Which Of The Following Terms Apply To A Bond

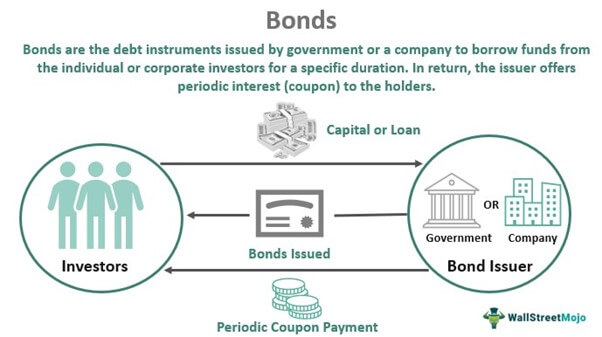

In today's complex financial landscape, understanding the terms associated with bonds is crucial for both seasoned investors and those new to the market. Misinterpreting these terms can lead to costly errors and missed opportunities. The bond market, a cornerstone of global finance, relies on clear and accurate terminology to facilitate efficient transactions and ensure transparency.

This article aims to clarify which terms accurately apply to bonds, differentiating them from those that are frequently misused or misunderstood. We will delve into key characteristics such as coupon rate, yield to maturity, credit rating, maturity date, and par value, providing a comprehensive overview. Our analysis will draw upon official statements from regulatory bodies and data from reputable financial organizations to ensure accuracy.

Key Bond Characteristics

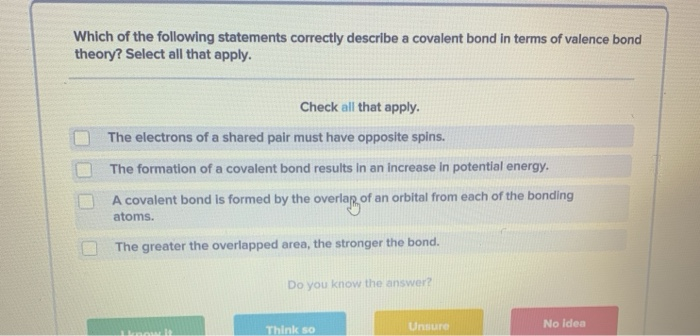

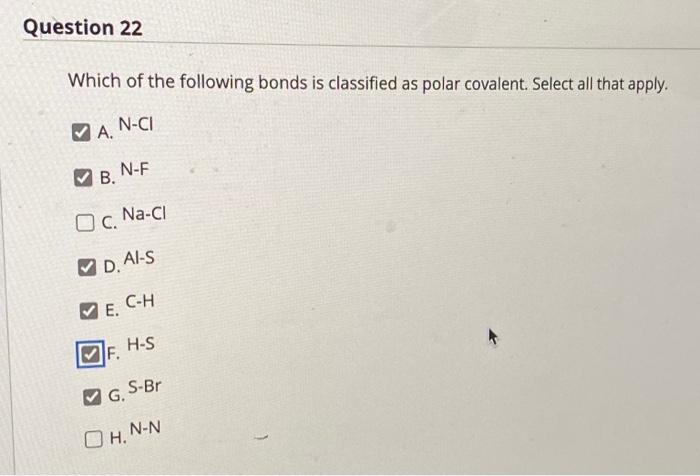

Coupon Rate and Yield

The coupon rate represents the annual interest payment a bond issuer makes, expressed as a percentage of the bond's face value. This rate remains constant throughout the bond's life, unless it is a floating-rate bond.

However, the yield to maturity (YTM) is a more comprehensive measure of a bond's return. It considers the bond's current market price, face value, coupon interest rate, and time to maturity, providing a more accurate reflection of potential investment returns.

YTM fluctuates with market conditions, while the coupon rate remains fixed.

