Which Of The Following Statements Is True Of Markets

Imagine a bustling marketplace, a symphony of sounds – vendors hawking their wares, buyers haggling for the best price, the rustle of fabrics, and the tantalizing aromas of freshly baked goods. This vibrant scene, repeated in countless variations across the globe, is the essence of a market, a dynamic space where supply meets demand, shaping economies and influencing lives.

At its core, understanding which statements accurately describe markets is crucial for anyone navigating the modern world. This isn't just about economics; it's about grasping the forces that shape our access to goods and services, influence prices, and ultimately impact our daily lives. The statement which is always true about markets is: Markets facilitate the voluntary exchange of goods and services between buyers and sellers.

The Fundamental Nature of Markets

Markets are not just physical locations; they are systems. They can exist virtually, connect continents, and operate 24/7. The fundamental characteristic of any market, however, remains constant: it's a mechanism for voluntary exchange.

This voluntary nature is critical. Sellers offer goods or services they hope to profit from, and buyers purchase them because they believe the value received is worth the price paid. No one is forced to participate; it's a dance of mutual benefit, ideally.

Think about buying a cup of coffee. The coffee shop offers the beverage at a certain price, and you, as the buyer, decide if that price is acceptable for the convenience, taste, and caffeine kick it provides. This simple transaction is a microcosm of the larger market at work.

Beyond Simple Exchange: Market Dynamics

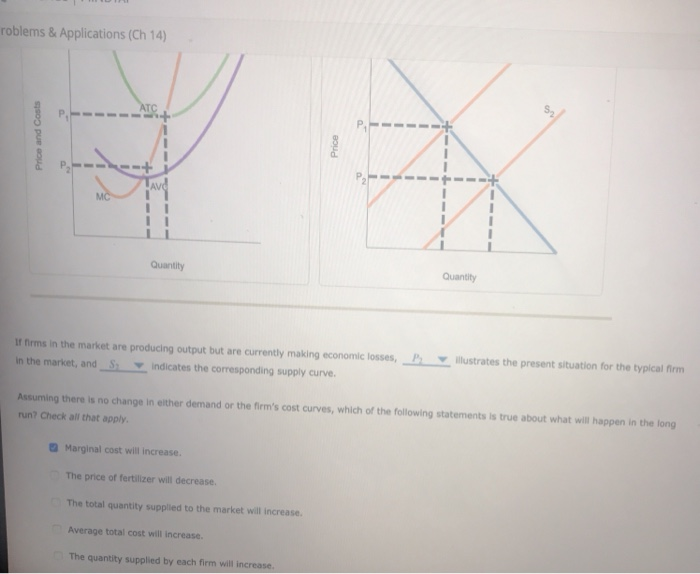

While voluntary exchange is the defining feature, markets are far more complex than simple transactions. Supply and demand interact to determine prices, creating a delicate balancing act. This is where economic principles truly come to life.

When demand for a product increases, and supply remains constant, prices tend to rise. Conversely, if supply increases and demand stays the same, prices tend to fall. These are basic but powerful principles that influence everything from gasoline prices to the cost of housing.

Furthermore, markets are influenced by a multitude of factors: government regulations, technological advancements, consumer preferences, and even global events. A sudden frost in Brazil, for example, can impact the global coffee market, demonstrating the interconnectedness of these systems.

