Which Of The Following Statements Is True Of Accounting Data

Urgent clarifications are emerging regarding the fundamental nature of accounting data, dispelling common misconceptions.

This article addresses the crucial question of what definitively characterizes accounting data, offering essential insights for business professionals and students alike.

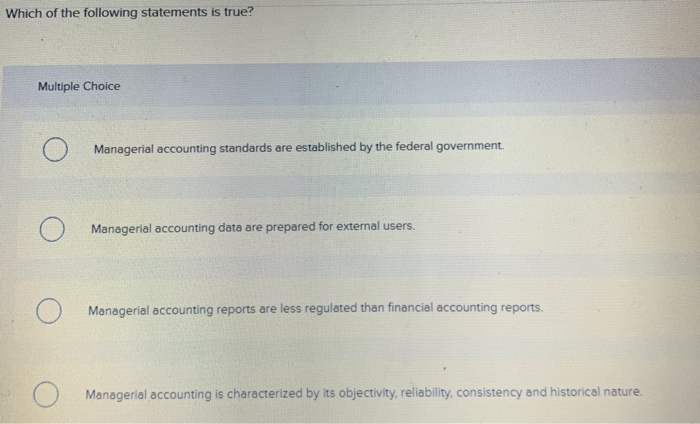

The Definitive Truth: Accounting Data Must Be Reliable

The statement that is unequivocally true of accounting data is that it must be reliable. This foundational principle ensures that the information presented is trustworthy and can be confidently used for decision-making.

Reliability encompasses several key characteristics, including verifiability, neutrality, and representational faithfulness. Without reliability, accounting data becomes essentially worthless.

Understanding Reliability in Detail

Verifiability means that the data can be independently confirmed by different parties using the same methods. This reduces the risk of manipulation or errors.

Neutrality dictates that the data is free from bias and presented objectively. Accounting data should not favor any particular stakeholder.

Representational faithfulness signifies that the data accurately reflects the economic reality of the transactions or events being reported. It should reflect the economic substance and not just the legal form.

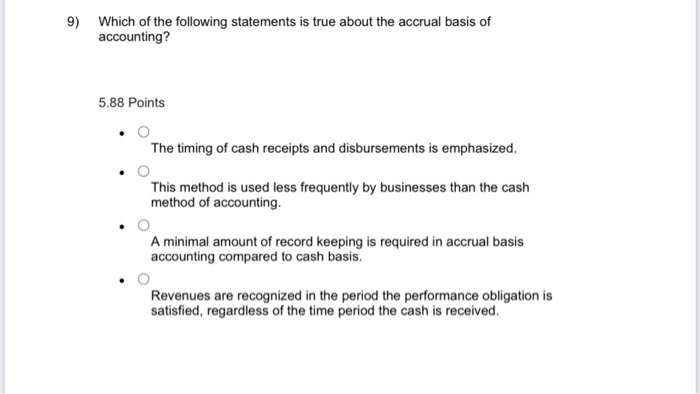

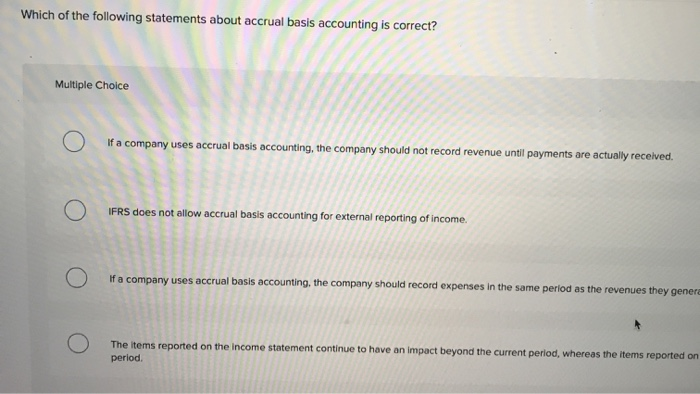

Why Other Statements Might Be Misleading

While other statements about accounting data might hold some truth in specific contexts, they don't possess the universal validity of reliability. For instance, the idea that all accounting data is perfectly precise is often unrealistic.

Accounting relies on estimations and judgments, particularly in areas like depreciation and allowance for doubtful accounts. Therefore, a degree of imprecision is often inherent.

Similarly, the notion that all accounting data is solely focused on past transactions is inaccurate. Accounting data plays a critical role in future projections and budgeting.

The Consequences of Unreliable Data

The consequences of using unreliable accounting data can be devastating. Incorrect financial information can lead to poor investment decisions and operational inefficiencies.

Moreover, it can damage a company's reputation and erode investor trust. In severe cases, it can lead to legal repercussions and even business failure.

The Enron scandal, for example, serves as a stark reminder of the catastrophic impact of manipulated and unreliable accounting data.

Ensuring Reliability: Key Practices

To ensure the reliability of accounting data, companies must implement robust internal controls. These controls should include segregation of duties, authorization procedures, and regular reconciliations.

