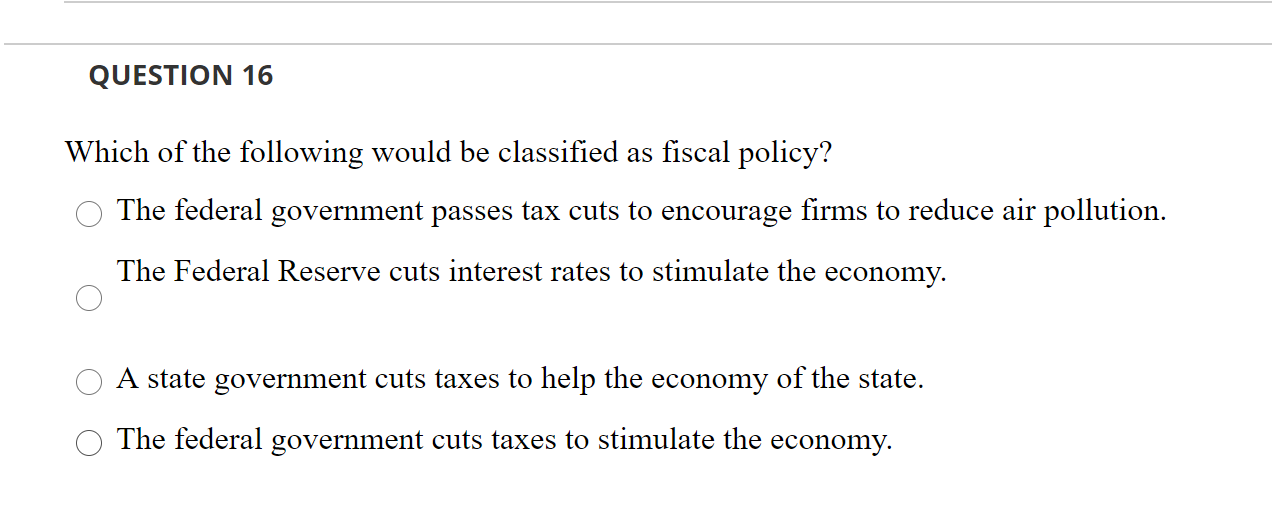

Which Of The Following Would Be Classified As Fiscal Policy

Urgent economic update: Understanding fiscal policy is now critical amid ongoing debates about government intervention. This report clarifies the definition of fiscal policy and its crucial components.

Decoding Fiscal Policy: What Qualifies?