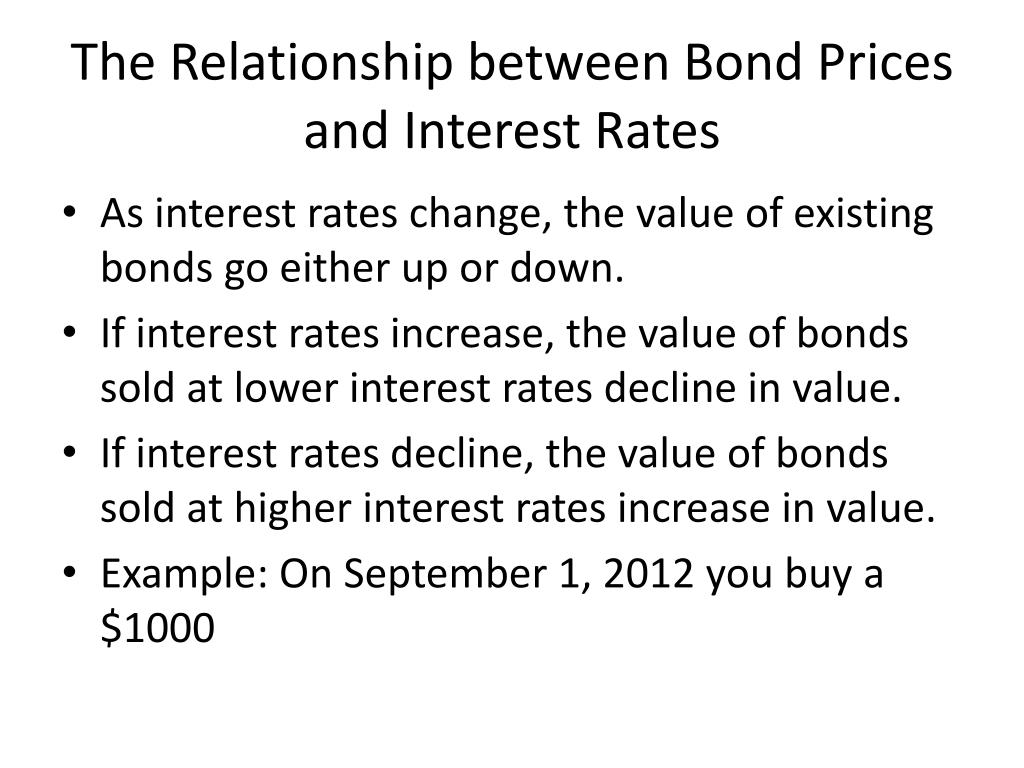

Par Value and Market Price

A bond's par value, also known as face value, is the amount the issuer will repay at maturity. It is the benchmark against which the coupon rate is calculated.

The market price, however, is the price at which the bond is currently trading in the market. This can be above (at a premium) or below (at a discount) the par value depending on interest rate movements and the bond's perceived risk.

Maturity Date and Duration

The maturity date is the date on which the bond issuer is obligated to repay the par value to the bondholder. Bonds can have short-term maturities (e.g., a few months) or long-term maturities (e.g., 30 years or more).

Duration, a related but different concept, measures a bond's sensitivity to changes in interest rates. It is an essential tool for managing interest rate risk in a bond portfolio.

Credit Rating and Risk

Credit rating is an assessment of the bond issuer's creditworthiness. Agencies like Moody's, Standard & Poor's (S&P), and Fitch assign ratings that indicate the probability of default.

Bonds with higher credit ratings (e.g., AAA or Aaa) are considered lower risk, while those with lower ratings (e.g., BB or Ba) are considered higher risk and are often referred to as "junk bonds" or "high-yield bonds."

Higher risk usually implies a higher required yield to compensate investors for the added risk.

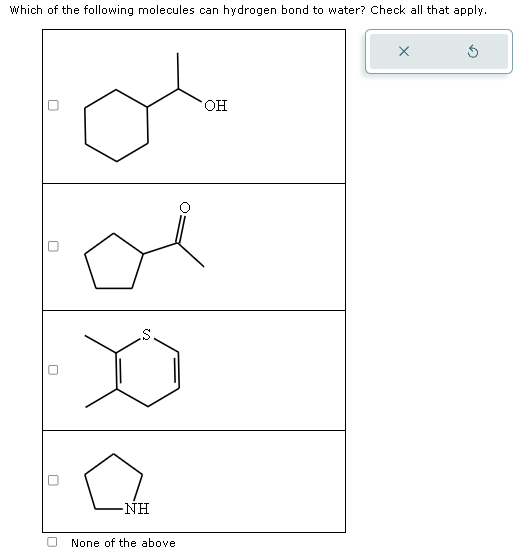

Terms Frequently Misunderstood

Some terms are often misused or misunderstood in relation to bonds, leading to potential investor confusion.

