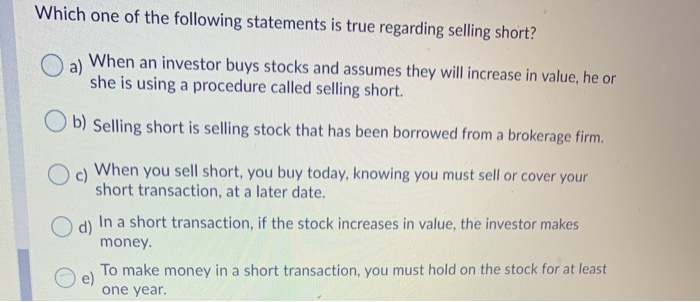

Risk and Return Profile

Common stock is generally considered a higher-risk investment compared to bonds. This is because its value can fluctuate significantly due to various market factors.

These factors include economic conditions, industry trends, and company-specific news. However, common stock also offers the potential for higher returns than bonds.

That is especially true during periods of strong economic growth. Investors accept the higher risk for the potential of greater capital appreciation.

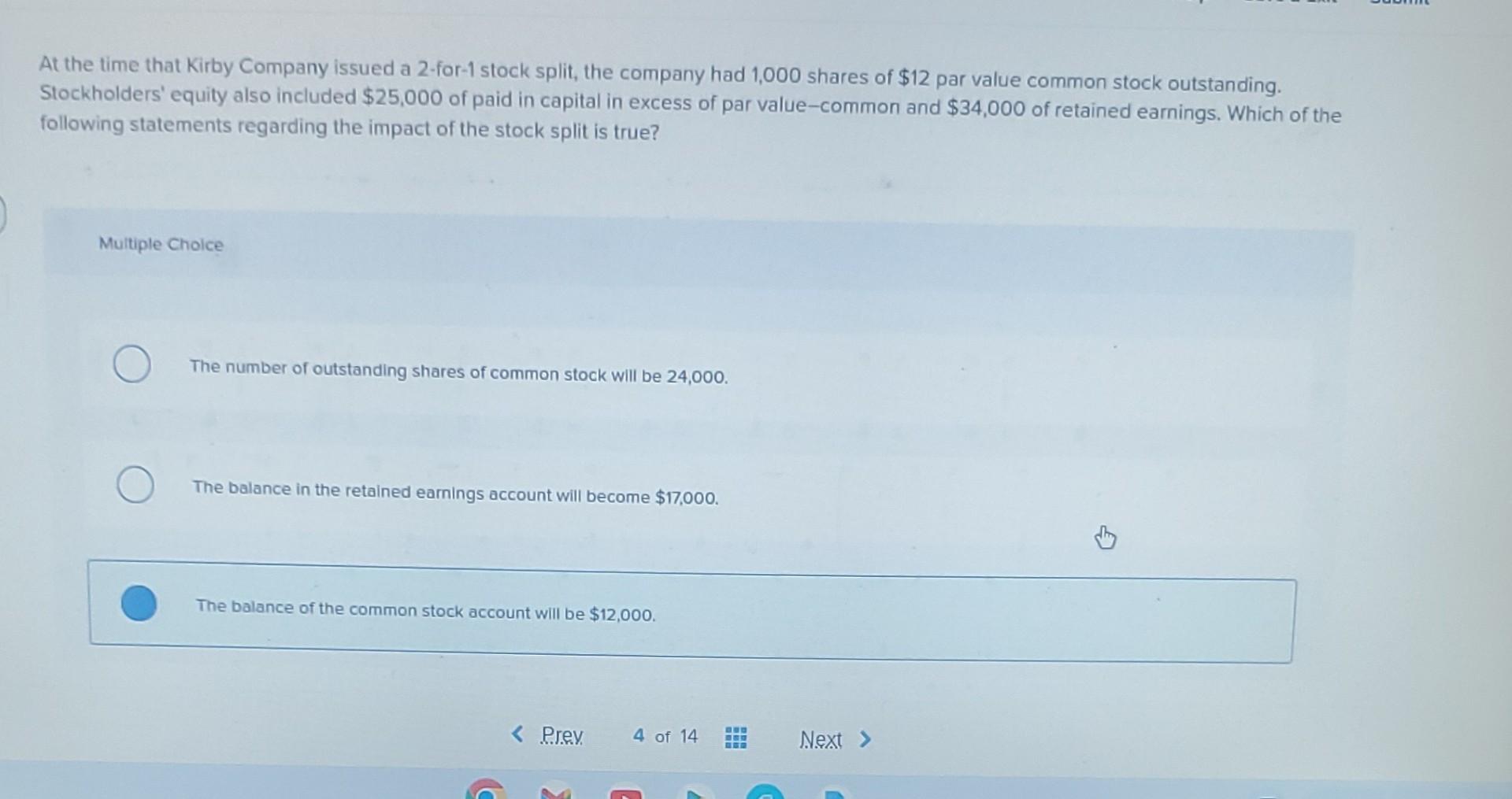

Preemptive Rights and Stock Splits

Some common stock may have preemptive rights. This gives existing shareholders the right to purchase new shares issued by the company.

This allows maintaining their proportionate ownership stake and prevents dilution of their voting power. Companies can also declare stock splits.

A split increases the number of outstanding shares and reduces the price per share, while the total market capitalization remains the same, theoretically.

Market Valuation and Trading

The price of common stock is determined by supply and demand in the stock market. Investor sentiment, earnings reports, and economic forecasts all influence the price.

Shares are typically traded on stock exchanges, providing liquidity and facilitating price discovery. The market value of a company's common stock is its market capitalization.

Market capitalization is calculated by multiplying the number of outstanding shares by the current share price.

Classes of Common Stock

Some companies have different classes of common stock. These classes may have different voting rights or dividend entitlements.

For example, Class A shares might have one vote per share. Meanwhile, Class B shares could have ten votes per share.

This structure often allows the company's founders or management to maintain control even with a minority ownership stake.

Key Considerations for Investors

Before investing in common stock, investors should carefully research the company. It is crucial to understand its business model and financial performance.

Assess the company's competitive landscape, management team, and growth prospects. Diversification is also important to mitigate risk.

Spreading investments across different companies and industries reduces the impact of any single investment on the overall portfolio.

The Bottom Line

Understanding the rights and responsibilities associated with common stock is crucial for making informed investment decisions. Common stock represents ownership in a company, granting voting rights and the potential for dividends and capital appreciation.

However, it also carries the risk of loss. Particularly in cases of company underperformance or liquidation.

Careful analysis and diversification are essential for navigating the complexities of the stock market and achieving long-term investment goals. By grasping these fundamentals, investors can better evaluate the correctness of any statement about common stock and make sound financial choices.