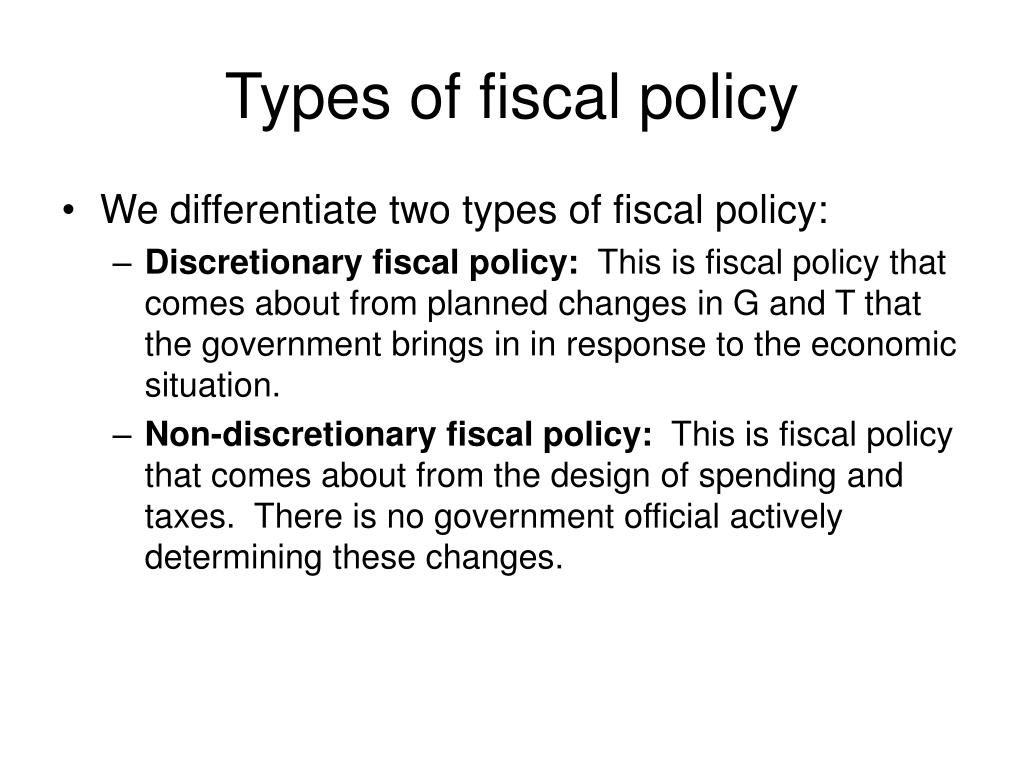

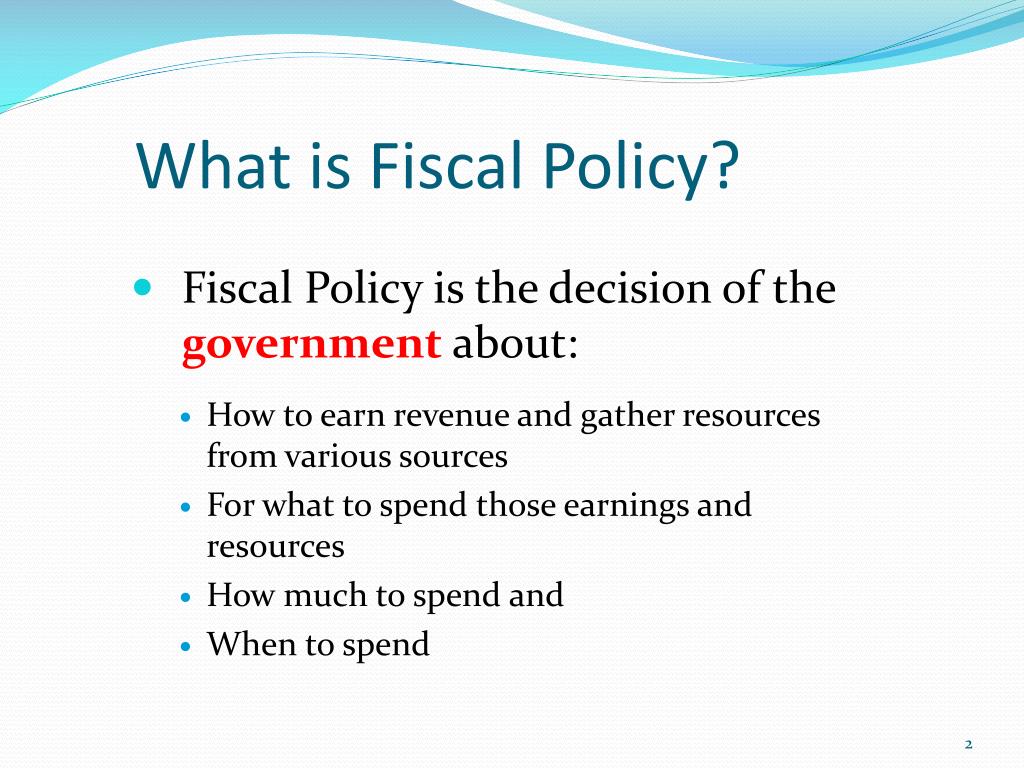

Fiscal policy involves the use of government spending and taxation to influence the economy. Understanding this distinction is vital for informed civic engagement.

Specifically, fiscal policy is defined as government's approach to impact macroeconomic conditions. It utilizes tax and spending measures.