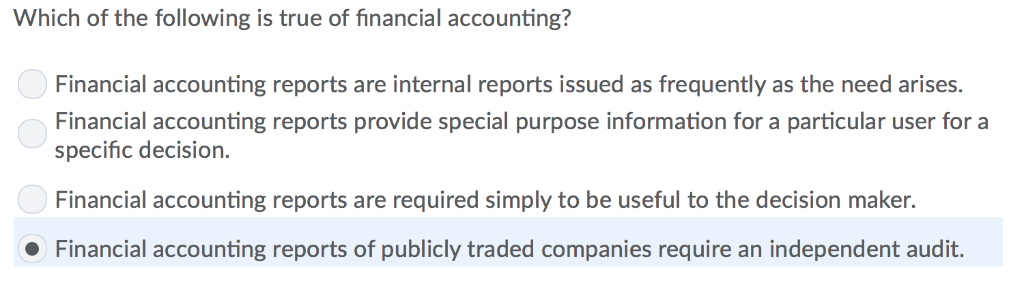

External audits by independent firms are also crucial for providing an objective assessment of the accuracy and reliability of financial statements. This can create additional confidence.

Furthermore, adhering to established accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), is essential.

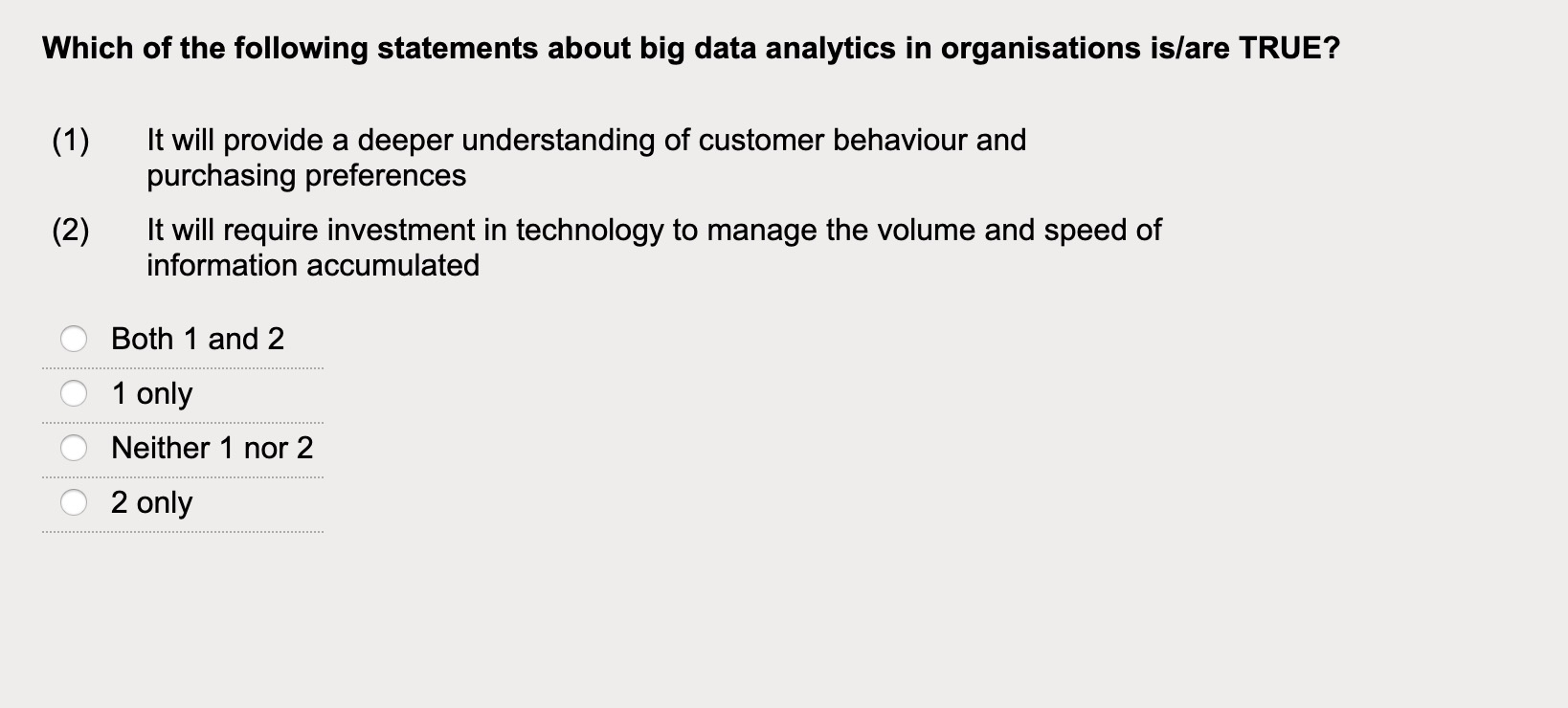

The Role of Technology

Technology plays an increasingly important role in ensuring the reliability of accounting data. Accounting software can automate many tasks and reduce the risk of human error.

Data analytics tools can help to identify anomalies and potential fraud. These tools enable quicker reaction to potential problems.

Blockchain technology is also emerging as a promising solution for enhancing transparency and verifiability in accounting processes.

Education and Training

Proper education and training are vital for accountants and financial professionals. They need to understand the principles of reliability and the importance of ethical conduct.

Continuing professional development ensures that they stay up-to-date with the latest accounting standards and best practices. These skills are a great asset.

Organizations like the American Institute of Certified Public Accountants (AICPA) offer resources and certifications to support professional development.

Moving Forward: Maintaining Data Integrity

The ongoing focus should be on maintaining the integrity of accounting data through continuous improvement. This includes refining internal controls, embracing new technologies, and promoting ethical behavior.

By prioritizing reliability, organizations can build trust with stakeholders and ensure the long-term success of their businesses.

Stakeholders should be actively engaged to ensure there is no data discrepancy, ensuring smooth operation.