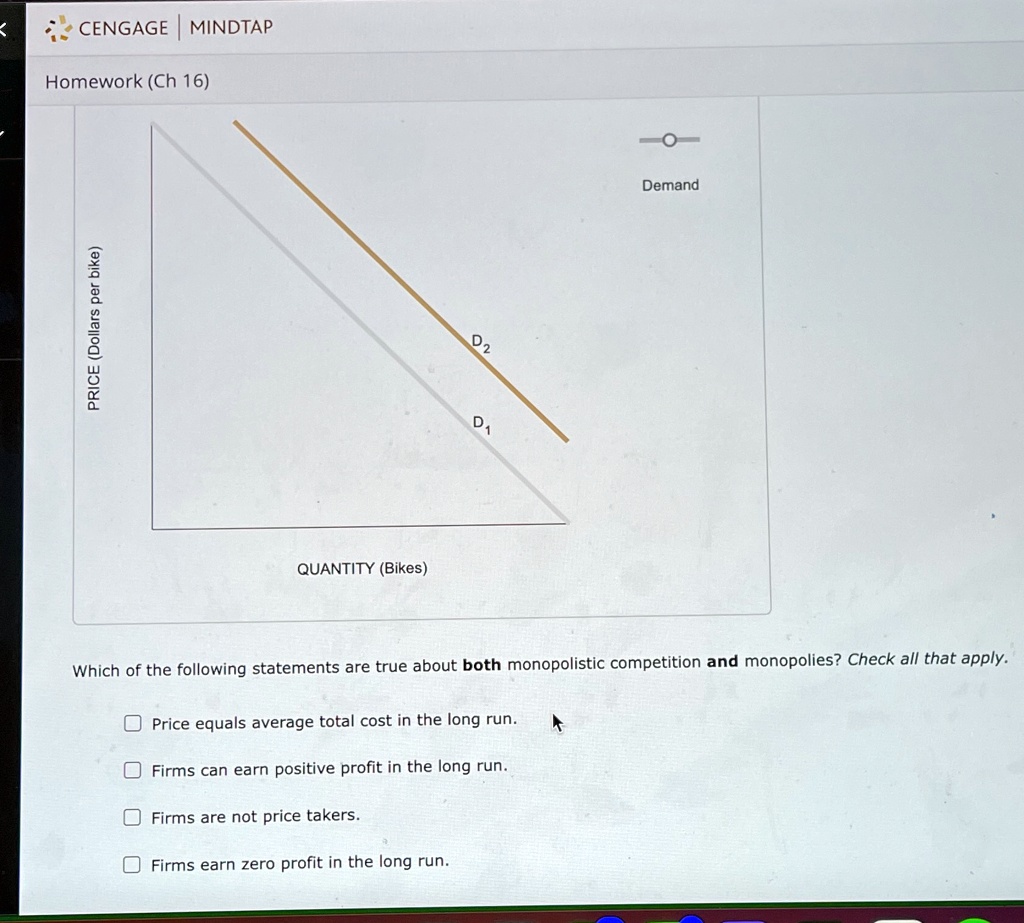

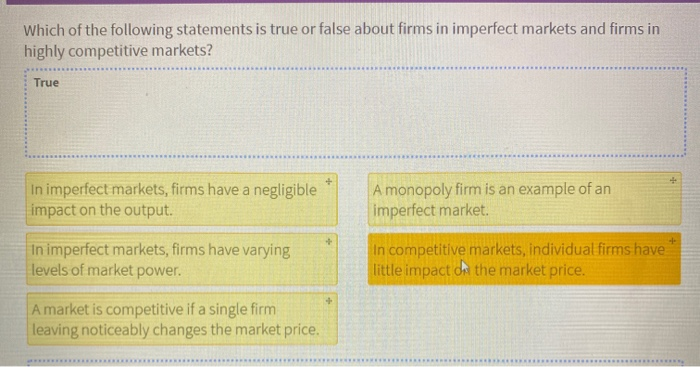

The Role of Competition

Competition is another key ingredient in a healthy market. When multiple sellers offer similar goods or services, they are incentivized to improve quality, lower prices, and innovate to attract customers. This rivalry benefits consumers and drives efficiency.

Imagine a city with only one coffee shop. They can charge high prices and offer mediocre service with little consequence. But when several coffee shops compete, they are forced to offer better products and lower prices to win over customers.

However, a lack of competition, such as in a monopoly or oligopoly, can stifle innovation and lead to higher prices for consumers. Therefore, ensuring fair competition is a crucial role of governments in many market economies.

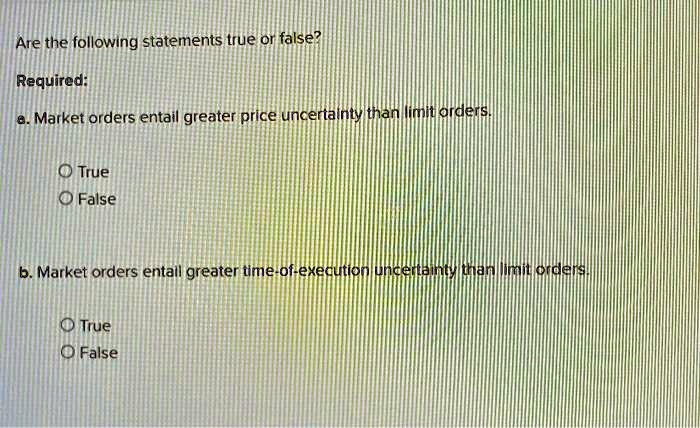

Market Efficiency and Information

An efficient market is one where prices accurately reflect all available information. In such a market, it is difficult for individual investors to consistently outperform the market average because all relevant information is already factored into prices.

This doesn't mean that prices are always "correct" in some absolute sense, but rather that they reflect the collective knowledge and expectations of all market participants. Information asymmetry, where some participants have more information than others, can distort market efficiency.

For example, insider trading, where individuals with privileged information about a company's prospects trade on that information, is illegal because it undermines market fairness and efficiency.