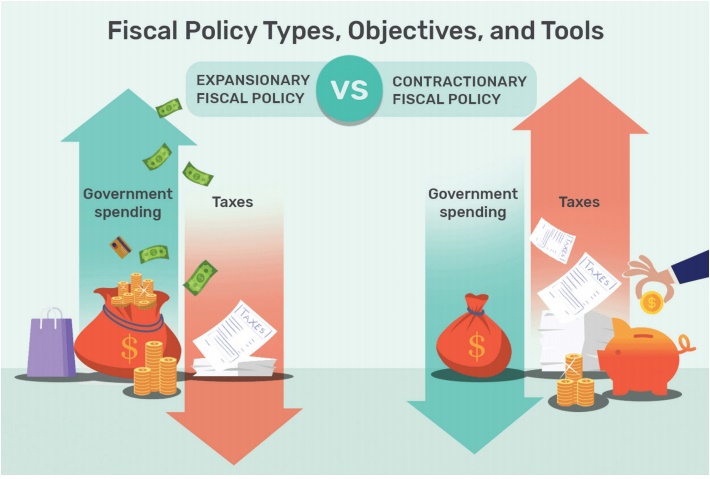

The Core Elements: Spending and Taxation

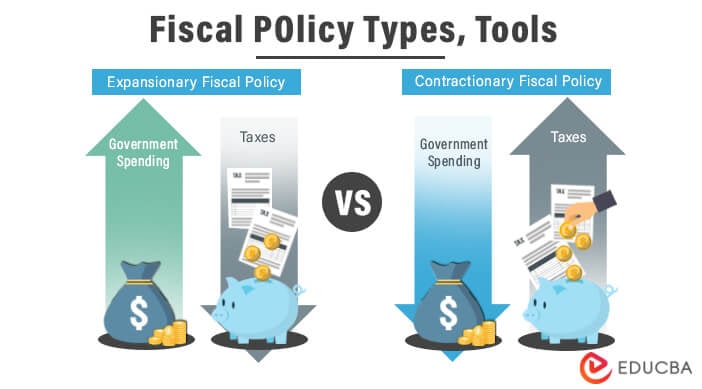

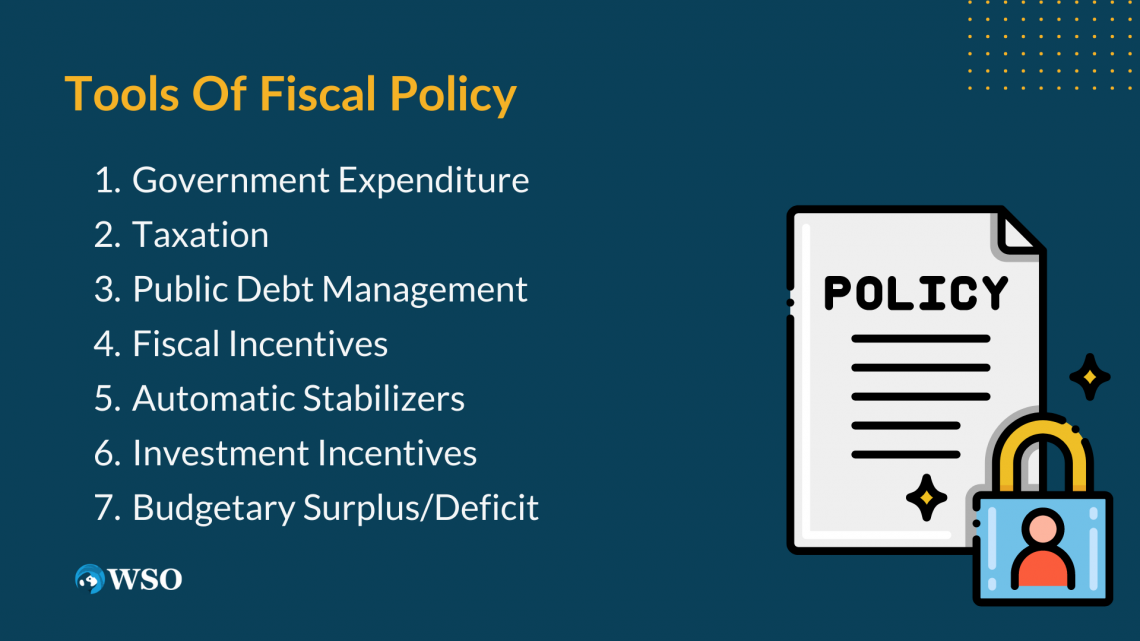

At its heart, fiscal policy centers on two primary mechanisms: government spending and taxation. These tools are wielded to manage economic cycles.

Government spending encompasses expenditures on infrastructure, defense, education, and social welfare programs. Taxation involves collecting revenue from individuals and businesses.

