Which Of The Following Statements Is True About Managerial Compensation

The question of how executives are compensated has become a flashpoint in contemporary business. A chasm exists between critics decrying exorbitant payouts and defenders emphasizing performance-based rewards. The debate over managerial compensation continues to rage, fueling discussions on fairness, corporate governance, and economic inequality.

At the heart of the matter lies understanding the various elements that comprise executive pay packages and their impact. It is about recognizing the complexities of incentivizing leadership while safeguarding shareholder value.

Decoding Managerial Compensation: Unveiling the Truth

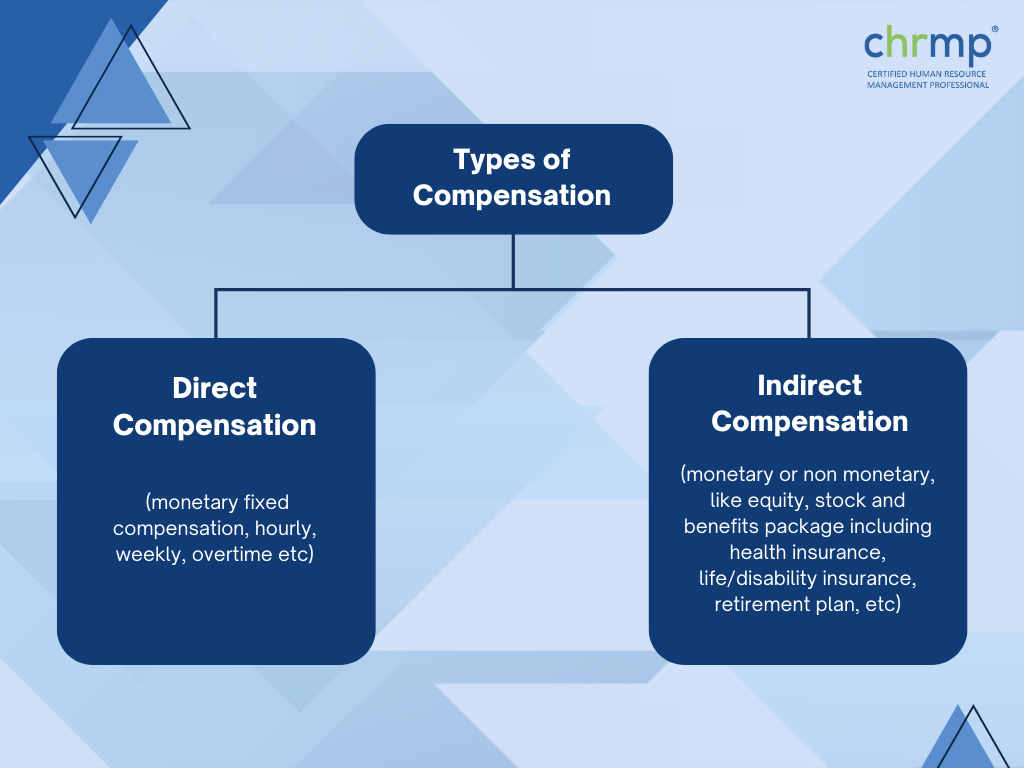

Managerial compensation encompasses more than just a base salary. It's a complex system, often including bonuses, stock options, restricted stock, and various perquisites.

Understanding its structure and drivers requires careful analysis of available data and expert opinions, leading us to assess which common statements about managerial compensation hold true.

Base Salary: The Foundation

The base salary represents a fixed component of an executive's total compensation. While seemingly straightforward, its determination involves considering factors like industry standards, company size, and individual experience.

Executive compensation surveys conducted by firms like Willis Towers Watson and Mercer provide benchmark data. These surveys are crucial for companies seeking to align base salaries with competitive market rates.

Incentive-Based Compensation: Driving Performance?

A significant portion of managerial compensation is tied to performance through bonuses and stock-based awards. Bonuses are usually linked to achieving specific financial or strategic goals, while stock options and restricted stock incentivize long-term value creation.

However, the effectiveness of these incentives is hotly debated. Critics argue that they can encourage short-term thinking and risk-taking behavior at the expense of long-term sustainability.

According to a report by the Economic Policy Institute (EPI), the ratio of CEO-to-worker pay has skyrocketed in recent decades. This data fuels the perception that executive compensation is often disconnected from company performance and worker wages.

Stock Options and Restricted Stock: Aligning Interests?

Stock options grant executives the right to purchase company stock at a predetermined price, while restricted stock vests over time, contingent upon continued employment. Both are intended to align executives' interests with those of shareholders.

The Council of Institutional Investors (CII) emphasizes the importance of clear and measurable performance metrics linked to stock-based awards. They advocate for rigorous oversight and transparency in compensation decisions.

"Stock options should be granted judiciously and tied to demanding performance goals to ensure they truly incentivize long-term value creation for shareholders." - Council of Institutional Investors

Perquisites and Benefits: The Hidden Costs

Managerial compensation also includes perquisites, such as company cars, private jet usage, and personal security. While these benefits may seem insignificant compared to salaries and bonuses, they can add substantially to the overall cost.

Transparency regarding these perks is often lacking. This can contribute to public skepticism about the fairness of executive pay packages.

Analyzing Common Statements: Separating Fact from Fiction

Several common statements circulate regarding managerial compensation. Determining their veracity requires careful scrutiny of available data and research.

One frequently heard claim is that executive compensation is solely determined by market forces. While market factors undoubtedly play a role, research suggests that other factors, such as board influence and social norms, also exert significant influence.

Another common assertion is that high executive pay is necessary to attract and retain top talent. While competitive compensation is certainly important, some studies indicate a weak correlation between executive pay and firm performance.

Furthermore, the claim that "executive pay reflects the true value of their contributions" is often challenged. The subjective nature of measuring an executive's impact makes this difficult to quantify objectively.

It's worth noting that regulations like the Dodd-Frank Act have attempted to increase transparency and shareholder oversight of executive compensation. But their effectiveness in curbing excessive pay remains a subject of debate.

The Role of Corporate Governance and Transparency

Effective corporate governance plays a crucial role in ensuring responsible and equitable managerial compensation. Independent compensation committees, comprised of board members with relevant expertise, are essential.

Increased transparency is also vital. Companies should clearly disclose the rationale behind compensation decisions and the performance metrics used to evaluate executives.

Shareholder engagement is another key element. Empowering shareholders to vote on executive pay packages provides a mechanism for holding boards accountable.

Looking Ahead: The Future of Managerial Compensation

The debate over managerial compensation will likely continue, driven by concerns about income inequality and corporate accountability. A shift towards more performance-based and long-term-oriented compensation structures is anticipated.

Greater emphasis on stakeholder value, encompassing employees, customers, and communities, may also influence compensation decisions.

Ultimately, finding the right balance between incentivizing executives and safeguarding shareholder interests requires ongoing dialogue, informed analysis, and a commitment to ethical and transparent practices. The need for responsible governance in executive compensation is paramount.