Which Of The Following Would Be Considered Speculative Investments

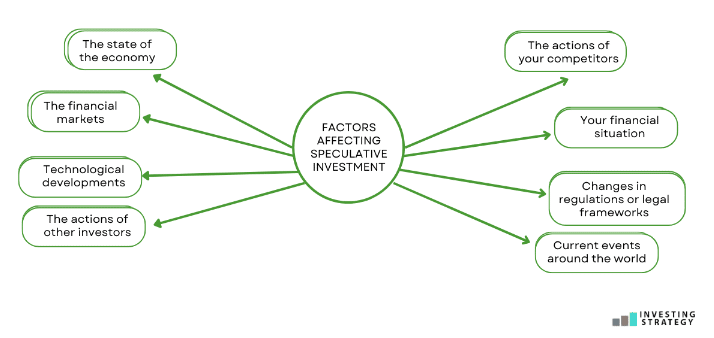

In an era defined by rapid technological advancements and fluctuating economic landscapes, understanding the nuances of investment is more critical than ever. Investors constantly navigate a spectrum of options, ranging from conservative choices aimed at steady growth to ventures promising potentially high returns but carrying considerable risk.

This article aims to clarify the concept of speculative investments, distinguishing them from more traditional asset classes and outlining the factors that contribute to their higher risk profile. Identifying these investments is crucial for individuals looking to make informed financial decisions and avoid unnecessary exposure to market volatility.

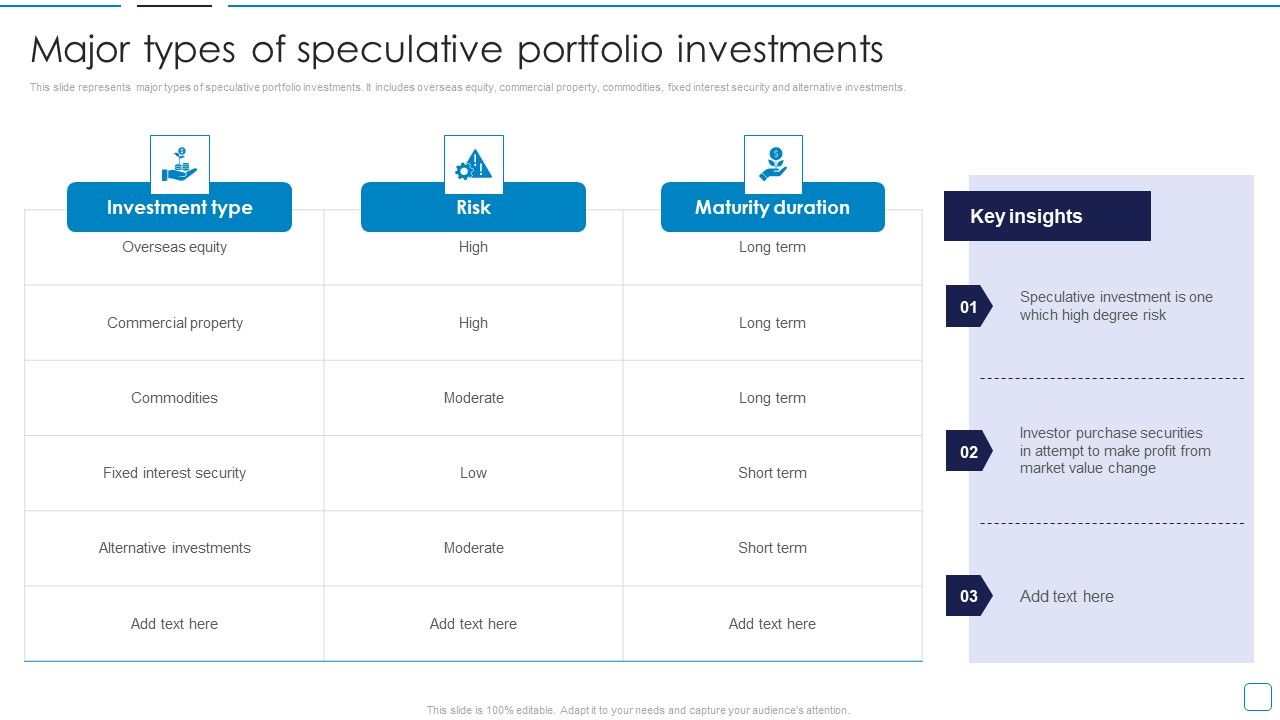

What Qualifies as Speculative? Speculative investments are generally characterized by a high degree of uncertainty and the potential for significant losses. They often involve assets with limited historical data, unproven business models, or markets prone to rapid shifts in sentiment.

Understanding Key Speculative Asset Classes

Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum are perhaps the most widely recognized examples of speculative investments. Their value is driven primarily by supply and demand, with limited intrinsic worth. Market volatility is a significant concern, as prices can experience dramatic swings in short periods.

Regulatory uncertainty and technological risks, such as potential security breaches or network failures, add to the inherent risks. Despite the potential for high returns, cryptocurrencies are not suitable for risk-averse investors.