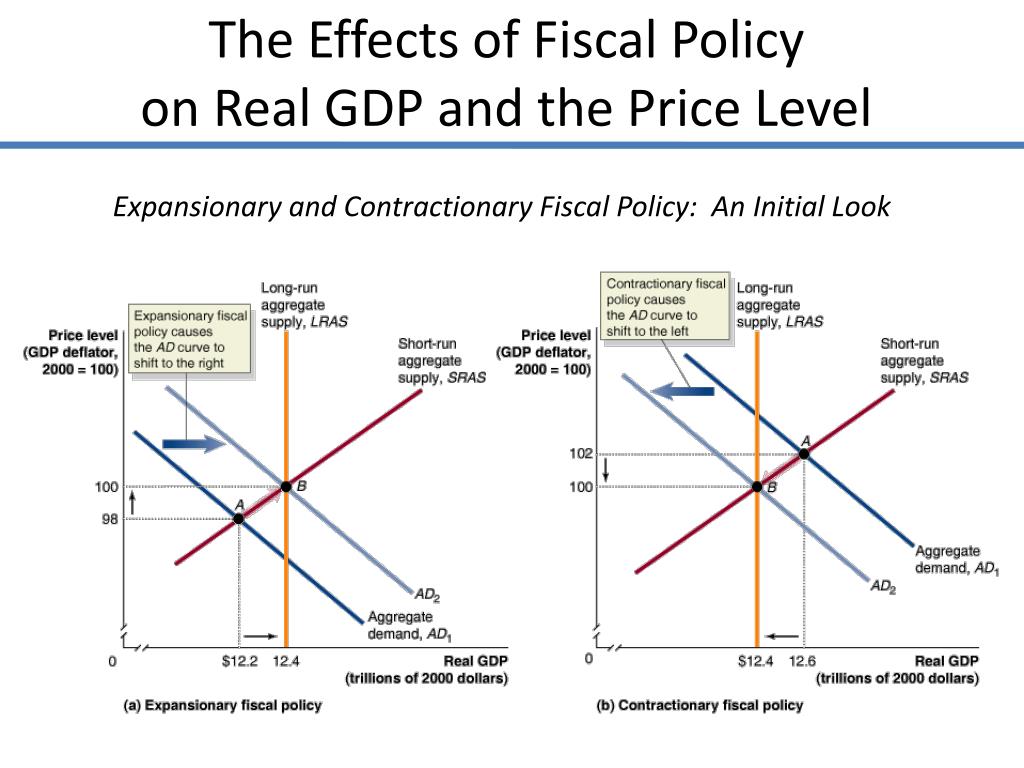

Changes in these areas directly affect aggregate demand, economic growth, and inflation. They shape the overall economic landscape.

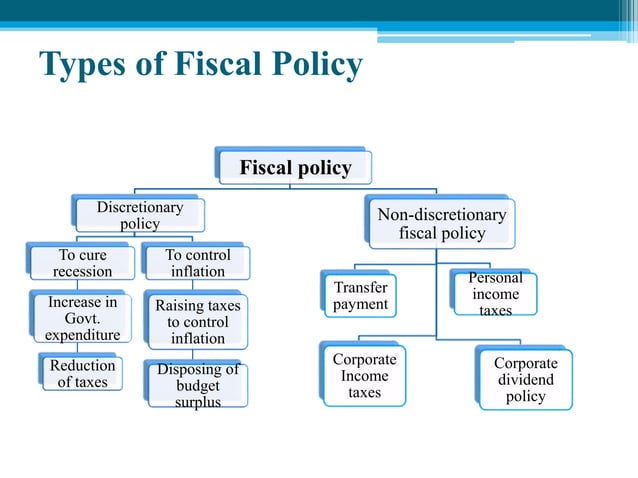

Examples of Fiscal Policy in Action

Consider the American Rescue Plan Act of 2021. This legislation involved significant government spending to mitigate the economic impact of the COVID-19 pandemic.

Tax cuts, such as those enacted during the Bush administration, also represent fiscal policy. They directly affect disposable income and business investment.

Infrastructure projects, like the Infrastructure Investment and Jobs Act, are another clear example of fiscal policy. They boost economic activity and improve public works.

What is NOT Fiscal Policy?