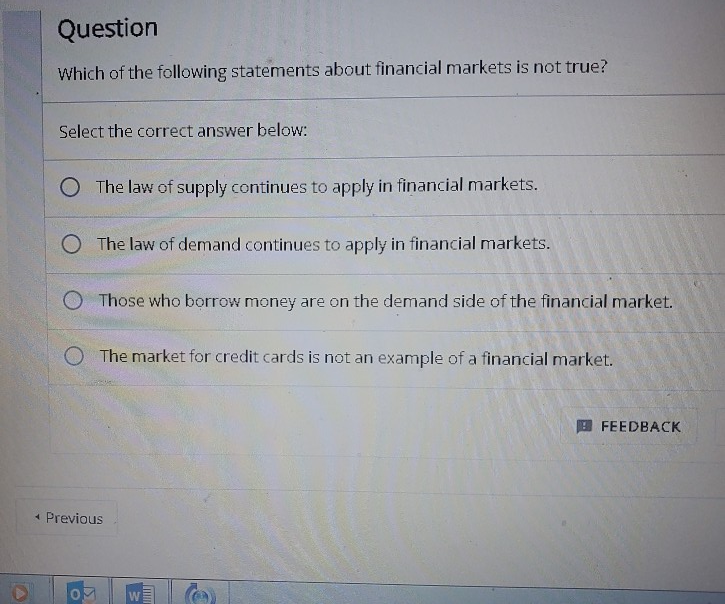

Market Failures and the Need for Intervention

While markets are generally efficient at allocating resources, they are not perfect. Market failures can occur when markets fail to produce the optimal outcome for society. These failures often necessitate some form of government intervention.

One common example is the existence of externalities, costs or benefits that affect parties who are not involved in the transaction. Pollution is a classic example of a negative externality; the cost of pollution is not borne solely by the producer but also by the wider community. Government regulations, such as emissions standards, are often implemented to address such externalities.

Another type of market failure occurs when there are public goods, such as national defense or clean air, which are non-excludable (difficult to prevent people from consuming them) and non-rivalrous (one person's consumption does not diminish another's). Because private markets tend to under-provide public goods, governments often step in to provide them.

The Importance of Legal and Ethical Frameworks

Beyond government intervention, a robust legal and ethical framework is essential for the proper functioning of markets. Contracts must be enforceable, property rights must be protected, and fraud must be deterred. Without these safeguards, trust erodes, and markets cannot thrive.

Consider a scenario where contracts are not legally binding. Businesses would be hesitant to engage in transactions, fearing that their counterparties might renege on their agreements. This would significantly hinder economic activity.

Similarly, ethical behavior plays a crucial role in fostering trust and cooperation within markets. Companies that prioritize ethical practices, such as honesty and transparency, are more likely to build strong relationships with customers and suppliers, leading to long-term success.

Markets and Innovation

Markets are powerful engines of innovation. The pursuit of profit motivates businesses to develop new products, improve existing ones, and find more efficient ways of producing goods and services. This constant innovation leads to economic growth and improved living standards.

Think about the smartphone revolution. Competition among companies like Apple and Samsung has driven rapid innovation in mobile technology, resulting in devices that are more powerful, more versatile, and more affordable than ever before.

This innovative spirit is not limited to the technology sector. It can be seen in every industry, from agriculture to healthcare, as businesses strive to meet the evolving needs and demands of consumers.

The Global Marketplace

In today's interconnected world, markets are increasingly global. Goods and services flow across borders, capital moves freely between countries, and businesses operate on a global scale. This globalization has both benefits and challenges.

On the one hand, it allows consumers access to a wider variety of goods and services at lower prices. It also creates new opportunities for businesses to expand their markets and access new technologies.

On the other hand, globalization can lead to job displacement in some countries, increased competition, and concerns about environmental and labor standards. Managing the complexities of the global marketplace requires careful consideration of these factors.

Conclusion: The Enduring Relevance of Markets

The marketplace, whether a traditional bazaar or a sophisticated online platform, remains a cornerstone of modern society. Understanding the principles that govern markets – voluntary exchange, supply and demand, competition, and the importance of ethical and legal frameworks – is essential for navigating the complexities of the 21st century.

While markets are not without their flaws, they are generally efficient at allocating resources, promoting innovation, and improving living standards. By fostering a deeper understanding of how markets function, we can work towards creating a more prosperous and equitable world.

From the farmer selling produce at the local market to the tech entrepreneur launching a new startup, the spirit of voluntary exchange continues to drive economic activity and shape our world. The statement that markets facilitate this exchange remains a fundamental truth, a guiding principle in the ever-evolving landscape of commerce.