Penny Stocks

Penny stocks, typically defined as shares trading for under $5, represent another category of speculative investment. These stocks are often associated with small, unproven companies with limited operating history. Lack of liquidity can also be a significant problem, making it difficult to buy or sell shares at desired prices.

Due to the low trading volume and limited public information, penny stocks are susceptible to manipulation and fraud. Investors should exercise extreme caution and conduct thorough due diligence before investing in these securities.

Initial Public Offerings (IPOs) of Unproven Companies

Investing in IPOs, especially those of companies with limited track records, can be highly speculative. While IPOs offer the potential for early-stage growth, they also come with significant uncertainty about the company's long-term prospects.

The initial valuation of an IPO can be difficult to assess accurately, leading to inflated prices driven by hype rather than fundamental value. Investors should carefully consider the company's business model, competitive landscape, and management team before investing.

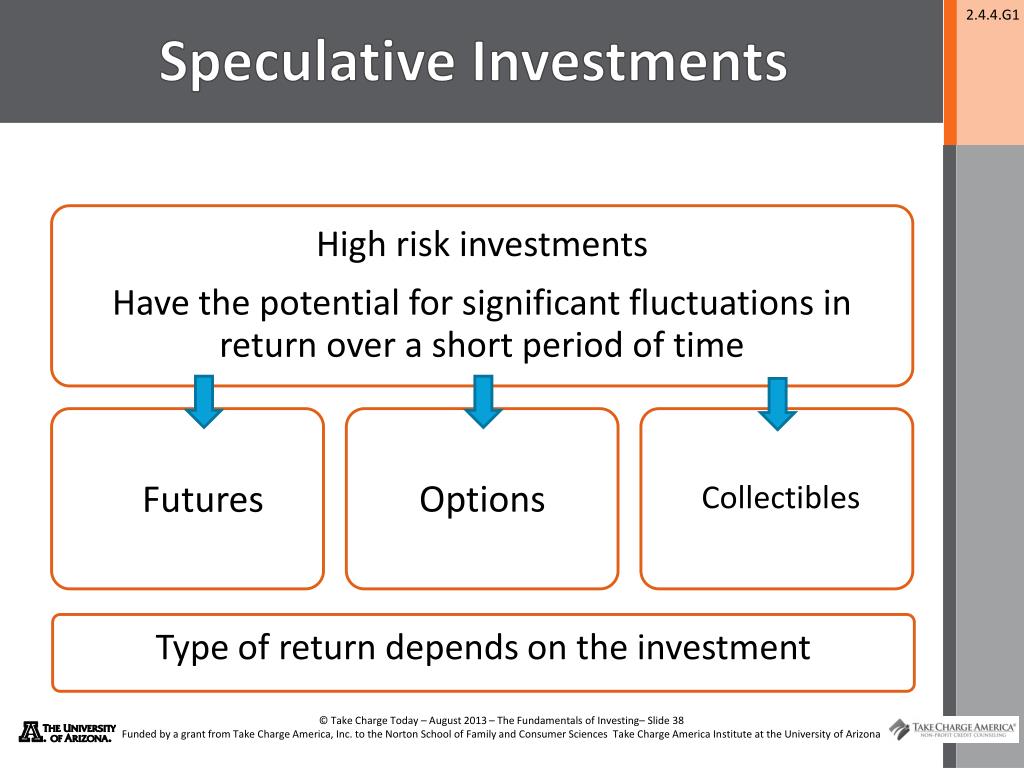

Options and Futures

Options and futures are derivative instruments that allow investors to speculate on the future price movements of underlying assets. These investments offer the potential for high leverage, meaning that small price changes can result in significant gains or losses.

The complexity of options and futures contracts requires a deep understanding of market dynamics and risk management techniques. Novice investors should avoid these instruments until they have gained sufficient experience and knowledge.

High-Yield Bonds (Junk Bonds)

High-yield bonds, also known as junk bonds, are debt securities issued by companies with below-investment-grade credit ratings. These bonds offer higher yields to compensate investors for the increased risk of default.

Economic downturns or company-specific problems can lead to defaults, resulting in significant losses for bondholders. Investors should carefully assess the financial health of the issuer before investing in junk bonds.

The Importance of Due Diligence

Regardless of the specific type of speculative investment, thorough due diligence is essential. This includes researching the underlying asset, understanding the associated risks, and assessing the potential for loss. Consulting with a qualified financial advisor can provide valuable insights and guidance.

Investors should only allocate a small portion of their portfolio to speculative investments and be prepared to lose their entire investment. Diversification is crucial to mitigate risk and protect against unexpected market movements.

The Human Element: The allure of quick riches often drives individuals toward speculative investments, but it's crucial to approach these ventures with a clear understanding of the risks involved. Stories abound of individuals who have made fortunes through speculative investments, but equally numerous are the tales of financial ruin resulting from chasing unrealistic gains.

Ultimately, responsible investing involves a balance of risk and reward, with a focus on long-term financial goals rather than short-term speculation. Understanding the characteristics of speculative investments and exercising caution can help investors make informed decisions and protect their financial well-being.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should consult with a qualified financial advisor before making any investment decisions.