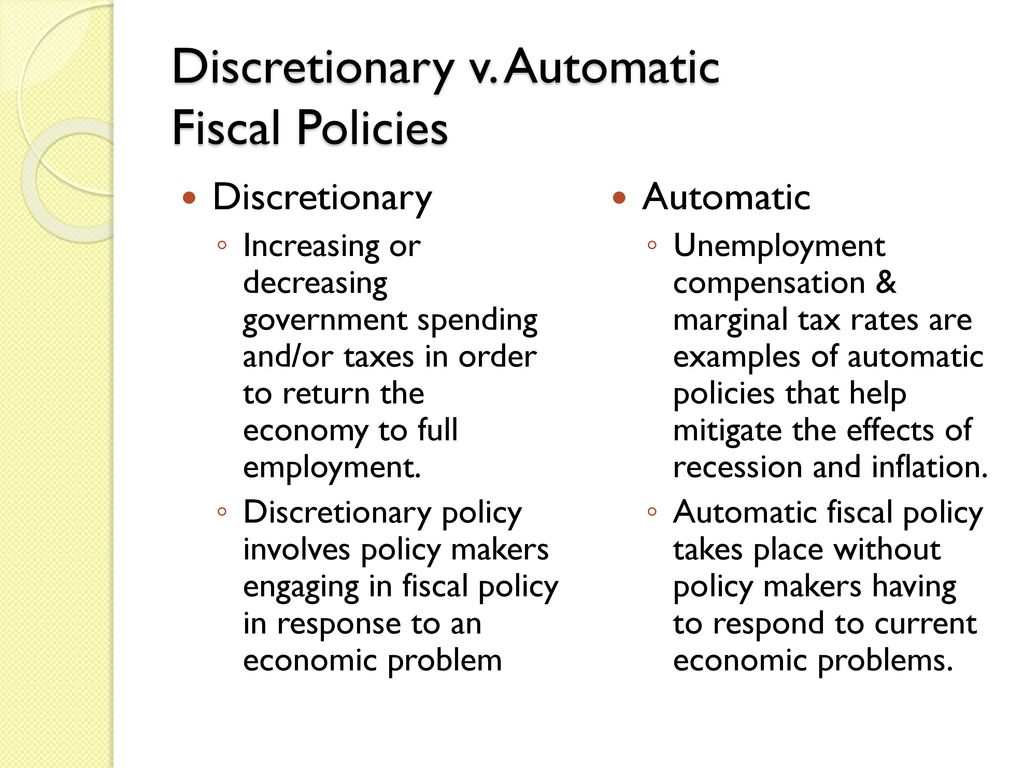

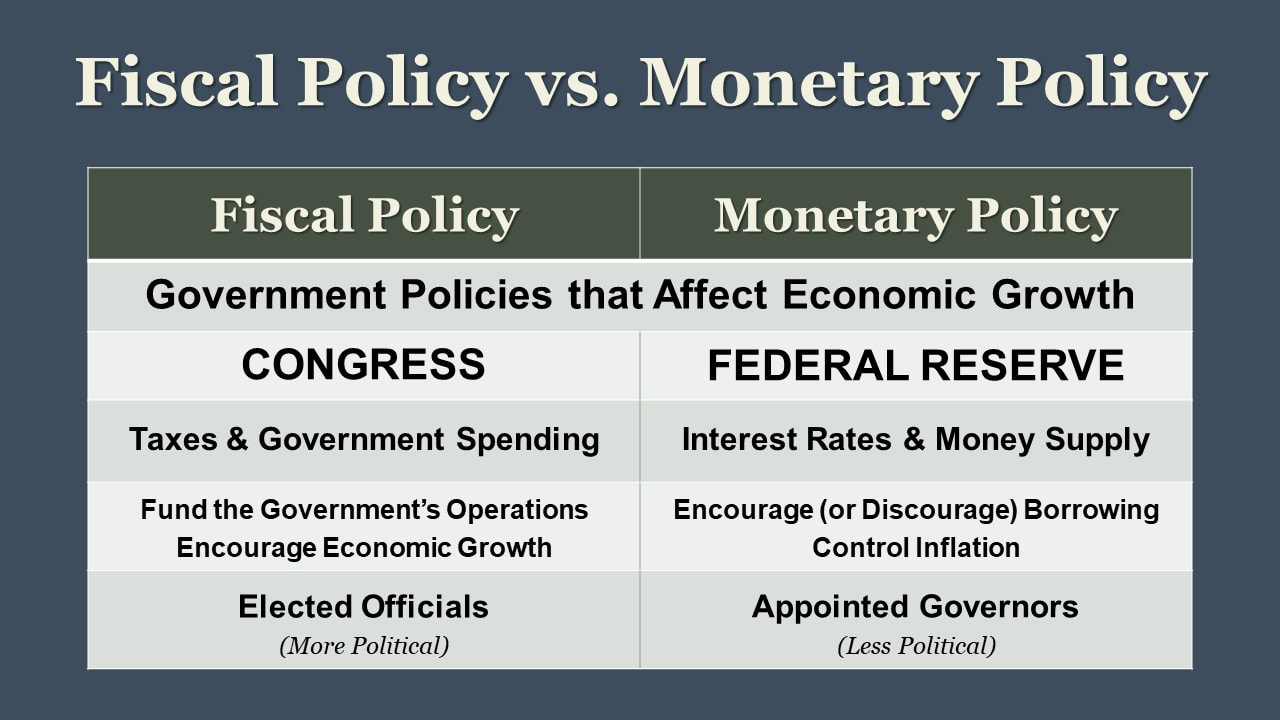

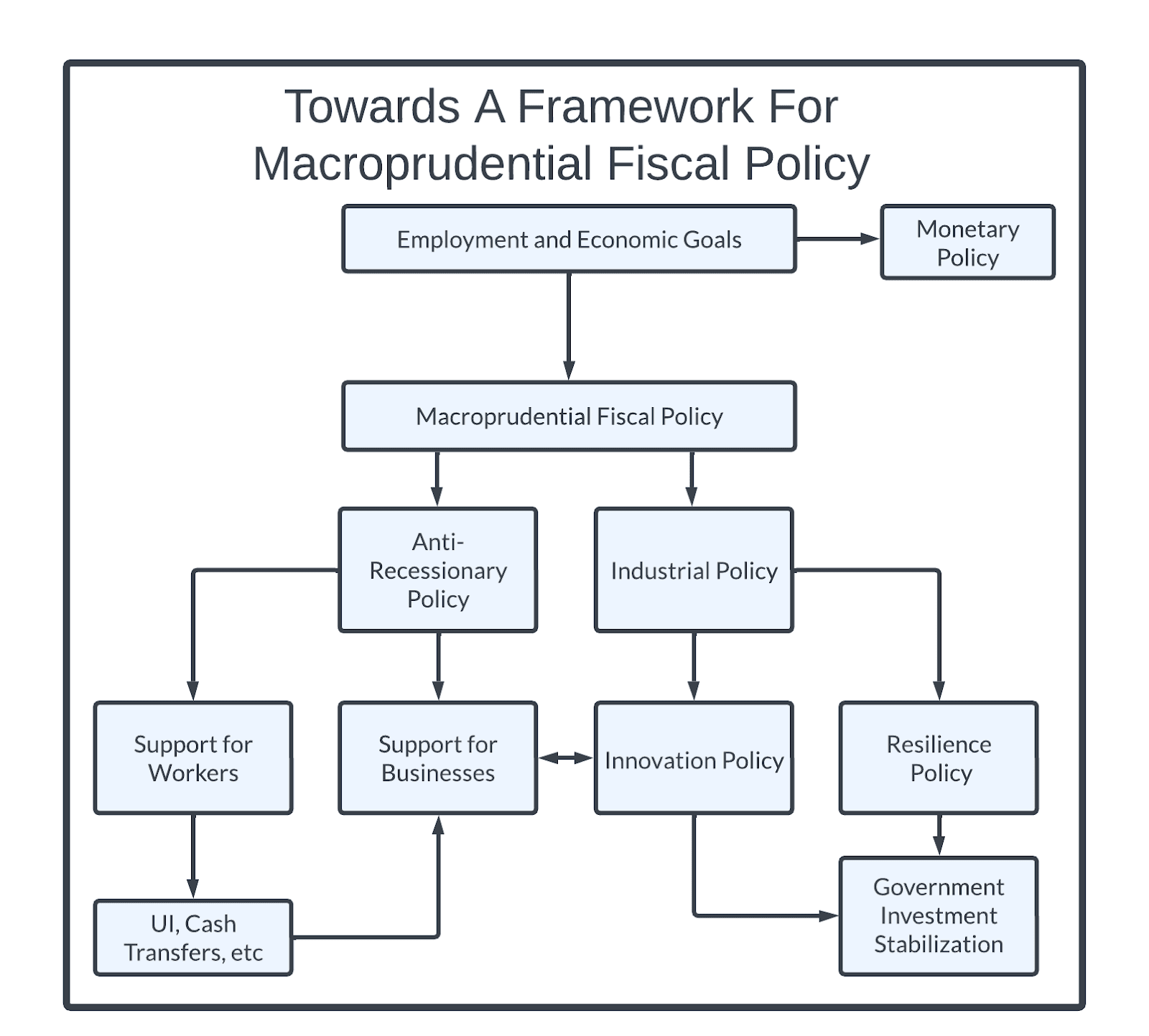

It is crucial to distinguish fiscal policy from monetary policy. Monetary policy is managed by central banks, like the Federal Reserve in the U.S.