For instance, equating a bond's credit rating directly with its absolute safety is a fallacy; even highly-rated bonds carry some degree of risk. Similarly, thinking a high coupon rate guarantees a high return ignores the impact of the purchase price relative to par.

Furthermore, nominal yield and current yield are often used interchangeably but are distinct concepts. Nominal yield refers to the coupon rate, while current yield represents the annual interest payment divided by the bond's current market price.

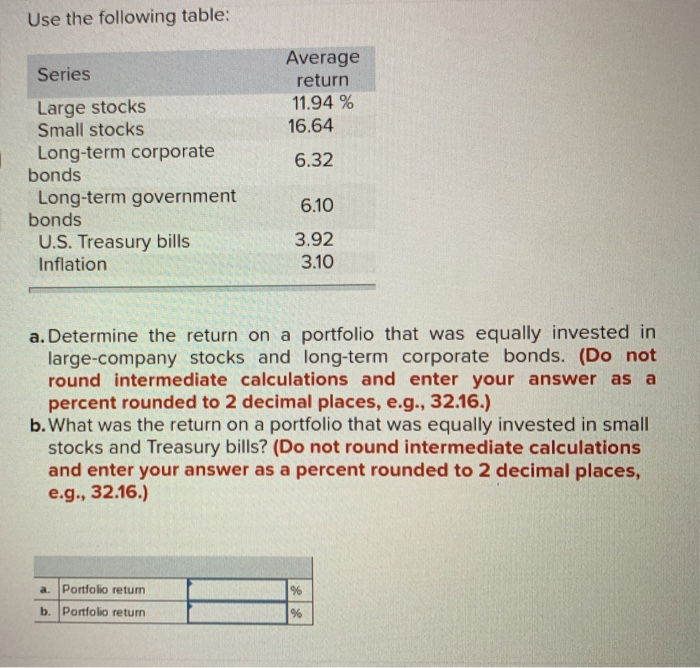

Perspectives on Bond Investing

Investment strategies involving bonds vary widely depending on the investor's risk tolerance, investment goals, and time horizon. Conservative investors often favor high-grade bonds to preserve capital, while aggressive investors may seek higher returns through lower-rated or longer-maturity bonds.

Institutional investors, such as pension funds and insurance companies, typically have different objectives and constraints than individual investors. They often focus on matching their liabilities with bond investments of appropriate maturities and credit quality.

According to a recent report by the Securities Industry and Financial Markets Association (SIFMA), understanding the nuances of bond terminology is paramount for all participants in the bond market, regardless of their investment style or size.

The Future of the Bond Market

The bond market continues to evolve in response to changing economic conditions, technological advancements, and regulatory reforms. The rise of electronic trading platforms and algorithmic trading has increased market efficiency and liquidity.

However, these developments also introduce new challenges, such as increased volatility and the potential for flash crashes. The ongoing debate about the appropriate level of regulation in the bond market reflects the need to balance innovation with investor protection.

As interest rates are expected to rise in the coming years, understanding the impact on bond prices and yields will be crucial for investors seeking to navigate the changing landscape. Continued education and due diligence are essential for making informed investment decisions in the bond market.

![Which Of The Following Terms Apply To A Bond [ANSWERED] Use bond energies to predict ΔH for the following reaction](https://media.kunduz.com/media/sug-question/raw/52466732-1659251102.0087738.jpeg?h=512)

![Which Of The Following Terms Apply To A Bond SOLVED: Problem 6-25: Using Bond Quotes [LO 2] Suppose the following](https://cdn.numerade.com/ask_images/e059dea9697a4deba3cf290bb18aaa77.jpg)

![Which Of The Following Terms Apply To A Bond [Solved] The following bond list is from the busin | SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2022/12/6398be0ab5fdf_5066398be0a68543.jpg)