Monetary policy primarily involves managing interest rates and the money supply. These actions aim to control inflation and promote full employment.

Therefore, actions like adjusting the federal funds rate or implementing quantitative easing are not fiscal policy. They fall under the purview of monetary authorities.

Differentiating Fiscal from Monetary Actions

A clear example of the difference is this: Congress passing a bill to increase spending on renewable energy is fiscal policy. The Federal Reserve lowering interest rates to encourage borrowing is monetary policy.

These two policy realms, fiscal and monetary, operate independently but often coordinate to achieve economic stability. Each has distinct tools and targets.

Misunderstanding this difference can lead to confusion about the government's role in the economy. Accurate definitions are essential.

The Key Takeaway: Fiscal Policy Defined

In summary, fiscal policy refers to actions taken by the government involving taxation and government spending. These are the definitive features.

Any policy decision directly impacting government revenue or expenditure qualifies as fiscal. This includes budget decisions, tax law changes, and public works projects.

Therefore, when assessing policy options, remember that fiscal policy always involves governmental budgetary tools.

Looking Ahead: Ongoing Policy Debates

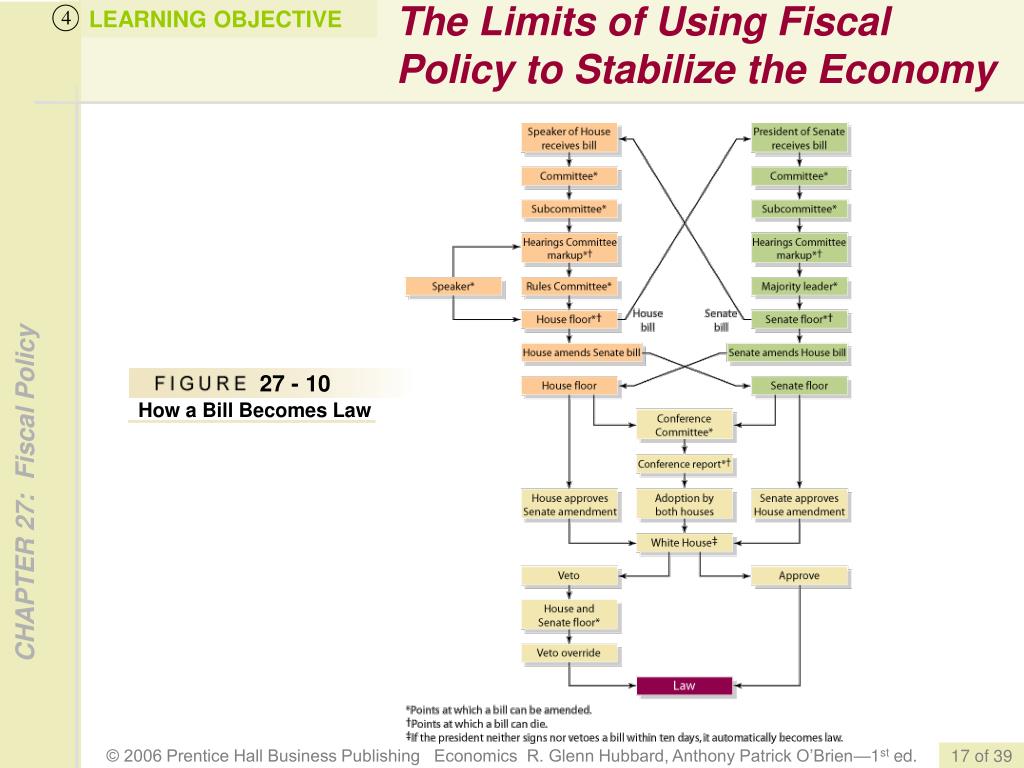

Discussions surrounding the national debt and future economic stimulus continue to highlight the importance of fiscal policy. These debates necessitate informed public discourse.

Policymakers are constantly evaluating the optimal balance between spending and taxation. This process requires careful consideration of economic conditions.

Stay informed about these developments, as they directly impact your financial well-being and the nation's economic future.

:max_bytes(150000):strip_icc():format(webp)/DDM_INV_fiscal-policy_df-5199e67bb34b4dcf83b058fa61ca4ad9.jpg)